Quote of the Week

“Reliable and economically meaningful carbon pricing regimes, whether based on tax, trading mechanisms or other market-based measures, should be set by governments at a level that incentivizes business practices … while minimizing the costs to vulnerable communities and supporting economic growth.”

Joint statement, after a meeting with Pope Francis, by CEO’s of ExxonMobil, BP, Royal Dutch Shell, Total, Chevron and ENI

Graphic of the Week

| Contents

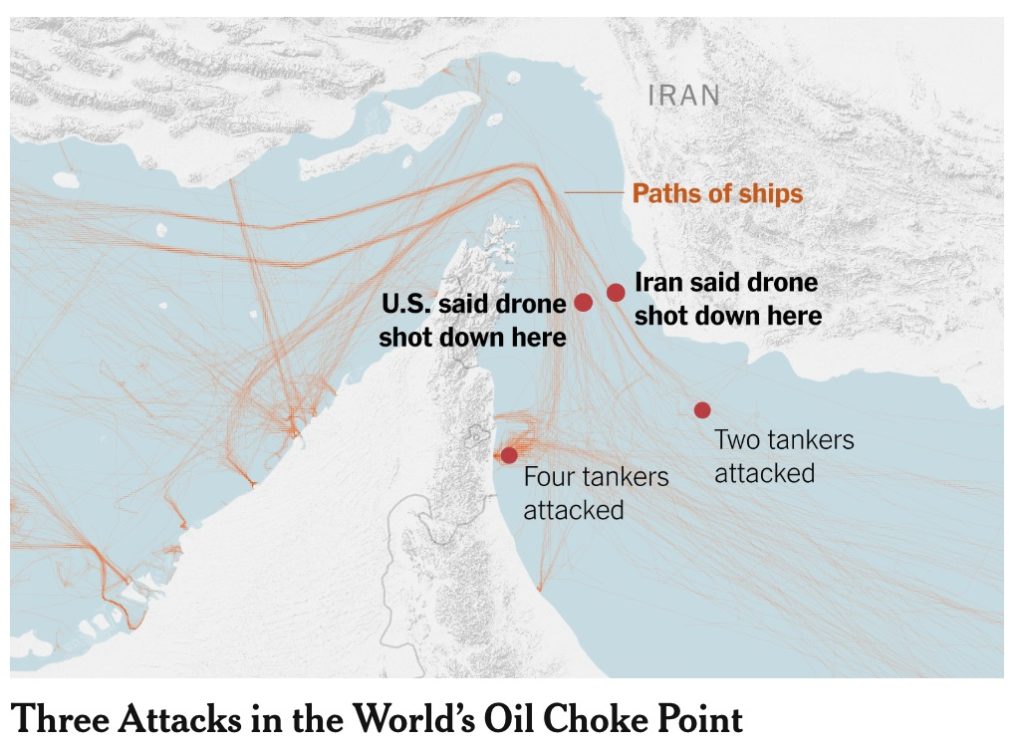

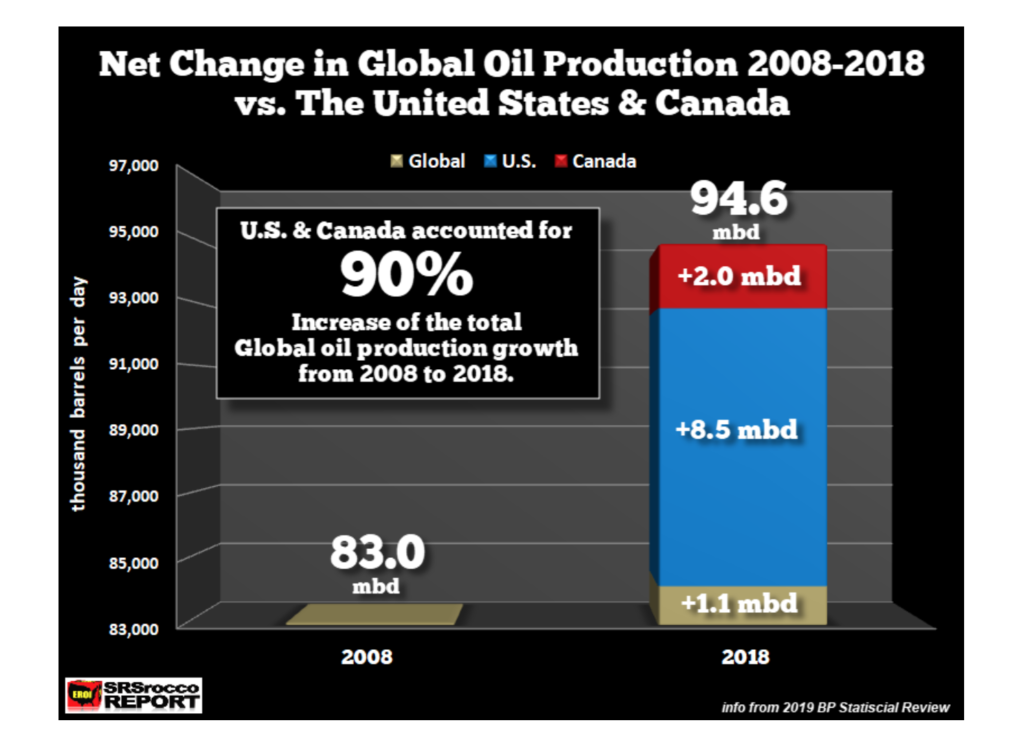

1. Oil and the Global Economy 1. Oil and the Global Economy Until last Thursday, the oil markets largely ignored the increasing tensions between the US and Iran, including the attacks on six oil tankers near the Strait of Hormuz. Then Iran downed an unmanned US surveillance drone, and oil prices soared on the possibility that a war which could potentially halt the 18 million b/d of oil exports was imminent. After a day of vacillation, Washington backed off a retaliatory attack on Iran, allowing the situation to cool. By week’s end US crude was up 10 percent closing at $57.43 in New York and $65.20, or about 5 percent, in London. The announcement that Presidents Trump and Xi are to confer about the trade dispute at the G20 summit later this week also supported the oil market. Trade talks between Washington and Beijing broke down more than six weeks ago after US officials accused China of backing away from commitments, prolonging the dispute that already is harming the global economy and disrupting supply chains. Hovering in the background of the G20 meeting is new information showing that manufacturing is faltering in the US and other key economies, darkening the prospects for the global economy and the demand for oil. The Purchasing Managers Index for US manufacturing activity declined to 50.1 in June, the lowest level in nearly a decade and manufacturing activity in Europe contracted in June, wrapping up the weakest quarter for the goods-producing sector in six years. A similar survey of Japanese manufacturers found activity was at its worst in three years. The World Bank earlier this month lowered its forecast for global economic growth in 2019 to 2.6 percent from its January estimate of 2.9 percent, citing trade disputes and declining business confidence. Worries are increasing that the longer the factory slowdown continues and the wider it spreads, the more likely it is to drag down other parts of the global economy. The OPEC+ Production Cut: After weeks of disagreements, conflicting reports, and discussions about scheduling conflicts, OPEC has finally decided when it will hold the meeting to decide whether to extend the oil production cuts beyond June. The cartel+ is postponing the originally scheduled June 25-26 meeting for a week, to July 1-2. The Joint Ministerial Monitoring Committee (JMMC)—which reviews market fundamentals and makes recommendations to the whole group—will meet on the morning of July 1. A full OPEC meeting will be held in the afternoon on the same day, while OPEC’s non-OPEC partners led by Russia will join the talks on the next day, July 2. Before last week’s price spike, it looked as if Moscow and its allies would go along with the Saudi position that the production cut should continue until the end of the year. Steadily falling oil prices prompted stories about how oil would fall to $40-50 a barrel should OPEC+ remove the production