Within alternative movements there is much interest in introducing local currencies and they have been central elements in many Transition Towns and other initiatives. Unfortunately I think most of these have been quite misguided, failing to grasp the power a local currency can have, and not likely to make a significant contribution to goals such as town sustainability and resilience.

In the sad history of the world a major role has been played by power over currency. Those who have most of the money, or capacity to create it such as banks, have been in a position to determine what happens, simply by being able to decide what it will be lent for, and on what terms. At one point the Duke of Wellington was almost defeated but was able to go on and win when the Rothschild bank decided to lend him a lot of money. Lincoln probably would have lost the American civil war because the banks refused to lend him money (on reasonable terms), but he did what Transition Towns should do, that is, he created his own money and spent it on what he needed.

In the new sustainable, just and delightful economies we are going to create, we local citizens will be in control of just about everything, including the creation, issuing and use of money. And the new currencies we will introduce will be the most powerful device we have for developing the systems we want. But this will only be so if they are carefully designed and introduced to bring about the desired outcomes. Unfortunately most of the local currencies I am aware of are totally lacking in sensible design, reveal no understanding of how best to use a local currency, and cannot have significant effects.

The most common form of local currency implemented in alternative initiatives today involves merely substituting a new note to be used instead of the existing normal/national currency. For example people can buy Bristol pounds by paying UK pounds for them. That can make almost no significant difference to the structure and functioning of the town or contribute to the development of the kind of new ventures and infrastructures needed. Above all it can do little or nothing to get the many currently idle resources and people into newly created productive employment. That is the extremely important function local currencies can perform, and it is a crucial element in the revolution we have to achieve.

The common argument is that the new local pound encourages local purchasing because it can’t be spent outside the town. But anyone who understands the importance of buying local will be doing that already, regardless of what currency they have. Anyone who doesn’t will buy what’s cheapest, which is typically an imported item. Obviously what matters here is getting people to understand why it’s important to buy local; just substituting a local currency won’t make much difference to that, (…although it probably does increase public awareness and readiness to buy from local producers, and it can have good effects on social cohesion.) Note that substituting does not create additional money; it does not add to the money supply or increase the things that can be paid for or done.

Similarly, currencies which depreciate with time miss the point and are unnecessary. Anyone who understands the situation does not need to be penalised for holding new money and not spending it. In any case it’s wrong-headed to set out to encourage spending; people should buy as little as they can, and any economy in which you feel an obligation to spend to make work for someone else is an idiotic economy. In a sensible economy there is only enough work, producing and spending and use of money as is necessary to ensure all have sufficient for a good quality of life.

The main purpose of a local currency: Getting unused productive capacity into action.

The simplest old LETS system provides a good illustration. (LETS=Local Exchange Trading System). Consider a situation where Fred can produce carrots and wants bread but can’t get any because he has no money, and Mary can produce bread and wants carrots but can’t buy any because she too has no money. So both are going without necessities, just because they have no money. The solution is obvious; create your own, that is, trade using IOUs. Mary can then say “Thanks for the carrots Fred; I now owe you one dollar because we agreed that’s what they were worth.” Fred will say, “Thanks for the bread. I now owe you one dollar because we agreed that’s what that amount of bread was worth.”

In a thriving LETS system with many participants, a person holding an IOU worth one dollar can use it to buy one dollars worth of anything any other member has to sell. The IOUs function as money, that is as a newly created currency which enables production and exchange between people who have no normal/national money at all. Thus a form of currency has been created that puts previously idle resources and people to work supplying each other with necessities. Obviously the physical money, the notes or electronic records are not central here; what matters is the organisation, the arrangements that have been set up to enable desirable economic interaction to begin. The money is only a recording device, enabling everyone to keep track of how much they have contributed and what they owe and what they have earned the right to receive. Note that this new form of money does not need to be borrowed from anyone, and there is no need to go into debt to get it or to pay interest on the amount you have. And no bank has any say in what it is used for, or can refuse to make money available for a purpose that doesn’t suit it.

Here is an indication of the basic application that I see as the fundamental mechanism for towns starting to get control of their situation. Our Community Development Cooperative sets up a community garden and invites people to come and work in it, especially those who are unemployed or homeless. Time contributions are recorded so that later produce can be shared in proportion to contributions. The record represents “income” in a form like an IOU. It can be used to “buy” garden produce when it becomes available. In time when the CDC has set up many similar ventures “work” time put in at the garden can be used to get goods from the clothing or bread baking or orchard co-op.

There are some very large scale versions of this money-creation process in operation, for instance whereby big corporations trade with each other without using any normal money, let alone having to borrow it at interest to be able to purchase. They do this simply by registering at a central agency the amounts owed for goods purchased etc. from members of the system.

But it is at the town level where the revolutionary potential lies. For instance a council might print an amount of new money and use it to set up little businesses providing jobs for unemployed people to produce things they need. The council tells everyone that it will accept this money as payment for council rates. The new money the council receives as rate payments can then be used to purchase some of the labour and supplies it needs from the ventures being set up, thereby completing the money’s circular flow. The newly employed people can buy things from other firms paying for them with the new money because those firms know they can use the money to pay part of their tax.

