The world’s best solar power schemes now offer the “cheapest…electricity in history” with the technology cheaper than coal and gas in most major countries.

That is according to the International Energy Agency’s World Energy Outlook 2020. The 464-page outlook, published today by the IEA, also outlines the “extraordinarily turbulent” impact of coronavirus and the “highly uncertain” future of global energy use over the next two decades.

Reflecting this uncertainty, this year’s version of the highly influential annual outlook offers four “pathways” to 2040, all of which see a major rise in renewables. The IEA’s main scenario has 43% more solar output by 2040 than it expected in 2018, partly due to detailed new analysis showing that solar power is 20-50% cheaper than thought.

Despite a more rapid rise for renewables and a “structural” decline for coal, the IEA says it is too soon to declare a peak in global oil use, unless there is stronger climate action. Similarly, it says demand for gas could rise 30% by 2040, unless the policy response to global warming steps up.

This means that, while global CO2 emissions have effectively peaked, they are “far from the immediate peak and decline” needed to stabilise the climate. The IEA says achieving net-zero emissions will require “unprecedented” efforts from every part of the global economy, not just the power sector.

For the first time, the IEA includes detailed modeling of a 1.5C pathway that reaches global net-zero CO2 emissions by 2050. It says individual behaviour change, such as working from home “three days a week”, would play an “essential” role in reaching this new “net-zero emissions by 2050 case” (NZE2050).

Future scenarios

The IEA’s annual World Energy Outlook (WEO) arrives every autumn and contains some of the most detailed and heavily scrutinised analysis of the global energy system. Over hundreds of densely packed pages, it draws on thousands of datapoints and the IEA’s World Energy Model.

The outlook includes several different scenarios, to reflect uncertainty over the many decisions that will affect the future path of the global economy, as well as the route taken out of the coronavirus crisis during the “critical” next decade. The WEO also aims to inform policymakers by showing how their plans would need to change if they want to shift onto a more sustainable path.

This year it omits the “current policies scenario” (CPS), which usually “provides a baseline…by outlining a future in which no new policies are added to those already in place”. This is because “[i]t is difficult to imagine this ‘business as-usual’ approach prevailing in today’s circumstances”.

Those circumstances are the unprecedented fallout from the coronavirus pandemic, which remains highly uncertain as to its depth and duration. The crisis is expected to cause a dramatic decline in global energy demand in 2020, with fossil fuels taking the biggest hit.

The main WEO pathway is again the “stated policies scenario” (STEPS, formerly NPS). This shows the impact of government pledges to go beyond the current policy baseline. Crucially, however, the IEA makes its own assessment of whether governments are credibly following through on their targets.

The report explains:

“The STEPS is designed to take a detailed and dispassionate look at the policies that are either in place or announced in different parts of the energy sector. It takes into account long-term energy and climate targets only to the extent that they are backed up by specific policies and measures. In doing so, it holds up a mirror to the plans of today’s policy makers and illustrates their consequences, without second-guessing how these plans might change in future.”

The outlook then shows how plans would need to change to plot a more sustainable path. It says its “sustainable development scenario” (SDS) is “fully aligned” with the Paris target of holding warming “well-below 2C…and pursuing efforts to limit [it] to 1.5C”. (This interpretation is disputed.)

The SDS sees CO2 emissions reach net-zero by 2070 and gives a 50% chance of holding warming to 1.65C, with the potential to stay below 1.5C if negative emissions are used at scale.

The IEA has not previously set out a detailed pathway to staying below 1.5C with 50% probability, with last year’s outlook only offering background analysis and some broad paragraphs of narrative.

For the first time this year, the WEO has “detailed modelling” of a “net-zero emissions by 2050 case” (NZE2050). This shows what would need to happen for CO2 emissions to fall to 45% below 2010 levels by 2030 on the way to net-zero by 2050, with a 50% chance of meeting the 1.5C limit.

The final pathway in this year’s outlook is a “delayed recovery scenario” (DRS), which shows what might happen if the coronavirus pandemic lingers and the global economy takes longer to recover, with knock-on reductions in the growth of GDP and energy demand.