ceiling and flood the market with still more oil in the second half of the year. For now, an extension of the production cap seems the best possibility, but the Middle East situation remains highly volatile, and prices could spike higher at any time. There is increasing evidence that the recent attacks on oil tankers just south of the Strait of Hormuz were carried out by or with help from Iran. These attacks were not intended to sink the ships but were a warning that Tehran can do significant damage to the world’s oil supply at any time. Some 70 large crude carriers or about 10 percent of the world’s total are in the vicinity of the strait at any time. In the days after attacks crippled two oil product tankers in the Gulf of Oman, fewer ships were leaving gulf ports, and daily freight rates for oil supertankers were as much as 50 percent higher. Adding to shipowners’ problems are insurance premiums. Coverage for a one way, seven-day supertanker charter through the gulf has soared by about 15 percent in recent days. US Shale Oil Production: In the June issue of its Drilling Productivity Report, the EIA continues to forecast rapid growth in US shale oil production despite signs that an industry that consistently loses money is cutting investment. The output from the seven major shale formations is expected to rise by about 70,000 b/d in July to a record 8.52 million. The largest increase is forecast for the Permian Basin, where output is expected to climb by 55,000 b/d to a record peak of 4.23 million. The Bakken in North Dakota and the Niobrara in Colorado and Wyoming are forecast to increase by about 10,000-11,000 b/d in July, but production from the other five basins is to drop or stay about the same. It will be September before the actual rather than a forecast for July is known. Three years ago, the STACK/SCOOP plays in Oklahoma were believed to be the next big shale oil bonanza. In recent months, the enthusiasm has come to an end as the deposit is not turning out to be as productive as first believed since the geological formation of the region is turning out to be more complex than expected. While drilling in the basin will continue, it is unlikely to become another Permian. While the EIA has production in the Bakken growing by 11,000 b/d next month, the most recent report from the North Dakota Department of Mineral Resources is not so optimistic. The June report from the department shows production dropping slightly from March to April when production was 1.391 million b/d. North Dakota set a production record of 1.403 in January, but production has stagnated since then. The current price for Bakken shale oil is a low $40 a barrel, and drillers in the basin are having trouble with excess natural gas that has to be flared and in moving its oil to market. Given that Bakken production did not grow in the first four months of the year; that capital investment is moving toward the faster-growing Permian; and the low wellhead price, it seems doubtful that production will grow by 48,000 b/d between April and July. A recent study based on the data in the 2019 BP Statistical Review shows that in the ten years between 2008 and 2018 the US and Canada were responsible for 10.5 million b/d or 90 percent of the 11.8 million b/d worldwide increase in production. Given that most US shale oil basins have already peaked, it seems unlikely that the performance in the last ten years will be repeated in the next ten. |

