It has occurred to me that the fungibility of public debt is not sufficiently recognized—and perhaps of private debt as well. In other words, when our government in the U.S. engages in deficit spending, the focus is generally on who, precisely, is the immediate beneficiary. As Richard Heinberg notes in The End of Growth, deficit spending has often been coincidental with higher military spending, in which case government deficits and the growing debt is seen as function of American militarization. Alternatively, or additionally, deficits like the one initiated by George W. Bush, alongside his tax cuts for the wealthy, may be seen merely as a largesse for the rich. Others, particularly political conservatives, are critical of what they see as a bloated welfare state and will always see social programs as some ill-conceived fiscal vacuum sucking-up any tax revenues and budget agreements not held closely in check. In any event, government deficits are often consider as being outside the economy, as if the borrowed money is being stuffed under the mattress in the Lincoln Bedroom.

I do think it is important to understand not only who directly benefits from deficit spending, and also the context and conditions under which Congress and the president decide to fund some amount of its total outlays with borrowed money. At no point will I judge such considerations to be unworthy of our attention. However, lost in this focus on the direct beneficiary of government spending (or failure to raise revenue) are some very important systemic considerations that, I will later suggest, help explain the way a post-peak economy has extended itself while offering a hypothesis about the way growing inequality is a likely, if not inevitable, outgrowth of a capitalist economy as it nears the end of easy or possible growth.

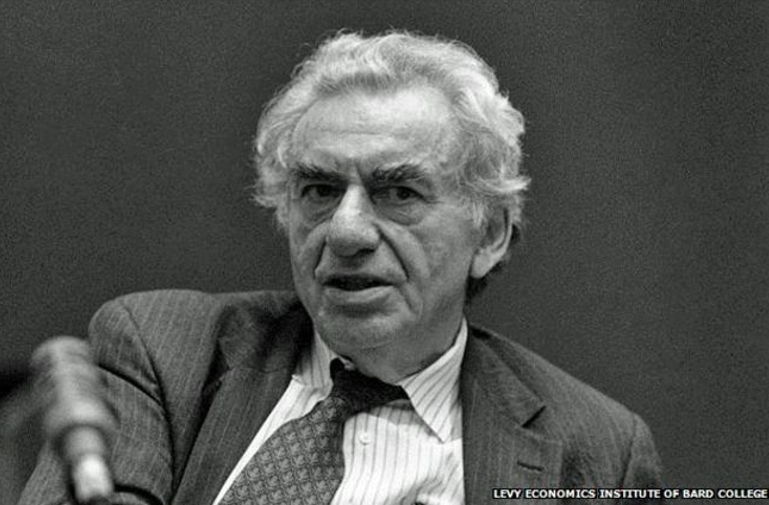

These thoughts on the fungibility of deficit spending were developed as I was slogging through some of the works of the late Hyman Minsky (1919-1996), an American economist who rejected both the neo-classical and Keynsian syntheses by reminding us that our economy is a financial one based in nearly all aspects on investment, savings, and debt. As Minsky puts it “A capitalist economy is an integrated financial and production system and the performance of the economy depends upon the satisfaction of financial as well as income production criteria” (Can It Happen Again? 20).

Before I delve into Minsky’s insights and their consequences for an economy at or near the limits of growth, some words about my purpose here and thus who (in effect) I’m arguing against. The broader context that I’m speaking within, as always, is that the American way of life, and thus our economic arrangements, is unsustainable; and since they are unsustainable they will someday stop working, probably in fits and starts, but over some duration, and probably either with tectonic or glacial dislocation. One of the purposes of economic analysis is to help understand the symptoms of an unsustainable economy, especially as they are so often mistaken for the disease itself.