The chart below shows how the use of different energy sources changes under each of these pathways over the decade to 2030 (right-hand columns), relative to demand today (left).

Left: Global primary energy demand by fuel in 2019, million tonnes of oil equivalent (Mtoe). Right: Changes in demand by 2030 under the four pathways in the outlook. Source: IEA World Energy Outlook 2020.

Notably, renewables (light green) account for the majority of demand growth in all scenarios. In contrast, fossil fuels see progressively weaker growth turn to increasing declines, as the ambition of global climate policy increases, from left to right in the chart above.

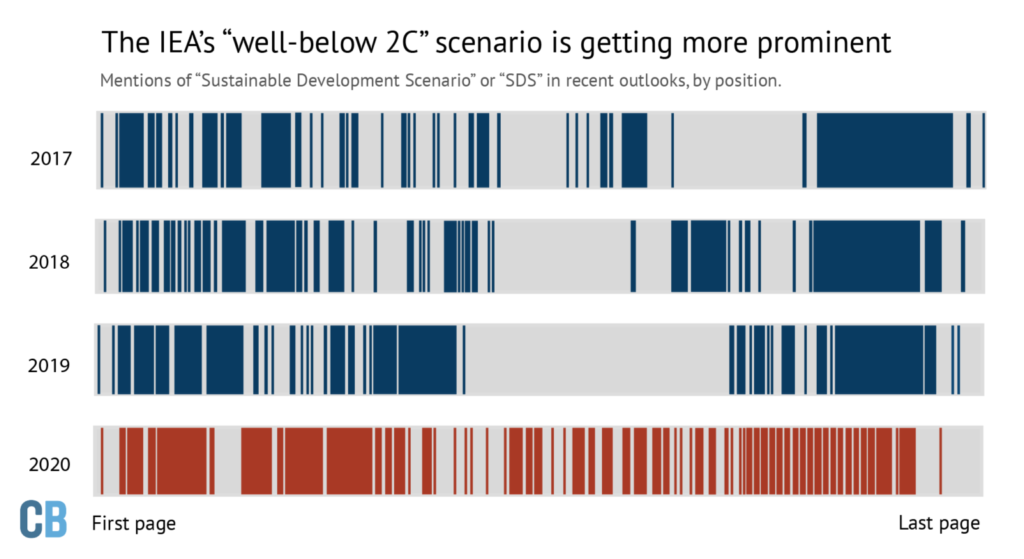

Intriguingly, there are signs that the IEA has been giving greater prominence to the SDS, a pathway aligned with the “well-below 2C” Paris goal. In the WEO 2020, it features more frequently, earlier in the report, and more consistently through the pages, compared with earlier editions.

This is shown in the chart below, which shows the location, by relative page position, of each mention of “sustainable development scenario” or “SDS” in the WEOs published over the past four years.

Mentions of “sustainable development scenario” or “SDS” in the last four WEO reports, by relative page position. Source: Carbon Brief analysis of IEA World Energy Outlook 2020 and previous editions. Chart by Joe Goodman for Carbon Brief.

Solar surge

One of the most significant shifts in this year’s WEO is tucked away in Annex B of the report, which shows the IEA’s estimates of the cost of different electricity generation technologies.

The table shows that solar electricity is some 20-50% cheaper today than the IEA had estimated in last year’s outlook, with the range depending on the region. There are similarly large reductions in the estimated costs of onshore and offshore wind.

This shift is the result of new analysis carried out by the WEO team, looking at the average “cost of capital” for developers looking to build new generating capacity. Previously the IEA assumed a range of 7-8% for all technologies, varying according to each country’s stage of development.

Now, the IEA has reviewed the evidence internationally and finds that for solar, the cost of capital is much lower, at 2.6-5.0% in Europe and the US, 4.4-5.5% in China and 8.8-10.0% in India, largely as a result of policies designed to reduce the risk of renewable investments.

In the best locations and with access to the most favourable policy support and finance, the IEA says the solar can now generate electricity “at or below” $20 per megawatt hour (MWh). It says:

“For projects with low-cost financing that tap high-quality resources, solar PV is now the cheapest source of electricity in history.”