2. The Middle East & North Africa

Iran: The Washington-Tehran confrontation took a turn for the worse last week. There seems to be little question that the US sanctions are making life very difficult and the Iranians are thrashing around trying to retaliate without getting themselves blown up. The recent attacks on tankers in the Gulf of Oman were carefully orchestrated to send a message, but not to sink any ships or take lives. Likewise, the attack on the US drone, whether blessed by the supreme leader or ordered by an overenthusiastic air defense officer, has made the point that Tehran has the ability to make life difficult by slowing or cutting off some 20 percent of the world’s oil supply.

Tehran is trying to build an international alliance against the US pressure and Moscow is saying it will help Iran with its oil payments problem if the new EU Instex payment system which would bypass the US dollar is not launched soon. Tehran announced that it would exceed the enriched uranium limit shortly in hopes that the European members of the nuclear pact will pressure the US to lift the sanctions. For now, there seems to be little else Tehran can do, other than help the Houthis fire missiles at Saudi Arabia, without provoking a military response.

In the meantime, Iran’s economy is slipping deeper into recession as oil revenues dry up. Iranian crude oil and condensate exports, which averaged about 1.7 million b/d in March, fell to about 1 million b/d in April and an estimated 800,0000 b/d in May, according to data from Platts trade flow software and shipping sources. The majority of those exports in May were to China, Turkey, and Syria, according to these sources.

After the US ended all sanction waivers for Iran’s oil customers on May 2, Iran’s crude oil exports dropped significantly in May this year compared to April and plunged by more than 2 million bpd off their 2.5-million-bpd peak in April 2018, just before the US withdrew from the Iran nuclear deal and moved to re-impose sanctions on Iran’s oil industry.

Tehran says it is considering revising its financial and budgetary policies to remove oil income from them as a means to “counter Washington’s economic sanctions”. How this would work is unclear as oil income is an essential part of Iran’s state revenues and the plunging crude exports are crippling its economy.

Secretary of State Pompeo will visit India this week but is unlikely to offer relief from the oil sanctions to one of Tehran’s best customers.

Iraq: On Wednesday rockets hit two sites in southern Iraq used by foreign oil companies including ExxonMobil. Three people were wounded. Police said one rocket landed 100 meters from a building used as a residence and operations center by Exxon. Some 21 Exxon staff were evacuated by plane to Dubai. There was no immediate claim of responsibility for the attack near Iraq’s southern city of Basra, the fourth time in a week that rockets have struck near US installations. Three previous assaults on or near military bases housing US forces near Baghdad and Mosul caused no casualties or significant damage. An Iraqi security source said it appeared that Iran-backed groups in southern Iraq were behind the Basra incident.

