“The sense of security more frequently springs from habit than from conviction, and for this reason it often subsists after such a change in the conditions as might have been expected to suggest alarm. The lapse of time during which a given event has not happened, is, in this logic of habit, constantly alleged as a reason why the event should never happen, even when the lapse of time is precisely the added condition which makes the event imminent.”

–George Eliot, Silas Marner

It’s been ten years since the Global Financial Crisis (GFC) of 2008. Print, online, and broadcast news media have dutifully featured articles and programs commemorating the crisis, wherein commentators mull why it happened, what we learned from it, and what we failed to learn. Nearly all of these articles and programs have adopted the perspective of conventional economic theory, in which the global economy is seen as an inherently stable system that experiences an occasional market crash as a result of greed, bad policies, or “irrational exuberance” (to use Alan Greenspan’s memorable phrase). From this perspective, recovery from the GFC was certainly to be expected, even though it could have been impeded by poor decisions.

Some of us have a different view. From our minority perspective, the global economy as currently configured is inherently not just unstable, but unsustainable. The economy depends on perpetual growth of GDP, whereas we live upon a finite planet on which the compounded growth of any material process or quantity inevitably leads to a crash. The economy requires ever-increasing energy supplies, mostly from fossil fuels, whereas coal, oil, and natural gas are nonrenewable, depleting, and climate-changing resources. And the economy, rather than being circular, like ecosystems (where waste from one component is food for another, so all elements are continually recycled), is instead linear (proceeding from resource extraction to waste disposal), even though our planet has limited resources and finite waste sinks.

In the minority view of those who understand that there are limits to growth, the GFC (or something like it) was entirely to be expected, since whatever cannot be sustained must, by definition, eventually stop. Indeed, the crash requires less of an explanation than the recovery that followed. Instead of skidding into a prolonged and deepening depression, the global economy—at least as measured conventionally—has, in the past years, scaled new heights. In the US, the stock market is up, unemployment is down, and GDP is humming along nicely. Most other nations have also seen a recovery, after a fashion at least. We have enjoyed ten years of reprieve from crisis and decline. How was this achieved? What does it mean?

Let’s take a look back, through the lens of the minority view, at this most unusual decade.

Where We Were

The years leading up to 2008 saw (among other things, of course) soaring interest in the notion of peak oil. Many peak oil analysts were industry experts who studied depletion rates, production decline rates in existing oil wells and oilfields, and rates of oil discovery. They reached their conclusions by analyzing the available data using charts, equations, and graphs; and by extrapolating future production rates for oilfields and countries. They generally agreed that the rate of world oil production would hit a maximum sometime between 2005 and 2020, and decline thereafter.

However, some peak oilers were ecologists (I was among this group). Informed by the 1972 computer scenario study The Limits to Growth (LTG), these observers and commentators understood that many of Earth’s resources (not just fossil fuels) are being used at unsustainable rates. The “standard run” LTG scenario featured peaks and declines in world industrial output, food production, and population, all in the first half of the twenty-first century. The peak oil ecologists therefore saw the imminent decline in world petroleum output as a likely trigger event in the larger process of society’s environmental overshoot and collapse.

The two groups shared an understanding that oil is the lifeblood of modern industrial civilization. Petroleum is central to transport and agriculture; without it, supply chains and most food production would quickly grind to a halt. Moreover, there is a close historic relationship between oil consumption and GDP growth. Thus, peakists reasoned, when world oil production starts its inevitable down-glide, the growth phase of industrial civilization will be over.