The IEA says that new utility-scale solar projects now cost $30-60/MWh in Europe and the US and just $20-40/MWh in China and India, where “revenue support mechanisms” such as guaranteed prices are in place.

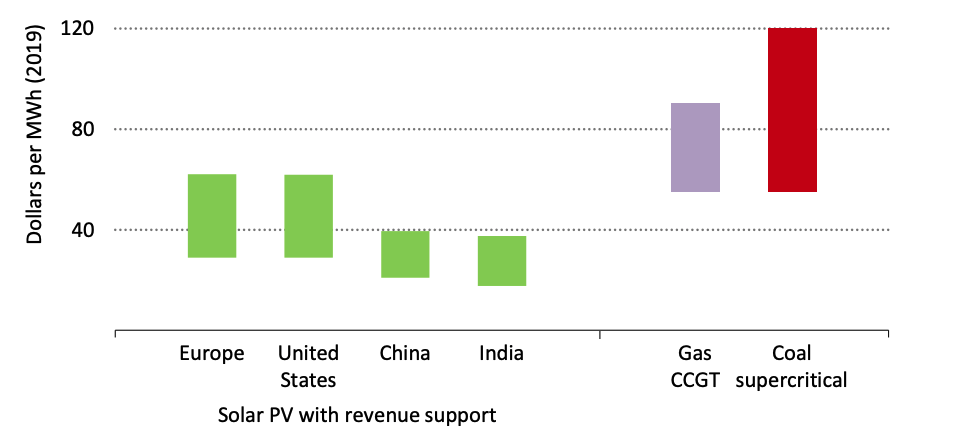

These costs “are entirely below the range of LCOE [levelised costs] for new coal-fired power plants” and “in the same range” as the operating cost of existing coal plants in China and India, the IEA says. This is shown in the chart below.

Estimated levelised costs of electricity (LCOE) from utility-scale solar with revenue support, relative to the LCOE range of gas and coal power. Source: IEA World Energy Outlook 2020.

Estimated levelised costs of electricity (LCOE) from utility-scale solar with revenue support, relative to the LCOE range of gas and coal power. Source: IEA World Energy Outlook 2020.

Onshore and offshore wind are also now assumed to have access to lower-cost finance. This accounts for the much lower cost estimates for these technologies in the latest WEO, because the cost of capital contributes up to half of the cost of new renewable developments.

When combined with changes in government policy over the past year, these lower costs mean that the IEA has again raised its outlook for renewables over the next 20 years.

This is shown in the chart below, where electricity generation from non-hydro renewables in 2040 is now seen reaching 12,872 terawatt hours (TWh) in the STEPS, up from 2,873TWh today. This is some 8% higher than expected last year and 22% above the level expected in 2018’s outlook.

Global electricity generation, by fuel, terawatt hours. Historical data and the STEPS from WEO 2020 are shown with solid lines while the WEO 2019 is shown with dashed lines and WEO 2018 as dotted lines. Source: Carbon Brief analysis of IEA World Energy Outlook 2020 and previous editions. Chart by Carbon Brief using Highcharts.

Solar is the largest reason for this, with output in 2040 up 43% compared with the 2018 WEO. In contrast, the chart shows how electricity generation from coal is now “structurally” lower than previously expected, with output in 2040 some 14% lower than thought last year. The fuel never recovers from an estimated 8% drop in 2020 due to the coronavirus pandemic, the IEA says.

Notably, the level of gas generation in 2040 is also 6% lower in this year’s STEPS, again partly as a result of the pandemic and its long-lasting impact on economic and energy demand growth.

Overall, renewables – led by the “new king” solar – meet the vast majority of new electricity demand in the STEPS, accounting for 80% of the increase by 2030.

This means they overtake coal as the world’s largest source of power by 2025, outpacing the “accelerated case” set out by the agency just a year ago.

The rise of variable renewable sources means that there is an increasing need for electricity grid flexibility, the IEA notes. “Robust electricity networks, dispatchable power plants, storage technologies and demand response measures all play vital roles in meeting this,” it says.

Revised outlooks

The lower costs and more rapid growth for solar seen in this year’s outlook means there will be record-breaking additions of new solar capacity in every year from 2020, the IEA says.

