It only took us a century to use up the best of the planet’s finite reserves of fossil fuels. The dawning century will be a lot different.

In the autumn of 1987 I often sipped my morning coffee while watching a slow parade roll through the hazy dawn.

I had given up my apartment for a few months, so I could spend the rent money on quality bike-camping equipment for a planned trip to the Canadian arctic. My substitute lodgings were what is now referred to as “wild camping”, though most nights I slept in the heart of downtown Toronto. One of my favourite sites afforded a panoramic view of the scenic Don Valley Parkway, which was and remains a key automobile route from the suburbs into the city.

Even thirty-five years ago, the bumper-to-bumper traffic at “rush hour” had earned this route the nickname “Don Valley Parking Lot”. On weekday mornings, the endless procession of cars, most of them carrying a single passenger but powered by heat-throwing engines of a hundred or two hundred horsepower, lumbered downtown at speeds that could have been matched by your average cyclist.

Sometimes I would try to calculate how much heavy work could have been done by all that power … let’s see, 1000 cars/lane/hour X 3 lanes = 3000 cars/hour, X 200 horsepower each = the power of 600,000 horses! Think of all the pyramids, or Stonehenges, or wagon-loads of grain, that could be moved every hour by those 600,000 horses, if they weren’t busy hauling 3000 humans to the office.

This car culture is making someone a lot of money, I thought, but it isn’t making a lot of sense.

One early autumn afternoon a year later, in the arctic coastal town of Tuktoyaktuk, I dressed in a survival suit for a short helicopter trip out over the Beaufort Sea. The occasion was perhaps the most elaborate book launch party on record, to celebrate the publication of Pierre Berton’s The Arctic Grail: The Quest for the Northwest Passage and The North Pole. The publisher had arranged for a launch party on an off-shore oil-drilling platform in said Northwest Passage. As a part-time writer for the local newspaper, I had prevailed upon the publisher to let me join the author and the Toronto media on this excursion.

The flight was a lark, the dinner was great – but I couldn’t shake the unsettling impression made by the strange setting, beyond the ends of the earth. I thought back, of course, to those thousands of cars on the Don Valley Parkway alternately revving and idling their powerful engines. We must be burning up our petroleum stocks awfully fast, I thought, if after only a few generations we had to be looking for more oil out in the arctic sea, thousands of kilometers from any major population centre.

This post is the conclusion of a four-part series about my personal quest to make some sense of economics. I didn’t realize, in the fall of 1988, that my one-afternoon visit to an off-shore drilling rig provided a big clue to the puzzle. But I would eventually learn that dedicated scholars had been writing a new chapter in economic thought, and the quest for energy was the focus of their study.

Before I stopped my formal study of economics, I sought some sort of foundation for economics in various schools of thought. I devoted a good bit of attention to the Chicago School, and much more to the Frankfurt School. It would not have occurred to me, back then, to understand economics by paying attention to the fish school.

Schooled by fish

Well into the 21st century, I started hearing about biophysical economics and the concept of Energy Return On Investment (EROI). I can’t pinpoint which article or podcast first alerted me to this illuminating idea. But one of the first from which I took careful notes was an April 2013 article in Scientific American, along with an online Q & A, by Mason Inman and featuring the work of Charles A.S. Hall.

The interview ran with the headline “Will Fossil Fuels Be Able to Maintain Economic Growth?” Hall approached that topic by recalling his long-ago doctoral research under ecologist H.T. Odum. In this research he asked the question “Do freshwater fish migrate, and if so, why?” His fieldwork revealed this important correlation:

“The study found that fish populations that migrated would return at least four calories for every calorie they invested in the process of migration by being able to exploit different ecosystems of different productivity at different stages of their life cycles.”

The fish invested energy in migrating but that investment returned four times as much energy as they invested, and the fish thrived. The fish migrated, in other words, because the Energy Return On Investment was very good.

This simple insight allowed Hall and other researchers to develop a new theory and methodology for economics. By the time I learned about bio-physical economics, there was a great wealth of literature examining the Energy Return On Investment of industries around the world, and further examining the implications of Energy Return ratios for economic growth or decline.1

The two-page spread in Scientific American in 2013 summarized some key findings of this research. For the U.S. as a whole, the EROI of gasoline from conventional oil dropped by 50% during the period 1950 – 2000, from 18:1 down to 9:1. The EROI of gasoline from California heavy oil dropped by about 67% in that period, from 12:1 down to 4:1. And these Energy Return ratios were still dropping. Newer unconventional sources of oil had particularly poor Energy Return ratios, with bitumen from the Canadian tar sands industry in 2011 providing only about a 5:1 energy return on investment.2 In Hall’s summary,

“Is there a lot of oil left in the ground? Absolutely. The question is, how much oil can we get out of the ground, at a significantly high EROI? And the answer to that is, hmmm, not nearly as much. So that’s what we’re struggling with as we go further and further offshore and have to do this fracking and horizontal drilling and all of this kind of stuff, especially when you get away from the sweet spots of shale formations. It gets tougher and tougher to get the next barrel of oil, so the EROI goes down, down, down.”3

With an economics founded on something real and physical – energy – both the past and the immediate future made a lot more sense to me. Biophysical economists explained that through most of history, Energy Return ratios grew slowly – a new method of tilling the fields might bring a modestly larger harvest for the same amount of work – and so economic growth was also slow. But in the last two centuries, energy returns spiked due to the development of ways to extract and use fossil fuels. This allowed rapid and unprecedented economic growth – but that growth can only continue as long as steady supplies of similarly favourable energy sources are available.