Just weeks ago, ExxonMobil looked ready to a sign contract for $53-billion project to boost Iraq’s oil output at its southern fields. However, a combination of contractual wrangling and security concerns, heightened by escalating tensions between Iran and the United States, is holding back the deal. The main sticking point is how Exxon would be paid, with the company aiming to share the oil produced by two fields – a method of payment Iraq has long opposed, saying it infringes on state ownership of production. One of the Iraqi negotiators said Baghdad would not sign anything with the current terms proposed by Exxon.

Baghdad is formulating contingency plans in case the situation in the Middle East results in some kind of blockade of Iraq’s oil exports through the Persian Gulf. Oil ministry spokesman Assem Jihad said, “There is no replacement for the southern port and our other alternatives are limited. It’s a source of anxiety for the global oil market.”

Saudi Arabia: Saudi Energy Minister al-Falih said last week that countries need to cooperate on keeping shipping lanes open for oil and other energy supplies after the tanker attacks. While he did not outline any concrete steps, Falih said the kingdom would do everything necessary to ensure safe passage of energy from Saudi Arabia and its allies in the region.

Crown Prince Mohammed himself told Saudi daily Asharq Al Awsat that the Aramco IPO is on track for 2020 or 2021, depending on market conditions. In August, the company will hold its first earnings call. The listing of 5 percent in Aramco, which last year emerged as the world’s most profitable company booking $111.1 billion in annual net earnings, is the foundation of the Crown Prince’s ambitious economic diversification program. While some have questioned the valuation of the company, its recent maiden international bond worth $12 billion drew an estimated $100 billion in investor interest.

Yemen’s Houthi rebels hit a power station in Saudi Arabia’s southern province of Jizan with a “cruise missile,” the group’s Al Masirah TV channel reported. On Thursday, the Saudi-Emirati-led military coalition in Yemen confirmed Houthi forces fired a “projectile” at a desalination plant in Al Shuqaiq city, but said no one was wounded and there was no damage caused to the facility.

The prospectus recently issued by Saudi Aramco showed the company’s largest oilfield, Ghawar, producing 3.8 million b/d instead of what many had thought was its current capacity of around 5 million b/d. Ghawar has contributed about half of the estimated 150 billion barrels of crude that Saudi Arabia has produced to date. Its remaining reserves are 48 billion barrels, so there is still a lot of oil there, but it will get harder to recover and require considerable expenditure.

Aramco is developing new fields to account for depletion, with half a dozen expected to come on stream by 2026 — adding an extra 1.25 million b/d, according to data from consultancy Energy Aspects. The firm emphasizes that future upstream development is designed to keep things steady “at current capacity levels…Aramco is not talking, as it has done in the past, about raising potential capacity from 12 million b/d to 15 million.”

Libya: Militias from Misrata are preparing to defend Tripoli, 125 miles to the east, against General Khalifa Haftar, a self-proclaimed foe of Islamists who launched a surprise attack in April against a UN-backed government based in the capital. Initially shocked by the audacity of Haftar’s assault, armed groups in western Libya have improved coordination and revived armories from Libya’s 2011 revolution against Muammar Gaddafi to equip their fighters. Their early disarray allowed Haftar’s Libyan National Army (LNA) force, allied to a parallel administration in eastern Libya, to reach Tripoli’s southern outskirts. But since then defenders drawn from Misrata and Tripoli have managed to hold off Haftar’s attack, even regaining some turf.

Western diplomats expect a long war — possibly until year-end — as both sides seem confident of their prospects and enjoy backing from foreign powers who are not pushing for a ceasefire. Such turmoil could disrupt oil flows and increase migration across the Mediterranean – a nightmare scenario for European countries. For now, both sides seem intent on a military solution.

Turkey has supplied drones and armored trucks to Tripoli’s defenders, diplomats and Tripoli officials say. Ankara’s support has helped balance supplies by Egypt and the United Arab Emirates to LNA. Perhaps as important is the fighting spirit in Misrata, the main bastion against Haftar, where the largest mobilization is underway since 2011 when the city helped topple Gaddafi.

