If the cement industry were a country, it would be the third largest emitter in the world.

In 2015, it generated around 2.8bn tonnes of CO2, equivalent to 8% of the global total – a greater share than any country other than China or the US.

Cement use is set to rise as global urbanisation and economic development increases demand for new buildings and infrastructure. Along with other parts of the global economy, the cement industry will need to dramatically cut its emissions to meet the Paris Agreement’s temperature goals. However, only limited progress has been made so far.

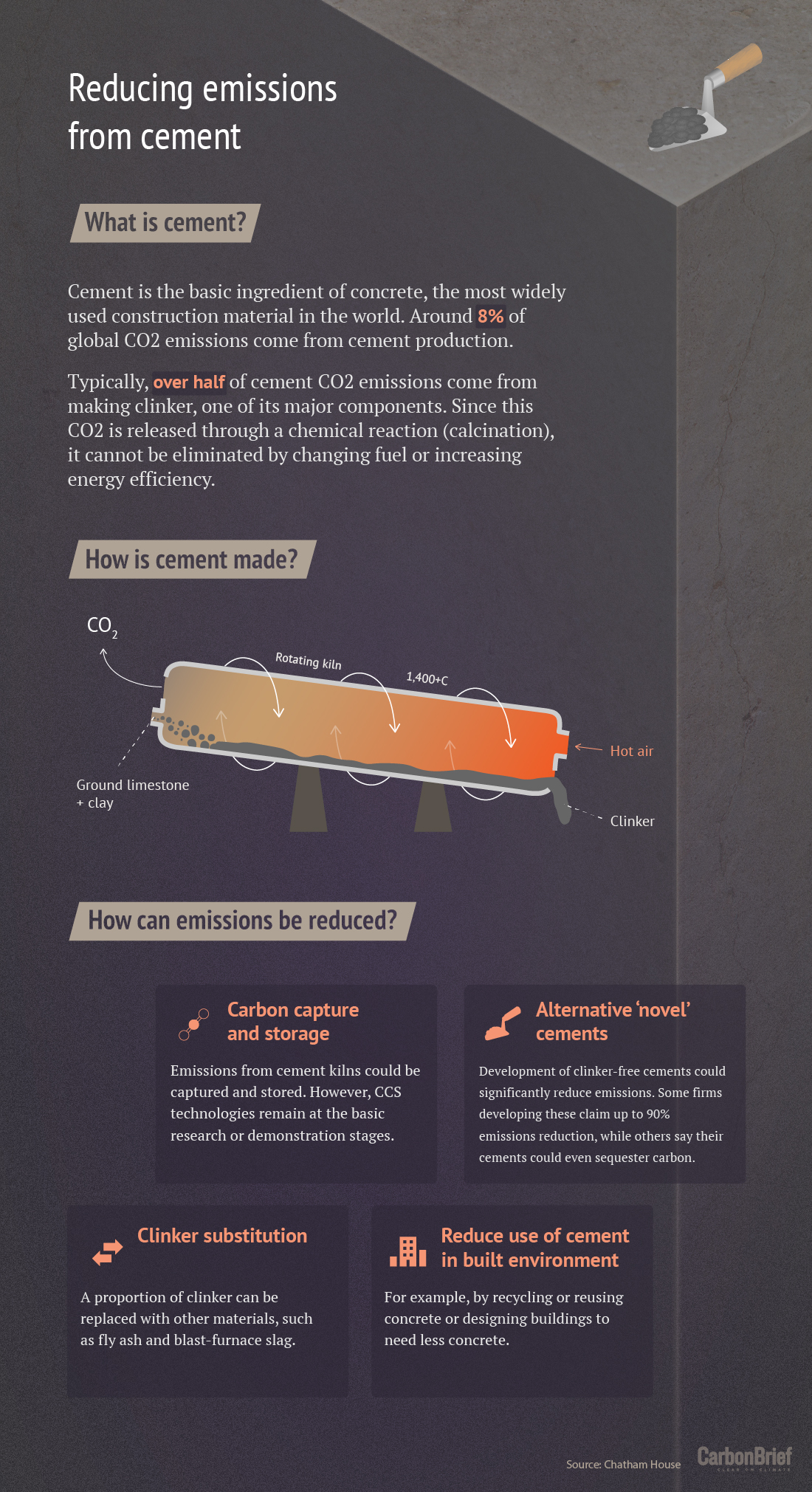

Reducing emissions from cement. Infographic by Rosamund Pearce for Carbon Brief.

What is cement?

