Quote of the Week

“Global oil inventories are falling because of OPEC and non-OPEC production cuts, but the road to market balance will be long.”

–Arthur Berman, Consulting Geologist

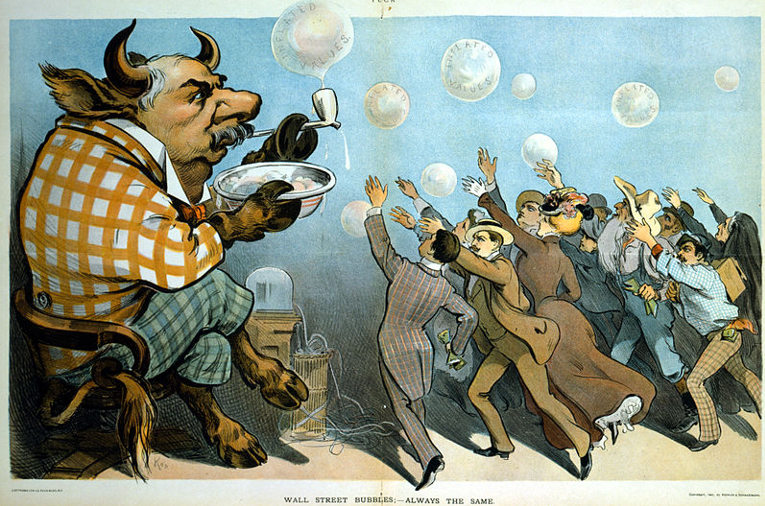

Graphic of the Week

Contents

1. Oil and the Global Economy

2. The Middle East & North Africa

3. China

4. Russia

5. Nigeria

6. Venezuela

7. The Briefs

Oil and the Global Economy

Last week, oil prices underwent their biggest weekly decline in a month as the markets lost confidence in OPEC’s ability to reduce the global oil surplus in the near future. The move was supported by reports that a glut was developing in the physical oil market in the North Sea area as lower Asia purchases, increased shipments of US crude to the EU, and more supplies coming out of storage all served to drive down prices. At week’s end, US futures were once again trading below $50 a barrel and London’s Brent below $52.

A few analysts are starting to question just what is going on behind the sudden and rapid gyration in oil prices. Some note futures trading by computer algorithm that can take a small piece of speculative news and turn it into several days of rapid price movements. These analysts talk of quantitative vs. qualitative news. The recent two-week surge in prices that moved oil up 12 percent from $47 to circa $53 was based on a deluge of statements by OPEC officials claiming that the production freeze was doing well, would be extended to the end of the year, and was likely to reduce the oversupply to normal levels. These officials, of course, represent oil exporting countries where their economies are collapsing due to low oil prices.

On the other side of the equation, we have the US shale oil industry which continues to pump out a dubious mantra as to how well they will be doing in the coming months. Despite evidence to the contrary, they are claiming that the industry’s technological prowess has reduced costs of producing shale oil to $40, or $30 or even $20 a barrel. We currently are deluged with financial press stories of the newly discovered wonders of the Permian Basin which is bigger than Saudi Arabia; holds $900 billion worth of oil; and which can be produced at $20 a barrel. Now that Exxon has freed its XTO shale-drilling subsidiary to act like a wildcatter rather than an International Oil Company behemoth, even more, oil will be coming from the Permian.

People are starting to question some of the US oil production numbers that are coming out of the EIA, particularly their weekly production change numbers and the ever-optimistic Drilling Productivity Report. A recent analysis concludes that the weekly Status Report numbers and those contained in the Drilling Productivity Report projections (currently projecting a 123,000 b/d increase in May) prove to be very inaccurate after corrections are made weeks later. Some say it would be better if the EIA did not publish uncorroborated numbers as they only add to price volatility.

Forecasts as how all this will balance out by the end of the year are all over the map. Citi Bank says we will see $65 oil by Christmas. Goldman Sachs says OPEC is doing just fine with its production cuts and that the current price decline is just an artifact of computer algorithms. The CEO of Total says oil prices could tumble again by the end of the year due to gains in US shale oil production.