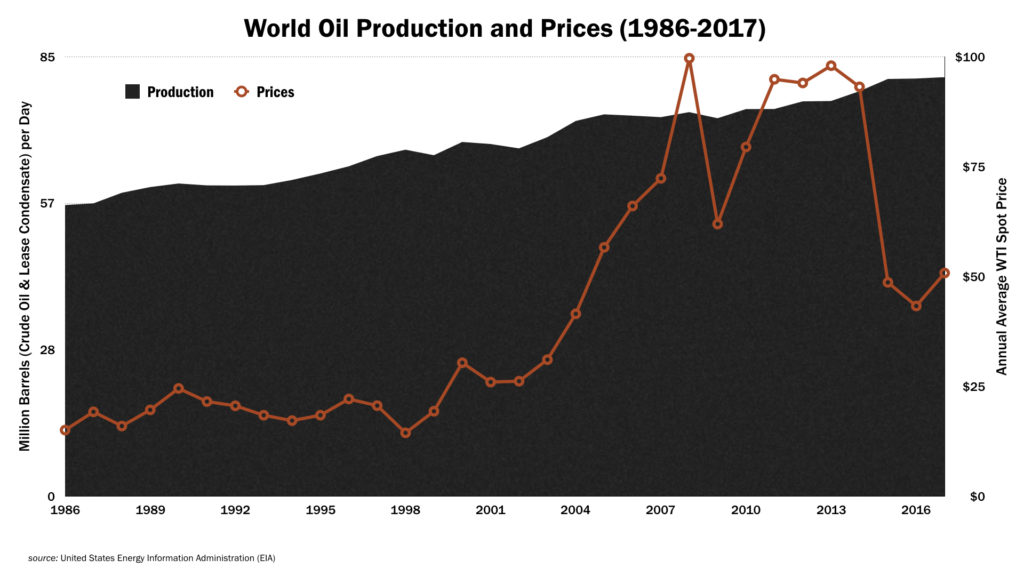

In the years leading up to 2005, the rate of increase in world conventional crude oil production slowed; then output growth stopped altogether and oil prices started rising. By July 2008 the West Texas Intermediate (WTI) crude benchmark oil price briefly hit an all-time, inflation-adjusted high of $147 per barrel. High oil prices starve the economy of consumer spending. And, due to subprime mortgages, collateralized debt obligations, and other factors, the economy was set for a spill in any case. Within weeks, the foundations of the financial industry were giving way. Stock prices were tumbling and companies were going bankrupt by the dozen. Most of the US auto industry teetered on the brink of insolvency. The news media were filled with commentary about the possible demise of capitalism itself.

In sum, the financial crash of 2008 looked to some of us like not just another stock market “correction,” but the end of a brief and blisteringly manic phase of civilized human existence. It was confirmation that our diagnosis (that fossil-fueled industrialism was unsustainable even over the short term) and prognosis (that the peak in world oil production would trigger the inevitable collapse of oil-based civilization) were both correct.

Our expectation at that point was that oil production would decline, energy prices would rise, and the economy would shrink in fits and starts. Living standards would crumble. It would then be up to world leaders to decide how to respond—either with resource wars, or with a near-complete redesign of systems and institutions to minimize reliance on fossil fuels and growth.

But we were wrong.

Back From Death’s Door

Instead there was a recovery, in both world oil output growth and in overall economic activity. How so?

It turned out that most peakists had been unaware of a so-called revolution waiting to be unleashed in the American oil and gas industry. Although world conventional crude oil production (subtracting natural gas liquids and bitumen) remained flatlined roughly at the 2005 level, new sources of unconventional oil began opening up in the United States, especially in North Dakota and south Texas. Small-to-medium-sized companies began drilling tens of thousands of twisty wells deep into source rock, fracturing that rock with millions of gallons of water and chemicals, and then propping open newly formed cracks with tons of fine sand. These techniques released oil trapped in the “tight” rocks. It was an expensive process that came with significant environmental, health, and social costs; but, by 2015, five million barrels per day of “light tight oil” (LTO) were supplementing world liquid fuel supplies.

This development profoundly shifted the entire global energy narrative. Pundits began touting the prospect of US energy independence. Peak oil suddenly seemed a mistaken and antiquated idea.

Moreover, while fracking was revolutionizing the oil and gas industry, debt was resuscitating the financial system. Viewing the deflationary GFC as a mortal threat, central banks in late 2008 began deploying extraordinary measures that included quantitative easing and near-zero interest rates. At the same time, governments dramatically increased their rates of deficit spending. The hope of both central bankers and government policy makers was to use the infusion of debt to revive an economy that was otherwise on the brink of dissolution. The gambit worked: by 2010, US and world GDP were once again growing.

