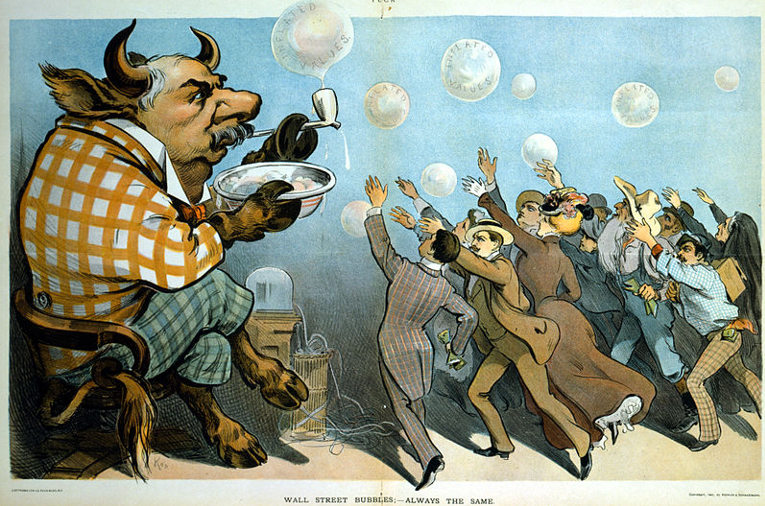

Anyone with any sense for global economic trends ought to be worried. The signs are everywhere of a serious deflationary crisis. It is obvious that Chinese growth is falling. The prices for energy and the raw materials that feed the growth economy keep falling. The demand for Chinese exports is down too. Stock Markets in Asia are falling, despite attempts to prop them up. Countries are being tempted to export their problems abroad – for example by competitive devaluation. In Europe its obvious that a “solution” is being cobbled together for the Euro and Greek crisis even though no one at all believes that it will work. At the same time the policy response of “quantitative easing” which has kept interest rates down very low has reached the end of the road. With interest rates at or near to zero the scope for addressing the crisis through monetary policy (low interest rates) is exhausted. Many pundits believe that low interest rates have not encouraged productive investment but speculative bubbles – the creation of capacity in fields that in the long run will not pay, or fuelled a casino style speculation, a giant bubble of bets that could soon collapse, bringing the global economy down with it.

So what is going on? How do we explain the situation? In this paper I am going to argue that there are a number of ways of understanding and addressing what is developing into a global crisis. The desire to make the crisis understandable can convert into a temptation to make it seem simpler than it is. At its most banal we have the explanations that neo liberal German politicians are prone to – like the idea that the crisis is because of a lack of confidence and trust and that this can be resolved (in Europe) purely and simply by countries following the Eurozone rules. If the confidence and trust are restored then all will be well and the market will restore prosperity.

A more adequate story is needed than this – and it is one that needs to focus on global trends not just in Europe but in the USA, the so-called developing world and above all in China. This story has a number of different plots and sub plots, not one. We need to understand how the sub plots interweave. The story is one of debt, competitive imbalances and an energy crisis and all need to be told. To make the story even more complicated we need to keep in mind too that an even more important story, that of climate change, has to be held in our minds too. If and when humanity has any chance of resolving these crises it will have to resolve that one at the same time. Will this be possible? I don’t know – what I do know is that there is a theory, by archeologist Joseph Tainter, that humanities’ problem solving capacities are limited by complexity. A friend is currently trying to get me to use twitter. However I am daunted by reducing complex situations to short simple messages. Understanding the global economy is like entering a labyrinth. As I get older I notice that some people become famous because of the clarity in the way that they write. What may not be noticed is that the apparent clarity in a political economic message is often the result of simplification. The popularity of neo-liberal economcs is like that.

So lets look at the ways of describing the crisis. In summary this can be described as the interrelationship between 4 processes.

(1) Structural policy stupidity – policy governance cannot cope with the complexity of the crisis. Politicians cannot cope with communicating complex messages to their peoples nor find the mechanisms to cope with the complexity of the issues.