Cement is used in construction to bind other materials together. It is mixed with sand, gravel and water to produce concrete, the most widely used construction material in the world. Over 10bn tonnes of concrete are used each year.

The industry standard is a type called Portland cement. This was invented in the early 1800s and named after a building stone widely used in England at the time. It is used in 98% of concrete globally today, with 4bn tonnes produced each year.

The production of Portland clinker, which acts as the binder, is a crucial step in making Portland cement. Limestone (CaCO3) is “calcinated” at high temperatures in a cement kiln to produce lime (CaO), leading to the release of waste CO2. Overall, the following reaction occurs:

Why does cement emit so much CO2?

Around half of the emissions from cement are process emissions arising from the reaction above. This is a principle reason cement emissions are often considered difficult to cut: since this CO2 is released by a chemical reaction, it can not be eliminated by changing fuel or increasing efficiency.

A further 40% of cement emissions come from burning fossil fuels to heat kilns to the high temperatures needed for this calcination process. The last 10% of emissions come from fuels needed to mine and transport the raw materials.

Therefore, cement emissions depend largely on the proportion of clinker used in each tonne of cement. The type of fuel and efficiency of equipment used during clinker production also have an impact.

Meanwhile, the floor area of the world’s buildings is projected to double in the next 40 years. This means cement production is set to grow to around 5bn tonnes by 2030, a 25% increase from today, reaching over four times 1990 levels.

Efficiency gains alone will, therefore, not be enough to significantly cut the sector’s emissions.

Which countries have high cement emissions?

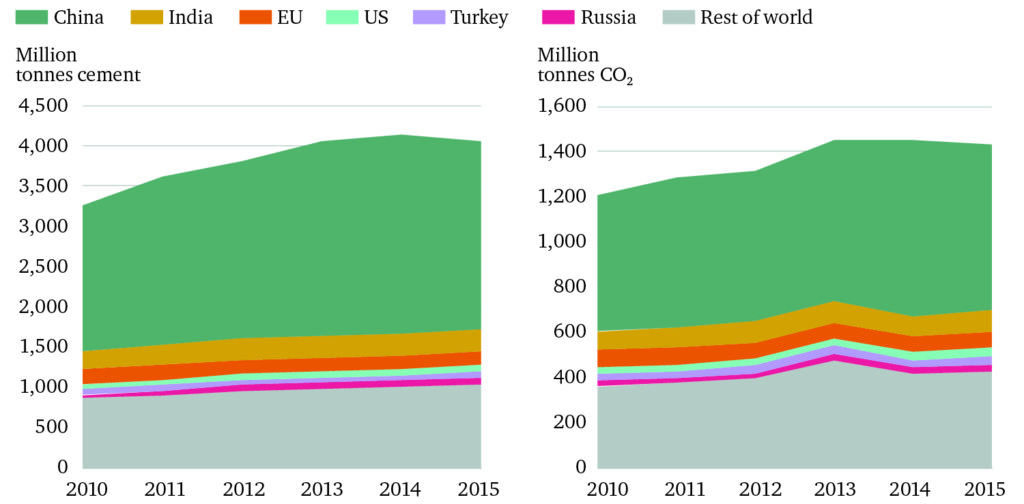

China is by far the largest producer of cement, followed far behind by India and the combined countries of the EU, as the graph below from a recent report by Chatham House shows. Three-quarters of cement production since 1990 occurred in China, which used more cement between 2011 and 2013 than the US did in the entire 20th century.

Cement production and emissions from 2010 to 2015. Source: Analysis of Olivier et al. (2016) by Chatham House.

China also has high levels of cement production in per capita terms, as it experiences rapid urbanisation, with many people moving to high- or low-rise buildings made from cement. However, Chinese consumption may be close to levelling off.

In contrast, India’s consumption is set to increase significantly as it in turn rapidly urbanises and builds infrastructure. Most future growth is expected to happen in India and other emerging markets.

In Europe, existing kiln facilities are capable of meeting future demand for cement, according to Chatham House. European cement producers are also some of the most advanced in terms of their use of alternative fuels, it adds. However, older equipment puts them behind India and China on energy efficiency.

Likewise, the US, the fourth-largest cement consumer, lags behind other major producers in terms of energy efficiency and its clinker ratio.

Have cement emissions been reduced?

The average CO2 intensity of cement production – the emissions per tonne of output – has fallen by 18% globally over the past few decades, according to Chatham House. However, the sector’s emissions as a whole have risen significantly, with demand tripling since 1990.

Progress so far has come in three main areas. First, more efficient cement kilns have made production less energy-intensive. This can improve further: global average energy use per tonne of cement is still around 20% higher than production with current best available technology and practice.

