Welcome to the bidding war that didn’t happen. The decision last week by international oil giant Chevron Corp. to leave its takeover bid for shale oil and gas-heavy Anadarko Petroleum Corp. unaltered in the wake of a higher offer from rival bidder Occidental Petroleum Corp. surprised some who had expected a back and forth escalation between the two competitors.

Chevron’s CEO told Bloomberg, “Winning in any environment doesn’t mean winning at any cost.” Chevron’s hesitancy to pay up for Anadarko’s assets suggests a measured assessment about what Anadarko might deliver, one tempered by emerging political developments and perhaps a less sanguine view about the durability of the shale boom.

Anadarko, after all, has considerable operations in Colorado which recently enacted a bill increasing the ability of municipalities to curtail oil and gas development, authorizing more stringent air quality monitoring and rules, and turning the commission which was tasked with “fostering” oil and gas development into one which actually regulates it. That spells less oil and gas development in a state that has been critical to Anadarko and to the shale boom.

The promoters of shale oil and gas investment are pretending as if the kind of backlash which happened in Colorado could not occur elsewhere. Don’t count on that being the case.

Beyond this, energy writer Nick Cunningham summarizes the most recent update of prospects for shale hydrocarbons released by a skeptical Post Carbon Institute. Issues identified by the institute way back in 2012 have continued to unfold as foretold. All the technological improvements since then are only hastening the day when production will turn down according to the report’s author. Simply put, production from oil and gas shale deposits is being “frontloaded.” That implies that when the decline comes, it’s likely to be surprisingly steep. (The precipitous decline of Mexico’s giant Cantarell oil field after a technique known as nitrogen injection supercharged production for several years provides a cautionary tale.)

During the height of a boom, promoters who stand to profit forecast a long prosperous future ahead, a never-ending cornucopia that will fill the pockets of those smart enough to invest now. But as anyone who has lived long enough knows, the time to sell is when just this kind of narrative is being offered.

The current momentum could carry the boom further. Actively betting against it might prove costly in the short run. But simply leaving the party a little early might be wise when compared to the ugly hangover that is likely to ensue if one continues to party until the boom winds down. That could happen as early as the next recession—or when the portion of drillers’ exploration and development budgets devoted to merely replacing lost production from these fast-declining wells reaches 100 percent, whichever comes first.

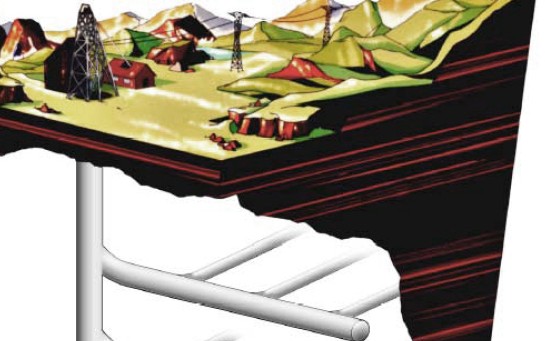

Image: Artist’s rendition of a shale oil extraction process using radio waves. Lawrence Livermore National Laboratory (2006). Via Wikimedia Commons https://commons.wikimedia.org/wiki/File:Oil_shale_radio_frequency_extraction.JPG