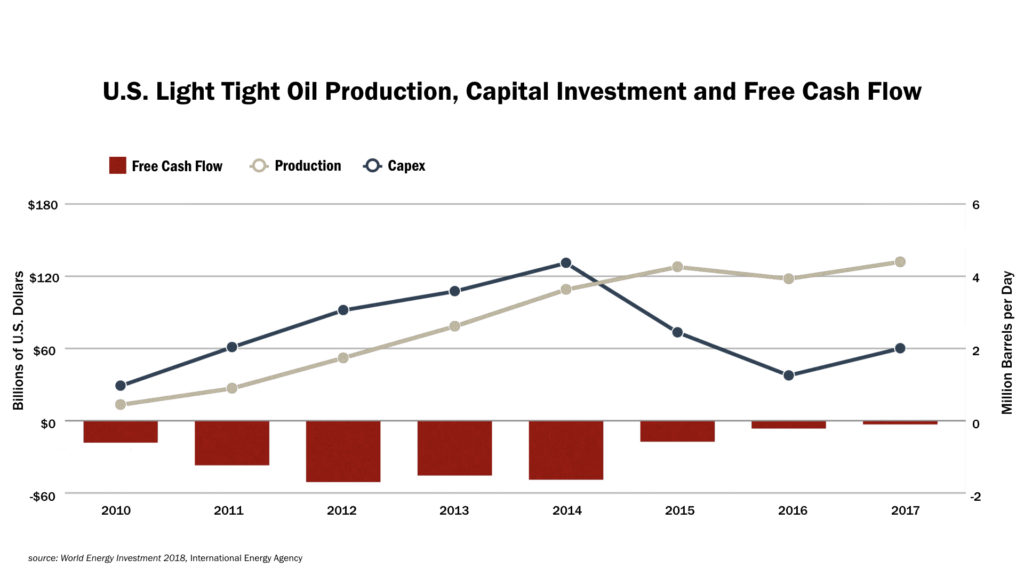

It turned out that the fracking revolution and the central bank debt free-for-all were closely linked. Fracking was so expensive that only wells in the best locations had any chance of making money for operators, even with high oil prices. But companies had bought leases to a lot of inferior acreage. Their only realistic paths to success were to make slick (if misleading) presentations to gullible investors, and to borrow more and more money at low interest rates to fund operations and pay dividends. In fact, the fracking business resembled a pyramid scheme, with most companies seeing negative free cash flow year after year, even as they drilled their best prospective sites.

In 2013, we at Post Carbon Institute (PCI) began publishing a series of reports about shale gas and tight oil (authored by geoscientist David Hughes), based on proprietary well-level drilling information. These reports documented the high geographic variability of drilling prospects (with only relatively small “sweet spots” offering the possibility of profit); and rapid per-well production declines, necessitating very high rates of drilling in order to grow or even maintain overall production levels. Given the speed at which sweet spots were becoming crowded with wells, it appeared to us that the time window during which shale gas and tight oil could provide such high rates of fuel production would be relatively brief, and that an overall decline in US oil and gas production would likely resume with a vengeance in the decade starting in 2020. These conclusions flew in the face of official forecasts showing high rates of production through 2050. However, our confidence in our methodology was bolstered as individual shale gas and tight oil producing regions began, one by one, to tip over into decline.