This contrasts with its STEPS pathway for solar in previous years, where global capacity additions each year – net of retirements – have flatlined into the future.

Now, solar growth rises steadily in the STEPS, as shown in the chart below (solid black line). This is even clearer if accounting for new capacity being added to replace old solar sites as they retire (gross, dashed line). Under the SDS and NZE2050, growth would need to be even faster.

Annual net additions of solar capacity around the world, gigawatts. Historical data is shown in red while central outlooks from successive editions of the WEO are shown in shades of blue. The WEO 2020 STEPS is shown in black. The dashed line shows gross additions, taking into account the replacement of older capacity as it retires after an assumed lifetime of 25 years. Source: Carbon Brief analysis of the IEA World Energy Outlook 2020 and previous editions of the outlook. Chart by Carbon Brief using Highcharts.

The story of raised outlooks for solar – thanks to updated assumptions and an improving policy landscape – is directly contrasting with the picture for coal.

Successive editions of the WEO have revised down the outlook for the dirtiest fossil fuel, with this year seeing particularly dramatic changes, thanks in part to a “structural shift” away from coal after coronavirus.

The IEA now sees coal use rising marginally over the next few years, but then going into decline, as shown in the chart below (red line). Nevertheless, this trajectory falls far short of the cuts needed to be in line with the SDS, a pathway aligned to the “well-below 2C” Paris target (yellow).

Historical global coal demand (black line, millions of tonnes of oil equivalent) and the IEA’s previous central scenarios for future growth (shades of blue). This year’s STEPS is shown in red and the SDS is in yellow. Carbon Brief analysis of the IEA World Energy Outlook 2020 and previous editions of the outlook. Chart by Carbon Brief using Highcharts.

This year’s outlook makes particularly drastic changes for India, where the use of coal in electricity generation is seen growing far more slowly than expected last year.

In the STEPS, coal-fired power capacity would grow by just 25 gigawatts (GW) by 2040, the IEA says, which is 86% less than expected in the WEO 2019. Rather than nearly doubling in size from 235GW in 2019, this means that India’s coal fleet would barely grow over the next two decades.

Similarly, growth in the amount of electricity generated from coal in India is now expected to be 80% slower than thought last year, according to the IEA figures.

Here’s a remarkable detail buried in @IEA #WEO20

India will build 86% less new coal power capacity than expected last yr

Long seen as driving global coal growth, IEA now says India will add just 25GW by 2040

The result? Global coal capacity will fall.https://t.co/bt7QfouTAf pic.twitter.com/SUDlaMo8so

— Simon Evans (@DrSimEvans) October 15, 2020

The IEA expects continued rapid retirements of old coal capacity in the US and Europe, which would by 2040 close 197GW (74% of the current fleet) and 129GW (88%) respectively.

Taken together, and despite a rapid expansion in southeast Asia, this means the outlook – for the first time – sees the global coal fleet shrinking by 2040.

Energy outlook

Taken together, the rapid rise of renewable energy and the structural decline for coal help keep a lid on global CO2 emissions, the outlook suggests. But steady demand for oil and rising gas use mean CO2 only flattens off, rather than declining rapidly as required to meet global climate goals.

These competing trends are shown in the chart, below, which tracks primary energy demand for each fuel under the IEA STEPS, with solid lines. Overall, renewables meet three-fifths of the increase in energy demand by 2040, while accounting for another two-fifths of the total. Smaller increases for oil and nuclear are enough to offset the decline in coal energy use.

Global primary energy demand by fuel, millions of tonnes of oil equivalent, between 1990 and 2040. Future demand is based on the STEPS (solid lines) and SDS (dashed). Other renewables includes solar, wind, geothermal and marine. Source: IEA World Energy Outlook 2020. Chart by Carbon Brief using Highcharts.

The dashed lines in the chart above show the dramatically different paths that would need to be followed to be in line with the IEA SDS, which is roughly a well-below 2C scenario.

By 2040, although oil and gas would remain the first and second-largest sources of primary energy, there would have been declines in the use of all fossil fuels. Coal would have dropped by two-thirds, oil by a third and gas by 12%, relative to 2019 levels.

