What led to the twentieth century’s rapid economic growth? And what are the prospects for that kind of growth to return?

Slouching Towards Utopia: An Economic History of the Twentieth Century, was published by Basic Books, Sept 2022; 605 pages.

Taken together, two new books go a long way toward answering the first of those questions.

Bradford J. DeLong intends his Slouching Towards Utopia to be a “grand narrative” of what he calls “the long twentieth century”.

Mark Stoll summarizes his book Profit as “a history of capitalism that seeks to explain both how capitalism changed the natural world and how the environment shaped capitalism.”

By far the longer of the two books, DeLong’s tome primarily concerns the years from 1870 to 2010. Stoll’s slimmer volume goes back thousands of years, though the bulk of his coverage concerns the past seven centuries.

Both books are well organized and well written. Both make valuable contributions to an understanding of our current situation. In my opinion Stoll casts a clearer light on the key problems we now face.

Although neither book explicitly addresses the prospects for future prosperity, Stoll’s concluding verdict offers a faint hope.

Let’s start with Slouching Towards Utopia. Bradford J. Delong, a professor of economics at University of California Berkeley, describes “the long twentieth century” – from 1870 to 2010 – as “the first century in which the most important historical thread was what anyone would call the economic one, for it was the century that saw us end our near-universal dire material poverty.” (Slouching Towards Utopia, page 2; emphasis mine) Unfortunately that is as close as he gets in this book to defining just what he means by “economics”.

On the other hand he does tell us what “political economics” means:

“There is a big difference between the economic and the political economic. The latter term refers to the methods by which people collectively decide how they are going to organize the rules of the game within which economic life takes place.” (page 85; emphasis in original)

Discussion of the political economics of the Long Twentieth Century, in my opinion, account for most of the bulk and most of the value in this book.

DeLong weaves into his narratives frequent – but also clear and concise – explanations of the work of John Maynard Keynes, Friedrich Hayek, and Karl Polanyi. These three very different theorists responded to, and helped bring about, major changes in “the rules of the game within which economic life takes place”.

DeLong uses their work to good effect in explaining how policymakers and economic elites navigated and tried to influence the changing currents of market fundamentalism, authoritarian collectivism, social democracy, the New Deal, and neoliberalism.

With each swing of the political economic pendulum, the industrial, capitalist societies either slowed, or sped up, the advance “towards utopia” – a society in which all people, regardless of class, race, or sex, enjoy prosperity, human rights and a reasonably fair share of the society’s wealth.

DeLong and Stoll present similar perspectives on the “Thirty Glorious Years” from the mid-1940s to the mid-1970s, and a similarly dim view of the widespread turn to neoliberalism since then.

They also agree that while a “market economy” plays an important role in generating prosperity, a “market society” rapidly veers into disaster. That is because the market economy, left to its own devices, exacerbates inequalities so severely that social cohesion falls apart. The market must be governed by social democracy, and not the other way around.

DeLong provides one tragic example:

“With unequal distribution, a market economy will generate extraordinarily cruel outcomes. If my wealth consists entirely of my ability to work with my hands in someone else’s fields, and if the rains do not come, so that my ability to work with my hands has no productive market value, then the market will starve me to death – as it did to millions of people in Bengal in 1942 and 1943.” (Slouching Towards Utopia, p 332)

Profit: An Environmental History was published by Polity Books, January 2023; 280 pages.

In DeLong’s and Stoll’s narratives, during the period following World War II “the rules of the economic game” in industrialized countries were set in a way that promoted widespread prosperity and rising wealth for nearly all classes, without a concomitant rise in inequality.

As a result, economic growth during that period was far higher than it had been from 1870 to 1940, before the widespread influence of social democracy, and far higher than it has been since about 1975 during the neoliberal era.

During the Thirty Glorious Years, incomes from the factory floor to the CEO’s office rose at roughly the same rate. Public funding of advanced education, an income for retired workers, unemployment insurance, strong labor unions, and (in countries more civilized than the US) public health insurance – these social democratic features ensured that a large and growing number of people could continue to buy the ever-increasing output of the consumer economy. High marginal tax rates ensured that government war debts would be retired without cutting off the purchasing power of lower and middle classes.

Stoll explains that long-time General Motors chairman Alfred Sloan played a key role in the transition to a consumer economy. Under his leadership GM pioneered a line-up ranging from economy cars to luxury cars; the practice of regularly introducing new models whose primary features were differences in fashion; heavy spending on advertising to promote the constantly-changing lineup; and auto financing which allowed consumers to buy new cars without first saving up the purchase price.

By then the world’s largest corporation, GM flourished during the social democratic heyday of the Thirty Glorious Years. But in Stoll’s narrative, executives like Alfred Sloan couldn’t resist meddling with the very conditions that had made their version of capitalism so successful:

“There was a worm in the apple of postwar prosperity, growing out of sight until it appeared in triumph in the late 1970s. The regulations and government activism of the New Deal … so alarmed certain wealthy corporate leaders, Alfred Sloan among them, that they began to develop a propaganda network to promote weak government and low taxes.” (Profit, page 176)

This propaganda network achieved hegemony in the 1980s as Ronald Reagan and Margaret Thatcher took the helm in the US and the UK. DeLong and Stoll concur that the victory of neoliberalism resulted in a substantial drop in the economic growth rate, along with a rapid growth in inequality. As DeLong puts it, the previous generation’s swift march towards utopia slowed to a crawl.

