For economic and enironmental reasons, the reign of Old King Coal is coming to an end. The royal’s reign has crossed centuries. According to the U.S. Department of Energy (DOE), coal was first used to generate electricity for homes and factories in the 1880s. By 1961, coal had become the major fuel used to generate electricity in the United States[i].

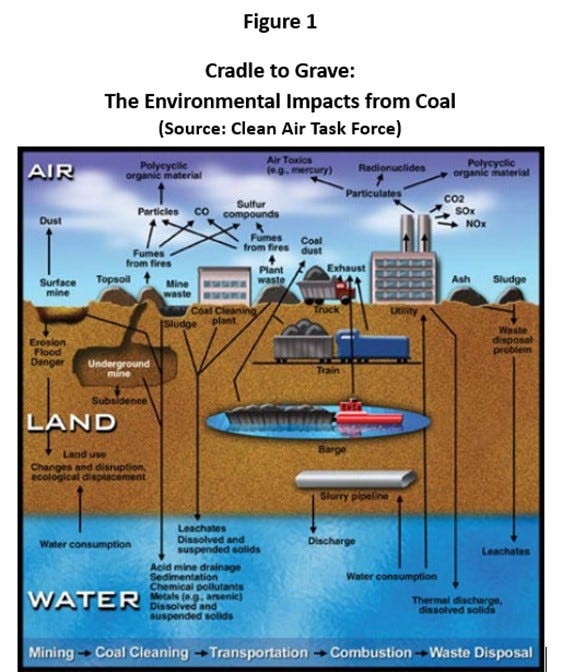

Although the preferred power of the industrial revolution, coal comes with a hefty social cost. Its negative impacts on the environment begin with its extraction and only end when the ash created from its combustion is correctly disposed of in lined pits that prevents it from entering into wells, streams, and rivers. (See Figure 1)

Coal ash is the second largest industrial waste stream in the U.S., amounting to 70 million tons produced annually[ii]. It is incredibly toxic. According to the industry’s own data, 94% of the coal ash ponds in the United States are unlined. Almost all of them are contaminating the groundwater around them.

The ash contains at least 17 heavy metals and pollutants, including lead, mercury, cadmium, chromium, selenium, and at least six neurotoxins and five known or suspected carcinogens. The potential adverse impacts of breathing and ingesting coal ash on the human body are extensive.

There are two basic ways of correctly dealing with coal combustion residuals (CCR) — whether existing or new. They are storing it in lined ponds, preferably as far from potable water supplies as possible, and finding a way to use it so it doesn’t need to be stored at all.

The scope of the existing coal ash problem was addressed in Part 1 of Turning a Pain in the [Coal] Ash into an Asset. In Part 2, I’ll be going into more detail on a solution being put forward by Krubera, LLC. The company has licensee rights to a patented process that uses coal combustion residuals in a manner that meets all the criteria of the federal CCR rule on beneficial use.

The big knock by opponents of solar and wind energy systems is summed up in the oft-quoted phrase, “The sun doesn’t always shine, and the wind doesn’t always blow.” It is a fact that’s useless to deny. It’s also a problem with a solution making it one of the better kinds of problems to have.

Touched by Occam’s razor, Krubera’s solution to the coal ash dilemma is straightforward. It combines two well-proven processes — encapsulation and low-profile pumped storage hydro (PSH).

As shown in Figure 2, the system is comprised of two reservoirs — one lower than the other. The lower reservoir is the problematic pond from which the CCR is excavated. Once excavated, the CCR is dried, encapsulated by adding cement and/or lime, and turned into concrete that’s then used to construct the upper reservoir.

The average size of the lower reservoir is between 140 and 500 acres depending on the site’s characteristics and contents. When operational, the water in the lower pond is pumped up using any of a variety of power sources — preferably clean ones like solar or wind — when power is plentiful and cheap. Because the system is essentially a closed loop, water requirements can be kept within reason. In most cases, rainwater will replace water lost from evaporation.

When renewable energy sources struggle to meet demand or become unavailable, water in the upper level can be released to flow through the powerhouse turbine. The power produced is fed back into the grid — creating a cash stream for the system owner.

