This essay of mine was originally published in Kings Review and is republished here under Creative Commons licence

A Knight on a chessboard can be looked at from two different perspectives. Firstly, we can zoom in and analyse it in absolute terms as a closed system. What is the shape of the Knight? What capabilities does it have? What kind of language does it use to describe itself?

Secondly, we can zoom out and analyse it in relative terms, like looking at a Knight in relation to the arrangement of Bishops, Pawns and Rooks on a chessboard, seeing it as but one element of a broader interactive system.

Likewise, Bitcoin, and other cryptocurrencies, can be seen from two broad perspectives. We can immerse ourselves in the code, in the Bitcoin community and in its rhetoric, and analyse whether these internal dynamics are positive or not. Or we can ignore the particularities of the code, the self-proclaimed goals of the proponents, and instead analyse Bitcoin and its connection to the rest of the monetary system, financial sector and broader societal institutions.

I use this chessboard analogy with caution. The world is not actually a game played by different institutions with fixed characteristics like chess pieces. The analogy is useful, though, as a tool to help one see that the peculiar characteristics internal to say, a knight, really have to be perceived in light of the context that the knight finds itself in. Bitcoin does not exist in a vacuum, and as such its attributes can only express themselves within the constraints set by others on a broader metaphorical board.

This is important because it affects the way we either praise or critique Bitcoin. Members of the Bitcoin community sometimes describe the workings of the cryptocurrency as if they imagined it on a chessboard with no other pieces, or perhaps on a chessboard made up entirely of knights. For example, despite the fact that Bitcoin has made almost no dent in central banking, someone might claim “Bitcoin is an apolitical protocol which renders central banks redundant and allows us to mutually contract with each other freely…” The statement is prefigurative, a normative vision of an imagined future reality rather than a description of an actual current reality.

Similarly, critiques of Bitcoin might fight against this vision, or attack Bitcoin in isolation without thinking about its context. They might claim, “It is subject to abuse and fraud!”, without admitting that relative to the existing payments and banking system – with its routine, legitimised, large-scale social injustice committed by transnational banking behemoths – the abuses are tiny.

It is only by zooming in and out, and considering the interplay between these absolute and relative perspectives that we can start to detect the complex power dynamics within Bitcoin. Like a country, it has internal power dynamics – which can be lauded or talked down – but also finds itself within a broader geopolitical situation, in which the domestic dynamics are less important. In this article, I will first sketch the internal narrative of Bitcoin empowerment, then offer four lines of critique, and then go back and suggest why, despite the critique, we should be glad Bitcoin exists.

What the Knight says about itself: The narrative of personal empowerment

If you spend time at a Bitcoin event, you will hear a lot of claims being made concerning Bitcoin’s potential to create personal empowerment. These imagined benefits often include:

- Bitcoin as defence of privacy: The (semi-)anonymous nature of the transactions protects people from the prying eyes of authorities, bypassing oppressive state surveillance and corporations

- Bitcoin as protector against monetary abuse: In contrast to a central bank that can inflate away hard-earned savings, the hard-coded money supply protects people through promoting deflation

- Bitcoin as agent of creativity, excitement and self-determination: There is a certain exhilaration and even fun in using a new, experimental technology, especially when they are frowned upon by the existing (state and corporate) status quo. People often search for spaces of rebellion, and the option to challenge existing conventions in a spirit of self-determination

- Bitcoin as agent of mental expansion and open-mindedness: We have long passively accepted monetary monopolies. Bitcoin has opened up the horizon to multiple currency systems. Furthermore, the underlying blockchain technology can be used for other, non-monetary purposes

- Bitcoin as a less costly way to transact: The current commercial bank payments system extracts rent from people in many ways. Bitcoin allows us to bypass that, achieving cheaper transactions

- Bitcoin as creator of financial inclusion: Bitcoin offers a lifeline to people in countries with unstable banking systems and corrupt governments, allowing them to escape an otherwise compromised system

We have to take these claims seriously. For example, we do indeed value privacy. It allows us to do things that powerful interest groups might critique, and historically this is a very important driver of progressive change. Indeed, as books like The Misfit Economy point out, activities in the grey area between deviance and normality are often sources of innovation. A similar principle is even found in ecological design frameworks like permaculture, where value is not only placed in cultivated systems, but also in the chaotic creativity that exists on the unregulated margins.