The good news for the US shale industry is that bankers are again showering them with money despite the wave of bankruptcies in the last two years. Some see signs that the smaller shale oil drillers now are burning through their credit lines at an alarming pace which may give the bankers a reason for second thoughts. The entry of Exxon and other major oil companies into the Permian Basin frenzy means that much of the new drilling is well-financed and does not need loans from Wall Street to keep in operation.

How all this nets out is too complex to foresee. Demand for oil may be an important part of the equation. Last week’s price plunge was triggered in part by an unexpected increase in US gasoline stocks at the time when analysts were looking for stock drawdowns. The price of gasoline in the US is creeping up, and the US economy may not be expanding as quickly as has been projected. Although the Chinese are still importing a lot of crude, much of this is being refined and re-exported which is driving down the demand for crude elsewhere in Asia.

2. The Middle East & North Africa

Iran: The Iranians are starting to realize that in the long-term their viability rests on diversifying their economy so that it is not so dependent on oil. The government claims that non-oil exports have increased by 30 percent in the last year, but these increases are based on a small number so that in the immediate future economic growth will depend on increasing and exporting oil and gas production.

We still have no word of any major oil and gas deals being signed with foreign oil companies outside of the revival of existing contracts relating to the South Pars offshore gas field.

There have been reports that Tehran is willing to keep its oil production stable if OPEC votes to extend its production freeze to the end of the year.

Saudi Arabia: The Saudi position on the extension of the production freeze does not yet seem to be settled. Some are saying that the Saudis will likely be in favor, but others are saying it is too early to discuss what happens at the end of June. Others are talking about a shorter extension, which would not last until the end of the year before being revisited.

The Saudis are key to the extension. Their contribution to the production cut along with the other Gulf Arab states who follow the Saudi lead amount to 65 percent of the total cut. Without the Saudis, the cut would be meaningless and quickly offset by increased production elsewhere.

Libya: The major news last week was the announcement that the country’s El-Feel, 80,000 b/d, oil field is ready to resume production after a two-year outage. The problem is that the field can’t resume production until after the Sharara oil field reopens as El-Feel gets its electrical power from Sharara. Sharara pumped about 213,000 b/d until April 9th when it was shut down. There were no signs last week that Libya’s major oil fields are about to reopen.

3. China

The most important news last week was that China’s GDP increased at an annual growth rate of 6.9 percent in the first quarter, beating most expectations. Outside of the usual skepticism about Chinese GDP numbers in general, the quarter by quarter numbers are believed to be viable and good economic growth did take place in the quarter. Other statistical series such as electric power production tend to back up changes in GDP. The increase is believed to have come from state policies of easy money and more infrastructure spending.

The Chinese reported that their crude oil production was down by 6.8 percent year over year in the first quarter. The government attributed this decline to high production costs, increased imports of cheaper oil and lower refinery activity. Beijing says it is increasing efforts to find more domestic oil while developing clean alternatives.

According to pricing agency S&P Global Platts, China’s oil demand was up 5.3 percent year-over-year because of additions to its strategic reserve, a boost in holiday travel and “robust” economic growth.

China’s coal production in March was reported to up by 1.9 percent year over year to 300 million tons. This is the first monthly increase since 2015. China’s power generation in March was up by 7.2 percent year over year and first quarter power generation was up by 6.7 percent. Thermal (coal) powered generation was up by 7.7 percent in March and 7.4 percent in the first quarter. Given the size of China’s electric power industry, increases of this size require a substantial amount of coal which accounts for the increase in domestic coal production as well as increased coal imports.

4. Russia

Moscow reports that it now has cut its oil production by 250,000 b/d with only 50,000 to go in order to meet its production cut goal of 300,000 b/d. The basis for the cut was Russia’s record high production of last October which exceeded 11 million b/d. Given the time it has taken to cut from the record high and the size of Russia’s production, Moscow is not making much of contribution to reducing the oil surplus. What happens next is still up in the air. While the Saudis and several other members are talking about a six-month extension, Russia is non-committal, saying it will wait until the formal May 24th meeting to make a decision. If Russia does not go along with the extension but starts increasing production again, it is hard to how the extension will have much success unless the Gulf Arabs make additional large cuts.