That helps clarify who I’m arguing against—namely economists, policy-makers, and commentators who believe a different set of policy decisions can return us to the golden age of economic growth, along with steady wage increases. According to this argument, since growth leads to increases in equality, the cure for current inequality is yet more growth.[i] This position–in effect, how to make America great again–is common to the left and the right, liberals and conservatives, so in some ways I’m arguing against both. More specifically, and this brings us back to one of our principle themes, each side has a differing economic and moral theory about when and how governments should engage in deficit spending, a theory that is overly focused on the immediate recipients and insufficiently aware of systemic effect of deficit spending. Each side, in other words, believes strongly that their particular version of taxation and spending—namely fiscal policy—will aid the right people in the right way and get the economy “back on track again.” Both sides likewise belief that our economic ills are a matter of aiding the wrong people through deficit spending and our tax policy. While I personally gravitate towards a liberal fiscal policy on moral grounds, the fact that its less unfair won’t bring back the golden age of economic growth and we’d best find a way to achieve justice and equality in the context of economic contraction and dislocation and not by attempting to make it disappear in a flurry of economic expansion.

One admission before I continue: I am not an economist (nor do I want to be, because political economy is too important to be left only to economists), but that means I am writing not only at, but probably beyond, the limits of my awareness of the wider field of variables. I lack a great deal of technical knowledge and, most of all, have a somewhat limited knowledge of what I don’t know. Even if the following takes on a declarative tone, please know that not only am I offering this as a hypothesis, I would also welcome any relevant help with my ongoing education. Perhaps my preliminary formations are commonplace knowledge or perhaps they fail to address a primary facet of economic systems and the interrelations therein contained.

Borrowed Consumption

Writing mainly between the 50s and the 80s, Minsky’s primary preoccupation was the lack of a major economic crisis since WWII, though he also notes the increasing volatility of the period between 1965 and the early 80s. This preoccupation was in large part informed by his awareness that because “it” (a Great Depression) did happen, it probably could happen again. In fact, he was critical of any economic model that couldn’t explain and model our economic history, especially the persistent crises of the nineteenth and early twentieth centuries. Since it could happen, because it did, he was interested in discerning why it hadn’t, at least not yet.

Although Minsky believed in the inherent instability of the economy, he believed that this instability was (as economists are a little too eager to say) endogenous or inherent to the capitalist system. Those of us who believe that a capitalist growth economy is unsustainable because of resource limits are instead looking at exogenous factors, a view that Minsky doesn’t entertain.[ii] In contrast to Minsky’s explanation that capitalism is inherently unstable, I would suggest that during times of open frontiers and easy resource access, capitalism may, with a little bit of management, be pretty stable, but that it becomes unstable during times of resource scarcity, high clean-up costs, and especially if it experiences a chokepoint in the energy supply. Part of what I am trying to do here is place Minsky’s insights about finance, profits, and deficit spending into that post-peak context. While he shows how a crisis in the business cycle might be kept from spinning out of control with fungible public deficits, some of the same insights can help us understand the way capitalism is now trying to sustain itself as it faces permanent (and perhaps gale force) “headwinds,” to use more jargon of economic analysis.

Minsky suggests that we should see the healthy working of a capitalist economy primarily in terms of profits: “profits, broadly defined, are the pivot around which the normal functioning of the economy with private business debts revolves” (203). To the liberal ear, tuned to the importance of labor or consumption, this may seem like a conservative preamble to a supply side economics, and perhaps in some ways it is. What the liberal also hears, I think, is instead a lack of moral judgment about the way the economy works, out of which some clear insight is secured. Minsky’s focus on profits relates directly to his notion that the economy is an “integrated financial and production system,” as I noted above. Whether we long for or fear its demise, capitalism, as left-leaning sociologist Wolfgang Streeck puts it, is a system “that has coupled its material provision to the private accumulation of capital, measured in money,” where basic “sustenance” depends “on the successful accumulation of privately appropriated capital” (How Will Capitalism End 202).