When energy return ratios drop significantly, economic growth will slow or stop, though the energy crunch might be disguised for a while by subsidies or an explosion of credit. So far this century we have seen all of these trends: much slower economic growth, in spite of increased subsidies to energy producers and/or consumers, and in spite of the financial smoke-and-mirrors game known as quantitative easing.

The completed Hebron Oil Platform, before it was towed out to the edge of the Grand Banks off Newfoundland Canada. Photo by Shhewitt, from Wikimedia Commons.

The power of the green frog-skins

John (Fire) Lame Deer understood that though green frog-skins – dollars – seemed all-important to American colonizers, this power was at the same time an illusion. Forty years after I read Lame Deer’s book Seeker of Visions, the concepts of biophysical economics gave me a way to understand the true source of the American economy’s strength and influence, and to understand why that strength and influence was on a swift road to its own destruction.

For the past few centuries, the country that became the American empire has appropriated the world’s richest energy sources – at first, vast numbers of energy-rich marine mammals, then the captive lives of millions of slaves, and then all the life-giving bounty of tens of millions of hectares of the world’s richest soils. And with that head start, the American economy moved into high gear after discovering large reserves of readily accessible fossil fuels.

The best of the US fossil energy reserves, measured through Energy Return On Investment, were burned through in less than a century. But by then the American empire had gone global, securing preferred access to high-EROI fossil fuels in places as distant as Mexico, Saudi Arabia and Iran. That was about the time I was growing to adulthood, and Lame Deer was looking back on the lessons of his long life during which the green frog-skin world calculated the price of everything – the blades of grass, the springs of water, even the air.

The forces of the American economy could buy just about anything, it seemed. But dollars, in themselves, had no power at all. Rather, biophysical economists explained, the American economy had command of great energy resources, which returned a huge energy surplus for each investment of energy used in extraction. As Charles Hall explained in the Scientific American interview in 2013,

“economics isn’t really about money. It’s about stuff. We’ve been toilet trained to think of economics as being about money, and to some degree it is. But fundamentally it’s about stuff. And if it’s about stuff, why are we studying it as a social science? Why are we not, at least equally, studying it as a biophysical science?”4

The first book-length exposition of these ideas that I read was Life After Growth, by Tim Morgan. Morgan popularized some of the key concepts first worked out by Charles Hall.5 He wrote,

“Money … commands value only to the extent that it can be exchanged for the goods and services produced by the real economy. The best way to think of money is as a ‘claim’ on the real economy and, since the real economy is itself an energy dynamic, money is really a claim on energy. Debt, meanwhile, as a claim on future money, is therefore a claim on future energy.”6

The economic system that even today, though to a diminishing extent, revolves around the American dollar, was built on access to huge energy surpluses, obtained by exploiting energy sources that provided a large Energy Return On Investment. That energy surplus gave money its value, because during each year of the long economic boom there was more stuff available to buy with the money. The energy surplus also made debt a good bet, because when the debt came due, a growing economy could ensure that, in aggregate, most debts would be paid.

Those conditions are rapidly changing, Morgan argued. Money will lose its value – gradually, or perhaps swiftly – when it becomes clear that there is simply less of real, life-giving or life-sustaining value that can be bought with that money. At that point, it will also become clear that huge sums of debts will never and can never be repaid.

Ironically, since Morgan wrote The End of Growth, the dollar value of outstanding debt has grown at an almost incomprehensible pace, while Energy Return On Investment and economic growth have continued their slides. Is the financial bubble set for a big bang, or a long slow hiss?

Platform supply vessels battle the blazing remnants of the off shore oil rig Deepwater Horizon, 2010. Photo by US Coast Guard, via Wikimedia Commons.

The economy becomes a thing

When I was introduced to the concepts of biophysical economics, two competing thoughts ran through my head. The first was, “This explains so much! Of course, the value of money must be based on something biophysical, because we are and always have been biophysical creatures, in biophysical societies, dependent on a biophysical world.”

And the second thought was, “This is so obvious, why isn’t it taught in every Economics 101 course? Why do economists talk endlessly about GDP, fiscal policy and aggregate money supply … but only a tiny percentage of them ever talk about Energy Return On Investment?”