DeLong and Stoll, then, share a great deal when it comes to political economics – the political rules that govern how economic wealth is distributed.

On the question of how that economic wealth is generated, however, DeLong is weak and Stoll makes a better guide.

DeLong introduces his discussion of the long twentieth century with the observation that between 1870 and 2010, economic growth far outstripped population growth for the first time in human history. What led to that economic acceleration? There were three key factors, DeLong says:

“Things changed starting around 1870. Then we got the institutions for organization and research and the technologies – we got full globalization, the industrial research laboratory, and the modern corporation. These were the keys. These unlocked the gate that had previously kept humanity in dire poverty.” (Slouching Towards Utopia, p. 3)

Thomas Edison’s research lab in West Orange, New Jersey. Cropped from photo by Anita Gould, 2010, CC BY-SA 2.0 license, via Flickr.

These may have been necessary conditions for a burst of economic growth, but were they sufficient? If they were sufficient, then why should we believe that the long twentieth century is conclusively over? Since DeLong’s three keys are still in place, and if only the misguided leadership of neoliberalism has spoiled the party, would it not be possible that a swing of the political economic pendulum could restore the conditions for rapid economic growth?

Indeed, in one of DeLong’s few remarks directly addressing the future he says “there is every reason to believe prosperity will continue to grow at an exponential rate in the centuries to come.” (page 11)

Stoll, by contrast, deals with the economy as inescapably embedded in the natural environment, and he emphasizes the revolutionary leap forward in energy production in the second half of the 19th century.

Energy and environment

Stoll’s title and subtitle are apt – Profit: An Environmental History. He says that “economic activity has always degraded environments” (p. 6) and he provides examples from ancient history as well as from the present.

Economic development in this presentation is “the long human endeavor to use resources more intensively.” (p. 7) In every era, tapping energy sources has been key.

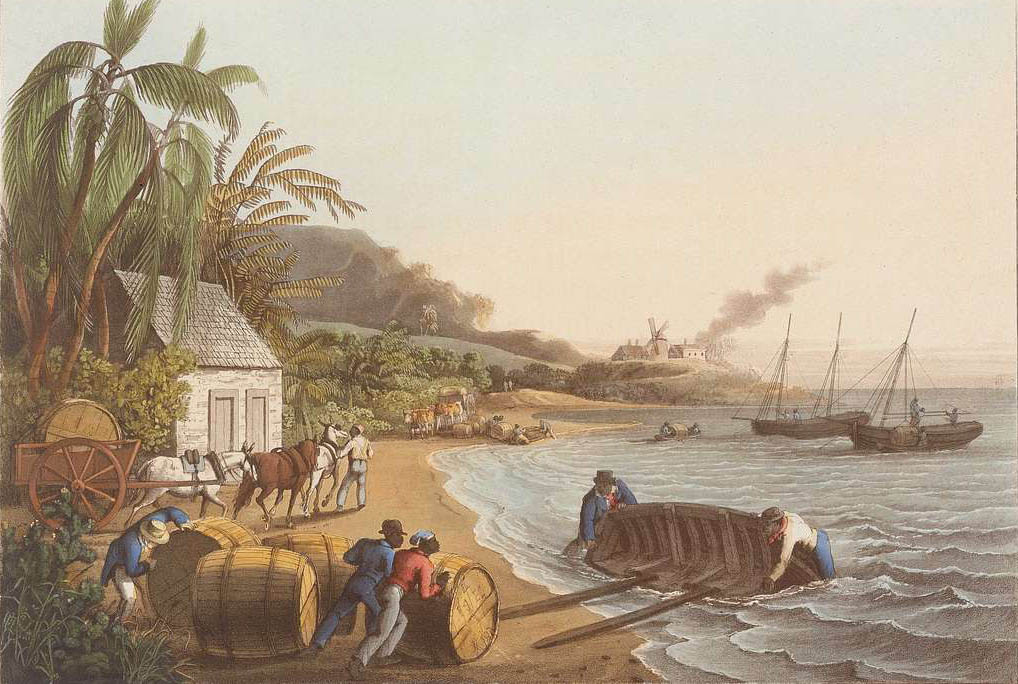

European civilization reached for the resources of other regions in the late medieval era. Technological developments such as improved ocean-going vessels allowed incipient imperialism, but additional energy sources were also essential. Stoll explains that the Venetian, Genoese and Portuguese traders who pioneered a new stage of capitalism all relied in part on the slave trade:

“By the late fifteenth century, slaves made up over ten percent of the population of Lisbon, Seville, Barcelona, and Valencia and remained common in southern coastal Portugal and Spain for another century or two.” (p. 40)

The slave trade went into high gear after Columbus chanced across the Americas. That is because, even after they had confiscated two huge continents rich in resources, European imperial powers still relied on the consumption of other humans’ lives as an economic input:

“Free-labor colonies all failed to make much profit and most failed altogether. Colonizers resorted to slavery to people colonies and make them pay. For this reason Africans would outnumber Europeans in the Americas until the 1840s.” (p. 47)

While the conditions of slavery in Brazil were “appallingly brutal”, Stoll writes, Northern Europeans made slavery even more severe. As a result “Conditions in slave plantations were so grueling and harsh that birthrates trailed deaths in most European plantation colonies.” (p 49)

‘Shipping Sugar’ from William Clark’s ‘Ten views in the island of Antigua’ (Thomas Clay, London, 1823). Public domain image via Picryl.com.

