This article was originally published as part of the Disparity to Parity project, created by a group of farmers, activists, scholars, organizers, movement leaders and policy analysts united by a commitment to food, farm and land justice, resilience and wellbeing. Visit the project’s website to read more essays on the history of parity, racial equity, economic justice, environmental resilience, food sovereignty and hear from farmers on the concept of parity.

The recent renegotiation of the North American Free Trade Agreement (NAFTA), resulting in the US-Mexico Canada Agreement (USMCA), put Canada’s successful dairy and poultry supply management program in the spotlight. President Trump (and Tom Vilsack, then representing the US Dairy Export Council) complained about the unfairness of Canada’s protection of its dairy market against US exports to Canada and called for it to be abolished. Rather than joining Trump’s demand to open up Canada’s markets, the Wisconsin Farmers Union, National Family Farm Coalition, and the International Union of Teamsters, among others, pointed out that the entire Canadian market is too small to make any real difference in the crisis confronting US dairy farmers, and, more fundamentally, that we should be learning from the Canadian experience to shape a better approach to oversupply and low prices in the US.

Supply Management and a Fair Price Market

This shift from export expansion to supporting a fair price market would not be insignificant. Supply management was an essential component of US farm policy starting with the New Deal. Organized political pressure by farmers and their allies led to the establishment of federal legislation that set minimum prices for farm goods that met the costs of production and provided a decent living (parity), and supply management to balance demand with the volume of production. A national grain reserve was created to stabilize prices in times of droughts or other natural disasters.

Over the next few decades there was a steady assault on these programs by agribusinesses, corporate-led think tanks, the Chamber of Commerce and American Banking Association, among others, that resulted in a series of policy changes that eroded the parity programs. By the time the last vestiges of that program were eliminated in the 1996 Farm Bill, the idea of supply management was dismissed as a relic of the past. The debate on the USMCA resurfaced supply management as a viable alternative proposal to a US dairy policy that has been disastrous for small and mid-sized dairy farmers.

Looking North: Lessons from the Canadian System

The Canadian program, which carefully balances supply and demand of national dairy supplies, would not function under a flood of cheap imports from the US or other countries. Canada excluded dairy from liberalization in the original NAFTA. The USMCA erodes that exclusion, creating a special window, called a tariff rate quota, for duty-free exports of US dairy products to Canada amounting to 3.6 percent of the Canadian market. This comes on top of a concession equivalent to 3.25 percent of the market granted under Canada’s entry into the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and additional market access for 17,500 tons of European cheese under CETA (the Canada-European Union trade deal). Taken together, these new concessions could amount to nearly nine percent of the Canadian dairy market. While the Canadian government has promised farmers some compensation for the opening under CETA, National Farmers Union Canada President Jan Slomp says, “We take no comfort in promises of compensation…CETA shrinks total revenue available to Canadian farmers, yet the subsidy is given to the farmer that expands. To expand when revenue is diminished is a rather reckless business decision.” This approach will contribute to oversupply in Canada, replicating the problem at the heart of the US dairy crisis.

Canada also agreed to abolish the Class 6 and Class 7 milk designations (which had allowed Canada to control the price and thus reduce the over-supply of high-protein concentrates and powders used in cheese and processed foods) in Annex 3B of the USMCA chapter on agriculture. That annex also details plans to tie Canadian prices to domestic prices set by USDA (adjusted by Canadian processor margins). Furthermore, Canadian exporters would add a price surcharge to exports of skim milk powder, milk protein concentrate and infant formula if they exceed certain set volumes, so as not to out-compete US producers. Canada exports a very small share of its dairy supplies, which has served as a sort of escape valve to account for fluctuations in domestic demand. The new provisions will likely undermine the effectiveness of that tool.

Despite these concessions and the weakening of the overall program, it is a working example of supply management in the 21st century. This doesn’t mean that the US should simply copy the Canadian program, but rather that it provides a concrete example to build from. US farmers have raised concerns about the Canadian quota system, especially the capitalization of quotas, which creates steep entry-barriers for new and aspiring dairy farmers. After discussions with Canadian farmers, the Dairy Together campaign, led by the Wisconsin Farmers Union, developed a plan that addresses these concerns: First, a base level of production is established for each farm. Farmers wishing to expand production beyond that base pay a fee for additional production units; those fees are then pooled and distributed back to the farmers that did not expand beyond their base.1 As US groups consider the kind of program that could work in our country, we should look to the Canadian example to create model legislation and the contours of a new program moving forward.

