I will be in Berlin for a presentation of “The Seneca Effect” this Monday, March 26th. The presentation is organized by the Urania societyand it will be in English, with symultaneous translation in German. There follows a good critical comment of the book by Alexander Behr on “Brennstoff.” I used Google translate the text into English and then I refined it using my modest knowledge of German. I know it is not a great translation, but it seems to be readable to me. And I hope that it is also faithful enough to the original

A Review by Alexander Behr

Who remembers the Club of Rome? It was a late 1960s coalition of scientists who warned against overexploitation of the planet’s natural resources. The first report to the Club of Rome entitled “The Limits to Growth” in 1972 created a tremendous response. Today, the 42nd report to the Club of Rome was published. The author, the Italian chemist Ugo Bardi, attempts to explain why complex systems collapse and how we can handle them.

In the 1970s, the founders of the Club of Rome created a model to calculate the “limits of growth” generated by increasing resource use. Ugo Bardi, himself a longtime member of the Club of Rome, continues to develop the theses of that groundbreaking work and presents his new study on the subject with his book “The Seneca Effect – Why Systems Collapse and How We Can Handle It“.

Bardi is particularly interested in the collapse of the ancient Roman Empire and the transferability of this historical event to the present day. The eponymous Roman philosopher Seneca is quoted by Bardi with the memorable phrase: “Growth is slow, while the road to ruin is fast.” Seneca, born in 4 BC, was first an influential advisor to Emperor Nero and later fell out of favor. He foresaw the collapse of the Roman Empire well before its actual entry.

Considering that Rome was founded in the 8th century BCE and reached its apogee in the 2nd century AD, one can attest that the Roman Empire grew for about a thousand years, to decay in a mere two to three centuries – Ugo Bardi calls this phenomenon the “Seneca effect”. But why do complex systems collapse? Bardi tries to test the “Seneca effect” on the basis of the current world order.

He explores the question of whether it would be conceivable that today’s complex world system could experience a more or less abrupt collapse due to mutually reinforcing effects. According to Bardi, small causes can lead to big effects in complex systems. The problem is that modern industrial society, as soon as it goes into a crisis, usually tries to solve the problems it faces by expanding its governance structures – in other words, it is doing a fatal “more of the same” instead to initiate a change.

The silver runs out

So, inevitably, the so-called “tipping points” occur and that makes it extremely difficult for complex societies to respond to disorder with adaptation. One of the main reasons for the collapse of the Roman Empire was that the mines in northern Spain were no longer able to supply the silver necessary for coin production in the usual quantities. The cost of controlling the controlled territories became too high. In addition, trading on the Silk Road devoured large quantities of the coveted precious metals.

The exhaustion of the gold and silver mines was followed by a cascade of feedback effects that was far more visible and spectacular than the influences that caused it. The Roman Empire experienced political unrest, internal conflicts and the collapse of its army. Ugo Bardi believes that this “Seneca collapse” can teach us a lot about the difficulties facing our current empire, the globalized world under Western hegemony. Due to the fact that the modern world has grown so fast, it could collapse with a bang, said Bardi.

In his book, Ugo Bardi takes us on a journey through materials science and physics: he explains material breaks in ships and airplanes. Repeated, especially cyclic, loads lead to the weakening of the structure, to the so-called material fatigue. Cracks appear, which are barely visible at first – the break is often treacherous and in one rapid swoop: it is the “Seneca ruin” of the material. Bardi argues that in complex systems the unexpected and sudden change from one state to another can always lead to surprises.

The earthquake equation

Bardi assumes that the “Seneca effect” can be observed within materials is the same effect, within certain limits occurring in social, economic and biological systems. All these systems would have to obey the general laws of thermodynamics, from which certain rules and tendencies could be deduced. But the findings from physics in many cases also tell us what we do not know. Thus, so far, there are no such things as an “avalanche equation ” or an “earthquake equation” that would be able to determine exactly when and where an avalanche would go off or an earthquake would occur.

