The most compelling image of the 28th Conference of the Parties of the United Nations Framework Convention on Climate Change—otherwise known as COP 28—will always be the chairman Al Jaber’s fight with Mary Robinson, in which he declared that “There is no science out there, or no scenario out there, that says that the phase-out of fossil fuel is what’s going to achieve 1.5C”. He followed up with “Please help me, show me the roadmap for a phase-out of fossil fuel that will allow for sustainable socioeconomic development, unless you want to take the world back into caves.”

It’s little wonder that the head of the Abu Dhabi National Oil Company would claim that phasing out fossil fuels only makes sense if you “want to take the world back into caves”. What is a wonder is that his self-serving arguments are supported by predictions of the “optimal” level of global warming in the refereed economic literature.

The objective of the Paris Agreement signed at COP 21 was to limit the increase in global average temperature to 1.5°C, and at most 2°C, and to do this in part by achieving net zero carbon emissions by 2050.

However, far from recommending net zero CO2 emissions by 2050, “Nobel” Prize winner William Nordhaus {Nordhaus, 2018} claimed that properly balancing the costs of climate change against the costs of abating it would see CO2 emissions peak at 40 gigatons a year in 2050, and they would still be positive in 2100 {Nordhaus, 2018, Figure 2, p. 347}.

Furthermore, under Nordhaus’s “optimal” global warming management path, the temperature increase would reach 3.5°C in 2100, and it would still be rising {Nordhaus, 2018, Figure 4, p. 348}.[1] Nordhaus’s most recent version of the Dynamic Integrated Climate-Economy (DICE) model reduces these numbers somewhat {Nordhaus, 2023}, but his so-called optimal levels are still far higher than the targets set by the Paris Agreement.

So, was Al Jaber actually correct? Should we continue using fossil fuels, with their phasing out not occurring until the 22nd century—when, in all likelihood, there would be no economically recoverable oil left? Should we just keep on burning until the early 22nd century, to enable the poor to benefit from “sustainable socioeconomic development”?

Mainstream economists certainly think so. The behavioural economist Hersh Shefrin stated that “Al Jaber’s remarks are consistent with the scientific assumptions underlying Nordhaus’ model”, and argued that Al Jaber was correct that “too rapid a phaseout” would do more socioeconomic harm than good:

Nordhaus’ model supports Al Jaber’s contention that the economic costs of too rapid a phaseout would outweigh the benefits. Indeed his model implies that a 2-degrees Celsius goal is far superior to a 1.5-degrees goal, even if climate damages are double his assumed values. Al Jaber is an economist, and his perspective is consistent with mainstream economic analysis. {Shefrin, 2023. Emphasis added}

Mainstream economics, in other words, implies that the politics has gotten too far ahead of the economics, and Al Jaber has done us a favour by calling for some balancing of ecological wishes against economic reality.

If only! Unfortunately, Shefrin’s analysis goes wrong when he uses the word “scientific” to describe the assumptions in Nordhaus’s “Integrated Assessment Model” DICE. The assumptions in DICE are anything but scientific. In fact, in all my years of critiquing mainstream economics {Keen, 2011}, I’ve never read anything quite as delusional as the work of Nordhaus and his colleagues on the economics of climate change {Keen, 2023; Keen, 2020}.[2]

The key fatal flaws in their analysis are their ridiculously low estimates they have made, using ridiculously bad methods, of the damages that global warming will do to the economy. Even if the Ramsey growth model {Ramsey, 1928} at the core of DICE, FUND, PAGE and other IAMs was a perfect description of reality—and it is far from that—then feeding in the numbers that economists have made up about global warming into those models would still vastly underestimate the damages that it will do to the economy. It’s all in the numbers, and the methods they’ve used to make up those numbers are statistical nonsense.

They have assumed that only industries directly exposed to the weather will be affected by global warming, so that most of the economy will be “negligibly affected by climate change.”