Last week Exxon renewed a request to the US Treasury Department for a waiver on the regulation that prevents it from helping the Russians drill in Arctic. The Exxon-Russia deal, signed in 2011, was in place before the Ukrainian sanctions forced Exxon to pull out. For Exxon, drilling in the Arctic, which is supposed to hold billions of barrels of crude could be very profitable as global warming is making the job easier, and drilling in Russian rather than US or Canadian water bypasses the blowback from environmentalists. There are even plans to build a large natural gas plant near Vladivostok. The last time Green Peace showed up in Russian waters, they were arrested as pirates.

To the surprise of many, the Trump administration denied permission to Exxon to drill in Russia, citing the current Ukrainian sanctions. The US administration is under considerable scrutiny over its relationship with the Russians and its appointment of Rex Tillerson who negotiated the Exxon-Russian deals as Secretary of State. When news of Exxon’s request surfaced last week, the makings of a major political storm started brewing in Washington.

For a company the size of Exxon, only a deal the size of the burgeoning relationship with Russia would be enough to spark another round of growth for the company

5. Nigeria

Most of the oil news last week dealt with the brewing corruption scandal in which Shell and ENI allegedly paid a former Nigerian oil minister and powerbroker some $1.2 billion in return for a valuable offshore oil block. The former minister allegedly scattered the money around among various Nigerian office holders to clear the way for Shell and ENI to get the block. For years Shell and ENI have denied knowing anything about a bribe, but in the last week leaked emails have implicated the companies more deeply in the scandal. Next week a court in Milan is to decide whether to go ahead with criminal proceedings against the oil companies.

Nothing new about Nigerian oil production which is supposed to be recovering in the next few months provided the insurgents remain quiescent was reported.

6. Venezuela

The situation continues to deteriorate. Last week hundreds of thousands of desperate people, who are starving, took the streets in protest only to be met by the army, tear gassed by helicopters, and shot at by armed bands of vigilantes who support the government, known as “colectivos.” So far 20 protestors have been killed, but the numbers are likely to go far higher. Some are saying that if President Maduro is forced from office, the colectivos will resort to urban warfare ushering in a prolonged period of anarchy.

In addition to it all its other problems, the government is running out of money. It only has $10 billion in reserves, of which about $7 billion is in gold bars. The country owes $6 billion in debt payments in the next eight months and many billions more in private debts. Last Wednesday the government seized a GM plant which had been reduced to building spare parts as there was no money to import the parts necessary to build cars. GM promptly closed down the plant and fired the 2,700 workers it had been forced to keep on the payroll. It was revealed last week that Venezuela had contributed $500,000 to President Trump’s inauguration committee in hopes of getting more favorable treatment from the new government.

There has been no recent information on the state of Venezuela’s oil production or exports, which presumably are dropping. Given the ever-escalating anarchy, it seems likely that oil production or at least exports will be seriously reduced or even completely cease in the near future. If the country is no longer exporting, the loss of some 1-2 million b/d from the world markets is almost certain to drive prices higher. Much of the country’s exports have been going to China of late to pay off multi-billion dollar loans. The US has been importing about 750,000 b/d from Venezuela in recent months.

7. The Briefs

Rig Count: US drillers added oil rigs for a 14th week in a row, extending an 11-month recovery that is expected to boost US shale production in May in the biggest monthly increase in more than two years. Drillers added five oil rigs in the week to April 21, bringing the total count up to 688, the most since April 2015. While all four of the biggest oil basins boosted activity this week, the handful of rigs added is the smallest amount of growth in nearly two months. (4/22)

XL Pipeline: Protests are coordinated around the Nebraska review of the planned Keystone XL oil pipeline, days before the developer’s annual meeting, organizers said. Bold Nebraska called on opponents of the project to hold grassroots events ahead of the May 3 public meeting for the Nebraska Public Service Commission. (4/22)