Clearly, then, huge numbers of enslaved workers played a major and fundamental role in rising European wealth between 1500 and 1800. It is perhaps no coincidence that in the 19th century, as slavery was being outlawed in colonial empires, European industries were learning how to make effective use of a new energy source: coal. By the end of that century, the fossil fuel economy had begun its meteoric climb.

Rapid increases in scientific knowledge, aided by such organizations as modern research laboratories, certainly played a role in commercializing methods of harnessing the energy in coal and oil. Yet this technological knowhow on its own, without abundant quantities of readily-extracted coal and oil, would not have led to an explosion of economic growth.

Where DeLong is content to list “three keys to economic growth” that omit fossil fuels, Stoll adds a fourth key – not merely the technology to use fossil fuels, but the material availability of those fuels.

By 1900, coal-powered engines had transformed factories, mines, ocean transportation via steamships, land transportation via railroads, and the beginnings of electrical grids. The machinery of industry could supply more goods than most people had ever thought they might want, a development Stoll explains as a transition from an industrial economy to a consumer economy.

Coal, however, could not have powered the car culture that swept across North America before World War II, and across the rest of the industrialized world after the War. To shift the consumer economy into overdrive, an even richer and more flexible energy source was needed: petroleum.

By 1972, Stoll notes, the global demand for petroleum was five-and-a-half times as great as in 1949.

Like DeLong, Stoll marks the high point of the economic growth rate at about 1970. And like DeLong, he sees the onset of neoliberalism as one factor slowing and eventually stalling the consumer economy. Unlike DeLong, however, Stoll also emphasizes the importance of energy sources in this trajectory. In the period leading up to 1970 net energy availability was skyrocketing, making rapid economic growth achievable. After 1970 net energy availability grew more slowly, and increasing amounts of energy had to be used up in the process of finding and extracting energy. In other words, the Energy Return on Energy Invested, which increased rapidly between 1870 and 1970, peaked and started to decline over recent decades.

This gradual turnaround in net energy, along with the pervasive influence of neoliberal ideologies, contributed to the faltering of economic growth. The rich got richer at an even faster pace, but most of society gained little or no ground.

Stoll pays close attention to the kind of resources needed to produce economic growth – the inputs. He also emphasizes the anti-goods that our economies turn out on the other end, be they toxic wastes from mining and smelting, petroleum spills, smog, pervasive plastic garbage, and climate-disrupting carbon dioxide emissions.

Stoll writes,

“The relentless, rising torrent of consumer goods that gives Amazon.com its apt name places unabating demand on extractive industries for resources and energy. Another ‘Amazon River’ of waste flows into the air, water, and land.” (Profit, p. 197)

Can the juggernaut be turned around before it destroys both our society and our ecological life-support systems, and can a fair, sustainable economy take its place? On this question, Stoll’s generally excellent book disappoints.

While he appears to criticize the late-twentieth century environmental movement for not daring to challenge capitalism itself, in Profit’s closing pages he throws cold water on any notion that capitalism could be replaced.

“Capitalism … is rooted in human nature and human history. These deep roots, some of which go back to our remotest ancestors, make capitalism resilient and adaptable to time and circumstances, so that the capitalism of one time and place is not that of another. These roots also make it extraordinarily difficult to replace.” (Profit, p. 253)

He writes that “however much it might spare wildlife and clean the land, water, and air, we stop the machinery of consumer capitalism at our peril.” (p. 254) If we are to avoid terrible social and economic unrest and suffering, we must accept that “we are captives on this accelerating merry-go-round of consumer capitalism.” (p. 256)

It’s essential to curb the power of big corporations and switch to renewable energy sources, he says. But in a concluding hint at the so-far non-existent phenomenon of “absolute decoupling”, he writes,

“The only requirement to keep consumer capitalism running is to keep as much money flowing into as many pockets as possible. The challenge may be to do so with as little demand for resources as possible.” (Profit, p. 256)

Are all these transformations possible, and can they happen in time? Stoll’s final paragraph says “We can only hope it will be possible.” Given the rest of his compelling narrative, that seems a faint hope indeed.

* * *

Coming next: another new book approaches the entanglements of environment and economics with a very different perspective, telling us with cheerful certainty that we can indeed switch the industrial economy to clean, renewable energies, rapidly, fully, and with no miracles needed.

Image at top of page: ‘The Express Train’, by Charles Parsons, 1859, published by Currier and Ives. Image donated to Wikimedia Commons by Metropolitan Museum of Art.