The most sensitive sectors are likely to be those, such as agriculture and forestry, in which output depends in a significant way upon climatic variables… Our estimate is that approximately 3% of United States national output is produced in highly sensitive sectors, … and about 87% in sectors that are negligibly affected by climate change. {Nordhaus, 1991, p. 930. Emphasis added}[3]

Nordhaus’s list of “negligibly affected” sectors included all of manufacturing, all wholesale and retail services, finance, government, much of utilities, and even mining {Nordhaus, 1991, Table 5, p. 931}! He later amended this to “underground mining” and therefore cut his “negligibly affected” estimate from 87% to 85% {Nordhaus, 1993, p. 15}, but this simply confirmed that he equated “exposed to climate change” with “exposed to the weather”. All subsequent papers by Neoclassical economists have retained the assumption that only industries exposed to the weather will be affected by climate change.

They have assumed that today’s weak relationship between income and temperature can be used to predict the impact of global warming:

Mendelsohn assumes that the observed variation of economic activity with climate over space holds over time as well; and uses climate models to estimate the future effect of climate change. {Tol, 2009, p. 32. Emphasis added}

They have assumed that empirical relationships derived from data on change in temperature and GDP between 1960 and 2014 can be extrapolated out to 2100—thus assuming that 3.2°C more of global warming won’t alter the climate!:

an increase in average global temperature of 0.04°C per year [from 2020] … reduces world’s real GDP per capita by 7.22 percent by 2100. {Kahn, 2021, p. 3}

They have assumed that tipping points—critical features of the Earth’s climate such as the Greenland and West Antarctic icesheets, the Amazon rainforest, and the “Atlantic Meridional Overturning Circulation” which keeps Europe warm today—can be tipped with only minimal additional damage to GDP:

Tipping points reduce global consumption per capita by around 1% upon 3℃ warming and by around 1.4% upon 6℃ warming, based on a second-order polynomial fit of the data. {Dietz, 2021, p. 5. Emphasis added}

Finally, they have assumed that an experience as unknown and radical as altering the planet’s climate can be modelled using the second-simplest mathematical function of all, a “pure quadratic” (or “second-order polynomial”) with only a single parameter. The only simpler function is a straight line through the origin, which asserts that the variable of interest is equal another variable multiplied by a constant.

A pure quadratic asserts that the damage done by global warming to the economy is equal to a constant times the value of global warming squared. The only parameter to estimate is the value of the constant, and in Nordhaus’s DICE, it is a very small constant: 0.003467 or 0.3467%. Nordhaus claims that 1 degree of warming (which we’ve already exceeded) will reduce global GDP by 0.35%, 2 degrees by 4 times 0.3467% or 1.3%, 3 degrees by 9 times 0.3467% or 3.1%, and 4 degrees by 16 times 0.3467% or 5.6%.

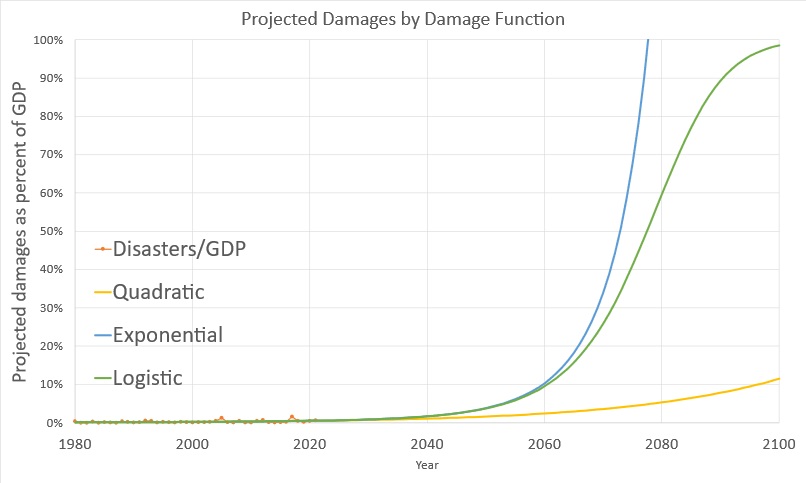

These damages are trivial simply because, with a parameter as low as Nordhaus’s, his damage function predicts minor damages until the temperature rise gets into the teens. To illustrate that this is simply assuming the result they wish to give, Brian Hanley and I fitted the NOAA “Billion Dollar Damages Database” to three functions: the quadratic that Neoclassical economists conventionally use, an exponential, and a logistic—see Figure 1. The quadratic predicts damages of about 10% of GDP by 2100; the logistic predicts GDP’s total destruction by 2100, and the exponential predicts it before 2080.