Second, use of alternative fuels has also lowered emissions – for example, using biomass or waste in place of coal. This is especially the case in Europe, where around 43% of fuel consumption now comes from alternatives, Chatham House says.

Third, reducing the proportion of Portland clinker in cement has also cut emissions. “High-blend” cements can reduce emissions per kilogram by up to four times, according to Chatham House. Clinker can be substituted with other cement-like materials, including waste from coal combustion and steelmaking. This can affect the cement’s properties, however, so is only suitable for some end uses.

The world average clinker ratio (clinker:cement) fell to 0.65 in 2014, with a large range from 0.57 in China to 0.87 in Eurasia.

After several decades of progress, the CO2 intensity of cement changed little from 2014 to 2016, according to the International Energy Agency (IEA). This is because energy efficiency improvements were offset by a slight increase in the clinker ratio, it says.

Nevertheless, overall cement emissions were flat or declining in recent years as demand in China levelled off.

BioMason uses bacteria to grow cement bricks which it says can sequester carbon. Credit: bioMASON, Inc.

How far can cement emissions be cut?

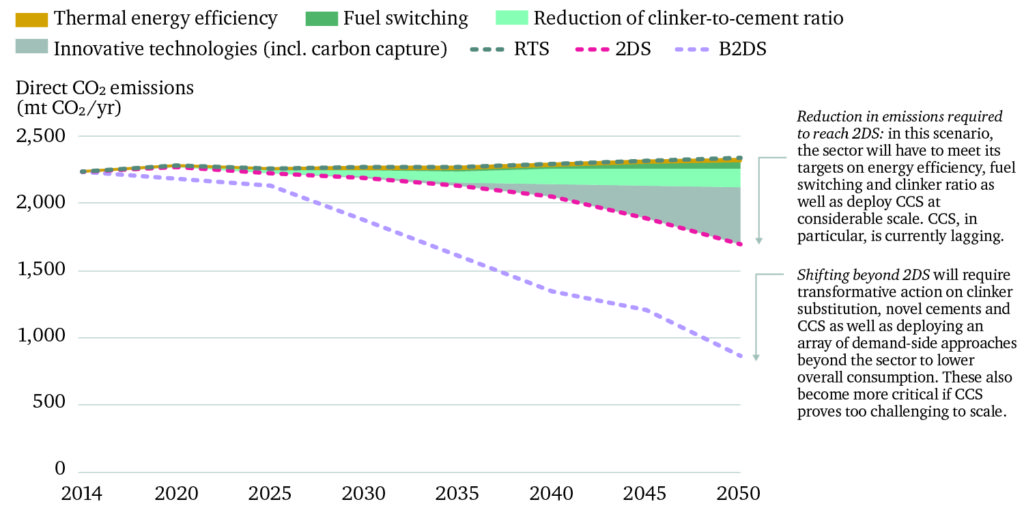

The IEA and the industry-led Cement Sustainability Initiative (CSI) recently released a new low-carbon roadmap, showing how it considers emissions can be cut in line with a “2C” scenario and a “below 2C” scenario. The roadmap assumes cement demand will increase 12-23% by 2050.

For a 2C scenario – in line with 50% chance of limiting global temperature rise to 2C above pre-industrial levels by 2100 – the roadmap says a 24% cut in cement emissions is needed. (It is worth noting this is not in line with the Paris Agreement, which calls for temperature rise to stay “well below” 2C at the very least.)

The roadmap relies on four areas of action for these emissions cuts.

Three of these are the strategies previously being pursued by the cement industry to limit emissions, namely, improved energy efficiency, lower-emission fuels and lower clinker ratios.

For example, the roadmap sets a target average global clinker ratio of 0.60 by 2050, down from 0.65. This is a significant challenge: Chatham House notes it would need around 40% more clinker substitutes by 2050 than today, at a time when the availability of traditional substitutes – fly ash and blast-furnace slag – will likely begin to fall.

The fourth area is “innovative technologies”, which is essentially shorthand for reducing emissions using carbon capture and storage (CCS). This has not yet been used in the cement industry (bar trials), but the roadmap assumes integration of CCS in the cement sector reaches commercial-scale deployment by 2030. Uncertainty over the potential to rapidly scale-up CCS and its large cost are major barriers to its use in reducing concrete emissions.

The chart below shows Chatham House analysis of the IEA and CSI cement roadmap. The red dotted line shows the 24% emissions cut in line with the 2C scenario (2DS) by 2050.

