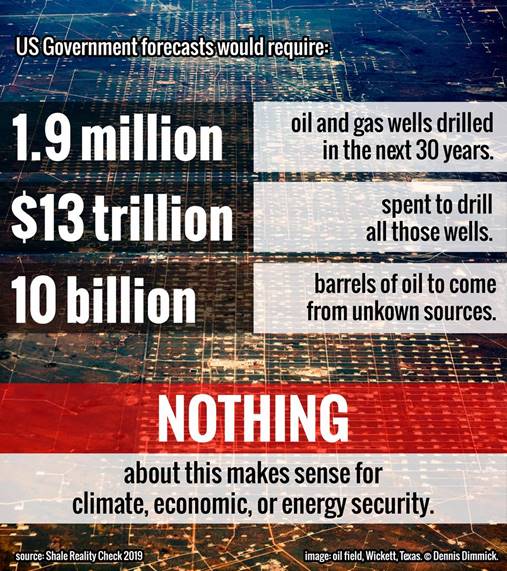

1.9 million. 13 trillion. 10 billion. These are the numbers that jumped off the page when I read PCI Fellow David Hughes’s latest “shale reality check” report on the U.S. government’s forecasts of domestic oil and gas production. To elaborate, these forecasts mean that by 2050:

- 1.9 million new oil and gas wells will need to be drilled;

- $13 trillion will need to be spent to drill all those wells; and

- 10 billion barrels of tight oil production will be “missing” from shale plays to meet the reference case forecast for cumulative production.

These are just some of the crazy numbers behind the Energy Information Administration’s (EIA) latest forecasts for U.S. oil and gas production through 2050.

Every year, the EIA releases a new forecasts of domestic energy in the coming decades. These forecasts—specifically the “reference case”—are virtually taken to the bank by policymakers, investors, and the mainstream media as the most likely scenario of future production, consumption, and prices.

This despite the fact that they are very often wrong and vary tremendously from year to year. Or the fact that for several years now David Hughes has published “reality checks” on the forecasts of tight oil and shale gas production (extracted through “fracking”) found in the Annual Energy Outlook—reality checks that have consistently shown that the EIA’s projections are, to be polite, extremely optimistic.

Hughes’s latest report evaluates the EIA’s reference case forecasts for the top tight oil and shale gas plays (accounting for roughly 90% of production) against:

- current and historical production;

- the number of producing wells;

- the decline rates for wells and fields;

- the distribution of wells in terms of their quality;

- definition of the relatively limited “sweet spot” areas in each play; and

- the projected number of wells, well density, and money required to meet the EIA’s forecasts.

As you can imagine, this analysis is time-consuming, exacting, and challenging. So why does Hughes take this on year after year? And why does it matter? Because our energy policy is literally a life and death matter and no one else is providing the public with a reality check on the ubiquitous cries of long-term, growing energy supplies, energy security, and all of the associated economic benefits of the so-called “shale revolution.”

Hughes’s Shale Reality Check 2019 finds that the EIA’s forecasts for major plays like the Bakken, Eagle Ford, Marcellus, Utica, and the Permian Basin are terribly unrealistic. Of the 13 shale plays analyzed, nine are rated as extremely optimistic, three highly optimistic, and only one moderately optimistic. And even with all this optimism, the overall forecast falls short by nearly ten billion barrels of tight oil, or 10% of the production volume required through 2050.

Hughes’s Shale Reality Check 2019 finds that the EIA’s forecasts for major plays like the Bakken, Eagle Ford, Marcellus, Utica, and the Permian Basin are terribly unrealistic. Of the 13 shale plays analyzed, nine are rated as extremely optimistic, three highly optimistic, and only one moderately optimistic. And even with all this optimism, the overall forecast falls short by nearly ten billion barrels of tight oil, or 10% of the production volume required through 2050.

The EIA anticipates that tight oil production will be 38% higher in 2050 than in 2018 and shale gas 81% higher, with tight oil providing nearly 70% of all US oil production over the next three decades and shale gas 74% of all gas produced over that same period. For the shale portion alone, this would require over 1.5 million new wells to be drilled at a cost of roughly $11 trillion, and would consume by 2050 most of the proven reserves and unproven resources of tight oil the EIA estimates exist. For good or bad, David Hughes finds that this rosy forecast is highly unlikely to materialize.

Though Hughes is careful to focus his analysis only on the geological and technological feasibility of the EIA’s forecasts, I have to stress that when viewed from the broader perspective of economic, energy, and climate security, the EIA’s Annual Energy Outlook is borderline insane.

Just look at the climate reality: The international climate science community has warned that emissions must be slashed 45% by 2030 and net zero by 2050 in order to limit global temperatures to the targets agreed upon by 197 nations in 2016. And last week, 11,000 scientists issued a stark warning that “the world’s people face untold suffering due to the climate crisis unless there are major transformations to global society.”

Perhaps this ostensibly independent arm of the U.S. Department of Energy has been co-opted by the Trump Administration’s denial of the climate crisis and utter fidelity to depleting, ever costlier, and more environmentally and socially ruinous forms of energy. But the writing is already on the wall. We must transition away from our dependence on fossil fuels. To think that the public, policymakers, and even industry will allow nearly two million new wells to be drilled and 13 trillion dollars spent on a literal dead-end energy pathway is crazy. And yet that’s precisely what the Energy Information Administration is putting forward as a vision for the future.

Teaser photo credit: Oil Field in Wickett Texas. © Dennis Dimmick, c/o Flickr.