(2) Problems are also caused by uneven development between countries and sectors which cannot be sustained without methods for recycling purchasing power from the more competitive countries to the less competitive ones. These imbalances become most problematic when capital export from surplus to deficit countries slows which happens when growth slows in the deficit countries.

(3) The crisis is both cause and effect of a rising amount of debt – personal, corporate, state and financial sector – which has acted as a drag on growth. As growth falls all kinds of debt become more difficult to service so the monetary authorities have tried to push interest rates down. Nevertheless the finance sector has tended to become both more speculative and more predatory as there is a “hunt for yield”. Interest rates rise when risk premiums are imposed on distressed borrowers (including states), money making occurs through financing arrangements based on “passing the risk parcel” exploiting the naivety of lenders about complex financial arrangements and by the promotion of asset price bubbles. The bigger players are rescued during crises but the smaller players (including tax payers and those who lose their state benefits) are made to pay.

(4) The crisis is the result of reaching “the limits of economic growth” and, in particular, because of resource depletion in the energy sector. This is less obvious because of currently low and falling energy and commodity prices but we need to study the experience of the energy sector over last few years, not just the immediate situation. The immediate fall in commodity and energy prices is a result of the onset of the crisis – a crisis which very high and rising energy prices up until recently helped bring on. The high energy prices have been compatible with a high level of debt only because interest rates have been so low and because there has been a “hunt for yield”, something that would pay more than leaving money on deposit paying very little.

Depletion of resources in the energy and mining sector means that it is taking more energy than before to extract energy (and other mined resources) and this has pushed up the costs of extraction of energy and other minerals. High energy costs act as a drag on the growth of the economy as a whole – because energy costs, like interest rates, enter into the production of virtually everything else. This is particularly acute problem in the energy sector itself as the energy sector is such a huge user of energy. The energy companies need a high price for energy otherwise they cannot actually make a profit. However, if energy prices are high for too long the economy wilts.

The development of unconventional oil and gas has been possible because quantitative easing has made a large amount of money to Wall Street at a low interest rate and they have been “searching for yield” – looking for somewhere to put this money to earn a high rate of interest. This funded the voracious capital expenditure needs of the industry with its high drilling intensity. However it pre-supposed that prices would remain high enough for long enough to cover costs and this has not happened. The problem is set to get a lot worse as depletion speeds up.

So, to repeat, the best way to tell the story of this crisis needs to relate ALL of these elements together – policy failure, debt, imbalances, energy. Each element is causatively connected to the others but sometimes in a time lagged way which obscures the relationships. Together these elements are bringing about what some observers are calling “secular stagnation”.

“Stanley Fischer, vice-chairman of the US Federal Reserve, has laid out the predicament that forecasters face. Half way through each year, economists have had to explain why their global growth forecasts were too optimistic, he said, and this has happened “year after year”. While growth rates have been falling across the world, it’s not yet clear whether this is all a hangover from the 2008 crash or something more fundamental.”[1]

In my view it is “something more fundamental”. It is related to reaching the limits to growth – and this has to do with fossil fuel and materials depletion and the end of cheap energy. However, this does not exclude a partial truth in the other narratives that economists are using to explain low growth.

In the reminder of this article I run through each of these themes in more depth.

Explanation number one: “structural policy stupidity”

First of all structural policy stupidity – all politics must be sold in one way or another to the governed. Even autocrats strive to govern with ideas as well as through simple fear. The rhetoric of politicians must to some degree match the way people think about things – that means one ingredient for successful politics is where politicians succeed in appealing to popular illusions embodied in “common sense”. One such popular illusion is that states have to arrange their finances using the same principles that ordinary households use to run their personal finances. Never mind that this is not true – the politicians who pursue policies and use a rhetoric that appeals to the “person in the street” viewpoint have a head start. As a number of economists have noted these politicians work with an ultra simple (and wrong) model of economic reality – that if governments follow rules and don’t borrow excessively this will inspire confidence and trust and economies will grow, spurred on by competition. It does not matter that this idea may actually be self defeating when an economy is slipping into recession – the important point is that collective illusions persist when they fulfil a collective purpose for those that hold them. In this case a key collective purpose of “the balanced budget illusion” is that it makes communicating with electorates so much easier. It enables a message of “we cannot afford” and “being cruel to be kind” to be directed against vulnerable groups who can be more easily scapegoated.

