Heat pumps are widely seen as the most important technology when it comes to decarbonising heating. Organisations including the International Energy Agency and McKinsey see heat pumps providing most of our heating needs in the future, on the path to net-zero emissions.

Until recently, heat pump sales had been struggling to take off, but this is changing rapidly. In a previous Carbon Brief guest post we reported double-digit growth in 2021.

Since then, Russia’s invasion of Ukraine, the resulting energy crisis and related policy interventions have boosted installations in Europe even further, to unprecedented new highs.

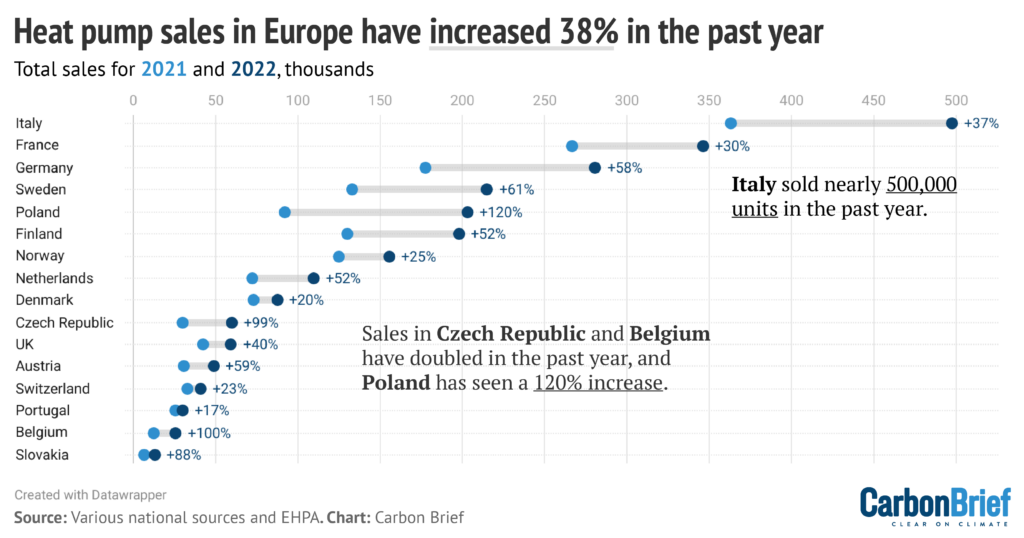

For the first time in 2022, heat pump sales in Europe reached 3m, up 0.8m (38%) from a year earlier and doubling since 2019. Sales doubled in a single year in Poland, Czech Republic and Belgium.

One main driver is cost: gas and oil prices skyrocketed in 2022 and even though electricity prices also increased sharply in many countries, running costs tipped in favour of heat pumps.

With further policy changes likely to continue supporting the rollout of heat pumps, we look at their current and potential future adoption across Europe.

Expanding markets

Initial figures for Europe show that 3m heat pumps were installed in 2022, up 38% year-on-year. This builds on a 34% increase in 2021, which was, in turn, much higher than the previous norm of around 10% per year. This acceleration is shown in the figure below.

Annual heat pump sales in Europe, 2012-2022. Source: EHPA. Chart by Carbon Brief using Datawrapper.

Within the total for Europe, national heat pump markets can be grouped into three categories: mature heat pump markets, emerging heat pump markets and dormant heat pump markets.

Mature markets in Europe, where heat pumps have been installed in large numbers for a long time and annual growth tends to be lower, include the Nordic countries, Switzerland and France.

Countries with emerging markets, showing more recent and rapid growth in large numbers, include Germany, Poland and the Netherlands. Dormant heat pump markets include Ireland (where no data is available for 2022), Portugal and the UK.

Most notable about 2022 is the rapid growth in both mature and emerging market segments, and the signs of awakening in dormant markets, such as the UK.

This is shown in the figure below, where heat pump sales in 2021 (light blue circles) and 2022 (dark blue) are shown for a selection of European countries. The percentage growth in sales between the two years is indicated at the end of each bar.

Growth in European heat pump markets in 2022, by country, in terms of the number of units sold and the percentage increase. Source: EHPA for all countries except those with the following national sources, SULPU, UNICLIMA, BWP, Duurzaam Verwarmd, NOVAP, PORT PC, SKVP, FWS. Chart by Carbon Brief using Datawrapper.

Even the very mature market in Finland experienced extraordinary growth in 2022, with heat pump sales up 50%. The Finnish government gives grants of up to €4,000 to replace oil-fired heating.

Similarly, Norway already has the highest heat pump penetration in the world. Around two-thirds of households now use the technology, which accounts for almost all new heating systems. Yet Norway still saw 25% growth in heat pump sales in 2022.

Despite having installed heat pumps for a long time and having a very mature market, Switzerland also saw 23% growth in 2022. Two-thirds of all heating systems sold in the country in 2022 were heat pumps. To level the playing field for clean heating technologies, Switzerland implemented a carbon tax on heating fuels in 2008, which is currently set at around €120 per tonne of carbon dioxide (CO2). This is coupled with a federal grant programme administered by the cantons.

For a mature heat pump market, Sweden also recorded impressive growth of 61% in 2022. Sweden’s carbon tax, which has been in place since the 1990s and reached €115/tCO2 in 2021, has been a primary driving force behind its heat pump market.