Figure 1: Comparing three damage functions {Keen, 2023, Figure 9, p. 39}.

Nordhaus claims that the choice of a quadratic was based on “recent reviews”:

Based on recent reviews, we further assume that a quadratic damage function best captures the impact of climate change on output (Nordhaus and Moffat, 2017; Hsiang et al., 2017).

However, this alleged foundation is nonsense. Nordhaus is the lead author of one review he cites {Nordhaus, 2017}, and he surveys exclusively the work of other economists. This is like Al Capone surveying his own gang and using their answers as character references.

The other paper “Estimating economic damage from climate change in the United States” {Hsiang, 2017} is not a review, but just another paper making the same assumptions ridiculed earlier, that current data (in this case, from 1981 to 2010) can be extrapolated to predict the impact of global warming until 2099 {Hsiang, 2017, pp. 1362-63}, and that only industries exposed to the weather will be affected by global warming.[4] It reaches even more ridiculous conclusions about the economy’s capacity to exist at extremely high levels of global temperature increase:

the very likely (5th to 95th percentile) range of losses at … 8°C warming is 6.4 to 15.7% GDP. {Hsiang, 2017, p. 1365}

This claim highlights another deceptive absurdity of these economic papers: they report what might sound like large figures for economic damages—such as the prediction in “Global non-linear effect of temperature on economic production” by Burke, Hsiang and Miguel {Burke, 2015} of a 23% fall in GDP in 2100.[5] But these predictions are relative to a future GDP which is assumed to be much higher than today’s. When their terminal predictions are converted into reductions in expected growth rates until that terminal date, they are obviously predicting trivial damages, as Table 1 illustrates.

Table 1: GDP Damage to Growth Rate Fall Converter for a sample of economic papers

GDP Damage to Growth Rate Fall Converter

| Paper | Prediction | Date for Prediction | Degrowth p.a. |

| Authors

|

Date

|

GDP Loss

|

D°C Pre-Ind

|

Future year

|

Relative to

|

Years

|

|

| Burke, Hsiang, Miguel

|

2015

|

23.00%

|

4.0

|

2100

|

2020

|

80

|

-0.33%

|

| Kalkuhl & Wenz

|

2020

|

14.00%

|

3.5

|

2100

|

2020

|

80

|

-0.19%

|

| Howard & Sylvan

|

2021

|

20.00%

|

7.0

|

2220

|

2020

|

200

|

-0.11%

|

| Kahn, Mohaddes, Ng

|

2020

|

7.22%

|

4.0

|

2100

|

2020

|

80

|

-0.09%

|

| Nordhaus

|

2018

|

8.60%

|

6.0

|

2100

|

1900

|

200

|

-0.04%

|

| Nordhaus

|

1994

|

6.70%

|

6.0

|

2090

|

1900

|

190

|

-0.04%

|

| Nordhaus

|

1994

|

3.60%

|

3.0

|

2090

|

1900

|

190

|

-0.02%

|

| Warren, Hope, Gernaat

|

2021

|

3.67%

|

4.0

|

2100

|

1890

|

210

|

-0.02%

|

| Nordhaus

|

1991

|

12.00%

|

3.0

|

2100

|

1900

|

200

|

-0.01%

|

| Nordhaus

|

2023

|

3.12%

|

3.0

|

2100

|

1765

|

335

|

-0.01%

|

| Hsiang, Kopp, Jina

|

2017

|

15.70%

|

8.0

|

2099

|

1995

|

104

|

-0.16%

|

Hsiang et al.’s paper predicts that an increase in the average global temperature of 8°C compared to the 1980-2010 average—which is far beyond what anyone expects, but that’s the number they provide—would make GDP in 2099 just 16% smaller.[6] This converts to a predicted fall in the annual rate of growth of just 0.15%—barely above the accuracy with which actual change in GDP is measured today.

