During Great Britain’s golden age of gambling, a Scot named William Cunninghame Graham—losing at cards, out of money, but not yet ready to quit for the evening—secured a loan of 1,000 pounds from a Colonel Archibald Campbell. Graham pledged as security the use of his estate to Campbell for the rest of Campbell’s lifetime should Graham be unable to repay the loan. Graham lost all the money. And thus, for a 1,000-pound loan did Graham gamble away his entire estate in one evening.

Today, a group of Wall Street hedge funds are acting like Graham on steroids in the face of a growing group of small investors who have awakened to the power of peer-to-peer communications made possible by social media. (More on peer-to-peer communications below.) In this particular case these small investors seem to be winning hand after hand by pledging much of their savings—in some cases their total life savings—to another risky but decidedly much more political proposition: Beating Wall Street hedge funds at their own game by forcing losses on them for bets the hedge funds have made against a down-on-its-luck retail chain called GameStop and other companies. The focus, however, has been on GameStop which specializes in video games and equipment which increasingly can be purchased online. Another blow to GameStop has been the ongoing pandemic which has kept people out of its retail stores.

The small investors, emboldened by an online Reddit group called WallStreetBets, have so far inflicted nearly $20 billion in losses on their arch short-selling foes as the stock price of GameStop has rocketed from about $17 a share on January 4 to $325 a share on Friday. The stock sold for under $4 a share as recently as July 31. On January 25 the stock closed at $76.79 a share. Two days later it closed at $347.51.

GameStop reached a high of $483 the next day before skidding far lower when major brokerages stopped allowing customers to buy the shares. The halt deeply angered investors wanting to get in on the surge or add to their positions and led to calls for a Congressional investigation. Many claimed the brokerages were caving to pressure from the hedge funds themselves.

Using a process that has long been a regular feature of the stock market, several hedge funds borrowed shares of GameStop from other shareholders for a fee—a process facilitated by most brokerages—and then sold them to others, hoping to buy the shares back cheaper, pocket the difference, and then return the shares to the owners.

Into the fray between those believing the stock would rise and the hedge funds that wanted GameStop’s stock price to fall came the Reddit group WallStreetBets mentioned above. The online group has become a meeting place for those interested in exchanging stock tips, sharing stories about gains and losses, and generally bucking each other up in their quest to vanquish the big guys on Wall Street. On Monday last week, the online community listed about 2 million members. As I write, that number has just topped 7 million.

As financial and legal analysts puzzle over whether these small investors have violated securities laws (ones that Wall Street insiders regularly trample!), they are completely missing the true social and political significance of the ongoing fight.

One can find out by going on the WallStreetBets page that many of those investing are devoted to the idea that they will hold and even buy more shares until the hedge funds give up entirely. They are doing so because they want to make a statement about the unfair power that financial firms and the wealthy who own and run them have over our lives.

Wall Street analysts, on the other hand, believe that these small investors are just like them—in it only for the money. But again, the frequent posts about keeping the faith, holding the stock and buying more as a sign of loyalty to the cause are too numerous to dismiss. There is even a page for sharing stories about (often paper) losses. Instead of getting criticism and derision, people are frequently saluted for taking a hit for the cause.

It took a British news outlet to understand the class conflict dimension of this fight. And the fight is not over as both sides expect it to resume on Monday morning.

Finally, let me explain why peer-to-peer communications are so powerful and important a feature of the vast changes roiling through global society. Previously, of course, newspapers, radio and television were the ways people informed themselves about the day-to-day news. If a person wanted to share his or her views, that person would have to be successful in getting a letter to the editor published or getting the attention of broadcast reporters, something almost impossible to do if you are an average citizen.

Now, as most everybody understands, people do not have to rely on these outlets owned and run by the wealthy for their information. And, if individuals want to share their opinions, they can do it directly with others across the internet. This has dangers, and we’ve seen them recently manifested in an attack on the U.S. Capitol.

But peer-to-peer communications also afford the chance for average citizens to coordinate their efforts both to fight the oppressive features of the current system, but more importantly, to start building the components of a new system they like better.

Consumers, workers and activists are intentionally atomized and discouraged from combining and coordinating their efforts by our current system. Peer-to-peer platforms are making it much, much easier for people to organize and coordinate.

These platforms are still like the Wild West. The vast majority of people don’t understand their potential or how to use them effectively to organize and effect change. And, some become so isolated in their reliance on such platforms that they fall prey to the fantasies of others who wish to manipulate them rather than liberate them.

Will WallStreetBets show itself to be a liberating force? Will it spawn a worldwide movement that demands a rethinking and restructuring of our financial system?

It is important to remember that WallStreetBets is not a unified force, but rather a (now very large) group of individuals giving voice to their individual frustrations and aspirations. It is a place where the sum of those frustrations and aspirations have finally found a path of expression that has the whole world watching. This growing online community and its rising number of outside supporters have stumbled into a colossal confrontation with the central power in finance capitalism, wealthy investors.

It turns out that stumbling is often the way we move forward when we are in unfamiliar territory—territory that can frighten us, exhilarate us and enlighten us all at the same time. We can only find out more by taking another step. And, that’s something the powers that be don’t want us to do.

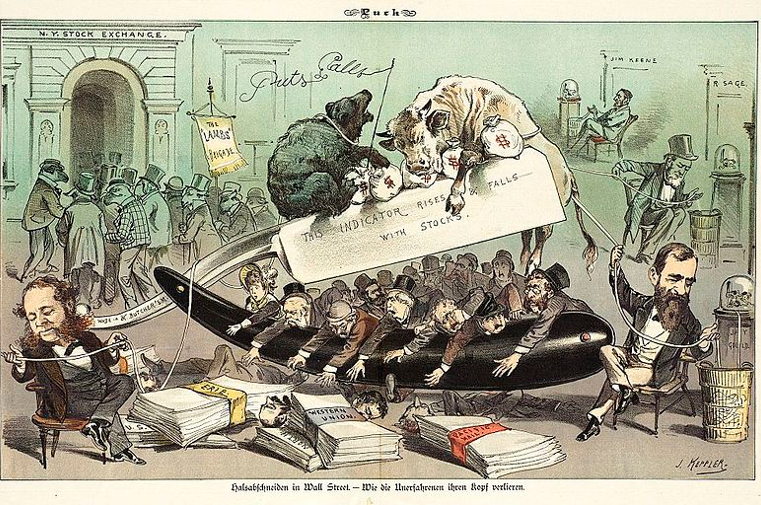

Image: Cut-throat business in Wall Street. How the inexperienced lose their heads. Cartoon 1881. Wikimedia Commons https://commons.wikimedia.org/wiki/File:Halsabschneiden_in_Wall_Street_-_Wie_die_Unerfahrenen_ihren_Kopf_verlieren.jpg