Looking South: Mexico’s Guaranteed Price Program

In 2019, Mexico initiated a program to achieve self-sufficiency in corn and other basic grains that begins to counter the push for reckless integration of North American food and farm systems. The Guaranteed Price program provides production incentives for small-scale farmers that include prices set to cover costs plus a reasonable return. Farmers receive public support to expand production of basic grains, milk and meat by small scale farmers, recognizing them as the backbone of Mexico’s food security and rural livelihoods. As a starting point, it established guaranteed prices for corn, wheat, rice, beans, and milk. According to Victor Suarez Carrera, the Undersecretary for Food Self-Sufficiency, that price is based on a reference price from the Chicago Mercantile Exchange, with adjustments for transportation, estimates of the cost of production, and a reasonable return to the farmer. It is set for one year, so farmers can plan around it.2 As indicated in the chart below, the price is guaranteed for eligible small-scale farmers (i.e., those producing on less than five hectares (12.35 acres) of land in the case of corn), up to a set volume. In its first year of operations, the program included two million farmers.

Changes were made along the way, including restoring a network of 800 collection centers in 30 states to facilitate purchase closer to farm communities. Many of those warehouses had been shuttered during the era of extreme liberalization. The base price of corn was revised to include an extra 150 pesos/ton for transportation costs. These changes took time, resulting in several months of delay. As a result, some farmers turned to markets outside the program, but even so, the guaranteed price served as a floor price, improving outcomes for farmers and lessening pressure on the government to manage all aspects of the supply chain. Most recently, changes were made to the program to allow for participation by medium-scale farmers (up to 50 hectares) at somewhat lower guaranteed prices.3

This program is the result of sustained pressure by farmers’ organizations meeting with a willing government. In an online seminar with government and civil society leaders on the program’s outcomes, Leticia Lopez, President of the Asociación Nacional de Empresas Comercializadoras de Productores del Campo (a civil society organization representing 60,000 farmers in 13 states) commented that the program represents a sharp break from the neoliberal programs implemented in previous decades, providing certainty to farmers on prices and protecting them from extremes of volatility and corporate concentration. It is a “triumph of farmers’ movements,” she said, and it continues to be a “fundamental role of farmers’ organizations to make sure it works.”

The Mexican Guaranteed Price program, like the Canadian dairy supply management program, is not a blueprint for a US parity program, but it offers important lessons as a laboratory for shifting agriculture policy to focus on fair market prices. In that sense, we can learn from their experiences and create the conditions in our own trade and farm policies to encourage continued innovations for supply management and parity pricing in our hemisphere and perhaps beyond.

Oversupply and the Global Context

To address fundamental issues such as oversupply and below cost prices, we must also insist on rolling back the additional trade liberalization called for in the USMCA. This is not only a question of solidarity, although that is a valid concept in these polarized times, but also of effectiveness. Trade liberalization under the World Trade Organization (WTO) and numerous bilateral and regional trade deals was designed to facilitate exchanges of goods, services and investments across borders, not to promote fair or sustainable agricultural systems or reduce economic disparities. They led to the dramatic expansion of US based agribusinesses into other aspects of supply chains and the rise of powerful corporations that are nominally Brazilian or Chinese or American but are in fact transnational.

The emergence of global, bilateral, and plurilateral trade deals set the stage for many of these changes. In 1996, Renato Ruggerio, the first Director General of the newly formed WTO proclaimed, “We are no longer writing the rules of interaction among separate national economies. We are writing the constitution of a single global economy.” He went on to insist that the new rules could rebalance the scales between rich and poor countries, but in fact, the WTO, along with NAFTA and the countless bilateral and regional trade deals that followed have knitted economies together in ways that lowered social and environmental protections and accelerated inequality within and between nations. Vast corporations were empowered to seamlessly operate across borders. This has been especially true in agriculture, where the traditional ABCDs (Archer Daniels Midland/Bunge/Cargill/Dreyfuss) that had focused on grain trading expanded vertically and horizontally into other aspects of supply chains and, at the same time, were supplemented by companies like the transnational JBS, one of the largest of those nominally Brazilian companies.

