Energy is not just one commodity among many in the economy; it is the commodity. Without energy, nothing gets done. And, oil is not just one form of energy in the energy commodity complex; it is the energy source upon which our modern way of life depends. In fact, it is the main energy source running through the arteries of the global economy.

Far from being a boon to the world, ultra-low oil prices signal that the global economy is flat on its back—even worse, flat on its back with two broken legs.

Petroleum geologist and consultant Art Berman recently detailed the problem in this piece. Berman is the man who accurately predicted—starting way back in 2008—the persistent losses that shale oil and gas would produce for the companies that extracted them. The shale industry continuously vilified Berman for his analysis over the next decade, even as the industry was in the process of blowing 80 percent of investors’ capital as of last year. With the arrival of the coronavirus, the coup de grâs has just been delivered to a shale oil and gas industry that was already on its knees.

Perhaps the most important thing to understand about the current oil “glut” is that it is not merely the result of producing too much oil for an economy humming on all cylinders. It is primarily the product of a coronavirus-infested economy in which demand has dropped 20 percent in just a few weeks. As Berman points out, estimated U.S. oil consumption has returned to a level not seen since 1971.

Energy is the very basis for economic activity. There is now 20 percent less oil flowing through the veins of the global economy, and economic activity is tightly correlated with oil consumption. Ergo, economic activity must be down significantly around the planet. Coal consumption is declining as well, but it is harder to measure in real-time. This piece suggests significant declines in Chinese coal consumption. And the clearing air in China and in practically every city around the globe suggests a lot less burning of everything that we call fuel.

It may seem that as soon as lockdowns end (and they have already ended in China), the world economy will pick up and quickly return to its old pace. Our recent experience will somehow be remembered as two-month leave of absence in retrospect.

One of the indications of whether that is happening will be energy consumption worldwide. For comparison the U.S. Energy Information Administration reports that the decline in worldwide consumption of refined petroleum products between 2007 and the end of 2009 was 1.5 percent, the period now called the Great Financial Crisis (GFC). Total world energy consumption during the same period actually increased by 0.2 percent (though it declined by 1 percent between 2009 and 2010). We are currently looking at energy consumption declines of 20 times that for oil and probably many times that for total energy consumption. The latest consumption numbers for U.S. refined petroleum products do not provide any reason for optimism.

It is not at all clear how under these circumstances we could now recover to our previous level of economic activity more quickly than we did after the GFC as some people are predicting.

People and companies buy and use energy (and the products energy is needed to produce) when they are confident about their prospects. I am doubtful that the confidence needed to lift the world economy to new heights will return anytime soon. Our energy picture leads to this conclusion and also suggests that the world economy has further contraction ahead before even a slow recovery can begin.

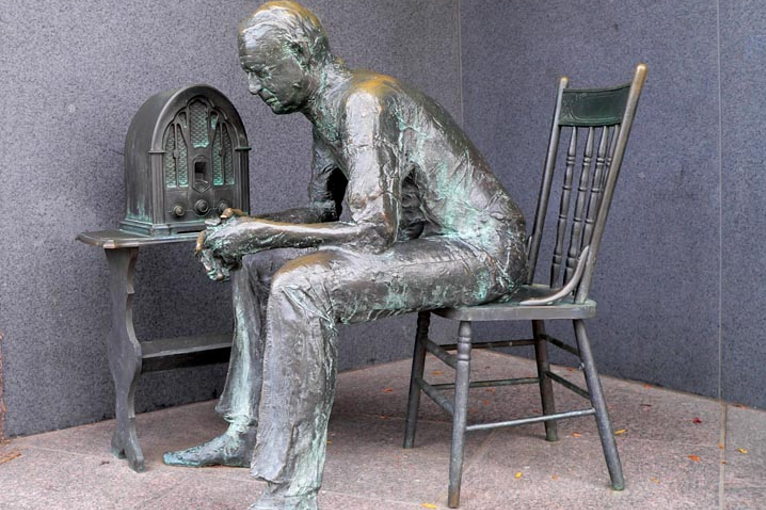

Photo: Bronze sculpture of a man listening to the 1930s valve radio. This sculpture by George Segal at the Franklin D Roosevelt Memorial, Washington, DC, commemorates the famous fireside radio chats during the Great Depression. Wikimedia Commons