PSH is a long-proven technology. It dates back to Italy and Switzerland in the 1890s and 1930 in the U.S. Since then, the systems have become ubiquitous and can be found all around the world. According to the 2021 edition of the Hydropower Market Report, PSH currently accounts for 93 percent of all utility-scale energy storage in the U.S.

The encapsulation of coal ash is also a well-established process. The environmental benefits of encapsulation are recognized and recommended by EPA.

“The best solution to disposal problems is to quit throwing it away.[iii]”

Storage is the missing piece of the clean energy puzzle. Notwithstanding all of the improvements to established clean energy alternatives like solar and wind and despite their increased economic competitiveness with fossil fuels — the sun indeed doesn’t always shine, nor does the wind always blow.

Hands down, intermittency is the most frequently raised qualm of opponents to solar and wind technologies. Economically competitive storage is the solution.

Let me be clear. Solar and wind systems have been the primary sources of new electric generation in the U.S. and many parts of Europe — particularly as a substitute for Russian oil and gas — even without economically competitive storage options. With competitive storage, a future economy powered by solar, wind, and other clean energy alternatives becomes a reality in a timeframe that will help to avoid the worst consequences of Earth’s warming.

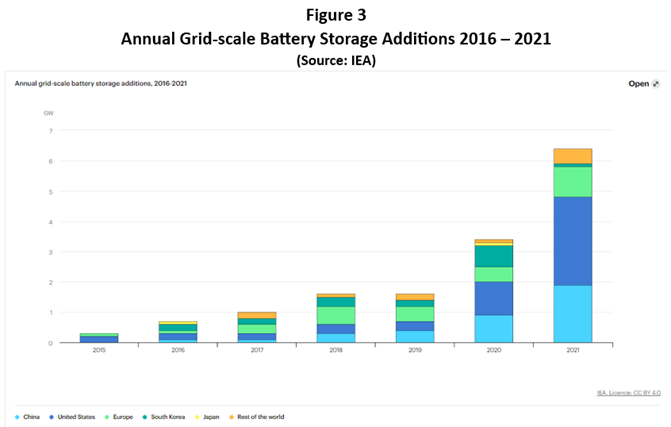

However, the International Energy Agency says that it can’t happen without grid-scale battery storage growing significantly. Worldwide growth is already in evidence (Figure 3).

IEA defines “significant” as expanding existing storage 44-fold between 2021 and 2030 to 680 GW. It means annual additions must grow from 6 G.W. in 2021 to an average of over 80 G.W. per year between 2022–2030.

Pumped-storage hydropower is still the most widely deployed storage technology today, but grid-scale batteries are catching up[iv].

A lot has been written lately on battery investments in manufacturing and research, as well as the potentially horrific environmental impact of mining needed metals, e.g., lithium, and minerals. There is also the matter of where the metals are to be sourced.

According to BloombergNEF, China is currently the biggest supplier, with Canada coming in second. Australia, Chile, and China produce 90 percent of the world’s lithium in a global market rapidly approaching $8 billion.

Metal and mineral batteries come with a hefty environmental cost. Mark Tedesco, a research professor at Columbia University’s Climate School, includes in the “side effects” of lithium mining the use of large quantities of water, potential increases in carbon dioxide emissions, the production of large amounts of mineral wastes, increased respiratory problems, and alteration of the hydrological cycle.

Norbert Hector, CEO of Krubera, believes that batteries are the nearest competitor to the company’s CCR/PSH system. He points out that the company’s design has two advantages over batteries. It doesn’t rely on rare earth elements like lithium, and its working life is 50 years compared to the ten years of a battery system.

Hector also points to the other economic and environmental advantages of the Krubera CCR/PSH energy storage system. These include:[NH1]

- The technology can be utilized anywhere a natural gradient provides an elevation difference between the upper and lower reservoirs.

- It meets all the beneficial use requirements of the 2015 CCR rule and more.

- The Krubera patented technology would meet a more stringent definition of “beneficial use” advocated by environmental groups. They’re advocating for greater transparency of where the ash ends up and greater surety that it’s being safely encapsulated.