Doubling sales

While mature, established European markets recorded surprisingly strong sales growth in 2022, the most rapid increases were found in emerging heat pump markets.

In three European countries – Belgium, Czech Republic and Poland – the heat pump market roughly doubled in a single year.

Poland has long been seen as a laggard when it comes to climate policy. Yet its heating market is changing fast and nearly a third of all new systems are now served by heat pumps.

Moreover, Polish heat pump sales more than doubled in 2022, with growth of 120% year-on-year, possibly the fastest growth ever seen for the technology.

To put this in context, Poland also saw the second-greatest increase in 2022 when measured in terms of the numbers of heat pumps sold, behind only Italy, and beating out larger economies with more established markets for heat pumps such as France, Germany and Sweden.

A reform of Poland’s Clean Air Programme in 2018 provided increased support for heat pumps. At the same time, their running costs have become much more economically attractive, thanks to rising fossil fuel prices driving up the cost of alternatives.

Another major mover in 2022, Belgium, has been a heat pump laggard, with some of the lowest installation rates in Europe. Yet in 2022 the market doubled, with around 13,000 additional units sold. Similarly, the Czech heat pump market grew to reach 60,000 units sold, up from 30,000 in 2021.

Elsewhere, Slovakia experienced record growth of 88% in 2022. According to Vladimir Orovnický, the president of the Slovak Association for Cooling, Air-conditioning and Heat Pumps, this was mainly driven by energy security concerns rather than government policy, although the nation’s Green Houses Program continues to offer grants of up to €3,400 for heat pumps.

In Germany, one of Europe’s largest markets for heating systems, heat pump sales grew by a record 53% in 2022. One important driver was the announcement that all newly installed heating systems will need to run on at least 65% renewable energy by 1 January 2024 – two years earlier than initially planned. Rising gas and oil prices probably also contributed to the increase.

In 2021, Germany had implemented a carbon price on gas and oil used for heating, which will rise from €30/tCO2 today to €45/tCO2 in 2025. This is likely to support further growth for heat pumps.

Finally, France, historically one of Europe’s largest markets, set a new record for sales of air/water heat pumps in 2022. Sales of these devices grew by 30% to reach around 346,000 units, up from 267,000 in 2021.

Correspondingly, 2022 marked a sharp decline in the French fossil fuel boiler market, with sales of gas and oil condensing boilers falling 30%. France provides generous grants to install heat pumps, with larger sums available to lower-income households.

Cold climates

In addition to the growth rates in 2022, it is also interesting to look at the geographical distribution of sales. Indeed, the shift to heat pumps is not just happening in warmer countries. On the contrary, the highest penetration of heat pumps can be found in the coldest climates

In Europe, the four countries with the highest number of installations of heat pumps per 1,000 households in 2022 are Finland, Norway, Sweden and Estonia. These four countries also face the coldest winters in Europe, as shown in the figure below (y-axis and darker blue shading).

Number of heat pumps sold per 1,000 households in 2022 versus average January temperatures. Source: EHPA. Chart by Carbon Brief using Datawrapper.

Evidence disproves the oft-heard allegation that heat pumps are unable to work in cold climates. Although heat pumps are less efficient when it is coldest, performance does not suffer drastically.

Data from field tests in Germany show that air-to-water heat pumps still produced more than two units of heat for each unit of electricity when the outside temperature was -3.6C. (In technical terms, their average “coefficient of performance”, or COP, was 2.3.) Even at temperatures below -10C, the heat pumps were operating with a COP of 1.6. Similarly, in Finland, tests of air-to-air heat pump systems from various manufacturers resulted in COPs of 3 at -10C and 2 at -20C.

Outlook for heat pumps

High fossil fuel prices have changed the economics of heat pumps, often making them cheaper to run than gas- or oil-fired heating. While prices for oil and gas have fallen from last year’s record highs, it is unlikely that the coming years will see a return to previously low levels.

Meanwhile, the EU’s Emission Trading System (EUETS) is due to start putting a price on carbon from heating fuels from 2027, which will further advance the economics of heat pumps.

Several countries have announced phaseout dates for fossil fuel heating, although it remains to be seen how exactly this will be implemented. The European Commission has also mentioned a possible phaseout date for the sale of fossil fuel heating systems by 2029 and, if adopted, this could trigger an even bigger shift to heat pumps in EU member states.

Novel policy instruments such as clean heat standards, that may require a specific quantity of clean heating systems to be installed, are currently being discussed in the US and the UK. In addition to the existing policies and regulations, such clean heat standards could play an important role in scaling up Europe’s heat pump market in the coming years.

Finally, reforms to the EU renewable energy directive (RED) might also provide countries with the incentive to deploy heat pumps. The RED sets targets for growing the use of renewable heating and cooling, yet the current version encourages inefficient uses of renewables in buildings.

It incentivises the use of less-efficient technologies, such as biomass boilers, and does not consider the use of electricity for heating and cooling. The European Parliament and Council are currently considering revisions to the RED, which may consider counting the electricity used to run heat pumps towards the target. If adopted, this could provide another boost to heat pumps as countries use them to increase their shares of renewables in heating and cooling.

Teaser image from Pixabay.