In a global society optimized for finance, it is easy to believe that finance holds the answer to all problems. In 2008 as shipping slowed to a crawl in the wake of the financial crash, sellers of the merchandise on board those ships became increasingly reticent about accepting letters of credit from wobbly banks as payment guarantees from buyers.

And, banks were increasingly hesitant to provide other forms of trade credit to buyers. The solution—as for so many other problems that year—was government financial guarantees for banks, depositors and various other financial institutions. That’s because when the essence of the problem was financial, a financial response could work.

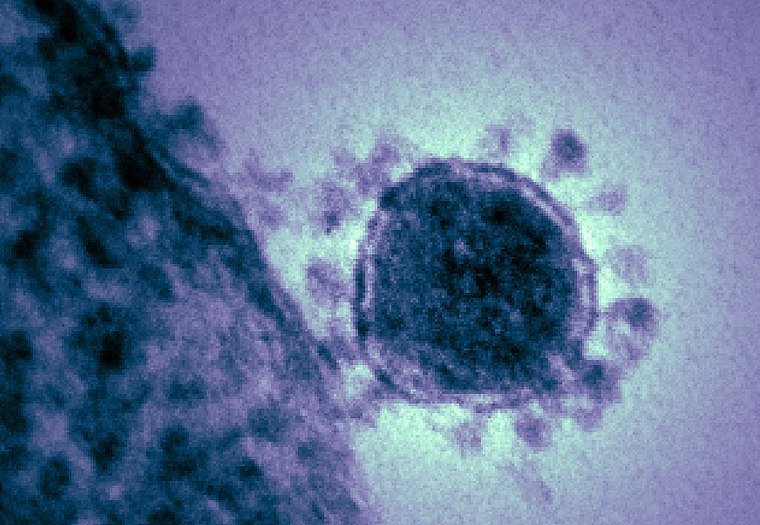

Today, it is the coronavirus which menaces the world economy—and the people who contract the virus, of course. Much of the Chinese economy—China has been the epicenter of the epidemic—has now been shut down in an effort to halt the spread of the infection which is believed to kill around 2 percent of those who get it. But as anyone reading headlines knows, coronavirus has now landed on every continent.

For weeks the world’s stock market investors ignored the increasing alarm bells about the toll the virus was taking on economic activity. Finally, those investors acted en mass last week to dump stocks. No one is calling it a crash yet. “Correction” is a much nicer word.

The belated realization among those investors seems to be that here finally is a problem that central banks and governments can’t solve with more easy credit and more spending. As one central banker reminded us: “Central banks can’t come up with vaccines.”

Coronoviruses simply don’t care about “central bank liquidity” and “government stimulus.” They only care about finding the next host in order to survive and replicate. And, if that host is a human with a job, he or she may not be going to work—or worse yet, that human may be one of those who never develops symptoms, but still transmits the disease to countless others.

With so many people staying home these days in China and factories closed, the countless items which those factories normally make aren’t being shipped to customers across the globe. If those customers are manufacturers using just-in-time inventory systems, they may soon by shutting down for lack of crucial components. That’s just the beginning of a cascade through the entire manufacturing sector as each link is stopped in its tracks for lack of essential parts.

But then we come to humans as consumers in the economy. If we humans become increasingly afraid to go out for fear of being exposed at the big box store or the restaurant or the movie theater, we will consume only necessities. The government of Hong Kong has decided to give HK$10,000 (about $1,200 U.S.) to every adult to stimulate its now sinking economy. But, will it matter that much if people do not want to go out and spend it? Will they choose to save it in order to weather the wave of coronavirus that they expect to sweep the world?

Global human society lives in the natural world, but behaves as if it lives apart from it. Oblivious to the risks, we have now built a globalized society that from the point of view of a coronavirus is a near perfect vehicle for the virus’ propagation. In the distant past, such viruses have had to content themselves with killing people of a certain city, province or, in rare cases, continent. Now, viruses ride passenger jets and arrive at all corners of the Earth within a single day.

Once there, these viruses find crowded cities with varying degrees of public health infrastructure and renew their journey by land.

But that is only one part of the story. For when all the tightly coupled logistical and financial nodes of the global system start transmitting signals of distress and breakdown, this really threatens panic and ruin.

There is little we can do about a virus this easy to spread except take care of ourselves and take reasonable precautions to avoid it. But as long as there is denial about this fact, we will seek to contain it with draconian measures that keep factories, schools and other public institutions shut and that frighten people in ways that make them inert rather than active participants in the solution.

The global economic system is now trapped in a vicious, self-defeating trajectory. With “efficient” supply lines and very little inventory of anything anywhere in the world, a halt for only a few weeks of deliveries of critical supplies could be catastrophic. And that catastrophe would most certainly hurt the many who can’t get the food, medical treatment and warmth they need in the cold winter weather. It would also be felt as a threat to the few who are the architects and beneficiaries of this system, the validity of which will be called into questioned.

Faith in this global system of mobile capital, labor arbitrage, and efficiency at all costs—a system which has consistently enriched the highest echelons of society while undermining the prosperity of the many—may not survive the coronavirus. And that may frighten the people at the top even more than the virus itself.

Photo: Colorized transmission electron micrograph of the Middle East respiratory syndrome-related coronavirus (MERS-CoV) that emerged in 2012. National Institutes of Health (NIH) (2012). Via Wikimedia Commons https://commons.wikimedia.org/wiki/File:Middle_East_respiratory_syndrome-related_coronavirus.jpg