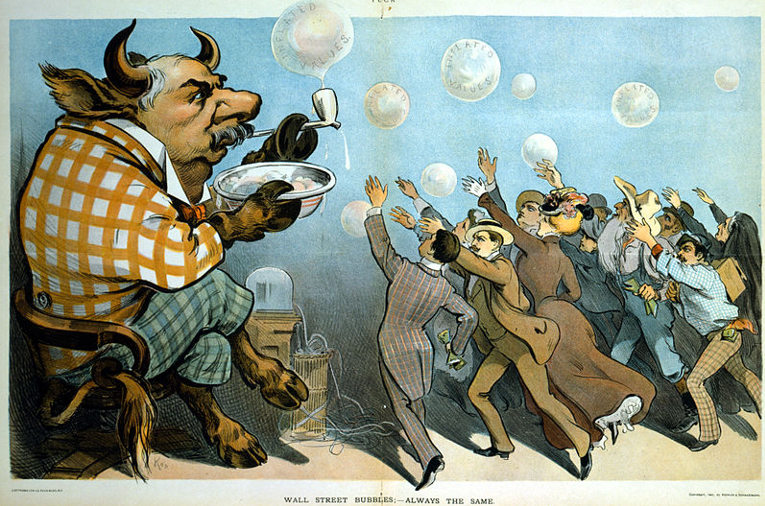

Therefore, according to Bardi, despite all our knowledge of earthquakes, we can only protect ourselves from them by constructing buildings to withstand them in the event of a fall. Similarly, it is in the case of financial crises: due to the complexity of the financial world, no one is able to know exactly when the next collapse of the banking system will arrive. Bardi interprets the mortgage crisis of 2008 as a classic example of a “Seneca collapse” as the property market crash was much faster than its previous growth.

In the transfer of complex physical systems to social and social processes there lies an innovative strength of the book, which contains numerous graphics. At the same time, however, it is also his enormous weakness. In order to transform physical phenomena into social phenomena, one needs a more or less rigid image of man. So Bardi assumes that “people tend to overuse resources.” He misses the fact that the depletion of resources always has to do with power and governance structures that must be historically determined and are always changeable.

Missing social theory

Elsewhere, Bardi attempts to apply the “Boltzmann Gibbs distribution”, which was developed to describe entropy in atomic systems, to the social distribution of monetary wealth. In the next paragraph, he relativizes his mind game. In some ways, one has the impression of listening to a professor who is chatting with himself. Ugo Bardi lacks a coherent social theory that could provide orientation in his quite interesting theses on the collapse of complex societies.

As an additional problem, Bardi attaches high importance to the highly problematic theses of the British economist Thomas Malthus. Malthus developed in the early 19th century the population theory which was named after him and which was directed primarily against the “excessive proliferation” of poor sections of the population in England. Already Friedrich Engels argued as the main objection that “overpopulation” basically does not represent a technical, but a socio-economic problem. According to Engels, capitalism is repelling an industrial “reserve army” of labor, a “lumpenproletariat”, who in the worst case will be denied any right to life.

Today, nearly one billion people worldwide belong to this lumpen proletariat – outcasts who do not even benefit from being exploited. Even today, all horror scenarios of the so-called danger of overpopulation are aimed at these people. But Bardi overlooks the fact that according to the World Food Report report, today’s agriculture could feed twice as many people as currently living on the planet. Overpopulation cannot be the reason for the uncontrolled exploitation of resources.

It is the current economic system that, with its inherent compulsion to maximize profits and drive economic growth, has caused enormous damage for about 200 years. Profits are more important than the satisfaction of human needs. Hunger and environmental destruction could be ended, distributive justice enforced. Despite the fact that Bardi misses this knowledge, he clearly takes a position on this point and advises to develop economies that are secure against the unpredictable shocks of the global financial system.

Likewise, Bardi advises that we “rid ourselves of the stubborn craving for fossil fuels that are ruining our planet” because peak oil could have a similar effect to a “peak silver” of the Roman Empire. But even before this happens, several tipping points of the ecological earth system are threatening, which cause not only a “Seneca collapse” of our society but of the entire ecological system. Despite some daring scientific pirouettes, Bardi’s new book provides important evidence that rethinking our view of the world is more than necessary.