Misrata’s fighters make up the main force defending Tripoli, where armed groups are less organized and tend to have flexible loyalties. Major Tripoli groups have not fully mobilized against Haftar, apparently seeking to keep their options open. Misratis say the Tripoli groups lack the “Misrata spirit” developed in 2011 when Gaddafi besieged the city for three months. Misratis tend to see Haftar, an ex-general from Gaddafi’s army, as a copy of the autocrat.

Community leaders rule out peace talks with Haftar: “We have more than 30,000 fighters in Misrata, but so far we have sent only 6,000.” Diplomats estimate Tripoli’s defenders at 3,000, similar to Haftar’s LNA force. Only 1,000 are at the frontlines.

Both sides have rejected a ceasefire. Misrata officials say their forces will try to take Tarhouna, a town southeast of Tripoli controlled by LNA. Haftar has been recruiting there. The LNA itself has strengthened positions near the central city of Sirte, controlled by Misrata.

3. China

Presidents Trump and Xi talked by phone last week and agreed to an extended meeting at the G-20 summit in Japan this week. US Commerce Secretary Wilbur Ross played down prospects of a trade deal at the meeting saying, “I think the most that will come out of the G-20 might be an agreement to resume talks.” Negotiations fell apart with US accusations that China backtracked on terms already agreed upon. China denies it did so. Since then, in addition to increasing punitive tariffs on roughly $200 billion of imports and eliminating the giant Huawei Technologies Co.’s access to American technology on national-security concerns, President Trump has ordered plans be drawn up to impose tariffs of as much as 25 percent on the rest of the $300 billion in imports of Chinese goods not yet subject to duties.

Military equipment firms in the US will likely have their supply of Chinese rare earths restricted. China’s state economic planner confirmed last week that industry experts have proposed export controls. Numerous reports from Chinese media have raised the prospect that China may limit its supplies of the minerals to gain leverage in the trade dispute.

China’s investment in thermal power construction last year fell to its lowest level since 2004, according to data from an official industry group. Beijing has vowed to reduce its dependence on polluting fossil fuels, and it aims to bring the share of coal in its overall energy mix to 58 percent by next year, down from 68.5 percent in 2012 and down to 50-53 percent by 2025. However, a recent study claimed China had resumed construction on more than 50 gigawatts of suspended coal-fired power projects last year and warned China could still build an additional 290 GW of capacity.

China could build as many as 30 overseas nuclear reactors through its involvement in the “Belt and Road” initiative over the next decade. A senior industry official told a meeting of China’s political advisory body this week that “China needed to take full advantage of the opportunities provided by ‘Belt and Road’ and to give more financial and policy support to its nuclear sector.”

4. Russia

Moscow is still trying to clean up the oil mess which left millions of barrels of contaminated crude stuck in its main export pipeline, which was closed down when its customers refused to accept the contaminated oil. The only way to deal with the situation is to pump the contaminated oil ahead into carefully segregated tank farms or tankers where it can be mixed with enough clean oil to bring the contamination down to acceptable levels. Some sections of the pipelines had to be reversed to pump the contaminated oil back into Russia where there was enough spare tank capacity to hold and decontaminate the crude.

The whole fiasco has been costly for Russia and has forced Moscow to reduce its oil production while the debacle is being cleaned up. For example, third-quarter exports of crude via Russia’s large Baltic port at Ust-Luga are set to slide to 2.8 million tons from 9 million scheduled for April-June. Oil flows to Europe have resumed, but problems still exist. Oil flows to Poland were suspended for a day last Wednesday evening after the discovery of contaminated oil still coming through the Druzhba pipeline.

In contrast to the US, Russia has done little to exploit what the IEA says is the world’s largest reserve of shale oil and gas. Some of the reason why this reserve has not been tapped is the high cost of the horizontal drilling and fracking necessary to produce shale oil from tight rock formations. However, a Gazprom official said last week that costs for extracting shale oil are falling and that the company expects they will reach an acceptable level to start production by 2022-2023.

5. Mexico

Mexico’s PEMEX will focus on shallow water projects and onshore plays and avoid investing in its deepwater oil fields for now, as the ailing Mexican state-run oil company seeks to turn around a 14-year slide in crude production. Pemex plans to book as reserves more than 20 billion boe via exploration and increased recovery factors, allowing it to achieve its December 2024 production goal of 2.6 million b/d. “We are putting a magnifying glass on opportunities near existing producing areas.” The company will incorporate 12 billion boe in new reserves by increasing the recovery factor of mature fields through enhanced and secondary oil recovery.