New Gas Deposit: Technological advancements have just pushed the boundaries of recoverable oil and gas in the US further, according to an announcement by the US Geological Survey. The agency reported that two formations in the Gulf Coast Basin might contain as much as 304.4 trillion cubic feet of natural gas plus 1.9 billion barrels of natural gas liquids, making the area the largest untapped continuous gas deposit in the country. (4/22)

Exploration and production spending in the United States will increase this year for the first time since the 2014 downturn, which roiled the industry for two years rife with layoffs and bankruptcy filings. Increasing capital expenditures is expected to drive production up this year by 5 percent, according to Fitch Ratings’ measurement across 40 US E&Ps. (4/22)

Schlumberger: Gains in first quarter activity in North America were offset somewhat by declines in Russia and parts of Europe, oilfield services company Schlumberger said. Most first quarter indicators for the largest company of its kind in the world were lower, both when compared to the fourth quarter and year-over-year. First quarter revenue of $6.9 billion was down 3 percent compared to the previous term, but up 6 percent from first quarter 2016. (4/22)

Eastern Mediterranean: in the space of seven years the balance of energy security in Western Europe will be radically changed. If the plan is executed and the planned Israel-Cyprus-Greece-Italy gas pipeline is built, European countries will be able to cut their ever-increasing dependence on Russian gas supplies. (4/21)

ExxonMobil is planning to speed up investment plans for shale gas drilling in Argentina’s prized Vaca Muerta formation in the Neuquén province. Exxon will start drilling Vaca Muerta in May, by drilling horizontal wells with laterals of 2,500-3,000 meters. The US major’s total investments in developing Vaca Muerta will have reached $750 million by the end of this year. (4/21)

BP’s Gulf of Mexico oil spill caused damage to beaches, animals, fish, and coral that the public values at $17.2 billion, according to a financial accounting released on the seventh anniversary of the disaster. The tally, published Thursday in the journal Science, is based on a survey of thousands of Americans that asked what they’d be willing to pay to prevent the kind of impacts unleashed by the spill, which began with an explosion on the Deepwater Horizon drilling rig on April 20, 2010. (4/21)

M&A in the oil patch: Investors enter 2017 with renewed enthusiasm for oil and gas deals, pushing transaction value 160 percent above last year, but that excitement may be on the wane. Reassured by Donald Trump’s presidential agenda and the relative stability of oil prices once OPEC and non-OPEC countries settled on oil quotas, investors opened 2017 with a record $73.04 billion in deals, according to findings by PwC. The investment represents a 160 percent increase in mergers and acquisitions deal value, year over year (4/21)

Coal in the EU: The long goodbye for coal in Europe is accelerating as the cost of shifting to green energy plunges. Companies including Drax Group Plc, Steag GmbH to Uniper SE are closing or converting coal-burning generators at a record pace from Austria to the U.K., made obsolete by competition from cheaper wind and solar power. After more than 500 years of using the carbonaceous rock — which fueled the industrial revolution even as emissions warmed the atmosphere — the continent simply can’t afford it anymore and is moving on. (4/21)

China is creating a consortium, including state-owned oil giants and banks and its sovereign wealth fund, that will act as a cornerstone investor in the initial public offering of Saudi Aramco, people with knowledge of the discussions told Reuters. (4/20)

Russian experts will help the Atomic Energy Organization of Iran build two 1,000-MW nuclear power plants, Iran’s Energy Minister told media. Construction will start soon. The announcement is part of deepening ties between Moscow and Tehran, expanding into a growing number of industries, from oil to defense and fisheries. (4/20)

Buy America: US President Donald Trump signed an executive order on Tuesday that would promote his “Buy American, Hire American” trade policy, an agenda that is worrying oil pipeline companies. The executive order, if carried out, would affect companies building oil pipelines in the US, requiring them to use US steel. (4/20)

Tar Sands: Canadian companies are using their operational expertise, large market values, and stable balance sheets to build up larger positions in Canada’s oil sands. Over the last decade, oil production from Canada’s oil sands has increased 100 percent, and an increasing number of players are participating in that growth. In 2006 there were 6 companies, not including the Syncrude Canada consortium, that controlled all oil sands production in Alberta. Now, there are around 20 oil sands producers. (4/20)