Another then-new book popped up right about then. Timothy Mitchell’s Carbon Democracy, published by Verso in 2013, is a detailed, dry work of history, bristling with footnotes – and it was one of the most exciting books I’ve ever read. (That’s why I’ve quoted it so many times since I started writing this blog.)7

As Mitchell explained, the whole body of economic orthodoxy that had taken over university economics departments in the middle of the twentieth century, and which remains the conventional wisdom of policy-makers today, was a radical departure from previous thinking about economics. Current economic orthodoxy, in fact, could only have arisen in an era when surplus energy seemed both plentiful and cheap:

“The conception of the economy depended upon abundant and low-cost energy supplies, making postwar Keynesian economics a form of ‘petroknowledge’.” (Carbon Democracy, page 139)

Up until the early 20th century, Mitchell wrote, mainstream economists based their studies on awareness of physical resources. That changed when the exploding availability of fossil fuels created an illusion, for some, that surplus energy was practically unlimited. In response,

“a battle developed among economists, especially in the United States …. One side wanted economics to start from natural resources and flows of energy, the other to organise the discipline around the study of prices and flows of money. The battle was won by the second group, who created out of the measurement of money and prices a new object: the economy.” (page 131)

Stated another way, “the supply of carbon energy was no longer a practical limit to economic possibility. What mattered was the proper circulation of banknotes.” (page 124)

By the time I went to university in the 1970s, this “science of money” was orthodoxy. My studies in economics left me with an uneasy feeling that the green frog-skin world was, truly, a powerful illusion. But decades passed before I heard about people like H.T. Odum, Charles Hall, and others who were developing a new foundation for economics. A foundation, I now believe, that not only explains our economic history, but is vastly more helpful in making sense of our future challenges.

* * *

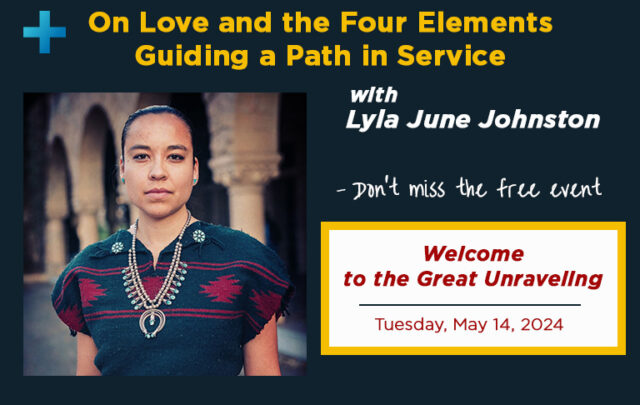

Lame Deer’s vision of the end of the green frog-skin world was vividly apocalyptic. He understood back in the 1970s that we are all endangered species, and that the green frog-skin world must and will come to an end. In his vision, the bad dream world of war and pollution will be rolled up, and the real world of the good green earth will be restored. But he had no confidence that the change would be easy. “I hope to see this,” he said, “but then I’m also afraid.”

Today we can study many visions expressed in scientific journals. Some of these visions outline new worlds of sharing and harmony, but many visions foretell the worsening of the climate crisis, economic system collapse, ecosystem collapse, crashes of biodiversity, forced global migrations. These visions are frightening and dramatic. Are we caught up, today, in an apocalyptic fever, or is it cold hard realism?

We have much to hope for, and we also have much to fear.

Image at top of post: Offshore oil rigs in the Santa Barbara channel, by Anita Ritenour, CC 2.0, flickr.com

Footnotes

- I have written about this subject at length in other posts, so the discussion of EROI here is brief. My articles in the American Journal of Economics and Sociology in 2020 summarize implications of EROI for the fossil fuel economy and for the renewable energy transition. Please contact me through the Contact page, here, for further information about these articles.

- Scientific American, April 2013, pages 60 – 61

- Q & A with Mason Inman, Scientific American online

- Q & A with Mason Inman, Scientific American online

- Morgan’s Life After Growth is the kind of book you can easily read in a weekend. Hall’s textbook Energy and the Wealth of Nations (with Kent Klitgaard, Springer 2012, 2018) is the kind of book that rewards careful study for a whole semester.

- Life After Growth, published by Harriman House Ltd. in 2013 and in paperback in 2016. This citation is from the 2013 Kindle edition.

- Among its many virtues, Mitchell’s book offers a corrective to one possible shortcoming of biophysical economics. Recall Charles Hall’s statement in Scientific American: “if [the economy is] about stuff, why are we studying it as a social science? Why are we not, at least equally, studying it as a biophysical science?” (emphasis mine) The biophysical grounding of economics helps us understand the physical limiting factors, which in turn help us explain the average per capita availability of resources. But almost no one receives the “average per capita” – in highly unequal societies like ours, most people get far less, and a small percentage get far more, than the average per capita. The distribution of economic resources is fundamentally a social question, and Mitchell excels in illuminating the social struggles that have formed our societies.