Complex messages are not popular and don’t sell well even if they more accurately reflect reality. Please note here that I am saying something more than politicians are mistaken – my argument is that ideas like the balanced budget illusion is more than “a mistake”. It is an illusion that has a structural function in the political process. It is not an accident that this particular theme repeats itself in history again and again. There is no reason to believe that once an idea has been rejected by one generation after a bitter learning experience, that a subsequent generation that have not been through the same learning experience will not have to learn it the hard way all over again.

One of the sayings of the management theorist Stafford Beer was that “the purpose of a system is what it does”. I really like this because it cuts through all the rhetorical justifications and excuses. If a system like the Eurozone is ruining its less competitive members in favour of the more competitive ones then this is the purpose of the system. Were it not the purpose of the system most powerful players in it would change it.

In this regard the very structure of the Eurozone has proved ideal for putting the banking and financial elite of Europe out of reach of democratic political processes. The currency is managed at a level out of the reach of any one state with the finances of each state disciplined by a set of rules that enforces close to a balanced budget. Given the inevitable crises each government that becomes vulnerable then has to cede more and more economic policy to financial interests who are free to impose neo-liberal policies like privatisation quasi automatically. The “coup” against Greece was a design feature of the Euro and delivers the primacy of finance over any pretence of democratic politics.

Given the complexity of eurozone governance, in which every state is supposed to have a say and decisions must be passed back to all of these governments, it seems as if governance requires a set of rules that governments adhere to, otherwise there would be endless re-negotiations for each new situation, and for each state, that would go on forever. In an interview in the New Statesman Yanis Varoufakis explained this when he described the viewpoint of Wolfgang Schaueble.

“Schäuble was consistent throughout. His view was ‘I’m not discussing the programme – this was accepted by the previous government and we can’t possibly allow an election to change anything. Because we have elections all the time, there are 19 of us, if every time there was an election and something changed, the contracts between us wouldn’t mean anything.’”

If you think about it this is not only a recipe for the negation of democracy it is the negation of any kind of economic policy discussion or policy variability. A common currency zone cannot work in these circumstances because it is paralysed by its complexity into ever being unable to adapt its economic policy. The default is then to a neo-liberal assumption of a balanced budget (or budget surplus, free market rules and privatisation). All it can do is to follow a set of pre-determined rules. In this case the policy that destroys economies like that of Greece appears as the price paid to avoid endless renegotiations.

The problem for the Eurozone and the global economy is that this is leading to a massive deflation….or maybe from an elite viewpoint this is not so negative. Maybe this is not “policy stupidity” but a cunning plan???

In a massive crisis in which only the super elite are rescued and everyone else ruined there would be a further massive concentration of wealth and power. Perhaps members of the super elite – the 1% of the 1% – think in this way. Or maybe I am paranoid.

Explanation number two – too much debt

Some economists think that that somehow debt doesn’t matter since, supposedly, debt transfers purchasing power from debtors to creditors who will spend it instead so debt is not supposed to affect “aggregate demand”. Alas this misunderstands the mechanisms of bank credit creation. In order for money creation and demand expansion to occur in the current system there is a requirement that more bank credit creation – i.e. more borrowing from banks – takes place. If individuals and companies are maxed out (“peak debt”) and if they are reluctant to take on more debt then aggregate demand cannot be increased. In fact, even if the central bank pumps out more money through “quantitative easing” this will do little or nothing to increase demand. The central bank will create money to buy bonds from banks but the money created and paid over will remain unused by the banks and the velocity of circulation will fall. The single demand expansion influence is that interest rates are lower and this is supposed to encourage investment – something that does not happen if the conditions for expansion do not otherwise exist. What happens instead is that money goes into speculation.