- The technology meets all regulatory standards and is exempt from FERC licensing when constructed in a closed-loop preserving public waterways and aquifers.

- The CCR/PSH system is a closed-loop design that significantly reduces any risk of pollutants leeching into the air or water.

- Most facilities where coal ash is produced and stored are already hooked into the grid, reducing the need for new lines and costly improvements.

- PSH facilities reduce the total amount of renewable energy sources required to meet and sustain a set amount of electricity demand.

- Much of the ancillary pollution from digging, hauling, and hauling again, e.g., from diesel truck engines and potential accidents, is avoided under the Krubera storage system.

- The CCR/PHS system spares communities of color and low income the added risks of digging and hauling coal ash from leaking sites.

The Inflation Reduction Act (IRA) has benefitted the Krubera system. The Act created a new section (48E) of the tax code[v] that expands the availability of the federal Investment Tax Credit (ITC) to stand-alone energy storage technologies with a minimum capacity of 5 kWh.

Krubera’s system creates an income stream for the utilities instead of the costly process of digging and hauling ash from existing unlined ponds. It also avoids the costs associated with maintaining or increasing the number of lined disposal sites.

The initial outlay for a Krubera system is 30 to 40 percent more than digging and hauling ash residuals to a lined landfill. However, the IRA’s transferable tax credits and the sale of power back into the grid offset the higher up-front cost. The credits pay up to 60 percent of the development cost of a stand-alone storage system.

The conversion of a waste stream into a cash stream takes the cost of cleanupoff the backs of ratepayers.

RMI estimates the remediation cost of Georgia Power’s coal ash ponds at over “$9 billion through the 2080s, with well over half of those charges set to be incurred over the next decade and financed as utility assets.” In North Carolina, regulators negotiated with Duke Energy to lower the amount the company intended to charge its ratepayers to remediate its coal ash problems.

Duke estimated its cleanup tab would be between $8 and $9 billion and warned shareholders that any inability to recover those costs could weaken its balance sheet. In total, Duke is expected to dig and haul 125 million tons of coal ash by 2038.

A lawsuit led to North Carolina’s supreme court directing the state’s utility regulators to reexamine a proposal “that would have ratepayers pay half the cleanup cost and shareholders pay the other half, extend the timeline for paying off those costs, and prevent the utility from profiting from the cleanup.”

“The proposed settlement would reduce coal ash costs included in Duke’s pending North Carolina rate requests by 60 [percent] while still allowing the utility to earn a return on the remaining cleanup costs[vii].”

One wonders why an offending utility should be allowed to charge its ratepayers for its conscious indiscretions — essentially profiting from a problem it created. A better way forward for utilities would be to turn the coal ash ponds into energy storage systems — doing so would turn the economics of remediation into a win/win/win proposition for the utilities, ratepayers, and the environment.

Given its many economic and environmental benefits, are utilities lining up outside Krubera’s door to order a CCR/PSH system? Not exactly.

Before laying the tens of millions of dollars for a CCR/PSH storage system, utilities would ideally like an opportunity to kick out the tires of an operating system. Given the billions of dollars for renewable energy projects and the aggressiveness of the Biden administration in climate-related regulation, including the disposal of coal ash and the containment of other toxic contaminants, Krubera naturally cast its eyes on Washington. The company hoped to raise between $5 and 10 million in partnership funds for a demonstration project.

What Hector found was a system difficult to understand and negotiate. He describes his experience as trying to put a square peg into a round hole — with the expected result of not fitting in.

Although the new 48(e) tax code provisions are available to purchasers of a Krubera CCR/PSH system, demonstration funds aren’t readily accessible. It’s the consequence of a combination of factors — some having to do with how the federal government goes about its business, while others result from bad planning.

The federal government is bound by a labyrinthian program and procurement system that slows the implementation of federal laws. The more complicated the act, the slower its implementation will be.

Speaking in practical terms, the Solar Energy Industries Association has this to say about the IRA. It is “a massive law with provisions that cut across several executive branch agencies and offices, including the U.S. Department of Treasury, U.S. Department of Energy, U.S. Department of the Interior, Environmental Protection Agency, U.S. Department of Agriculture,” and many others.