In addition to his view of the capitalist economy as one dependent on finances, Minsky was unique in his time by focusing on its historical dimension, one visible through its finances. For the economy is a set of relations with a past, present, and future that are tied together by debts and their repayments; the economy moves smoothly through the present into the future as the series and web of debts are repaid, thus allowing the repayment of other debts, and the confidence to create new ones. A financial crisis may have any number of causes,[iii] but the rubber hits the road, or rather it begins its uncontrolled skid, when debt, pivoting through businesses and their profitability, goes unpaid as businesses are unable to fulfill their commitments—to workers, to their suppliers, and so on. As Minsky puts it, “the performance of our economy at any date is closely related to the current success of debtors in fulfilling their commitments and to current views of the ability of today’s borrowers to fulfill commitments” (15-6). “Profits,” to rephrase, “are critical in a capitalist economy because they are a cash flow which enables business to validate debt and because anticipated profits are the lure that induces current and future investment” (33). A financial crisis might then be described as a system-wide cash-flow problem.

By focusing on profits, it is true, Minsky may simply be pointing to a symptom of a growing economy, though with an important focus not just on increase of goods and services, but on the steady payment of obligations. The repayment of debts, as he notes, is what validates the system and insures its perpetuation. And, of course, an economy needs profits to pay workers who will buy the goods and save for the future, which inspires further investment and thus future profits. There can be any number of chokepoints in what, in reality, is a cyclical system, one that needs to keep growing so that the repayment of debts that are accruing interest is possible. Profits, then, might be a sort of shorthand for a growing economy that creates enough surplus to keep its system of borrowing and lending secure. Today’s focus on economic growth may be another such shorthand, though to my ears its ring sounds the depths of a whole system approach. But, as we shall see, corporate profits are nevertheless a good measure of this surplus and they rise and fall with the economy’s overall ability to create enough surplus. Or to put it another way, it was through the notion of business profits that Minsky was able to grasp in useful ways the financial chokepoint of the modern capitalist growth economy, at a time when the financial aspect was generally ignored by neo-classical, Keynesian, and Marxist economics alike. This financial chokepoint, I will later show, can also be reversed to inflate an unsustainable system, turning it into a twilight zone of the “walking bankrupt,” to use one of Minsky’s phrases.

Minsky’s focus on profits as a way of validating the economy by way of constant debt repayment allows him to ask questions about the difference between the time-period since WWII, in which the challenges to this validation have been minor and kept in check, as opposed to the larger crises of the nineteenth and early twentieth-century, culminating in the Great Depression. For he is keen to identify the way government deficits, working alongside the monetary policy of central banks, have kept businesses profitable, loan repayment steady, and the economy basically free from major crises. In a system built upon borrowing and lending, Minsky points out, government deficits work as sort of loan, which adds positively to the economy’s balance sheets, but that doesn’t really need to be repaid, at least not on the sort of timeline according to which either business or household debt is held, and according to which a cycle of defaults might begin.

If a financial crisis is a system-wide cash-flow problem, then deficit spending adds money to the economy as the government borrows and spends it, adding the cash without which current debt and future investment (loaning) would not be validated. As Minsky puts it, “the impact on profits the deficit that big government can generate can override the failure of investment to increase the productivity of labor” (56). This explains why there hadn’t been a large crash in the post WWII era: because “our big government that is in place has made it impossible for profits to crash as in 1929-1933. As the government deficit now explodes whenever unemployment increases business profits in the aggregate are sustained. The combined effects of big government as a demander of goods and services, as a generator—through our deficits—of business profits and as a provider to financial markets of high-grade default-free liabilities when there is a reversion from private debt means that big government is a three way stabilizer of our economy” (56; emphasis added). Viewed through the lens Minsky provides, deficit spending doesn’t merely prop up one sector or further a set of interests, even though this may be part of what it does; when viewed as an aggregate, deficits prop up the whole economy.

It is the next step in his reasoning where Minsky becomes interesting for post-peak economic analysis, though in large part because of the interesting way he gets things wrong—at least as I see it. For reasons that I don’t fully understand, economists seem to want to identify what they call an endogenous cause for events. They want to see the workings of the economy in economic terms, such that both its growth and its crises are caused by “internal dynamics” of the economy, rather than exogenous effects—say, for instance, resource depletion. So while Minsky has no sense that our economic draw on the environment might not be sustainable, he does show how debt allows endogenous unsustainability to be sustained, temporarily. This same dynamic can be used to explain the way debt allows our economy—one that has exogenously overshot the carrying capacity of the planet—to temporarily sustain the unsustainability while extending this overshoot even further.