Meanwhile, other renewables – primarily wind and solar – would have surged to third place, rising nearly seven-fold over the next two decades (+662%). The SDS sees smaller, but still sizeable increases for hydro (+55%), nuclear (+55%) and bioenergy (+24%).

Together, low-carbon sources would make up 44% of the global energy mix in 2040, up from 19% in 2019. Coal would fall to 10%, its lowest since the industrial revolution, according to the IEA.

Despite these rapid changes, however, the world would not see net-zero CO2 emissions until 2070, some two decades after the 2050 deadline that would be needed to stay below 1.5C.

This is despite the SDS including “full implementation” of the net-zero targets set by the UK, EU and most recently China.

The World Energy Outlook 2020 is out!

It shows how the Covid crisis has brought deep disruption & uncertainty to the energy sector.

Whether it helps or hinders clean energy transitions will depend on how the pandemic plays out & how governments respond: https://t.co/Iu4KdrI6N9 pic.twitter.com/tNTFLljEph

— Fatih Birol (@IEABirol) October 13, 2020

(These targets would be only partially implemented under the STEPS, based on the IEA’s assessment of the credibility of the policies in place to meet the goals. For example, table B.4 of the report says that under the STEPS, there is only “some implementation” of the UK’s legally binding target to reach net-zero greenhouse gas emissions by 2050.)

Net-zero numbers

The NZE2050 “case”, describing a route to 1.5C, has been published for the first time this year, because the WEO team agreed “it was time to deepen and extend our analysis of net-zero emissions”, according to IEA director Fatih Birol, writing in the report’s foreword.

Over the past 18 months, major economies announcing or legislating net-zero emissions targets include the UK and EU. Most recently, China announced its intention to reach “carbon neutrality” by 2060. [Forthcoming analysis for Carbon Brief will explore the implications of this goal.]

Carbon Brief analysis of the last four WEOs shows that these developments – along with the publication of the Intergovernmental Panel on Climate Change (IPCC) special report on 1.5C in 2018 – have been accompanied by a significant uptick in coverage of these topics in the WEO.

Whereas the WEO 2017 used the phrase “1.5C” less than once per 100 pages, this increased to five uses in 2019 and eight uses per 100 pages in 2020. The usage of “net zero” is up from once per 100 pages in 2017 and 2018, to six in 2019 and 38 per 100 pages in this year’s report.

However, the NZE2050 case is not a full WEO scenario and so it does not come with the full set of data that accompanies the STEPS and SDS, making it difficult to fully explore the pathway.

This seems “bizarre”, says Dr Joeri Rogelj, a lecturer in climate change and the environment at the Grantham Institute at Imperial College London and a coordinating lead author of the IPCC 1.5C report.

The IEA already publishes lengthy annexes, with detailed information on the pathway for different energy sources and CO2 emissions from each sector, in a range of key economies around the world, under each of its main scenarios. (This year these are the STEPS and SDS.)

Rogelj, who last year joined scientists and NGOs calling for the IEA to publish a full 1.5C scenario, tells Carbon Brief that “all underlying data of the NZE2050 case should be made available with the same detail as the other WEO scenarios”.

Carbon Brief has asked the IEA for such data and will update this article if more details emerge. Rogelj adds:

“The main question, of course, is how the NZE2050 intends to reach its objective of net-zero CO2 emissions in 2050. Of particular interest here is how much and which type of CO2 removal [negative emissions] the scenario intends to use and how it intends to do so while ensuring sustainable development.”

The WEO devotes a full chapter to the NZE2050, with a particular emphasis on the changes that would be needed over the next decade to 2030.

(It also compares the pathway to those set out in the IPCC special report, saying that the NZE2050 case has a comparable CO2 emissions trajectory to the “P2” scenario, which stays below 1.5C with “no or low overshoot” and has relatively “limited” use of BECCS.)

THREAD: The @IEA now has an aggressive 1.5°C scenario, reaching net-zero by 2050.

It builds on the Sustainable Development Scenario, strengthening reductions in power & end-use, but with new behavioural measures.

