As a military conflict rages in Ukraine between Russia and what the Russian government calls “the West” (apparently meaning NATO allies and particularly the United States), there is a parallel economic battle between “stuff” and “finance.” Both categories are affected by economic sanction regimes imposed by each side. But there is a striking difference in what each side has to sell.

In advanced countries, the percentage of the total economy devoted to services has long exceeded that devoted to goods. This is a reflection of the increasing productivity of those working in manufacturing, mining, agriculture, forestry and fishing who make it possible for so many people to work in service industries. These raw materials and goods industries provide all the stuff those of us in the service economy require to stay alive and perform our services.

It is a testament to the remarkable rise in productivity of the raw materials and goods industries that in the United States, for example, the service sector accounts for almost 77 percent of all economic activity. In France, the percentage is about 70 percent. In Russia the percentage is a little lower, about 68 percent, which may reflect Russia’s relatively large mining, forestry, and agriculture inputs to its economy.

But regardless of the percentage, all service industries remain completely dependent on the raw materials and manufactured goods sectors to function. That has become even more apparent in the wake of price increases on essential goods and disruptions of trade that have resulted from the Russia-Ukraine conflict due to economic sanctions by both sides in the contest.

Western economies these days are dominated by finance and real estate. By that I mean they have large numbers of people working in financial industries including banking and investment services; insurance; and real estate brokerage, leasing and management. In the United States, for instance, the sectors which provide “stuff” to the economy (manufacturing, mining, agriculture, forestry and fishing) make up 19.4 percent of the economy while the finance, insurance and real estate (FIRE) sector make up 17.8 percent according to the U.S. Bureau of Economic Analysis.

But this underestimates the importance of finance as sector after sector of the economy is turned into a financial asset ruled by the imperatives of finance rather than the logic of service to customers. The purchase of hospitals and medical practices by private equity firms—with generally no expertise in running health care enterprises, but vast expertise in extracting money from companies—comes to mind. The same kind of extraction of wealth and reduction of service is taking place in the newspaper industry as private equity gobbles up paper after paper.

To understand why our world economy wobbles so readily in the face of an epidemic and now a war accompanied by severe restrictions on trade, it is worthwhile to look at the economy not through the visual of a pie chart, but rather as an inverted pyramid with the comparatively tiny agriculture, mining and utilities sectors underpinning all other activities. To see how I represented this, it is worthwhile to review a piece I wrote in 2007 entitled “Upside down economics.” It’s an ecologist’s view of how the economy actually works.

We are today balancing more services than ever before on the small sectors that produce raw materials and the energy needed to convert these materials into something we can use in manufacturing, construction and transportation. Disruptions due to shortages in these vital areas reverberate throughout the economy.

Those who are looking at their utility bills worldwide, but especially in Europe, are feeling the extreme impacts we are experiencing in the energy market. For example, in Europe natural gas trades at prices many times higher than at the beginning of last year when tensions between Europe and Russia were low and no war was in sight.

The wide-ranging sanctions placed on Russian trade by NATO allies and other supporters of Ukraine were expected to bring the Russian economy to a halt. They definitely hurt, but we have no reliable information on how much. What seems to have hurt even worse is the decline in the availability of oil and natural gas due to the curtailment of Russian exports; the decline in fertilizer exports from Russia and Belarus which are both large exporters; and the decline in metals exports from Russia’s many mines.

All of this is leading to devastating closures of energy-intensive industrial operations in Europe due to high energy prices that make their products uncompetitive. These industries include steel, fertilizer, aluminum, and some manufacturing such as glass-making. Of course, energy-intensive retail operations such as bakeries which require large amounts of heat may simply fail because they cannot move their operations elsewhere.

The ethos in the West since the days when Margaret Thatcher was prime minister of Great Britain has been that all activity and relationships should be governed by the marketplace and the logic of finance. Thatcher is famous for saying: “There’s no such thing as society. There are individual men and women and there are families.”