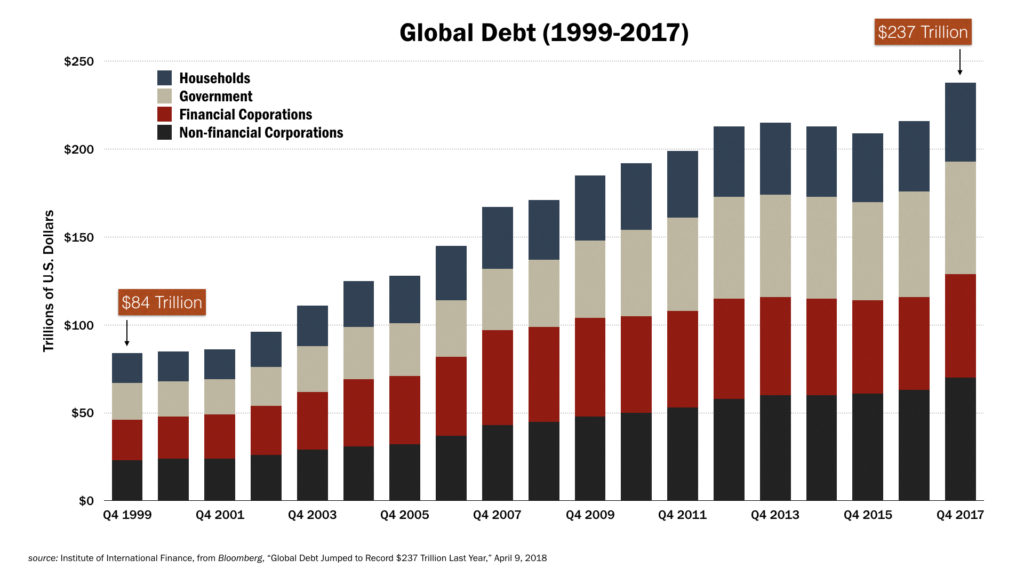

In sum, without low-interest Federal Reserve policies the fracking boom might never have been possible. For the world as a whole, a steady decline in energy resource quality has been hidden by massive borrowing. Indeed, since the GFC, overall global debt has grown at over twice the rate of GDP growth. Humanity consumes now, with the promise of paying later. But in this instance “later” will likely never come: the massive public and private debt that has been run up over the past few decades, and especially since the GFC, is too vast ever to be repaid (it’s being called “the everything bubble”). Instead, as repayments fall behind, banks will eventually be forced to cease further lending, triggering a deflationary spiral of defaults. If the fracking bubble hasn’t burst by that time for purely geological reasons, lack of further low-interest financing will provide the coup-de-grace.

While low-interest debt managed to fund a brief energy reprieve and to forestall overall financial collapse, it couldn’t paper over a deepening sense of malaise among much of the public. Income growth for US wage earners had been stagnant since the early 1980s; then, during the 2008-2018 decade, wage earners in the lowest percentiles continued to coast or even lost ground while high-income households saw dramatic improvements. This was partly a result of the way governments and central banks had structured their bailouts, with most of the freshly minted cash going to investors and financial institutions. This lopsidedness in the economic rebound was mirrored in many other countries. A recent US tax cut that was targeted almost exclusively at high-income households (with another similar cut apparently on the way) is only exacerbating the trend toward higher inequality. And economic inequality is fomenting widespread dissatisfaction with both the economic system and the political system. None of the bankers who contributed to the GFC via shady investment schemes went to jail, and a lot of people are unhappy about that, too.

Further, there was no “recovery” at all for the global climate during the past decade; quite the opposite. As humanity burned more fossil fuels and spewed more carbon dioxide into the atmosphere, the scale of climate impacts grew. Hurricanes, typhoons, droughts, and wildfires fed deepening poverty and, in some instances (e.g., Syria), simmering conflicts. Growing tides of refugees began migrating away from areas of crisis and toward regions of relative safety.

At the same time, technological trends drove further wedges among social groups: while automation helped tamp down wage growth, the pervasive use of social media inflamed political polarization. An expanding far-right political fringe in turn fed anti-immigrant and anti-refugee populism, and sought to exploit the disgruntlement of left-behind wage earners. All of this culminated in the ascendancy of Donald Trump as US president, joining fellow authoritarians in Russia, China, the Philippines, Hungary, Poland, and elsewhere. Globally, political systems have been destabilized to a degree not seen in decades.

Altogether, this was a deceptive, uneven, and unsettling “recovery.”

How We Used Our Bonus Decade

As already mentioned, humanity didn’t get a bonus decade with regard to climate change. While building millions of solar panels and thousands of wind turbines, we also increased our burn rate for oil, natural gas, and coal (global coal consumption maxed out in 2014 and has fallen a little since then, though it’s still above the 2008 rate). That’s because, as George Monbiot puts it, “while economic growth continues we will never give up our fossil fuels habit.” And policy makers are not willing to give up growth.

Here’s a thought experiment: If there had been no recovery (that is, if GDP had continued to plummet as it was doing in 2009), and if, as a result, demand for fossil fuels had cratered, there would no doubt have been a lot of human misery (which there may be anyway ultimately, just delayed), but there also would have been less long-term impact on the global climate and on ecosystems. As it was, atmospheric greenhouse gas concentrations rose, as did the average global temperature, with devastating effect on oceans, forests, and biodiversity.