What the council has done is create, add, a new sector of the economy, one which trades using the new currency. In Simpler Way transition thinking we refer to this as Economy B, which the Community Development Cooperative works to expand as the arena in which socially necessary but neglected production can be undertaken, underneath the old Economy A that fails to attend to them. We can run Economy B via thoroughly participatory control mechanisms, primarily town meetings, and with no reference whatsoever to what banks or corporations think, what market forces would do, what is happening in the global economy or what maximises profits and GDP. Economy B is us taking some/more control of our own fate via rational collective application of our resources to our needs. In the near future as Economy A increasingly self-destructs more and more people will start to participate in Economy B. In the longer term we will be able to see how much of Economy A it makes sense to retain. It could be that many unimportant things could be left to it, or that we agree to phase it out completely.

It is at the national level where this approach can have its most profound effects. At present we have the extremely idiotic situation where governments borrow large sums of money from private banks to build infrastructures etc., and then have to pay it back with interest. Ellen Brown (2011) estimates that over a 24 year period Americans paid over $8 trillion in interest on the federal debt alone! Where do the banks get the money to lend to corporations and governments? They get it out of thin air. They “print” it (… now electronically.) But as Ellen and many others have pointed out, governments could create/print all their own money and issue it via their central banks and thereby prevent billions of taxpayer’s dollars flowing into the coffers of the super rich every year. After all, in its efforts to solve the Global Financail Crisis (GFC)to the US government printed and gave (to the rich) several trillion dollars. (The Australian Rudd government had the sense to give $900 to every Australian, and this is why we got through the GFC better than the rest.) Monetary reform movements around the world are trying to get rid of the present absurd system which lets private banks print and issue money in the form of debt to them and to constantly rake in billions.

But it is not the savings that are most important here, it is the power to determine development and distribution. Just as our town CDC can decide what activities to set up using the money it can create, a government that “prints” its own money can lend or give it to those wishing to set up socially desirable activities. It can take away from the Rothschilds the power to decide what will be developed. The existing banks will only lend if you can pay their high-as-possible interest rates, so loans go mostly to firms producing consumer rubbish for the few in rich countries. Banks never lend to the most needed projects.

Why then doesn’t Greece issue its own money and enable the setting up of many little farms and shops so that millions of people could start producing the necessities desperately needed? Greece is full of Freds and Marys capable of producing what each other needs but who can’t do that simply because they can’t get a little money to set up a tiny business. Why doesn’t the Greek government print something like an IOU to get all this going? Because the EU won’t let them, that’s why! The banks which lent recklessly to Greece (whose elites bear some of the blame) now have the power to decide Greek national policy and they gear it to repaying the impossible debt. This includes redirecting funds from welfare to debt repayment, and selling national assets (to foreign investors at bargain basement prices). Throughout history this has been one of the main ways the super rich get richer; when debtors can’t meet their interest payments they buy up the debtors’ assets cheaply because they are in no position to argue.

Similarly the conditions put on loans from the IMF and World Bank force just about all Third World countries to gear national economic activity to repaying the debt, and thus to direct it away from meeting internal needs. If they could set up an Economy B it would enable lots of labour, land, timber and talent to go into producing what people need … but that would mean these productive resources were not flowing into activities that benefit the owners of capital and rich word consumers. How convenient that the Structural Adjustment Packages prevent poor countries from applying their resources to meeting their needs.

At the town level what matters most is not the employment and firms that are created when a local currency is introduced with that intent. What matters most is that the process engages local people in the early steps towards having taken control of their situation. The global predicament involves levels of resource use that are far beyond sustainable, and control by distant globalised forces which inevitably drive to greater growth and enrichment of the rich. There can be no solution to this apart from transition to mostly small scale localised and largely self-governing communities which rationally and collectively gear local productive capacity to meeting local needs. The crucial step in this transition is the realisation that we have to get together to run our town to meet our needs. Its development, its fate, cannot be left to global market forces or distant government or what will maximise the profits of corporations. When we implement forms of money which bring with them the power to determine what will be developed we are introducing and reinforcing the understanding that we can choose how to build our town into the form we want. We don’t have to remain at the mercy of those who presently control money supply.

Such is the immense power over development, resource flows, and the lives of billions that comes with the capacity to create and lend money. So it is very unfortunate that alternative movements seem to have little understanding of the fact that we can very easily take much of that power away from the 1%, but only if we create and use new money in those ways that will enable the miracles. Just substituting eco-dollars for normal dollars won’t do it.

For a more detailed discussion see TSW: Money, Banking, Debt, Interest and Local Currencies,

Brown, E., (2011), “ECB a barrier to crisis exit”, Asia Times, 1, Dec.

Kennedy, M., (1988), Interest and Inflation Free Money, Permaculture Institute, Ginsterweg, D-3074, Steyerberg, Germany.

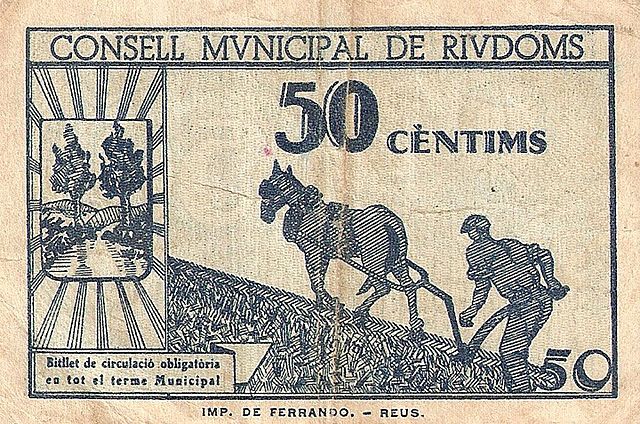

Featured Image: Bank note used in Riudoms during Spanish Civil War (15 June 1937). Via Wikimedia Commons.