On the other hand, each of these claims can be tested and subjected to further scrutiny. For example, is privacy really a form of empowerment by itself? Sure, it might be an element of a broader programme to give people breathing room to act independently, but privacy is equally used as a tool of elites to avoid accountability.

And what about this story of financial inclusion? Sure, maybe Bitcoin might offer a new means to create cheap remittance systems. On the other hand, there is something tiresome about the way that Western tech optimists constantly invoke the mythical land of ‘Africa’, with the imagined African person in the imagined African village, using Bitcoin to escape corruption in their country. As a person from ‘Africa’ who has also had experience with international development, it is easy to see this technology-centric narrative is both patronising and, to be frank, delusional.

Tech critique 1: Individual empowerment, or collective empowerment?

But, even if we take these claims at face value, and assume Bitcoin does have the potential to create personal empowerment, a second question remains: Does this necessarily translate into broader social empowerment?

Within the Bitcoin community – which has a distinct libertarian bias – there often seems to be the assumption that personal empowerment is roughly the same thing as broader social empowerment. There is bias towards believing that if a tool allows a person to protect themselves individually, it must also be positive at a collective level.

To illustrate this point using a different example, consider a basic pro-gun narrative you might encounter: this rifle can be used to protect me, and therefore it is a protector of rights, and thus a tool for broader social empowerment.

This approach – which starts from a defensive, individualistic perspective and then justifies it with an appeal to a secondary benefit that apparently accrues to everyone else – can be contrasted to arguments looking at the societal perspective first. In the case of rifles, we could also start from an assertion that collectively, gun violence harms society, and proceed from there to conclude that individual gun use should be restricted.

This problematic dynamic can be seen in the Bitcoin claim about deflation as a form of protection. While it is true that from the perspective of an individual person, deflation appears to empower them (in that the money-claims they hold miraculously become worth more relative to goods), deflation at a societal level can just mean that those who hold savings, or who hold (i.e. own) debt instruments, benefit relative to those who do not (and owe debts to others). Both inflation and deflation represent different forms of wealth transfer, and there is nothing intrinsically empowering or disempowering about either of them. It really just depends on who you are.

Deflation—in a crude sense—means work someone did (abstractly represented in a money claim) will be valued more than work they get back from someone else later (claimed with that money). Inflation means work they did will be valued less than work they get back from someone else.

Thus, as economist Beat Weber points out, the idea that deflation protects’you is what might be called an Uncle Scrooge perspective, in that it most appeals to people with monetary savings who are concerned about the state ‘inflating money away’. It is the conservative impulse of a creditor, or perhaps like that of a squirrel hoarding apparently scarce claims to nuts, a situation that may leave the individual squirrel empowered, but that collectively locks squirreldom into a destructive game.

The important point here, though, is not to prove whether inflation or deflation is preferable. It is rather to point out that it is not obvious that deflation is somehow better than inflation, and anybody who presents it as such is clearly taking a very partial view. Indeed, stop for a moment and think about what deflation means from an intergenerational perspective. While right now, Bitcoin inequality is justified in terms of early adopters being rewarded relative to late adopters, this later would turn into a battle between current generations who hold the limited currency, versus yet unborn generations who will be forced to earn it (or buy it) from them by providing services far in excess of what was required to originally obtain the currency.

Mid article message! Grab a pirated version of me book The Heretic’s Guide to Global Finance: Hacking the Future of Money here

Tech critique 2: Tools of empowerment are most easily appropriated by the already-empowered

|

| THE WORLD AIN’T FLAT: IT’S SPIKEY |

The individualistic bias sometimes found in the Bitcoin community can prioritise awareness of individual benefits over collective benefits. Empowerment, in turn, is often seen to stem from the individual not being interfered with, encapsulated in slogans like ‘don’t tell me what to do’, and ‘just leave me alone’.