The light blue scenarios are IPCC SR15.https://t.co/RB9jajDICn pic.twitter.com/HETn2c3Icn

— Glen Peters (@Peters_Glen) October 15, 2020

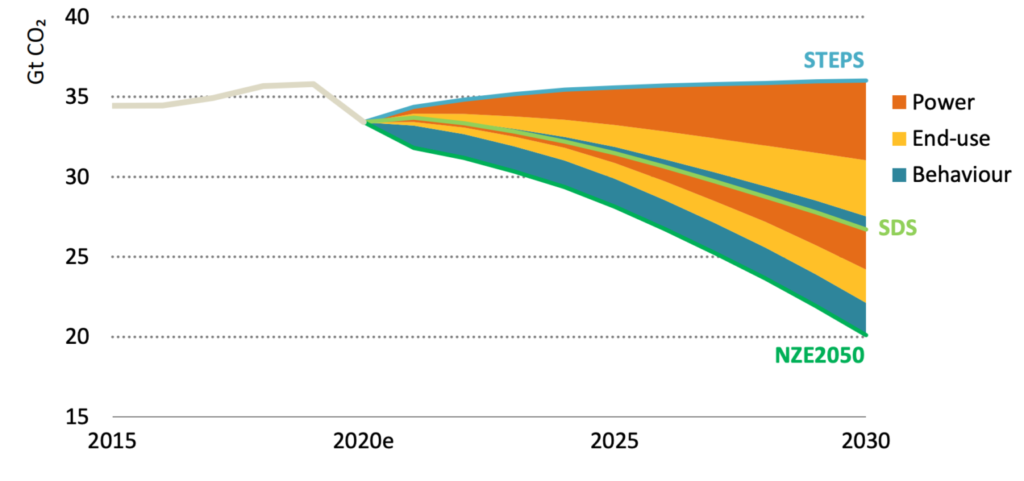

The chart below shows how CO2 emissions effectively plateau to 2030 in the STEPS, remaining just below the level seen in 2019, whereas the NZE2050 case sees a decline of more than 40%, from 34bn tonnes (GtCO2) in 2020 to just 20GtCO2 in 2030.

Global CO2 emissions from energy and industrial processes, 2015-2030, billion tonnes of CO2 (GtCO2), under the STEPS, SDS and NZE2050. Coloured wedges show contributions to the additional savings needed for the SDS and NZE2050. Source: IEA World Energy Outlook 2020.

The power sector contributes the largest portion of the savings needed over the next decade (orange wedges in the chart, above). But there are also important contributions from energy end-use (yellow), such as transport and industry, as well as from individual behaviour change (blue), explored in more detail in the next section.

These three wedges would contribute roughly equal shares of the extra 6.4GtCO2 of savings needed to go from the SDS to the NZE2050 in 2030, the IEA says.

The NZE2050 case would see low-carbon sources of electricity meeting 75% of demand in 2030, up from 40% today. Solar capacity would have to rise at a rate of around 300 gigawatts (GW) per year by the mid-2020s and nearly 500GW by 2030, against current growth of around 100GW.

CO2 emissions from coal-fired power stations would decline by 75% between 2019 and 2030. This means the least efficient “subcritical” coal plants would be phased out entirely and the majority of “supercritical” plants would also close down. The WEO says the majority of this decline would come in southeast Asia, which accounts for two-thirds of current global coal capacity.

Although nuclear would contribute a small part of the increase in zero-carbon generation by 2030 in the NZE2050, the IEA notes that the “long lead time of large-scale nuclear facilities” limits the technology’s potential to scale more quickly this decade.

For industry, CO2 emissions would fall by around a quarter, with electrification and energy efficiency making up the largest shares of the effort. More than 2m homes would get an energy efficiency retrofit during every month this decade, in “advanced economies” alone.

In the transport sector, CO2 would fall by a fifth, not including behavioural shifts counted below. By 2030, more than half of new cars would be electric, up from around 2.5% in 2019.

Behavioural changes

For the first time, this year’s outlook contains a detailed analysis of the potential for individual behaviour change to reduce CO2 emissions. (This is clear even at a simplistic level, with the word “behaviour” mentioned 122 times, against just 12 times in 2019.)