Ways of reducing cement emissions leading to a “Paris-compatible” pathway. Three scenarios are shown: “reference technology scenario” (RTS), “2C scenario” (2DS) and “beyond 2C scenario” (B2DS). Source: Chatham House analysis of IEA and CSI Technology Roadmap (2018).

The roadmap also sets out a “beyond 2C” scenario (B2DS; purple dotted line above), whereby a far higher 60% reduction in emissions would be required. Here, the proportion of total cement CO2 emissions captured by CCS would need to more than double compared to the 2C scenario, up to 63% in 2050, the roadmap says. It notes this “will be challenging to achieve”.

Chatham House also notes that steeper reductions will be needed “if assumptions about the contribution from CCS technologies prove to be optimistic”. It says:

“Shifting beyond 2DS will require transformative action on clinker substitution, novel cements and CCS as well as deploying an array of demand-side approaches beyond the sector to lower overall consumption. These also become more critical if CCS proves too challenging to scale.”

Can ‘novel’ cements cut emissions?

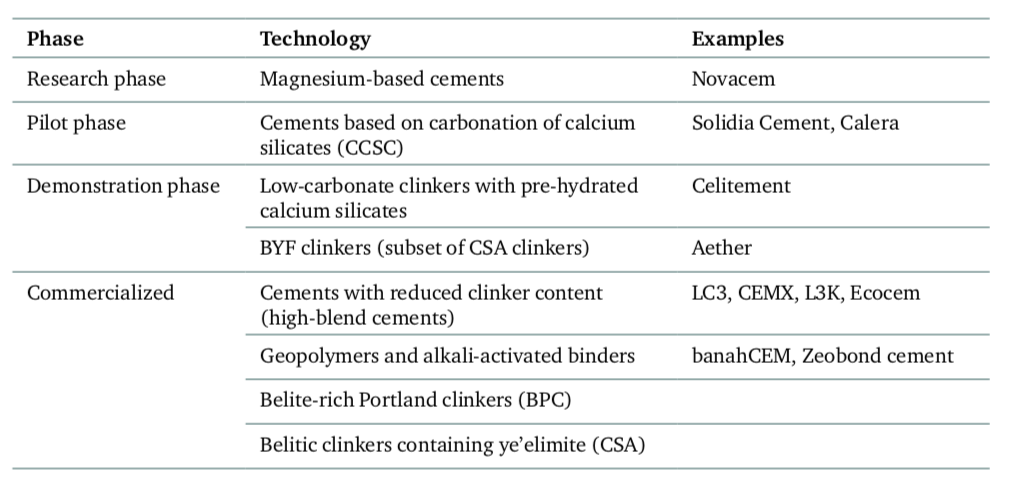

Some companies have been researching “novel” cements, which do away with the need for Portland clinker altogether. If these could rival the cost and performance of Portland cement, they would offer a way to significantly reduce emissions.

However, none have yet achieved large-scale commercial use and are currently used only in niche applications. Moreover, innovation in the sector tends to focus on incremental changes, a global patent search by Chatham House shows, with a limited focus on novel cements.

Geopolymer-based cements, for example, have been a focus of research since the 1970s. These do not use calcium carbonate as a key ingredient, harden at room temperature and release only water. Zeobond and banahUK are among firms producing these, with both claiming around 80-90% reduction in emissions compared to Portland cement.

There are also several firms developing “carbon-cured” cements, which absorb CO2, rather than water, as they harden. If this CO2 absorption can be made higher than CO2 released during their production, cements could potentially be used as a carbon sink.

Solidia Concrete™ cinder block. Credit: Solidia

US firm Solidia, for example, claims its concrete emits up to 70% less CO2 than Portland cement, including this sequestering step. The firm is now in a partnership with major cement producer LafargeHolcim.

Similarly, British start-up Novacem – a spin out from Imperial College London – claimed in 2008 that replacing Portland cement with its “carbon negative” product would allow the industry to become a net sink of CO2 emissions. However, the firm failed to raise sufficient funds to continue research and production.

Other firms are using completely different materials to make cement. North Carolina-based startup Biomason, for example, uses bacteria to grow cement bricks which it saysare both similarly strong to traditional masonry and carbon-sequestering.

The table below, from Chatham House, summarises the stages of development of several alternative cement technologies.

Low-carbon cements at different stages of the innovation cycle. Source: Chatham House (2018).

What are the barriers to low-carbon cement?

There are several reasons low-clinker or novel cements have so far failed to reach widespread use.