The problem, though, is that Bitcoin finds itself in a de facto unequal world, and it just so happens that “don’t tell me what to do” and “just leave me alone” are, perhaps co-incidentally, the same things that powerful people—like the freedom-loving Koch Brothers—say to prevent forms of monitoring or regulation of their giant secretive global businesses that impact upon the lives of many people with less economic clout. We have reasonable grounds to be sceptical about this.

You do not have to be a conspiracy theorist to realise that the people with the most ability to exploit Bitcoin (to start new companies, to get access to investment capital to develop the technology) also happen to be the same people who already are doing pretty well in society. Thus, even if the technology itself might have positive principles, access to it—whether that is explicit or implicit—is unequal.

We see this issue cropping up in gender critiques of Bitcoin, analysis of Bitcoin inequality, and critiques of the cult of meritocratic technocracy, the fact that programmers are not just your average Joe but a particular technological priesthood wielding a language that many do not understand. Indeed, the Bitcoin community, just like the mainstream finance community, has arguably developed its own exclusionary language and culture.

Analysing power and privilege like this is not rocket science. It operates on a few lines, such as 1) gender 2) race and ethnicity 3) age 4) socio-economic situation and education levels and 5) position in the geopolitical system. So, lo and behold, a middle-aged upper-class university-educated man from America tends to wield much greater power, have much greater access to goods and services, and perceive the world as much flatter, than, say, a young impoverished woman from Nepal. Their ability to enthusiastically adopt an otherwise neutral technology is likewise, much greater.

Certainly, some Bitcoin proponents can get very irritated when you draw attention to the subtle inequalities. It is like they perceive it as an irrelevant point, like the person is thinking “I have access, so everyone else obviously does too”, and “nobody is stopping you using it, therefore it is free”. They prefer to imagine that the only barrier to a utopian world comes in the form of external and unnatural aggressors like the government, corporate cronies and central banks. They themselves form no part of such a power structure.

Thus we find Silicon Valley tech entrepreneurs brimming with optimistic expectations of disruption and future success, proclaiming the word of blockchain rebellion as a universal tool of empowerment for all, contrasting themselves to the parasitic Wall Street banker. The critical observer, though, might just take a step back, and conclude that this is really just one group of elites fighting another group of elites for control of the ramparts of power, both invoking the interests of Average Joe in the process.

At a recent Bitcoin meetup, Vinay Gupta of Ethereum referred to a brilliant video that encapsulated this very point. It was Juice Rap News’ New World Order video, where a guy blames the world’s problems on a nefarious New World Order. He is subsequently shown that the NWO is a mental construct he uses as a tool to cast himself in the role of an underdog, to justify his own position of power within a greater system that he refuses to acknowledge.

It is an authentically disturbing line of critique, and one to take seriously. Despite the rhetoric of empowerment and rebellion, there is too often an inability of those articulating that rhetoric to comprehend their own position in a system. Their vision of Bitcoin as a neutral apolitical technology to be used by people to bring liberation to the world is not a reflection of reality. It is a reflection of the fact that they wield enough power to fail to perceive the inbuilt barriers to its usage.

Tech critique 3: Even if access is equal, technology can be abused by people

|

| TECHNOLOGICAL AMBIGUITY |

Perhaps the most well-established line of technological critique is the simple observation that technology can be abused: You can use this axe to chop firewood, but you can also use it to cut my head off. This is clearly a different line of critique to saying that access to axes, or encouragement to use axes, or education on axe use, is unequal.

Bitcoin, like many other technologies, can be overtly abused by people. This is something that keeps cropping up in the news, with stories of various forms of fraud, scams and hacks within the Bitcoin ecosystem. These scams, furthermore, are most likely to hit people who are already in a disempowered situation, such as those who are in debt and who are desperate for a quick way out.

The volatile and speculative nature of Bitcoin trading, like that of financial day trading, online poker, lotteries, and win-a-car competitions, can be twisted into a story of empowering escape from economic reality. This can also have a parasitic class element to it, as venture capitalists and technological elites push get-rich-quick narratives to the working man in the pub, claiming to be on the same side.

Of course, merely pointing out that a technology can be abused is not that interesting. Your cash can be robbed from your wallet, but we do not use this fact as an argument for banning the institution of banknotes.

