When it comes to regular newsletter writing, I am in awe of the Canadian writer, researcher and tech activist Cory Doctorow, who manages to produce long, detailed and carefully linked articles five days a week at his Pluralistic blog.

Now it seems that he has managed to add a neologism to the language, even if it is both ugly and memorable, to describe the business processes of tech companies over time. This is the word “enshittification”. Well, as I sad: ugly and memorable.

The phrase appeared first, I think, in a column that Doctorow wrote for Locus at the start of the year (it might have been earlier, since he is so prolific it is hard to keep track). The column dealt with the life cycle of technology companies. He was specifically interested in the exodus of users from Facebook and Twitter, although he has applied the model to TikTok and Amazon since then as well.

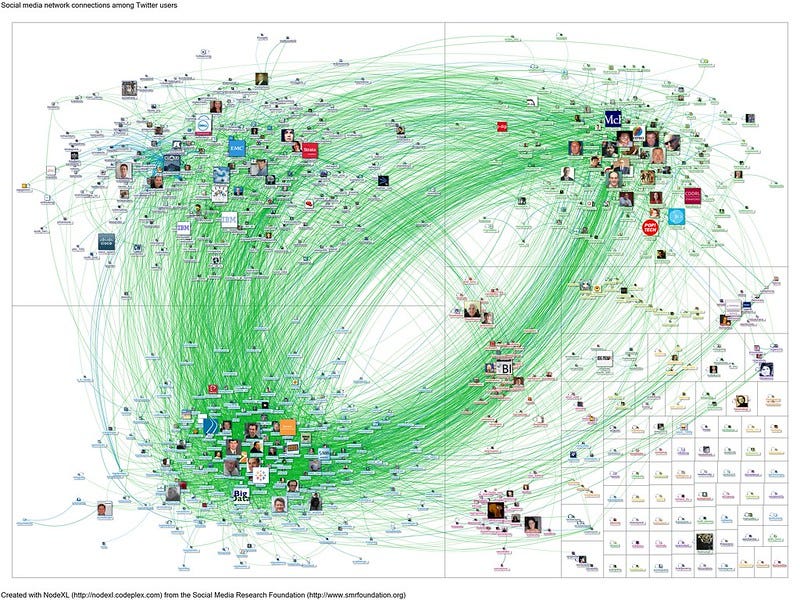

(Marc Smith, 20120227-NodeXL-Twitter-bigdata network graph, via Flickr, CC BY 2.0)

Switching costs

The argument goes like this. Successful social media companies enjoy network effects: the more people are on it, the more other people want to be, or need to be, on it. Network effects are factorial in their effects, because of the way the number of possible connections increases as more people join. But when people leave, this process goes into reverse.

One of the reasons why people don’t leave is because of ‘switching costs’. In social networks these costs are almost all social costs: you can’t access groups of friends you used to be able to access, for example. As social media companies have got more sophisticated (I don’t mean ‘sophisticated’ in a good way) they have learned new ways to make it more difficult to leave.

So, in short, the underlying logic of a social network is to make it as easy as possible for people to join—and as hard as possible to leave:

as Facebook and Twitter cemented their dominance, they steadily changed their services to capture more and more of the value that their users generated for them. At first, the companies shifted value from users to advertisers: engaging in more surveillance to enable finer-grained targeting and offering more intrusive forms of advertising that would fetch high prices from advertisers.

Takers not makers

This is the process of ‘enshittification’. And in the process, the value proposition changes. The companies become takers rather than makers. In his later article in Wired, on TikTok and Amazon, he had got this story down to a crisp few lines:

Here is how platforms die: First, they are good to their users; then they abuse their users to make things better for their business customers; finally, they abuse those business customers to claw back all the value for themselves. Then, they die.

The particular business models that have underpinned the digital tech sector have sharpened this process. Venture capitalists don’t worry too much early on about profits, or even revenues: what matters is user numbers and user growth. But they do later. Or they want to get their money back through a sale or a stock market flotation (IPO).

Beyond the tech sector

Perhaps not by chance, Doctorow’s neologism has had some airplay elsewhere recently. John Naughton mentioned it in his tech column in the Observer. And Tim Harford discussed it in a recent Undercover Economist (paywalled?) Financial Times column. And this whole process may also reflect that the tech sector is now a mature sector, with limited (or no) opportunities for growth from acquiring new customers, and therefore it starts to behave more like the rest of the economy.

In Techdirt in January, Mike Masnick suggested that this was a problem that extended beyond the tech sector. He traced it back to Milton Friedman’s assertion that the only duty of a company was to return value to shareholders. As a business model we know that this isn’t sustainable:

maximizing revenue in the short term… often means sacrificing long term sustainability and long term profits. That’s because if you’re only looking at the next quarter (or, perhaps, the next two to four quarters if we’re being generous) then you’re going to be tempted to squeeze more of the value out of your customers, to “maximize revenue” or “maximize profits for shareholders.” That’s because “Wall Street” and the whole “fiduciary duty to your shareholders” argues that if you’re not squeezing your customers for more value — or more “average revenue per user” (ARPU) — then you’re somehow not living up to your fiduciary duty.

Extractive business models

So this is about the conflict between companies with extractive business models, and companies with productive business models—locusts and bees, as Geoff Mulgan once called them.

Masnick quotes the tech publisher Tim O’Reilly in the same vein:

Tim O’Reilly has (correctly) argued that good companies should “create more value than they capture.” The idea here is pretty straightforward: if you have a surplus, and you share more of it with others (users and partners) that’s actually better for your long term viability, as there’s more and more of a reason for those users, partners, customers, etc. to keep doing business with you.

As Masnick and O’Reilly observe, this problem is more about the financialisation of the corporate sector than it is about particular characteristics of the tech sector (although the particular characteristics of the tech sector certainly help.)

Squeezing the business

I was reminded of Doctorow’s article because I was interested in the way that private equity companies squeeze the businesses they acquire to achieve efficiencies and increase returns, because I’d had a bad experience recently with a formerly family-owned business that had been acquired by private equity. It had become more interested in revenues and returns, and less interested in the quality of experience of its customers.

I might come back to private equity in another piece, since I think its significant role in the British economy (and the American) may be one of the reasons for productivity crisis in the UK. Because: if investors expect 5%-plus returns in a 1-2% growth economic environment, this is more likely to lead to extraction than to investment. The reason: investing for growth is harder, less predictable, and takes longer to generate returns than cutting jobs and services.

In other words, the diagnosis of ‘enshittification’ is right on the money. But the disease is far more widespread, and goes far deeper, than Doctorow suggests.

Teaser photo credit: An Aerial view of Meta’s Main Headquarters with the famed sign in view. Taken on a DJI Mavic 3 Classic; screenshotted from a video. By InvadingInvader – Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=128289136