So one more dip into Minsky. Although his preoccupation is avoiding an economic crisis, Minsky is ambivalent at best, about the role that big government has played. As he notes, “in the process of stabilization the economy [big government] sets the stage for a subsequent bout of inflation” (56), while creating a broadening realm of “inept business structure and poorly chosen investments” (57). How does it do that? Because “big government is a shield that protects an inefficient industrial structure,” allowing profits to be sustained or even increased, “even as output falls and the ratio to output to man hours worked does not increase” (56). Minsky, as I suggested, divides the post-War era into two more periods. The first was a tranquil period from the war to about 1965, the second one of more volatility and inflation from 1965 to Minsky’s present in the 80s. Streeck interestingly refers to this change as the transition from the tax state to the debt state. This second period was, Minsky argues, in part caused by the big government spending of the first period and the inefficient industrial structure it permitted: “Thus the current policy problem of inflation and declining rates of growth of labor productivity are not causally related but rather they are the result of a common cause, the generation of profits by means of government deficits, where the government spending do not result from spending that leads to useful outputs” (56).

Of course there are other ways to understand declining profits, volatility, and deficit spending—especially the permanent deficit spending that is now part of our economic system. Minsky was writing during an anomaly of economic growth, which he sees as theoretically or at least biophysically possible to maintain, followed by a growing level of both debt and instability. Although he doesn’t believe instability is normal, he does seem to think that better policies can help sustain a crisis free growth over a longer term. He thus is on the lookout for conditions created during the first phase which led to the second phase, while I would be more inclined to argue that in the second phase instability was caused by the excesses of ultimately unsustainable growth and demand, as an unsustainable economic arrangement began to pay its dues. These conditions were not the “poorly chosen investments” made under the “shield” of risk-free government borrowing that created an increasingly inefficient industrial system, guarded from the evolutionary forces that his dissertation adviser Joseph Schumpeter emphasized. They were symptoms of the peaking of post-war growth.

What, in other words, if all of capitalism’s growth spurts were ecologically unsustainable—that is, not repeatable into perpetuity? What if the transition from post-war days of tranquility to the more volatile period from 1966 to 1980, were at least in part caused by a declining ERoEI or rising oil prices, and increased trade deficits? What if the expectations of American workers, managers, and owners, alike—or aggregated together — exceeded the amount of consumption that the Earth could supply — unless, of course, it could get enough people to defer present consumption in return for the promise of future consumption–or, in other words, make loans? What if our current expectations for growing wages and increasing profits, along with high returns on investments were only possible it all this was supported by ever-increasing debt?

A brief glance at the growth of private, business, and government debt supports such a view. While it could of course be, as some conservative free marketeers will argue, that years of government intervention and incentive-sapping social programs have created a permanently inefficient productive structure, I think this position is difficult to maintain in light of all the other developments that should be included in a comprehensive economic history from 1946 to the present. We have since 1940 collectively consumed about 20 trillion dollars more worth of stuff than we actually have been able to earn: by definition we have demanded a lot more than our economic system could actually create, and a compelling case can be made, I think, that increasing levels of debt in the US and other nations is a response to expanding expectations that could not be met within the real and eventually immutable ecological limits of the Earth.

Deferred Consumption/Deterred Consumption

There is, of course, a problem with this view. If we were really at the limits of growth to the extent there was no slack in the economy, there would be no sense in which meaningful loans could be made. Americans could not be consuming above a sustainable level, beyond the limits of growth, unless there was at least enough surplus in the global system to shuffle some of the surplus in our direction. The very act of making a loan, unless it is made with worthless and inflationary money, unredeemable i.o.u.’s, assumes that the lender has some extra, that all his or her material goods aren’t necessary for survival. A meaningful loan assumes that lenders can defer some of his or her potential current consumption. It means there is “extra,” however we define it.