These papers categorically do not tell us what global warming is going to do to the economy. They simply tell us that economists have no idea what global warming actually means.

A survey of climate scientists turns up very different predictions, like this one by Xu and Ramanathan, that more than 5°C of warming implies “beyond catastrophic, including existential threats”:

The current risk category of dangerous warming is extended to more categories, which are defined by us here as follows: >1.5 °C as dangerous; >3 °C as catastrophic; and >5 °C as unknown, implying beyond catastrophic, including existential threats. {Xu, 2017. Emphasis added}[7]

The reason that scientists expect catastrophic damages from temperature increases that economists assert will only slightly reduce the rate of economic growth is that scientists know what they’re talking about when it comes to climate change, but economists frankly haven’t got a clue.

To put it simply, global warming means the disruption of the stable climate that enabled humanity to establish sedentary civilisations in the first place. The manifestations of this disruption will be myriad, from famines when droughts destroy grain crops, and turn Europe and North America into the Sahara—“When combining the above effects, this analysis finds the Sahel is the closest climate analogue for the northern hemisphere” (OECD 2021, p. 152. Emphasis added) —to “wet bulb catastrophes” when temperatures remain above 31°C when measured with a device that takes evaporation into account, which will kill any human without access to air conditioning within six hours (Vecellio et al. 2021).

Which symptoms will strike first or hardest can’t be known in advance. All that can be known is that, when these conditions become the norm, the very concept of “sustainable socioeconomic development” becomes an oxymoron. No advanced civilisation is sustainable under the conditions that further global warming will cause.

The great lie that economists have perpetrated—due to their ignorance of climate, rather than any outright intention to lie—is that we have a choice. We might have had fifty years ago, when The Limits to Growth {Meadows, 1972} asserted that we had to alter our economic system to avert ecological crises in the 21st century. But because we didn’t take that advice—thanks, in very large measure, to economists rubbishing their analysis without understanding it {Nordhaus, 1973}—choice no longer exists. Either we stop global warming, or global warming stops us. “Sustainable socioeconomic development” is no longer on the menu.

Instead, with more than 80% of our energy still coming from fossil fuels, we face a choice between business as usual followed by a chaotic collapse in global incomes, or a controlled reduction—as much as we can control it—with the burden imposed on those who can most afford it—the rich, rather than the poor, and inside countries as well as between them.

Adam Hardy and I independently developed one possible way to enable this: “Tradeable Universal Carbon Credits” (TUCCs) which would be allocated on an equal per capita basis within each economy—as COPOUT28 has shown, trying to get meaningful agreements between countries is simply a waste of time—and which would need to be paid every time a purchase was made (as well as the cash price, of course). With an equal per capital allocation of TUCCs, the very wealthy would exhaust their quotas before they got out of bed, while homeless people would have oodles to trade. This would allow a market to set a market price for carbon—something economists have made a fist of working out for themselves—and the rich would directly pay the poor to buy spare TUCCs off them. As much as 95% of the population of each country would actually be sellers of TUCCs, and the scheme would also put real pressure on firms to rapidly reduce carbon emissions. See https://ecocore.org/ for more information.

Do we think this scheme has a chance of being implemented? Not while people like Al Jaber are in charge of the process. It’s time to cop out from COP.

Notes

[1] See Projections and Uncertainties about Climate Change in an Era of Minimal Climate Policies. The article is free to download and open access.

[2] My report for Carbon Tracker is freely downloadable from Patreon.

[3] See To Slow or Not to Slow: The Economics of The Greenhouse Effect. The paper is free to download and open access.

[4] See Estimating economic damage from climate change in the United States. The paper is free to download and open access.