It is hard to understand how people can make common cause effectively with such an ethos. And, we have an almost perfect experiment regarding this British approach versus the Norwegian approach to governing. Both the United Kingdom and Norway were assigned areas of the North Sea to explore for oil and natural gas, areas with roughly the equivalent endowment of hydrocarbons.

The United Kingdom decided that the best way to exploit that oil and gas was to let private companies do it. Those companies did bring the oil and gas up from the seabed and made it available to the U.K. and to Europe. The U.K. became an substantial exporter of energy. But since the incentive for private companies is to produce as much oil and gas as quickly as possible to benefit shareholders, the U.K. has been a net importer of petroleum products since 2013 and an importer of natural gas for even longer.

Norway decided to manage its part of the North Sea through its state-owned oil company and through careful supervision of private companies. Monies derived from the government’s share of the revenues were directed into a sovereign wealth fund for supporting the needs of the people of Norway. Today, Norway has the largest such fund in the world. And, the country continues to export vast amounts of natural gas to Europe and large amounts of oil as well.

To be fair, the population of the U.K. is over 68 million and that of Norway is about 5.5 million. Still, the difference in approach and results provides a good illustration of what happens when one country emphasizes turning “stuff” into money as quickly as possible and another focuses on maximizing the well-being of its people long term by husbanding carefully both the “stuff” it has at its disposal and the financial rewards that “stuff” produces.

Russia by happenstance is a country with huge natural resources: oil and gas, huge fertile lands for agriculture—it is the world’s third largest wheat producer and the largest wheat exporter—metals, gems, and vast forests. Russia is probably not managing those resources in the way the Norway has managed its oil and gas resources. But the Russians have a lot of “stuff” still in the ground and annually available from their farm fields. All this bounty appears to have shielded the country somewhat from sanctions.

It seems increasingly apparent that the focus on “finance” will be less rewarding and the focus on “stuff” will become more important to the nations of the world. The trend toward bringing manufacturing back home; producing more energy locally; and growing more food and fiber for domestic consumption will get a boost from those countries wise enough to see the change in trend.

Integration of the world economy favors those who control finance and can therefore extract ever larger payments from centralized systems under their ownership or authority. Deglobalization—which was already underway due to the effects of the pandemic on supply lines and is now speeding up due to the war—will increasingly favor those who control stuff. And, it turns out that stuff is far more important to supporting our daily lives than the manipulations of the titans of finance.

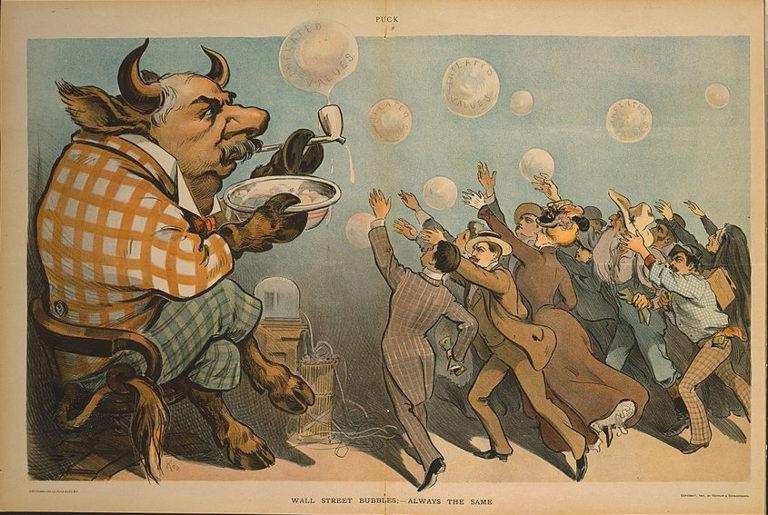

Image: “Wall Street bubbles; – Always the same ” (1901) by J. Ottman Lithographic Company via Wikimedia Commons https://commons.wikimedia.org/wiki/File:Wall_Street_bubbles;_-_Always_the_same_-_J._Ottmann_Lith._Co._;_Kep._LCCN00650795.jpg