The global economy doesn’t only assume this. It also assumes that this deferred consumption might be someday paid back from the expanding wealth of an ever-growing economy. There is little evidence to suggest that the US will someday eventually have 20 trillion dollars of then deferrable consumption that it can or will be willing to use to pay back our debt. And as for the present, there are all sorts of ways to understand the funneling of excess wealth or material goods to Americans beyond that which our immensely advanced industrial structure was legally able to manage according to the profit and earning structure of its golden days. I’m thinking, here, of our global empire, the various trade agreements, the threat of military action, the immiseration of many Asian workers and African farmers who are unwillingly deferring (or foregoing) consumption so that Americans can enjoy it instead. Debt is only part of the chorus that makes this great sucking sound as 6% of the global population demands almost a quarter of its goods. But it has the advantage of being relatively measurable in ways that a free trade agreement may not.

In his highly acclaimed Capital in the Twenty-first Century Thomas Piketty notes two important features about our current economic situation in the second decade of the century. The first is rising inequality, whereby elites are amassing both high incomes and ownership of large amounts of capital. Wealth concentration levels have returned to ones seen near the beginning of the twentieth century. To Piketty’s credit, he understands the relative equality of the mid twentieth century in terms of exogenous events—namely the huge destruction of capital during WWII alongside high tax rates used to help pay for the war. This is important because exogenous events cannot simply be reproduced by the economic policy tweaks that economist gravitate towards. Economic systems don’t create their own history in ways that many economists seem to assume, and certainly not just as they please. So even as equality is a sort of anomaly, it is for Piketty a beneficial one that we ought to recreate by way of massively significant political choices.

This brings us to the second feature of our economic situation—namely the high levels of debt, especially public debt. Most of this debt has been borrowed from these ultrawealthy elites, and with that in mind, Piketty asks a fairly direct question that, for the common liberal consciousness, has a simple answer. Why, Piketty asks, do we borrow from the wealthy instead of just tax the same amount from them? Why, in other words, did we make the transition from Streeck’s tax state to our current debt state (now being replaced by the consolidation state)? Taxing the wealthy, instead of borrowing from them and making interest payments paid with an increasing amount of our public revenue, seems much more fair, especially given the way wealth is largely inherited and increased by leverages that are much greater than any kind of personal merit would deserve. Other liberal commentators like Paul Krugman, Robert Reich, and Jeffrey Sachs similarly suggest that the post war boom was caused by this equality, and the structure of its effective demand, and that we might be able to create a new golden age of high economic growth if only we pursued policies that fostered equality. The standard liberal answer, at any rate, is that we borrow from the rich instead of taxing them because of a failure of our democratic culture. It is due to personal forces that can be reflected in, for instance, the “Occupy” movement, rather than to structural ones that I will attempt to describe next.

Let’s start by rephrasing the question: what do growing levels of inequality do for an economy straining for growth? The simple answer, that I am presenting as a hypothesis, is that it allows us to sustain our unsustainable economy yet a bit longer. I don’t condone inequality—far from it. But that doesn’t mean it can’t also be a symptom of an economy straining after growth when growth is becoming less and less feasible. Here’s how I figure it, and why Minsky’s notion about the aggregate and fungible quality of deficit spending is important:

The problem, in Minsky’s terms, is to maintain sufficient cash flow so that debts can be validated and the solvency of the system lures further investments. This is easy to manage when productivity is growing and profits are running high—when, in other words, the growth of the money supply is keeping pace with the growth in the aggregate amount of goods and services. The problem at the end of growth is a bit different. Our problem (as long as we maintain the quixotic quest for economic growth and the maintenance of an unsustainable system) is how to maintain sufficient cash flow and a growing money supply in the absence of increased goods and service—without, that is, resorting to immediately inflationary increases in the money supply. The answer, it turns out, is to grow the money supply by way of loans made by and interest paid to a wealthy super elite.