A more compelling subsection of this critique is not so much concerned with current abuse of the technology. Rather, it concerns the increasing control certain individuals have over it, and how this in turn opens up the scope for large-scale future exploitation. For example, we might consider the growing power of mining pools, which increasingly have a domineering position within the network.

These Bitcoin corporations are emerging because there are centralising tendencies internal to Bitcoin’s design. Miners are rewarded with new bitcoins for processing transactions and securing the network, but because the issuance of new bitcoins occurs at a fixed rate, regardless of how many people are mining, the more miners there are on the network the less the individual miner is likely to get. This means that to compete the individual miner must either obtain increasingly powerful computers, or band together with others to create collective corporations with enough processing power to compete. Unlike in some industries, there are no advantages to being a small nimble operation. Sheer brute force is really the only competitive edge, and that requires access to capital.

Where does this lead us? The future of Bitcoin could be one of passive users relying on huge mining pools, essentially corporate players, to run the network. Such an outcome would leave it not that far at all from our current bank-centred payments system.

Quick message: I don’t get paid for Creative Commons pieces like this, so if you’re enjoying it, please consider donating to me a virtual beer

Tech critique 4: The Techno-Leviathan

|

| NEUTRAL TECHNOLOGY? |

The three aforementioned critiques add up to a simple conclusion: there is unequal access to a technology that can also be abused by those who use it, and that may fail to deliver the collective benefits that some claim it would. People are used to such observations about technology. It is like pointing out that a pen can be used to write inspiring masterpieces as well as hate speech, in a society where only some people can read and write.

But what about the power dynamics built into the technology itself? What about the way the act of writing with a pen makes you think? This line of technological critique is not nearly as familiar as the normal ‘people can abuse technology’, or ‘there is unequal access to technology’ lines. This is the idea that the technology, in itself and regardless of other people, is not neutral. It is the kind of critique associated with people like Marshall McCluhan. A technology like a TV might show different content—government propaganda, Fox News, or a National Geographic documentary—but conceals an invisible power dynamic that is there regardless of the content. The fact that you are passively sitting there giving it energy. Are you aware of the attention that you have deferred to the machine?

I want to challenge the notion, pervasive in some parts of the Bitcoin community, that technology itself is apolitical, and it’s with this in mind that I came up with the concept of the Techno-Leviathan, originally sketched out in my article Visions of a Techno-Leviathan: The Politics of the Bitcoin Blockchain. The essence of the concept is this: technological infrastructures do not offer an escape from government, they just offer another, competing, governance system with its own power dynamics. You can decide to view rule by algorithms as a positive or negative thing, but the point is to recognise the power that is being given to the apparently neutral technology.

One way to conceptualise this is to think of mirrors. Can you see a mirror? Sure, you can see an image in a mirror, but try see the mirror itself. It is almost invisible behind the projected image. Likewise, people see all sorts of visions in the blockchain, visions of human freedom and epic escape, but they struggle to see the thing it is reflected in, and that thing is the internet monarch, the Techno-Leviathan. It is like reflective glass. And, like Narcissus, you should be careful about falling in love with the reflection in the mirror, because it obscures the fact that it is then the mirror itself that controls you.

Perhaps this is unnecessarily dramatic. A concept like the Techno-Leviathan is, mostly, derived by an internal reading of Bitcoin, in an imagined world where no other system exists. Yes, indeed, if blockchain technologies were to become pervasive, then this Techno-Leviathan would emerge. But, the reality of the world right now is that we’re nowhere close to that situation.

Back to the chessboard: The geo(electric) politics of a cashless future

|

| PLEASE KEEP YOUR ID CARD ON YOU AT ALL TIMES |

So let’s take a step back now, and zoom out to a bird’s-eye view of the chessboard. While the critically minded individual might take pleasure in deconstructing the narrative put out by the Knight on the chessboard, remember that the cryptocurrency remains a very small part of an overall system that is much more destructive.

The reality of our current world is that regardless of the rhetoric—conservative libertarian, left-wing anarchist, or otherwise—of the Bitcoin community, the mainstream financial sector is infinitely more powerful, much bigger, and has much more political clout. In fact, there is not even yet a real financial system that exists for Bitcoin. There are no banks for it, or official systems of lending, or real negotiable financial instruments denominated in it.

