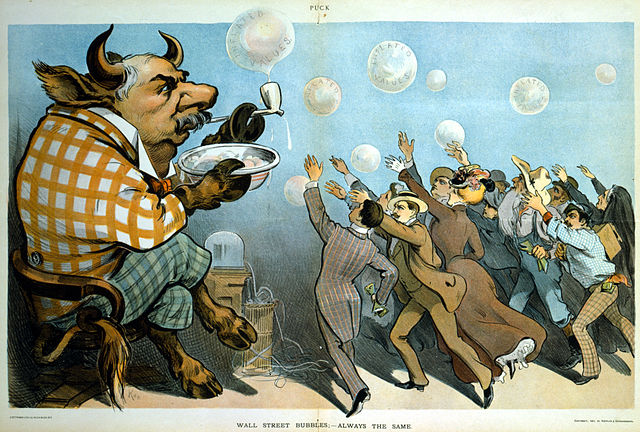

The steepest one-day point drop in the history of the Dow Jones Industrial Average last week shook stock investors into an awareness that all is not sweetness and light in the financial markets. The sudden downside stock market volatility had been preceded by the breathless upside volatility of a months-long melt-up—one that had financial gurus outbidding each other to increase their targets for major stock indices. (See here and here.) Investors, too, felt that heaven had arrived on Earth, at least financial heaven.

After years of steady gains—with only the occasional drop—stock and bond market investors had gotten used to narrow swings in price that didn’t disturb their sleep. In fact, whenever the stock (or bond market) looked like it might crash, the world’s central banks offered reassurance both in words and deeds. The deeds included unprecedented buying of bonds (which kept interest rates low) and in some cases the purchase of stocks. The Bank of Japan and Swiss National Bank are two central banks which buoyed stocks through purchases though they bought stocks for different reasons.

Whether the current volatility presages a market meltdown or not, I’ll leave to others. But volatility in the stock market isn’t the only kind of volatility humans don’t like. In fact, the entire project of human civilization might be characterized as an attempt to dampen volatility. The basis of civilization, that is, living in settlements, is agriculture, especially agriculture devoted to the production of grains. Why grains? Because grains can be stored from season to season and thereby smooth out food supplies throughout the year and cushion an unexpected drop in supplies from year to year due to drought, floods or other natural catastrophes.

In addition, irrigation allows for a steady supply of water to crops that otherwise would be entirely dependent on the weather to slake their thirst. But erasing the volatility of humans’ previous nomadic existence wasn’t an unalloyed good. Jared Diamond’s famous essay, “The Worst Mistake in the History of the Human Race,” catalogs the ills that beset nomadic humans as a result of the adoption of agriculture.

The trade-off for this reduction of volatility in food supplies is apparently that humans worked more while eating a far smaller variety of less nutritious food. They grew to smaller heights, had worse teeth, and suffered more infectious diseases and diseases related to poor nutrition. Besides this, life expectancy dropped considerably.

But agriculture itself produced a different kind of volatility. Reliance on just a few crops meant that failure of one or more of these (due to disease, for example) could lead to starvation. The Irish Potato Famine comes to mind. Volatility which was thought to be banished returned in a different form.

As for irrigation, it brings more consistent moisture to crops. But over time irrigation can also cause salt to build up in the soil, reducing fertility. So, irrigation means less volatility in yields for a while until yields crash as salt concentrations reach a critical level.

We believe that our modern agriculture has eliminated such problems. But, in fact, vulnerabilities have only worsened, waiting for a match to light a fuse that could devastate one or more major grains worldwide.

We also seek to lower volatility in many other areas of our lives. To offset our exposure to the elements, humans mastered fire to guard them against the cold of night and winter. Fire also made it possible to cook foods which in turn made it possible for humans to get far more nutrition out of those foods and thus require less of them to be grown or found.

Today, we seek total control of our living environment. In buildings and vehicles, maintaining the temperature and humidity at a level that suits us is often called climate control, though the only climate we control is very local. The irony is that the energy we use to minimize our exposure to cold in winter and heat (and moisture) in summer adds greenhouse gases to the atmosphere. We thereby exacerbate climate change and create the fierce polar vortexes and more frequent heat waves that cause us to use yet more energy to keep ourselves warm or cool. Once again, the volatility which we sought to repress ends up being expressed elsewhere.

The wonder of modern transportation now has many of us dealing with the fact that trips to the same destination during rush hour and during other times of the day might differ by a factor of two or three. That’s a lot of volatility that can be avoided if one can arrange to go to work or school on foot or perhaps by bicycle or possibly by train. The automobile which promised to free us from the confines of our villages and neighborhoods has indeed done that only to thrust us into a hell of volatility related to traffic jams.

Volatility can actually be good for us. Regular exercise moves the body from a sedentary state into a frenzy of activity. The body loves this volatility and most people who exercise report how much better they feel as a result. And, of course, we know that as general fitness improves, it leads to better health outcomes.

To break up our social and work routine, we like vacations, evenings at the theater and visits to friends.

Whenever we seek to reduce volatility in our lives, we should ask whether the result will be volatility transferred elsewhere. And, we should ask whether we are merely postponing volatility that will occur later and more violently in ways that could disable us.

Returning to the example of the stock markets, the world’s central banks have dampened volatility whenever it has arisen since the Great Recession. With the world’s economies highly correlated to stock market valuations, the banks feared that another steep drop in prices following the market crash of 2008 and 2009 would have put any economic recovery in jeopardy.

Self-styled student of risk Nassim Nicholas Taleb says that when the volatility of complex systems is intentionally repressed—such as a manipulated stock market or an authoritarian political regime—those systems tend to experience huge leaps in volatility at some point. This is because they have not been allowed to adjust to small shocks along the way and therefore have become increasingly maladjusted to their underlying reality.

The questions now for those involved in the stock market are: Have the central banks merely delayed market volatility so that it will one day emerge in a form that is unstoppable and highly destructive? If so, has that day arrived or will it be delayed again?

Cartoon, “Wall Street bubbles – Always the same”. American financier J. P. Morgan is depicted as a bull, blowing soap bubbles for eager investors. Several of the bubbles are labeled, “Inflated values.” Seen behind Morgan is a stock ticker, a machine which provided current information on stock prices. Puck magazine (1901). Via Wikimedia Commons.