The company is also struggling under a substantial debt load despite government efforts to prop up its finances. Pemex plans to refinance $2.5 billion in debt this year while trying to revive oil production to boost income, the state-owned company’s chief financial officer said, as pressure mounts from credit rating agencies over its performance.

Earlier this month, Fitch Ratings downgraded Pemex’s roughly $80 billion of bonds to speculative grade – or “junk” status. A second downgrade is seen coming soon from Moody’s Investors Service that would formally confirm Pemex as a junk credit, or fallen angel as bond issuers stripped of their investment-grade ratings are known.

The Mexican government plans to cut Pemex’s profit-sharing duty, known as DUC, to 54 percent by 2021 from the current 65 percent, the company’s financial director said Thursday. “Results from this plan might be huge, spectacular.” This subsidy is in addition to the $1.5 billion stimulus package President Andres Manuel Lopez Obrador already announced for Pemex this year which will increase Pemex’s investment budget by $4.8 billion/year after 2021.

6. Venezuela

Venezuela’s severe motor fuel deficit is starting to weigh on the country’s crude production, as oil workers struggle to reach their jobs, and oil equipment and supplies fail to reach oil fields. The fuel crisis could push crude output below the May average of around 750,000 b/d, senior oil union officials warn. Venezuela’s domestic gasoline consumption as of June 15th had declined to about 80,000 b/d and diesel consumption to about 60,000 b/d, compared with peak consumption of 300,000 b/d of gasoline and 190,000 b/d of diesel in 2014, according to an internal oil ministry memorandum.

The memorandum attributes the plunge in fuel consumption to the “operational collapse” of PDVSA’s refineries and the company’s failure to replace refined products formerly imported from the US, and now banned by US sanctions, with products sourced from non-US suppliers. The supply gap would be worse if not for Venezuela’s economic contraction that has eroded demand, and the breakdown of up to two-thirds of the country’s automotive fleet of some 5 million vehicles.

Union officials in the oil-producing states of Zulia, Guarico, Anzoategui, and Monagas say the fuel deficit in their operational areas forced the company to quietly suspend all of its remaining in-house worker transportation services two weeks ago. Food distribution to company cafeterias at the oil fields has also stopped. “There is no fuel for PDVSA’s fleet of passenger and goods transport services, and other public and private alternatives are down for lack of fuel,” a union official in the Orinoco division says. “Oil workers without transportation are choosing to stay at home, and production operations are being affected by the growing absenteeism.”

The 635,000 b/d Amuay refinery and 305,000 b/d Cardon refinery are processing about 120,000 b/d of crude to produce about 60,000 b/d of diesel and about 40,000 b/d of poor-quality gasoline that does not meet oil ministry specifications for the local market, a senior oil union official says. The fuel crisis is also starting to impact operational readiness levels in the armed forces and other government security agencies such as Bolivarian intelligence service Sebin, a defense ministry official says. Shortages of gasoline and diesel are making it difficult for Venezuela’s farmers and cattle ranchers to get their goods to market and food stores in the cities are running short.

Chevron, the last major US oil company still operating in Venezuela, could be forced to leave unless US officials extend sanctions waivers scheduled to expire on July 27. A Chevron exit would follow on the heels of other major American companies that have retreated from the chaos in Venezuela in recent years. Chevron produced an average of 40,000 barrels of oil and natural gas in the country during the first quarter of 2019, according to SEC filings. That’s down from 44,000 barrels during 2018, most of which was crude oil.

The company currently has five onshore and offshore production projects in Venezuela with PDVSA, the national oil company. Chevron even established its Latin American headquarters in Caracas. In January, the US imposed tough sanctions on PDVSA in a bid to push out Maduro. Those sanctions prohibited American companies from doing business with PDVSA. However, the US Treasury Department granted six-month waivers to Chevron and five oil services companies including Halliburton, Schlumberger, Baker Hughes, and Weatherford International. Those waivers, set to expire on July 27, allow the companies to conduct transactions and activities with PDVSA.

A loss of Chevron’s expertise and resources would only make matters worse for Venezuela’s oil industry, which is already on the brink of collapse under President Nicolas Maduro. And it could trigger losses for Chevron in a significant market it spent decades sinking time, money and sweat into. “If Chevron leaves, the country will almost certainly nationalize its oil assets,” said Muhammed Ghulam, an energy analyst at Raymond James. “Maduro is in a fight for his country. He needs all the cash and resources he can get.”