[5] See Global non-linear effect of temperature on economic production. The paper is free to download and open access.

[6] See S14: Estimating different functional forms for expected total direct damage on page 64 of their supplementary materials at Science. The paper is free to download and open access.

[7] See Well below 2 °C: Mitigation strategies for avoiding dangerous to catastrophic climate changes. The paper is free to download and open access.

References

Burke, Marshall, Solomon M. Hsiang, and Edward Miguel. 2015. ‘Global non-linear effect of temperature on economic production’, Nature, 527: 235.

Dietz, Simon, James Rising, Thomas Stoerk, and Gernot Wagner. 2021. ‘Economic impacts of tipping points in the climate system’, Proceedings of the National Academy of Sciences, 118: e2103081118.

Hsiang, Solomon, Robert Kopp, Amir Jina, James Rising, Michael Delgado, Shashank Mohan, D. J. Rasmussen, Robert Muir-Wood, Paul Wilson, Michael Oppenheimer, Kate Larsen, and Trevor Houser. 2017. ‘Estimating economic damage from climate change in the United States’, Science, 356: 1362-69.

Kahn, Matthew E., Kamiar Mohaddes, Ryan N. C. Ng, M. Hashem Pesaran, Mehdi Raissi, and Jui-Chung Yang. 2021. ‘Long-term macroeconomic effects of climate change: A cross-country analysis’, Energy Economics: 105624.

Keen, Steve. 2011. Debunking economics: The naked emperor dethroned? (Zed Books: London).

———. 2020. ‘The appallingly bad neoclassical economics of climate change’, Globalizations: 1-29.

———. 2023. “Loading the DICE against pension funds: Flawed economic thinking on climate has put your pension at risk ” In. London: Carbon Tracker.

Meadows, Donella H., Jorgen Randers, and Dennis Meadows. 1972. The Llimits to Growth (Signet: New York).

Nordhaus, William. 2018. ‘Projections and Uncertainties about Climate Change in an Era of Minimal Climate Policies’, American Economic Journal: Economic Policy, 10: 333–60.

Nordhaus, William D. 1973. ‘World Dynamics: Measurement Without Data’, The Economic Journal, 83: 1156-83.

———. 1991. ‘To Slow or Not to Slow: The Economics of The Greenhouse Effect’, The Economic Journal, 101: 920-37.

———. 1993. ‘Reflections on the Economics of Climate Change’, The Journal of Economic Perspectives, 7: 11-25.

Nordhaus, William D., and Lint Barrage. 2023. “Policies, Projections, And The Social Cost Of Carbon: Results From The Dice-2023 Model.” In. Cambridge, MA: National Bureau Of Economic Research.

Nordhaus, William D., and Andrew Moffat. 2017. “A Survey Of Global Impacts Of Climate Change: Replication, Survey Methods, And A Statistical Analysis.” In. New Haven, Connecticut: Cowles Foundation.

OECD. 2021. Managing Climate Risks, Facing up to Losses and Damages.

Ramsey, F. P. 1928. ‘A Mathematical Theory of Saving’, The Economic Journal, 38: 543-59.

Shefrin, Hersh. 2023. ‘Al Jaber’s ‘No Science’ Comment Embodies Nuances COP28 Leaders Need To Appreciate’, Forbes, Dec 4, 2023.

Tol, Richard S. J. 2009. ‘The Economic Effects of Climate Change’, The Journal of Economic Perspectives, 23: 29–51.

Vecellio, Daniel J., S. Tony Wolf, Rachel M. Cottle, and W. Larry Kenney. 2021. ‘Evaluating the 35°C wet-bulb temperature adaptability threshold for young, healthy subjects (PSU HEAT Project)’, Journal of Applied Physiology, 132: 340-45.

Xu, Y., and V. Ramanathan. 2017. ‘Well below 2 °C: Mitigation strategies for avoiding dangerous to catastrophic climate changes’, Proceedings of the National Academy of Sciences of the United States of America, 114: 10315-23.