These technologies are less tried-and-tested than Portland cement, which has been used in construction for centuries. This leads to resistance from cement consumers, particularly in a sector which – for obvious reasons – tends to put safety as a high priority. Many of these new technologies are also not mature enough to reach wide-scale use.

Alternatives also tend to have more limited applications, meaning there may be no single replacement for Portland cement. Their use would, therefore, mean a move away from prescriptive standards. Currently, almost all standards, design codes and protocols for testing cement binders and concrete are based on the use of Portland cement, notes Chatham House. It adds:

“New approaches and especially new industry standards require a lot of discussion and testing. For example, it can take decades for a new standard to be approved and implemented in the EU.”

However, recent advances in materials testing of concrete could allow its chemistry to be better understood, giving more confidence for industry standards to be adjusted.

Alternative cements also need to be able to compete with Portland cement on cost, particularly in the absence of strong regulatory or policy pressure such as carbon prices. But switching could require investments in new equipment or more expensive materials, which could take several years to recoup, says Chatham House.

Access to enough of the raw materials needed for some cements is also a major consideration. For example, the local availability of fly ash – a by-product of coal combustion and one of the most-used clinker substitutes – is decreasing as coal-fired power plants are closed.

Can cement demand be reduced?

Reducing demand for cement could also help to limit emissions, particularly in developing countries. For example, Chatham House highlights how urban designs based on a “capillary web” system and walking rather than cars can use a third less concrete. Similarly, principles from Gothic cathedrals have been used to design modern concrete floors that are 70% lighter than conventional counterparts.

Using “circular economy” concepts to allow reuse of modular parts from buildings can also play a part, as can maximising the life of infrastructure. China, for example, has come under criticism for constructing new substandard buildings that may only stand for 25 to 30 years before being demolished.

Concrete in buildings could also be replaced with timber, potentially allowing CO2 to be captured and stored. Some new types of engineered wood, such as cross-laminated timber, are creating more construction opportunities. However, the carbon savings of using timber rather than steel and concrete in buildings are not guaranteed.

Old concrete can also be crushed and reused in projects such as roadworks. However, the concrete will lose its binding properties unless new clinker is produced.

Are cement emissions regulated?

Cement is often considered too difficult to decarbonise, along with other sectors such as aviation and steel. As one recent report noted, if cement emissions are mentioned at all in public debate, “it is typically to note that little can be done about them”.

As a result, the cement industry has faced less political and commercial pressure compared to the power sector, Felix Preston tells Carbon Brief. Preston is senior research fellow at Chatham House and co-author of its cement report. He says the sector is still dominated by a handful of major firms that control large parts of the market. Preston adds:

“[These firms] are often dominant or very influential in a geographical area, as well as on the global stage. I think that has made it difficult – and it’s still difficult – to press for radical change. They don’t necessarily see the immediate incentive to take ambitious action.”

The EU deems cement to be at significant risk of carbon leakage, meaning it receives free allowances in the EU Emissions Trading System (EU ETS). In the lead up to the 2017 EU ETS reforms, the European Parliament’s environment committee (ENVI) unsuccessfully proposed ending this free allocation. Introduction of carbon floor prices– being considered in several member states – could still affect the sector, says Chatham House.

China’s ETS, is expected to expand to include cement, though it will only cover the power sector in its first phase.

Is the cement industry taking action?

Under the CSI, producers accounting for 30% of global cement production have worked together for around two decades on sustainability initiatives, including emissions reductions. At the Paris climate conference, the group announced plans to reduce its collective emissions by 20-25% by 2030. This would be a similar ambition level to the “below 2C” scenario outlined above.

The World Cement Association (WCA), meanwhile, is developing a “Climate Change Action Plan”, set to be published later this month. Current technology can only deliver half the CO2 savings needed to achieve the 2C goal of the Paris Agreement, the WCA recently warned delegates at its “Global Climate Change Forum” in Paris. The WCA membership base represents more than a billion tons of annual cement production capacity.

The World Cement Association (WCA) is urging industry members to increase efforts to adopt new technologies quickly and at scale to reduce its CO2 emissions in order effectively help fight climate change. #cement #sustainability #ClimateAction https://t.co/RUgEzIF1DC pic.twitter.com/PQHbl1EBT7

— World Cement Assoc. (@WorldCemAssoc) July 5, 2018

The recently launched Global Cement and Concrete Association (GCCA) also wants to improve the environmental credentials of the sector. It is set to take on the sustainability work done by the CSI in January 2019.

Several cement firms have also already introduced an internal carbon price, or have plans to introduce one.

Teaser photo credit: By Gavin Houtheusen/Department for International Development, CC BY 3.0,