NOTE: Images in this archived article have been removed.

It’s New Economy Week, and PCI Fellow Michael Shuman is sharing 24 Ways to Invest Locally. Each day this week, Post Carbon Institute will roll out four ways you can—right now—begin to move your money from Wall Street to Main Street, and help build a vibrant, more resilient economy in your community.

It’s New Economy Week, and PCI Fellow Michael Shuman is sharing 24 Ways to Invest Locally. Each day this week, Post Carbon Institute will roll out four ways you can—right now—begin to move your money from Wall Street to Main Street, and help build a vibrant, more resilient economy in your community.

TIPS 21-24

(21)

Spread Self-Directed IRAs – Tax-deferred investing through an IRA or 401k typically is done through mutual funds, which means your money is stuck on Wall Street. By rolling over your funds into a

Self-Directed IRA, you can direct a custodian to invest instead in any and all of the items above. The main restriction is that you cannot invest in your family’s business or home. But you can invest in your neighbors’ businesses or homes, and your neighbor can invest in yours!

(22)

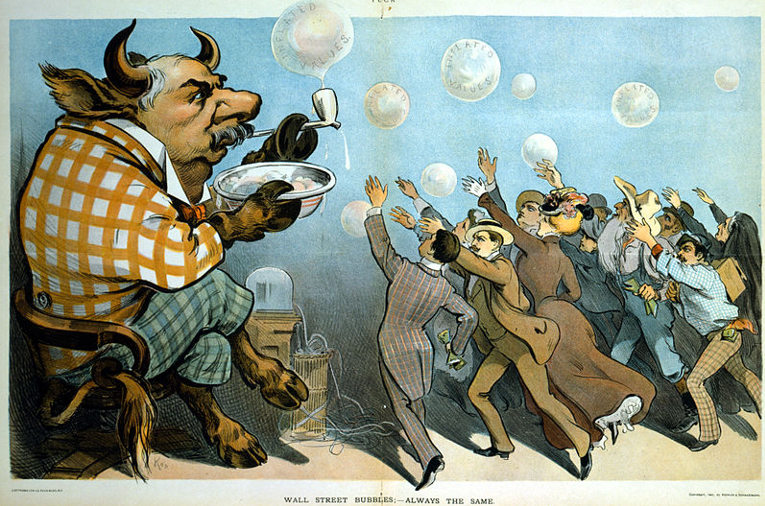

Encourage Your Neighbors to Rethink Their Finances – There’s a widespread mythology, spread by the investment industry, that patiently leaving one’s money on Wall Street will generate the best returns for retirement, college, or other long-term needs

www.cuttingedgecapital.com/is-the-stock-market-safe-for-the-long-term/. In fact, far better returns can be achieved through investing in one’s own home (such as in energy efficiency), and in one’s own education. And the single best way to localize your money and improve your rate of return is to wean yourself off credit cards.

(23)

Start a Slow Money Chapter – Across the United States, groups affiliated with

Slow Money are exploring all these strategies. The 17 active chapters, which involve both professional investors and newbies, have already mobilized $21 million into small farms and food businesses.

(24) Issue Slow Munis – Your local government issues bonds all the time, often to support economic-development projects. How about creating bonds to finance local businesses? Several proposals over the last two years have been discussed to create “food bonds,” the proceeds of which might go into a local fund that collateralized loans from local banks and credit unions to high-priority local food businesses. Properly structured, the interest from these bonds could be tax exempt, and these bonds could be purchased by residents of your community.

Seedlings image via chiotsrun/flickr

It’s New Economy Week, and PCI Fellow Michael Shuman is sharing 24 Ways to Invest Locally. Each day this week, Post Carbon Institute will roll out four ways you can—right now—begin to move your money from Wall Street to Main Street, and help build a vibrant, more resilient economy in your community.

It’s New Economy Week, and PCI Fellow Michael Shuman is sharing 24 Ways to Invest Locally. Each day this week, Post Carbon Institute will roll out four ways you can—right now—begin to move your money from Wall Street to Main Street, and help build a vibrant, more resilient economy in your community.