A Norwegian energy company said it was moving to the next phase of testing for a project that would use wind power to facilitate offshore oil production. DNV GL is leading a joint research project that includes the Norwegian Research Council, the regional subsidiary of Italian energy company ENI and US supermajor Exxon Mobil as its partners. The partnership is testing whether or not wind power could be used to help push water into offshore fields to increase reservoir pressure and stimulate production. (4/20)

Denmark: The start of production from an oil field in the Danish waters of the North Sea could serve as a testing ground for future development, a German company said. The regional subsidiary of German energy company Wintershall, Wintershall Noordzee, said Wednesday it started production from the Ravn field, its first in the Danish waters of the North Sea. The company said the field was developed using what it called an “appraisal through development concept,” which makes it so the company can both test and develop the reservoir’s performance. Wintershall said this could open the door for further field development options. (4/20)

Oklahoma is resting on its laurels in the renewable energy sector by signing legislation ending tax credits for the wind industry, the state’s governor said. Gov. Mary Fallin put her signature on a bill that ends tax credits for wind power, effective July 1. In a statement, the governor said the tax credits were part of a comprehensive energy strategy that left wind accounting for more than 25 percent of the electricity mix in Oklahoma. “With the support of the zero emissions tax credit, our state has become a national leader in wind energy,” she said. “Currently, Oklahoma ranks third in the nation in total installed wind capacity.” The governor’s signature ends the tax support three years early. (4/19)

EIA expects that electricity generation fueled by natural gas this summer (June, July, and August) will be lower than last summer, but it will continue to exceed that of any other fuel, including coal-fired generation, for the third summer in a row. The projected share of total US generation for natural gas is expected to average 34%, which is down from 37% last summer but still exceeds coal’s generation share of 32%. Based on data from the National Oceanic and Atmospheric Administration (NOAA), EIA estimates that average US population-weighted cooling degree days in the summer of 2016 reached the highest level on record. (4/19)

Alaska’s declining oil output in recent years has not only stretched the state’s budget, it has also added a challenge to the functioning of the pipeline. Decreased throughput means the pipeline is now about three-quarters empty, and crude oil flows are slower. The peak of oil flow through the pipeline was at 2 million barrels per day in 1988. Last year, throughput was 517,500 bpd, a 1.8-percent increase from 2015. This was the first annual increase since 2002, but still a far cry from the days of peak flow. (4/19)

Saudi Arabia seeks to wean itself off oil as the government says it will tender for 400 megawatts of wind in 4th quarter. The kingdom will develop 30 solar and wind projects over the next ten years as part of its $50 billion program to boost power generation and cut its oil consumption. The world’s biggest exporter of crude oil will produce 10 percent of its power from renewables by 2023, Energy Minister Khalid Al-Falih said Monday at a conference in Riyadh. It also plans to generate an unspecified amount of electricity from nuclear plants. The country is currently seeking bids to build 700 megawatts of wind and solar power capacity in the first round of tenders. (4/18)

Venezuela: Workers in scuba suits scrub crude oil by hand from the hull of the Caspian Galaxy, a tanker so filthy it can’t set sail in international waters. The vessel is among many that are constantly contaminated at two major export terminals where they load crude from Venezuela’s state-run oil company, PDVSA. The water here has an oily sheen from leaks in the rusty pipelines under the surface. That means the tankers have to be cleaned before traveling to many foreign ports, which won’t admit crude-stained ships for fear of environmental damage to their harbors, port facilities or other vessels. (4/18)

India: In 2016, India’s population grew by 1.20 per cent, compared to China’s 0.54 percent despite the latter’s lately liberalized two-child-per-family population policy. Demographers have forecast that India may overtake China’s population as early as in 2022, five years from now. Currently, China ranks No.1 in the list of countries (and dependencies) by population. India is No. 2. At the time of India’s Independence in 1947, the country’s population was only around 330 million. (4/18)