7. The Briefs (date of the article in the Peak Oil News is in parentheses)

Venezuela’s state-owned PDVSA plans to reactivate the Isla Refinery on Curacao in July with imported crude from third parties, according to sources in the company, labor union and with Curacao’s government. (6/18)

Canada approved construction of a contentious pipeline project on Tuesday that is expected to help the country’s struggling energy sector. The project is drawing attacks from environmentalists and indigenous leaders and could hurt Prime Minister Justin Trudeau when he heads to the polls in four months. If built, the Trans Mountain pipeline expansion will run alongside an existing pipeline from the oil sands in Alberta to just outside Vancouver, British Columbia, and will carry an additional 590,000 b/d of diluted oil sands bitumen, bringing the total daily flow along that route to nearly 1 million b/d. (6/20)

The US oil rig count increased by one to 789 while the natural gas rig count declined by 4 to 177, according to GE’s Baker Hughes. Miscellaneous rigs saw an increase of one. The combined oil and gas rig count is 967, down 85 year on year. Canada’s overall rig count increased by 12. Canada’s oil rigs are still down by 23 year on year, with gas rigs down 18 year on year. (6/22)

More US exports: US oil refiner Phillips 66 is proposing a deepwater crude export terminal off the US Gulf Coast, challenging at least eight other projects aiming to send US shale oil to world markets. The project, called the Bluewater Texas Terminal, signals another major expansion of its logistics operations. (6/20)

PA refinery fireball: A massive fire at Philadelphia Energy Solutions Inc’s oil refinery on Friday damaged the largest US East Coast plant to the point that it could remain shut for an extended period. Philadelphia fire officials said several explosions sent a huge fireball into the sky, engulfing the surrounding areas in smoke after 4 a.m., following the ignition of a fire that started in a butane vat at the 335,000 b/d refining complex, also the oldest in the Northeast. (6/22)

US gasoline prices jumped after the fire and explosions were reported at the Philadelphia Energy Solutions oil refinery. The refineries in the greater Philadelphia region supply largely eastern gasoline, diesel and jet fuel markets including Philadelphia, Washington, and New York City. (6/22)

US gasoline demand reached a record high last week, new Energy Information Administration data showed Wednesday. In the week ended June 14, implied US gasoline demand — which the EIA measures as product supplied — reached 9.928 million b/d, the highest that figure has ever been in data going as far back as 1991. (6/20)

Ethanol political football: Shortly after touring an ethanol plant in Iowa this week, President Trump stood in front of a crowd of farmers—a group of people who have every right to be upset with him. Trump’s trade war with China has bashed the struggling farm economy, but the president came to Iowa to share some popular news: His administration will allow the sale of more gasoline containing higher blends of corn ethanol. (6/18)

LNG boom delays? Construction delays and cost blowouts could hit the next wave of liquefied natural gas projects as there are a limited number of contractors able to handle the huge projects, three developers said on Wednesday. Around $200 billion in projects across the globe from Australia to the United States are racing to be approved over the next two years, vying to provide around 65 million tons of new annual supplies that are needed by 2025, according to estimates by consultants Wood Mackenzie. (6/20)

Gas power plant to be shuttered: General Electric Co said on Friday it plans to demolish a 750-megawatt natural-gas-fired power plant it owns in California this year after only one-third of its useful life because the slow-ramping one-of-a-kind plant, completed in 2009, is no longer economically viable in a state where wind and solar supply a growing share of inexpensive electricity. The closure illustrates stiff competition in the deregulated energy market as cheap wind and solar supply more electricity, squeezing out fossil fuels. (6-22)

Nuclear storage costs: “The Maine Yankee nuclear power plant hasn’t produced a single watt of energy in more than two decades, but it cost US taxpayers about $35 million this year.” So begins a powerful report this week about the crushing cost of nuclear waste storage by the Los Angeles Times. (6/20)

Utilities transforming? Bloomberg’s New Energy Outlook 2019 concludes that US coal and nuclear resources are expected to have “almost disappeared from the electricity mix” by 2050, largely as a result of “age and economics,” while renewables penetration reaches 43 percent. The report, released Tuesday, states that “cheap renewable energy and batteries fundamentally reshape the electricity system,” and projected that solar will rise from supplying about 2 percent of current world electricity supply to about 22 percent by 2050. (6/21)