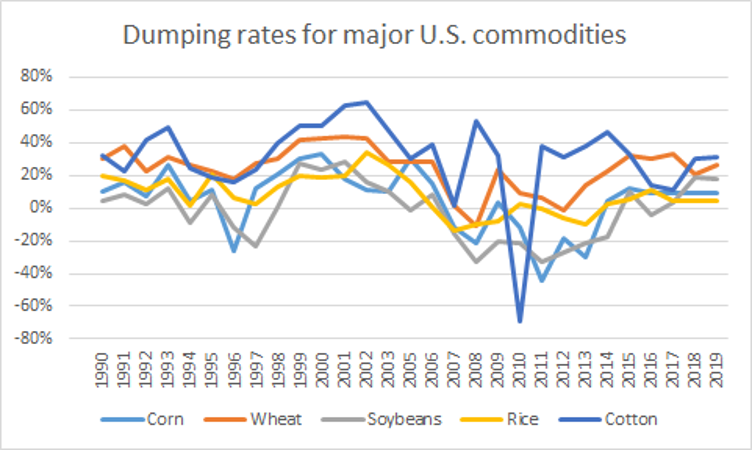

The Institute for Agriculture and Trade Policy (IATP) began to document the extent of dumping, i.e., exporting farm goods at below the cost of production, in the late 1990s. The dumping rate is the difference between the full cost of production (including estimates of transportation and subsidies) and the export price, divided by the full cost of production. For example, as of 2019, corn was exported at nine percent below the cost of production, wheat at 26 percent, and soy at 12 percent below the cost of production. With some brief exceptions, there has been a clear and consistent pattern of overproduction and underpriced exports by US based agribusiness firms invading global markets, to the detriment of farmers. Under NAFTA, for example, US exports of cheap corn to Mexico increased more than 400 percent. According to one study using Mexican census data, some 4.9 million Mexican family farmers were displaced between 1991 and 2007, with about three million becoming seasonal workers in agro-export industries.

Author’s update of calculations published in Murphy S, Hansen-Kuhn K (2019), The true cost of US agricultural dumping, Renewable Agriculture and Food Systems 1-15. https://doi.org/10.1017/S1742170519000097.

The deregulation of US financial and commodity markets and the resulting increase in excess speculation, followed by renewable energy legislation that dramatically increased the demand for ethanol, and crop failures in Australia and Russia, led to a huge increase in commodity prices in 2007-2008. The Food Price Crisis led to riots in many developing countries. That initial price spike was repeated in 2011-2012 when a major drought in the US caused grain prices to increase again. These periods of chaos in global markets created openings for corporations to consolidate power over supply chains to the detriment of farmers. When one family farm failed, it was often bought out by ever-larger farms and corporations that sold goods into ever more concentrated supply chains. These firms are in the business of adding value to primary commodities, whether they are fattening animals or turning corn into ethanol. They are happy to keep farmgate prices low, since they can take profits at other points in the supply chain. In addition, their enormous size means they can sustain short-term price swings or even profit from them, as long as they successfully predict the direction of those changes. Farmers, on the other hand, may defer losses temporarily, but often cannot weather successive rounds of boom or bust.

Increased dependence on export markets has increased vulnerabilities. For example, Trump’s imposition of tariffs led to retaliatory tariffs and decreases in purchases of US goods by China. COVID-19 created new disruptions to local and global supply chains. While Trump’s bailout program provided some temporary relief from initial losses, the situation highlights farmers’ vulnerability to the whims of presidents and politics. Global grain traders will simply shift purchases to other countries, with farmers assuming the risks of these trade wars, as well as other forms of volatility caused by speculative investments and climate change.

The continued rounds of volatility and disruption in markets underscore the failures of this system for farm economies and human lives. Canada and Mexico both have responded to farmer demands by establishing policies that protect their interests and establish a fair market, and the US should look to them for examples. The point is not to return to the past but to learn from what’s working now. The establishment of parity pricing for farmers, coupled with supply management and food reserves, would eliminate the conditions for dumping and should smooth price spikes, whether caused by market conditions, or climate change, or shortsighted geopolitical posturing.

2. Interview with Victor Suarez Cabrera, October 2019.

Read the essay at DisparitytoParity.org.

Teaser photo credit; By Daniellagreen – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=31671061