Meanwhile if companies and individuals are maxed out they will be making an effort to pay back their debts to the banks. When this happens money is destroyed and goes out of circulation. More particularly chain reactions from defaults and collapsing confidence destroys the trust and confidence on which the financial system works and leads to massive deflation. Now this situation of collapsing purchasing power in the private economy could in theory be balanced out by government spending leading to the governments running deficits – but that’s against the eurozone rules.

Explanation number three – global imbalances/failing mechanisms to recycle purchasing power

Another explanation for current stagnation is the breakdown of mechanisms for dealing with international trade and financial imbalances. In his book The Global Minotaur Yanis Varoufakis, describes the history of the post war economy by focusing on the story of how trade and financial imbalances were managed – particularly the imbalances between the USA and the rest of the world, but also imbalances in the Eurozone. As he explains, unless there is a mechanism for recycling surpluses from countries in trade surplus back to countries in trade deficit then purchasing power drains away from the deficit countries who are put in a deflationary squeeze as is happening to Greece currently. In the initial period after world war two the USA was dominant in the global economy and was in trade surplus to the rest of the world. It used the financial flows into America that were generated by its surplus of exports over imports by investing back into the rebuilding of countries like Germany and Japan and more generally into the American design for the postwar economy as bulwark against communism. The recycling of surpluses back into deficit countries kept the boom going. But you won’t catch Germany recycling its surpluses back into Greece now.

The answer to an export surplus in one country which occurs over and against import surpluses in other countries is for the countries with the export surplus to use the money that they earn in capital export back to the deficit countries. They invest in those countries. However, that implies that there is something in the deficit countries that is an attractive focus for investment. It implies that those countries are growing – which brings the argument round full circle. For decades the USA was the largest economy in the world and a growing economy. This meant that when the US first went into what was to be a long running trade deficit it was still worth Germans, Japanese or Chinese parking their dollar earnings as deposits into Wall Street banks or using them to lend to the US government. The dollars earned by Germany, Japan and later by China could be invested in the US economy or they could be used to buy oil. This was also because, by agreement with countries like Saudi Arabia, oil had to be purchased in dollars. This arrangement partly broke down however when Wall Street crashed in 2007 – in large part because it was operating a criminal business model. Loans were made to people who it was known would never be able to pay them back and packaged up with other assets and then sold on across the world to pension funds and other financial institutions who picked up the risk parcel, misled by ratings agencies. The ratings agencies were paid to say that the “toxic trash” was AAA grade.

Turning the finance explanation upside down

So, to come back to the story – yes the current problems are due to too much debt. Yes, mechanisms for recycling global financial flows arising out of trade imbalances no longer work so well after Wall Street and other banksters in London and Frankfurt are seen to be run by crooks….but one can argue that these two phenomena are also the result of the failure to grow, as much as the cause. You can turn at least a part of the argument on its head.

What I mean by that is that a rising amount of debt in general and troubled debt in particular is not just a cause of faltering growth – the faltering growth is a cause of the increasing amount of troubled debt.

Debt is not usually seen to be a problem for companies and individuals where their income is rising and sufficiently secure for people to pay the interest. It is when people find that their real income is stagnating or falling that more debt becomes distressed debt and distressed debt becomes the lender business model. Prudential lending pays in a growing economy with growing investment opportunities – but the temptation to resort to predatory lending occurs when there is an awareness of, even a decision to exploit, the desperation of people in trouble. This becomes part of the model. What happens when a country, or a company, or an individual, cannot pay? The answer is that the interest rate that they are supposed to pay for any new credit rises dramatically because they are now supposed to pay the lender “a risk premium”. This is the last stage of a process of debt accumulation. When a debt pyramid comes crashing down it does so because, just before it crashes, debt servicing costs get dramatically worse as “risk premiums” are loaded onto borrowers.