At PCI, we spent the past decade adapting our message to shifting realities. We gave a lot of thought to the transition to a post-growth economic regime, resulting in my book, The End of Growth. We also spent many hours pondering societal strategies for surviving overshoot, and came to much the same conclusion as some of our colleagues who’ve been working on these issues for decades (including Dennis Meadows, co-author of The Limits to Growth): that is, with impacts on the way, building societal resilience has to be a top priority. We determined that it’s at the community scale that resilience-building efforts are likely to be most successful and most readily undertaken. Determined to help build community resilience, we co-published a three-book series of Community Resilience Guides, as well as the Community Resilience Reader; we also produced the “Think Resilience” video series.

We analyzed the prospects for US shale gas and tight oil production via David Hughes’s series of reports mentioned above (also in my book Snake Oil), and we assessed the prospects for a transition to renewable energy in a book, Our Renewable Future, I coauthored with PCI Fellow David Fridley. In that book, we concluded that while an energy transition is necessary and inevitable, transformations in virtual every aspect of modern society will need to be undertaken and economic growth has to be curtailed in order for it to happen. We at PCI did other things as well (including producing additional videos, books, and reports), but these are some of the highlights.

I’m proud of what we were able to accomplish with the participation of our followers, fellows, staff, and funders. But, I’m sorry to say, our efforts had limited reach. Our books and reports got little mainstream media attention. And while some communities have adopted resilience as a planning goal, and Transition and other initiatives have promoted resilience thinking through grassroots citizen networks, most towns and cities are still woefully ill-prepared for what’s coming.

I’ve titled this essay “Our Bonus Decade” because the past ten years were an unexpected (by us peakists, anyway) extra—like a bonus added to a paycheck. But bonus is a borrowed Latin word meaning “good.” In retrospect, whatever good we humans derived from the last ten years of reprieve may ultimately be outweighed by the bad effects of our collective failure to change course. During those ten years we emitted more carbon into the atmosphere than in any previous decade. We depleted more of Earth’s resources than in any previous decade. And humanity did next-to-nothing to reconfigure its dominant economic and financial systems. In short, we (that is, the big We—though not all equally) used our extra time about as foolishly as could be imagined.

Where We Stand Now

As discussed above, US tight oil and shale gas output growth can’t be expected to continue much longer. LTO production in the rest of the world never really took off and is unlikely to do so because conditions in other countries are not as conducive as they are in US (where land owners often also own rights to minerals beneath the soil). At the same time, conventional crude oil, whose global production rate has been on a plateau for the past decade, may finally be set to decline due to a paucity of new discoveries.

At the same time, the burden of debt that was shouldered during the past decade is becoming unbearable. US federal government borrowing has soared despite “robust” economic conditions, and interest payments on debt will soon exceed military spending. China’s debts have quadrupled during the decade, its annual GDP growth rate is quickly slowing, its oil production rate is peaking, and the energy profitability of its energy sector as a whole is declining fast.

But that’s not all that’s happening. Let’s step back and summarize:

(1) We peak oil analysts had assumed that energy resource depletion would be the immediate trigger for societal collapse.

(2) However, climate change is turning out to be a far greater threat than we depletionists had thought fifteen or twenty years ago, when the peak oil discussion was just getting underway. The impacts of warming atmosphere and oceans are appearing at a frightening and furious pace, and climate feedbacks could make future warming non-linear and perhaps even unsurvivable. At this point one has to wonder whether the mythic image of hell is a collective-unconscious premonition of global climate change.

(3) Ten years ago we learned that debt cycles and debt bubbles are a significant related factor potentially leading to, or hastening, civilizational collapse.

(4) Now we are all getting a rapid education in the ways inequality can lead to political polarization and social instability.

As a shorthand way of speaking about these four related factors, we at PCI have begun speaking of the “E4 crisis” (energy, environment, economy, and equity). It’s no longer helpful to focus on one factor to the exclusion of the others; it’s far more informative to look for ways in which all four are interacting in real time.

Our bonus round of economic growth and relative normalcy will assuredly end at some point due to the combined action of these factors. I don’t know when the dam will burst. Nor do I know for certain whether there will be yet another fake “recovery” afterward—the next one perhaps being even weaker and more unequally experienced than the current one. And I’m not about to offer a definitive forecast for the timing of the global oil peak: one can imagine a scenario in which governments and central banks again print immense amounts of money in order to keep drillers and frackers busy. Only two things can I say with confidence: the big trends all add up to overshoot, crisis, and decline; and building personal and community resilience remains the best strategy in response.