Why? The answer becomes a bit more clear if we slightly revise the question. If we are living in a world of resource constraints, how do we minimize the ratio of consumption to economic growth? While the super-rich certainly consume far more than the poor, by an order of hundreds of times, there is a point at which the consumption stops and the rest of the wealth goes into savings and investment. Another corollary measure to help minimize the consumption-to-economic-growth ratio is to kick as many middle-class workers under the bus, either part way under through long-term wage stagnation, or completely under the bus by kicking them into an ultra-poor underclass. To put it another way, under conditions of resource constraints where the money supply needs to keep growing, you want as much deferred consumption as possible combined with as much subsistence living as possible. If, in contrast, we realized the liberal dream of a global middle class, levels of consumption would greatly increase, as more people entered the world of high meat consumption, automobile driving, and airplane flights. Equality would create more overall consumption. The tax state attempted to deliver on this promise; the debt state endorses, in effect at least, the upward flow of wealth. While it is not possible to capture all the motives at play in a functional proposition, austerity is of course easier on the planet’s ecology than Krugman’s new New Deal would be. The trick, then, is to impose austerity on the wealthy as well, and the upper 10% or 20%.

By borrowing from the rich instead of taxing them, in other words, is it possible to stabilize the economy through deficit spending while placing a good deal of the growing money supply in financial assets, and derivatives, that will never be consumed? This would only be increased by the extent to which complex derivatives are able to increase the money supply and the cash available to businesses without creating anything real or redeemable, a situation revealed when a crisis in confidence leads to a sell-off in which there aren’t enough legitimate buyers. A la Minsky, borrowing from the rich and then giving a hefty sum back to them “is a shield” that not only “protects an inefficient industrial structure” it is a shield that temporarily keeps reality at bay from an economy that is struggling to meet growth requirements necessary for its basic solvency. That, at any rate, is my hypothesis about the rise of inequality at the limits of growth. Of course, this dynamic may only account for a few percentage points and the picture is crisscrossed by all sorts of heterogenous forces. But a couple of percentage points makes the difference between growth (or the illusion of it) and recession or stagnation. That nearly all the income gains over the past few decades have gone to the very wealthiest, suggests that our economic growth, such as it is, is heavy on the capital side, but a capital that is largely composed of numbers on a ledger sheet.

If there is any remote justice to this effort of propping up the economy by borrowing money from the rich and making them all the richer in the process it is that they will never be able to “cash in” their investments for real goods and services. This process of creating quasi-liquid assets is of course inflationary in the long run: only as long as a great deal of the wealth of the nation is tied up in realms where it won’t be chasing goods and services and thus driving up their prices, but this can be maintained only as long as there is some degree of illusion that the economy can continue to grow and the great paper wealth that is being amassed might someday be useful. Once the curtain is pulled back, we’ll have either runaway inflation or the mother of all bank runs. The “high-grade default-free liabilities” are as such only as long as we believe they are and don’t run the stress test of “reality” upon them.

If we truly want to increase equality, then, it will have to be created at a sustainable level, and thus ones much lower than that enjoyed by the rich, middle-classes, and even workers of advanced industrial nations alike. We may choose to fight inequality by way of strikes, wage increases, and taxation, but that will not return us to a golden age; it will hasten our rendezvous with economics in the age of resource exhaustion and mounting clean-up costs.

.

[i] As Thomas Piketty argues in Capital in the Twenty-First Century, slow growth emphasizes the importance of inherited wealth and capital ownership, while growth funnels a greater percentage of the wealth of a nation to incomes across the spectrum.

[ii] Though if you believe in an integral ecology, il n’y as pas de hors-economie.

[iii] With a little touch of Schumpeter, Minsky believes that the success of safe loans creates a mistaken trust for a broader and increasingly more risky sort of loan. Government spending, necessary to avert crises, only furthers this process. The result is a “euphoric” economy that takes on too much debt.

Bibliography

Heinberg, Richard. 2011. The End of Growth: Adapting to our New Economic Reality. Gabriola Island, B.C.: New Society.

Krugman, Paul. 2007. The Conscience of a Liberal. New York: Norton.

Minsky, Hyman. 1982. Can it Happen Again? London: Routledge.

Piketty, Thomas. 2014. Capital in the Twenty-First Century. Cambridge, MA: Belknap.

Streeck, Wolfgang. 2016. How Will Capitalism End. London: Verso.

Teaser photo credit: Levy Economics Institute of Bard College