This “risk premium” might lead one to suppose that lenders actually are tolerating a higher level of risk for which they must be compensated – however this is only partly true for the biggest players. When the biggest players are deemed “too big to fail” they get backed by politicians so the “risk” is taken off – that is, after all, what happened to the German and French banks that lent to Greece. The deal stitched up by the IMF and the ECB meant that they got bailed out and the debt loaded onto the Greek people. So while risk premiums allow banks to increase their take the real risks do not rise commensurately.

The temptation to borrow under increasingly unfavourable conditions is not like borrowing to invest or to buy an asset with the secure expectation of a rising income. As debt increases the business model for lenders becomes more and more making money with distressed debt, vulture funds, passing the risk parcel and toxic trash. It occurs because borrowing states, institutions and individuals resort to what becomes a kind of gambling considered as a last resort, as an attempt at a way out of a desperate situation. That’s one of the ideas of Prospect Theory. Normally people are risk averse, they don’t risk what little they still have if they have anything left – however they do gamble when all of their other options seem hopeless anyway. Underlying all of this is that the rising incomes are no longer there. By way of contrast the institutions lending are not taking real risks because they have friends in very high places.

Turning the imbalance argument around

One can turn the idea about imbalances the other way round too. In one way of looking at the situation it seems that growth falters because the mechanisms to handle imbalances by recycling surpluses break down. No doubt there is truth in this but you can turn that idea round – i.e. it is when growth falters that the mechanisms to handle imbalances by recycling surpluses dry up. As we have argued the way to recycle surpluses is through capital export – the purchasing power flows back to the deficit countries not as money to purchase their goods as imports into the surplus countries but rather as money to buy into the industries and economies of the deficit countries, as investment. But who is going to invest into a stagnant or contracting economy?

Look what happened to the German privatisation of East Germany. The institution that was entrusted to sell off East German industry, the Treuehand, made a big loss. How could that be? When the East German economy was merged with the West German economy it was at the rate of one East German mark for one West German mark. This was an early lesson of what would happen in the eurozone except that it all happened inside Germany itself. The East Germans could not compete after reunification, just like the Greeks cannot compete now. So most East German businesses were making huge losses. However, if you want to sell off companies then you have to sell them as going concerns. You have to keep them going before you sell them….which often meant making huge losses. What they got for the sale of these companies never covered these losses.

Wolfgang Schaueble knows this – he was involved. They will not make any money selling Greek assets either. When the Austrian Railways considered a takeover of the Greek railways they said they would only do this if the Greek railways were given away. Unless Greece is growing and prospering there will be very little capital export into Greece to actually buy privatised assets.

So, to summarise the argument so far: slowing growth can be explained by increasing debt reaching its limits and the breakdown of mechanisms to even imbalances by recycling purchasing power from surplus to deficit countries. On the other hand the fact that debt is reaching its limits and surplus recycling limits are breaking down can be explained by slowing growth. Both are true in both directions of causation and what we are seeing here is a “vicious cycle” in operation.

Explanation number four – the energy crisis

Now let’s add the fourth way of looking at the issues. Let us start by making a distinction between growth of production and growth of production capacity. Growth of production can occur if there is spare capacity in an economy in the form of unemployed resources which can be brought back into utilisation – but for growth to be long term there must be a growth of the capacity of an economy.

This depends upon expenditure in capital formation – the creation of buildings, equipment and infrastructure. Capital formation is an energy intensive business because infrastructure, buildings and equipment require energy in their production – plus they require an energy throughput for their utilisation. The point about energy is that it is required for every good or service purchased. Even a haircut requires electric light or warmth in the barbers shop and to run electric clippers. Anything that enters into the production of all goods and services is a cost of production that all share. So if the cost of energy rises so does the cost of producing everything.

The nearest comparable example of a cost that enters into the production of all goods and services is interest rates. Virtually all individuals and companies must borrow so the interest rate enters into the cost of all production and into many everyday living expenses too. You can argue therefore that the real reason that interest rates have been driven down so low by central bankers is that energy costs have been so high. It is has not been possible for the economy to sustain BOTH high interest rates AND the higher energy prices. This is the reason for the stagnation.