Not so fast! “The unbridled enthusiasm for renewable energy growth echoes a previous time in our industry when the very same statements were being made in the 1970s regarding nuclear power,” said Gary Ackerman, president of Foothill Services Nevada and former executive director of the Western Power Trading Forum. “Funny, none of those forecasts turned out to be correct. The same will be said about the much anticipated renewable and battery storage explosion. I am always amazed by the substitution of intelligent reasoning with straight-edge rulers plotting lines on log-linear paper.” (6/21

Wind in Norway: Norway proposes to open two new areas in the North Sea with the potential to hold installed capacity of up to 3.5 gigawatts of offshore wind, as Western Europe’s largest oil producer aims to use its offshore oil and gas expertise to boost the wind power exports of Norwegian companies. (6/20)

EU carmakers have to sell more EVs as new emission targets loom. Most analysts think a number of car companies are at serious risk of failing to achieve the targets, and some are calling it the biggest threat in a generation for an industry already battered by global tariff disputes, disrupted cross-border supply chains and fading demand in Europe and Asia. (6/22)

EU’s EV trains + buses booming: Two major public transport orders this week from regional transport authorities in Germany showed how they are going beyond federal targets to decarbonize bus and train fleets. City state Berlin placed an order for 90 battery-powered buses while the state of Schleswig-Holstein ordered 55 battery-powered trains — which remove the need for costly overhead line electrification as diesel trains are replaced. Berlin plans to electrify its fleet of 1,400 city buses by 2030. (6/22)

Backlash at anti-science: President Donald Trump’s new order to cut the number of government advisory committees by a third is drawing condemnation from former government officials, scientists and environmental advocacy groups who say the committees provide a check against politically inspired regulatory reversals. “It’s just another extension of this administration’s attack on science, an attack on transparency, and an attack on anything that can get in the way of this administration doing what it wants to do without need for experts to intervene in any way,” said Gina McCarthy, former EPA administrator. (6/20)

Backlash at carbon rule: The Trump administration finalized a new carbon emissions rule for US power plants on Wednesday that it said could cut pollution without damaging the coal industry, replacing a much tougher Obama-era version to fight climate change. The move was a boost to coal companies facing tough competition from natural gas, solar and wind energy suppliers, but infuriated environmentalists and Democratic lawmakers who said the regulation was too weak to significantly reduce emissions and would put public health at risk. (6/20)

States’ partisan climate policies: At a time when the country is already deeply fractured along partisan lines, individual states are starting to pursue vastly different policies on climate change with the potential to cement an economic and social divide for years to come. A growing number of blue states are adopting sweeping new climate laws — such as New York’s bill , passed this week, to zero out net greenhouse gas emissions by 2050 — that aim to reorient their entire economies around clean energy, transforming the way people get their electricity, heat their homes and commute to work. (6/22)

New York state lawmakers passed early Thursday one of the nation’s most ambitious plans to slow climate change by reducing greenhouse gas emissions to zero by 2050. If signed into law, it would make New York the second US state to aim for a carbon-neutral economy, following an executive order signed by then California Governor Jerry Brown last year to make that state carbon neutral by 2045. (6/20)

Climate clash in Oregon: Republican lawmakers at the Oregon State Senate fled the state on Thursday to avoid being forced to vote on a climate bill that the Oregon House passed earlier this week in one of the strictest US emission-capping efforts to tackle climate change. Oregon will be looking to lower its emissions to 80 percent below the 1990 level by 2050. After clearing the Oregon House, the bill is now one vote away from becoming law. But this vote is in the Oregon Senate, where Republican Senators threatened walkouts to prevent the vote from taking place. (6/21)

Winners and losers: As disaster costs keep rising nationwide, a troubling new debate has become urgent: If there’s not enough money to protect every coastal community from the effects of human-caused global warming, how should we decide which ones to save first? After three years of brutal flooding and hurricanes in the US, there is growing consensus among policymakers and scientists that coastal areas will require significant spending to ride out future storms and rising sea levels — not in decades, but now and in the very near future. (6/20)

Big oil climate pledge: Some of the world’s major oil producers pledged Friday to support “economically meaningful” carbon pricing regimes after a personal appeal from Pope Francis to avoid “perpetrating a brutal act of injustice” against the poor and future generations. The list of participating companies included ExxonMobil, BP, Royal Dutch Shell, Total, Chevron and Eni. (6/18)