From this perspective, we do not actually have to care about whether or not Bitcoin’s hardcoded monetary policy is positive or not, or whether the evangelists are full of nonsense. From a strategic meta-level perspective, we might merely see Bitcoin as a potential future counterpower to the existing, and much more powerful, bank payment system. It does not necessarily matter if that counterpower happens to have some internal negative characteristics. What is important is that it is a counterpower.

This is especially important in the context of a growing move to a cashless society. The payments space is currently gurgling with excitement about contactless technology and micropayments, the increasing ability to use cards to pay for almost everything. Companies like Paypal, Stripe, Square and Venmo have the gloss of disruptive innovation, but all the start-ups and technological advances are built on one foundation: The commercial banks that act in concert with credit card networks like Mastercard and Visa.

Regardless of which efficient payments provider you use, whether it is ApplePay or Google, in the end they all rely on the same commercial banking payments infrastructure. And that is because the entire electronic money supply—that the payment system is supposed to move around—is created by commercial banks and does not exist without them.

If that comes as a surprise, it is worth noting that not one unit of electronic currency that you use comes from the central bank. Indeed, the only government money we directly use are coins and banknotes, otherwise known as central bank notes. An imagined cashless future, in which we move away from use of such notes, is basically one where all transactions must occur via commercial banks, who in turn deal with each other via the central bank.

And this means that every single one of your transactions becomes a potential piece of data to be monitored, incrementally building up a database of your personal characteristics so vast that even Facebook would be jealous (actually, have you considered why Facebook is trying to get into the payments game?). And with the correct big data methodologies to make sense of it, such data becomes hot property.

Some might react to this with indifference, saying “I’ve got nothing to hide, and contactless payment is so convenient”. Those who express doubt about cashless society are cast as either Luddites or criminals, trying to remain in the backward shadows.

This narrative needs to be countered. I am not a privacy fetishist, but I do know that it is essential for the sense of mental freedom it gives us. Without the occasionally ability to be invisible, society takes on the feeling of a panopticon, and that itself breeds distrust. You need the ability to feel alone—like that feeling of sitting alone in a bath, at peace with all your vulnerabilities—in order to value the presence of others.

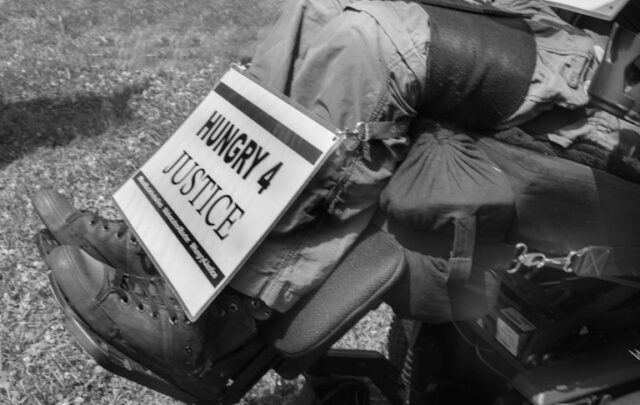

A very small amount of our overall transaction volume is currently undertaken with coins, but coins are important precisely because they give us that little passageway of flexibility and anonymity. They give the ability to flick a tip and a smile to a busker as we pass them in the street, a personal gesture that is unmediated and unverified and unmonitored.

In a potential future world where such physical tokens disappear, I want Bitcoin to exist. I want something that feels roughly like electronic cash, something that can exist as a marginal counterpower outside the walled gardens of mainstream payments.

And like coins, I expect Bitcoin will never become a dominant payment system. I expect it will, at most, account for 1 per cent of transactions. But that is fine. 1 per cent privacy is going to be a lifeline in any future world of 99 per cent bank surveillance.

If you enjoyed this…

- Further reading: Check out my piece Visions of a Techno-Leviathan: The Politics of the Bitcoin Blockchain

- Flip me a small donation – even £2.50 goes a long way

- And as a bonus, grab a copy of my book… now in pirate format