Most energy intensive of all is investment in the energy and mining sector. The amount of energy required to tap and process energy is rising as it becomes harder to find, extract, process and transport oil, gas and coal from smaller, deeper, more remote, and harder to tap geological sources.

Slowing growth of global productive capacity is the result of the global economy running up against ecological system limits. This is particularly apparent in the climate crisis and the costs that occur as a result of this but, more immediately too, in the economics of extracting fossil fuels. The long run trend is towards rising energy costs which acts as a drag upon the growth of the productive capacity of the global economic system. The most energy intensive sector of all is the energy sector itself. We can see that if we compare the amount of energy used per hour of human activity in the energy and mining sector compared to the amount of energy used per hour of human activity in other economic sectors. (This is the so called exosomatic metabolic rate). These figures are for Catalonia in 2005 because the academics who have studied this issue are mainly at the University of Barcelona but one can expect comparable figures in other places. The rates are 2,000 Megajoules per hour of human activity devoted to energy and mining. This compares to 2.8 Megajoules per hour outside of paid work in households, 75 Megajoules per hour in services and government, 331 Megajoules per hour in the building and manufacturing sector (not including energy and mining) and 175 MJ/h in agriculture. As a matter of fact 11% of the energy throughput of society was taken by the energy sector itself – even though only 0.0945% of the time of everyone in Catalonia was devoted to energy and mining.

With energy and mining being the most energy intensive sector one would expect the impact of rising energy costs to be felt initially and most powerfully in the energy and mining sector itself. This has indeed been the case. In a presentation by Steve Kopits of the Douglas Westwood Consultancy he shows this graph (CAGR = compound annual growth rate).

As can be seen the capital expenditure required per barrel of oil in the exploration and production sector has increased enormously. To extract oil is requiring greater and greater amounts of investment in exploration and production.

We can see very clearly what is happening if we look at the statistics for fracking for shale oil in the USA. The fact that the US oil and gas industry has had to resort to fracking is a sign that American oil and gas fields are highly depleted and near to exhaustion. As an analyst called Arthur Berman puts it, fracking is the “retirement party” of the oil and gas industry. It is not a new beginning. As a matter of fact the USA, Russia and Saudi Arabia almost produce an identical amount of oil but look at the difference in the way that they produce it:

USA = 11.7 MMBl/d, 35,669 wells, 297 million feet

Russia = 10.9 MMbls/d, 8688 wells, 83 million feet

Saudi Arabia = 11.4 MMBls/d, 399 wells, 3 million feet [2]

In order to extract a roughly equivalent amount of oil the US industry has to drill almost 100 times the footage in wells and drill 90 times the number of wells. It is obvious that that will require an enormous amount of energy to get out an equivalent amount of oil (and gas) and that the cost will be a lot higher. But is this investment actually profitable? The answer is that it is only profitable at higher and higher oil prices. Different oil and gas companies require different prices to break even but, according to Kopits most of the oil companies require an oil price of at least $100 for new investment in conventional oil production to be profitable. High prices are needed in the unconventional sector too and most of the fracking companies in the USA have not been making money for several years. In the last year the price has fallen even lower.

So how come that they are still around? How come they have not gone bust? There are several kinds of reply to this.

Firstly, in economics things happen if people take a view of the future in which they believe that they will be profitable – even if subsequent experience shows this not to be the case. No one can know the future exactly so every investment is to some degree a gamble. A whole economic sector can share the same gamble and invest on the assumption that they will make money even if this turns out not to the case – and indeed they can be encouraged to. An oil sector drilling 90 times the number of wells and 100 times the footage is going to be immensely profitable for the companies selling and/or hiring out the drilling rigs, pipelines, tankers and other equipment. As the saying goes – in a gold rush sell shovels. A coalition can form around illusions that are profitable to some powerful players who make a lot of money even while others lose. A vested interest coalition pursuing a delusion is called a Granfalloon. It is important to realise that it is in the interests of the Granfalloon to keep on hyping their message in order to keep the money flowing. (This does not mean that the members of a Granfalloon are intentionally misleading – it means that there is an element of confirmation bias in the way that they interpret and describe things. We all do this to some degree – it is very difficult not to select and interpret available information in a way that confirms ones existing preconceptions, one’s faiths).