Behavioural shifts, such as cutting down on flights and turning down air conditioning, will play a vital role in achieving net-zero emissions, according to the report.

While the SDS calls for modest changes to people’s lifestyles, such as increased use of public transport, these choices only make up 9% of the difference between that scenario and the STEPS.

By comparison, in the NZE2050 these changes are responsible for nearly a third of the CO2 reductions relative to the SDS in 2030.

The report includes a detailed analysis of estimated emissions savings from the global adoption of specific actions, including a global switch to line-drying laundry, slower driving speeds and working from home.

The authors estimate that 60% of these changes could be influenced by governments, citing widespread legislation to control car use in cities and Japan’s efforts to limit air conditioning in homes and offices.

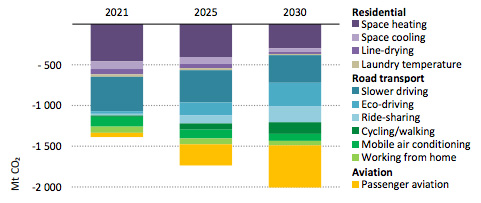

As the chart below shows, changes to people’s transport choices account for the majority of the emissions savings. Road transport (blue bars) accounts for more than half the savings in 2030 and significantly reducing the number of flights accounts for another quarter (yellow).

Impact of behaviour changes across three key sectors on annual CO2 emissions in the NZE2050 scenario. Source: IEA World Energy Outlook 2020.

Around 7% of CO2 emissions from cars come from trips of less than 3km, which “would take less than about 10 minutes to cycle”, according to the authors. In the NZE2050 scenario, all of these trips are replaced with walking and cycling.

The report estimates that behaviour shifts could cut emissions from flying by around 60% in 2030. These include substantial changes, such as eliminating flights of less than one hour long, as well as reducing numbers of both long-haul and business flights by three quarters.

Even so, due to the growth in aviation that is otherwise expected, total aviation activity in 2030 would still remain around 2017 levels in this scenario.

The remaining savings come from decisions to limit the use of energy in homes, such as turning both heating and air conditioning systems down.

Working from home has the potential to save emissions overall, as the reduction in emissions from commuting is more than three times larger than the increase in residential emissions.

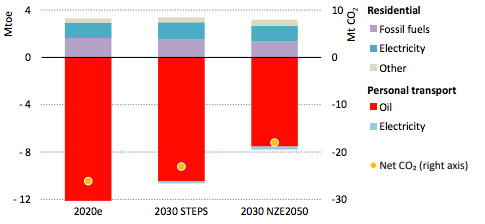

The report estimates that if the 20% of the global workforce who are able to work from home did so for just one day a week, in 2030 this would save around 18m tonnes of CO2 (MtCO2) globally, as the chart below shows.

In fact, the NZE2050 scenario assumes that all those who are able to do so, work from home three days a week, amounting to a relatively modest 55MtCO2 savings.

Due to wider changes in the energy mix in NZE2050, the emissions impact of widespread home working is small when compared to the current situation, shown in the left-hand column, or STEPS in 2030, shown in the middle column.

Change in annual global energy consumption (left y-axis) and CO2 emissions (right y-axis) if 20% of the population worked from home for one day a week, under three different scenarios. Emissions savings from transport (red and light blue) exceed the increase in residential emissions (purple, dark blue and grey) associated with working from home. Source: IEA.

While the report focuses on CO2 emissions from the energy system, it also alludes to the high levels of methane and nitrous oxide resulting from global agriculture and livestock farming in particular.

It notes that without shifts towards vegetarian diets it will be “very difficult to achieve rapid emissions reductions”.

The authors acknowledge that universal adoption of the proposed behaviour changes is unlikely, but suggest there are “alternative ways” in which such changes could combine to yield similar results.

For example, though some regions may not introduce tougher speed limits, others might decide to cut driving speeds by more than the 7km/h suggested in the report.

Simon Evans was one of more than 250 external peer reviewers who read sections of the World Energy Outlook in draft form.

Teaser photo credit: By AleSpa – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=29290121