The IRA is not alone. The bipartisan infrastructure legislation (BIL) has also created programs in support of the administration’s climate priorities.

It is essential to understand that a federal agency can’t just cut a check to projects it likes — although it may seem to at times. Agencies adhere to the language of the appropriations bill that gives them the funds to spend, as well as to the Administrative Procedures Act (APA).

The APA is all about rules and regulations; the IRA and BIL are nothing else, if not a regulator’s fertile fields. In some cases, the APA, BIL, and IRA can lead to an environmental impact assessment and possibly a more detailed impact statement. It all takes time.

To put this in perspective, Krubera was contemplating competing for a project under the Department of Energy’s Office of Clean Energy Demonstrations (OCED). The Office recently posted an announcement that it would soon be taking applications for a $450 million program on former mine lands. The source of the money was the BIL that was passed in November of 2021.

Final proposals were due in August — meaning that decisions wouldn’t be made and acted upon in the current federal fiscal year. Because the list of eligible technologies included stand-alone storage systems — particularly those that can be combined with solar or wind — Krubera considered entering the fray.

The first step was to prepare and submit a ten-page concept paper that the Office would review. Based on their submission, some companies would be encouraged to submit full proposals, while others were free to, but it wasn’t encouraged.

The mine lands program was not a perfect fit for Krubera’s system — but close enough to consider putting a team together. The funding announcement listed priorities beyond certain technologies, like job creation, environmental justice, and partnerships with the community in which a project would be undertaken.

It’s not that Krubera thought the government’s priorities weren’t legitimate. It’s just that public sector priority areas aren’t emphasized in the ordinary course of their business.

Krubera decided not to compete for the mine land funds for multiple reasons. Management felt finding an appropriate site meeting the program’s guidelines would have been a stretch. Most of the offending ash ponds in the U.S. are on utility rather than mine lands.

Going forward, Krubera will market the IRA’s tax credits and sale of power as reason enough for utilities to purchase a CCR/PSH system. It’s possible, as well, that a soon-to-be-decided legal case will result in the courts ruling in favor of EPA’s efforts to require utilities to remediate all problem ponds. Should that occur, it will likely prove an impetus for Krubera sales.

I think it’s fair to say that the combination of factors, e.g., siting requirements, emphasis on jobs created, and partnerships with local communities, led to Hector’s feeling of trying to put a square peg into a round hole.

There’s no judgment being made here of either the government or the company. Government executives and private businesses are bound by different priorities.

It is not to say that “it is what it is.” Federal programming can always be made better — whether that’s true in today’s politics is another matter.

Although the infrastructure bill was bipartisan, the collegiality never carried over to the IRA, which was passed with only Democratic support. The current debt limit debate in Congress includes an effort by House Republicans to strip out the IRA’s climate-related provisions.

The effort reflects the Republican House majority’s attempt to tar the IRA as yet another example of a woke socialist agenda. The on-again/off-again nature of federal climate policy hardly encourages businesses — especially smaller businesses and those unfamiliar with federal program practices — to want to partner with the federal government.

The IRA was a rush to enact a several hundred-page piece of legislation. The bill did not emerge “from careful study and bipartisan consensus building but from intraparty haggling and a harried legislative process.” In fact, very little these days is the product of a carefully considered bi-partisan approach to governance — including the arguably better infrastructure bill.

I wonder how many other innovators, like Krubera, are out there who won’t want to do business with the government. I can’t help but feel that Krubera is not alone in pushing back from a possible government partnership.

*************

[i] https://www.energy.gov/sites/prod/files/Elem_Coal_Studyguide.pdf

[ii] Estimates vary between 70 and 130 tons.

[iii] John Ward, chair of Citizens for Recycling First and executive director of the National Coal Transportatiossociation.

[NH1]IRA of 2022 transferable tax credits

Teaser photo credit: View of the TVA Kingston Fossil Plant fly ash spill, appx. 1 mile from the retention pond. This view is from just off Swan Pond Road. The pile of ash in the photo is 20–25 feet high, and stretches for two miles or so along this inlet (the inlet empties into the Emory River). Image courtesy of Brian Stansberry Posted in Wikipedia