Secondly, at this time with interest rates very low there have been very few places where businesses in the finance sector can make much money. There is a temptation to make money on a gamble and the oil and gas industry has been a place for Wall Street to make another gamble. This is especially the case as the collateral for the industry is in the ground. However, when the sub-prime mortgage boom went bust after 2007 banks were left with a lot of houses. Shifting them was not so easy – finding a use for the assets of insolvent fracking companies is likely to prove even more of a problem. How many banks have the expertise to run fracking companies?

Thirdly in economics things happen with a time lag. Even if companies are making a loss they do not immediately go bust. They and their creditors may take the view that the unfavourable conditions are temporary and more credit may be extended to bridge them over what are assumed to be temporary hard times. If oil and gas prices have fallen they may still be able to sell at a higher price because they have insured themselves by selling their oil and gas already on the futures market. To respond to soon would be to lay off workers, and break up teams that would be difficult to reassemble. The temptation is to hang on, assume that difficulties are temporary and to tell the world that there are no problems, that everything is just fine, that the latest technologies make it possible to produce at a profit at even lower prices. If one looks at the figure however this does not appear to be what is happening. That part of the oil and gas pursuing new development, and particularly in countries where depletion is already advanced, are caught in a dilemma that unconventional oil and gas is expensive oil and gas – and the market cannot be made to pay these high prices over a long enough period to make the development of their part of the industry profitable.

In conclusion

The story thus described is one in which the world economy could be heading into a massive economic meltdown. The authors of the famous Limits to Growth, writing in 1972, thought it likely that unless humanity could adjust to the limits that there would be an overshoot and collapse sometime in the future. The crisis of 2007-2008 gave a preliminary taste of what that kind of collapse might look like. The after shocks in the Eurozone and what has been happening in Greece likewise give us a picture of what the future might be like for all of us.

What this does not mean however is that there will be some general realisation, some mass epiphany or “Aha” moment when everyone realises in a blinding flash of insight that humanity has reached the limits of growth. There are also limits to the extent to which people change their basic faiths about the world. Such flashes of insight about their real situation do sometimes happen when people are thrown into troubled times and circumstances that challenge all that they believe. However, even then most people are reluctant to abandon their faiths as that could leave them even more disorientated and fearful – living in a world that suddenly appears a lot less secure, and facing a future that is a lot less rosy, than they previously believed.

Most mainstream economists and politicians will continue to believe that the task at hand is “get growth going again” and, in the vast tangle of connected events, will privilege those connections and processes for their mental attention that confirm their viewpoint on what is wrong, the other people who are responsible for what has gone wrong – and what must be done to remove these people. To drum up support for themselves elite politicians of this type will no doubt identify favourite scapegoats and enemies to demonise. The worst futures would be where these kind of politicians get a mass following, sponsored financially by the elite, and lead emerging fascist movements. The best of all futures would be where these kind of political leaders drift into irrelevance because a popular majority gravitate to those who have positive community level responses of sharing, mutual aid and re-localisation connected to ecological design – and link this to a new approach to politics that supports the transformation at the base of society. This would go together with a new politics of finance to replace the debt based money system and a new politics of energy that keeps the carbon in the ground. A politics of this type would not be about “getting growth going again”. It would be about creating economic arrangements that create security for communities while conserving resource use. This would involve a revival of the commons and a solidarity economy, making growth unnecessary for a good life.

Endnotes

1. http://www.telegraph.co.uk/finance/economics/11305888/Can-we-ever-really-expect-to-see-the-growth-of-the-past-again.html

2. http://www.slb.com/news/presentations/2015/~/media/Files/news/presentations/2015/Kibsgaard_Scotia_Weil_03232015.ashx

Photo credit: "Lujiazui at night, Shanghai" by JesseW900 – Own work. Licensed under CC BY-SA 4.0 via Commons.