This article is the part 2 from Chapter 5 of Richard Heinberg’s new book The End of Growth, which is set for publication by New Society Publishers in August 2011. This chapter ‘Shrinking Pie: Competition and Relative Growth in a Finite World’ looks in greater depth at the prospects for further development in in an increasingly resource strained environment.

Chapter 5, Part 1

Chapter 5, Part 3

Chapter 5, Part 4

Chapter 5, Part 5

Chapter 5, Part 6

The China Bubble

2. Export-Led Development Model

The fundamental economic model that China has depended on for the past couple of decades was borrowed from Japan, and consists of producing low-cost export goods to fund investment at home. Essentially the same model is being pursued by Thailand, Vietnam, Taiwan, Malaysia, Singapore, the Philippines, and Indonesia. The story of what happened to Japan as a result of following this strategy should be a cautionary tale for its neighbors, and for Beijing in particular.[1]

The post-war Japanese export boom resulted in spectacular growth for four decades, but the undervalued yen eventually caused a deflationary contraction of Japan’s economy, which is smaller today than it was in the late 1990s. There are good reasons to think the same policies will achieve the same results in China. However, China is much larger than Japan, and the world economy is today far more fragile than it was in the late 1980s when the Japanese bubble burst, so the global consequences of a Chinese crash would be far greater.

After World War II, Japan kept its yen weak, making exports relatively cheap to foreign buyers. Japan also benefited from a high savings rate, which enabled massive investment in infrastructure and manufacturing capacity. The country’s GDP ballooned by 600 percent from 1950 to 1970, pulling more people out of poverty more quickly than had ever been done anywhere previously.

Export- and investment-driven growth typically discourages consumption, as domestic prices are kept high and salaries low (to help fuel exports). In the case of Japan, yields on savings were suppressed so that available capital would flow to corporations and the government.

All of this resulted in a lopsided economy. In most modern market economies, consumption accounts for around 65 percent of GDP (in the U.S., the proportion is 70 percent), while investment in fixed assets such as infrastructure and manufacturing capacity makes up 15 percent. In 1970, Japan’s domestic consumption contributed 48 percent of the economy and fixed investment 40 percent. As Ethan Devine put it in his article “The Japan Syndrome” in Foreign Policy, “In plain English, the Japanese were consuming relatively little while investing heavily in steel plants and skyscrapers, which didn’t leave much for fish or tourism. Belatedly, Tokyo realized that a balanced economy must also have consumption andthat coating the country with factories and infrastructure wouldn’t do the trick.”[2]

Throughout the 1970s and early 1980s, Japan gradually strengthened the yen so as to support the development of a consumer culture, and consumption rose to more than half of GDP. In 1985, Tokyo let its currency appreciate more rapidly. But the result was simply a spectacular inflation of real estate and stock prices. The bubble’s collapse lasted more than a decade, with stock prices scraping bottom in 2003 (before plummeting even further after the commencement of the current global crisis in 2008). Export-oriented industries could not adapt to a domestically led economy because there was insufficient consumer demand. And so rapid growth turned to stagnation, which has persisted up to the present.

Japan still runs on exports, but now government spending is an essential prop for the economy. Twenty years of fiscal stimulus have done little more than stave off even more serious economic contraction, while government debt has grown to nearly 200 percent of GDP.[3]

Fast forward to China, 2011. Like Japan, China subsists largely on exports while investing heavily in infrastructure, paying for the latter with private savings that come from tamping down consumption. Beijing adopted the Japanese growth model in the 1990s, when its deregulation and opening up of the country’s economy was widely praised. While these policies created tens of millions of jobs, as well as thousands of new roads and millions of new buildings, they have also generated imbalances reminiscent of Japan in the 1980s—except that in many ways China has gone even further out on a limb.

Devine recites the startling numbers:

“China is far more dependent on exports and investment than Japan ever was, and the numbers are still moving in the wrong direction. Investment accounts for half of China’s economy while consumption is only 36 percent of GDP—the lowest in the world, drastically lower than even other emerging economies such as India and Brazil. But as the Japan example illustrates, low consumption leads to high savings, and China’s thrifty citizens, coupled with booming net exports, have bestowed upon the country the world’s largest current account surplus, triple that of Japan’s in 1985.”[4]

China’s legendary trade surpluses cause problems for its trading partners while stoking price inflation at home. And inflation, the usual result of an undervalued currency, is dangerous in a country where hundreds of millions of people still have trouble affording basic essentials.

To outsiders, China has looked like a shining example of what growth can accomplish, yet it has achieved its success by strangling personal consumption (which was the engine of growth in the U.S. and Europe) and sidelining small-scale entrepreneurs in favor of state-owned businesses and selected multinational corporations. Only a small percentage of its population has shared in the bounty.

China’s leaders are aware of the pitfalls of pursuing the Japanese development model, and have issued a comprehensive slate of reforms to foster consumption and curb excessive capital investment. But these efforts will only work if the U.S. and the rest of the world return to a path of growing consumption. If not, China’s choices may be limited. An export-driven economy can only succeed if others can afford to import.

References

2. Devine, “The Japan Syndrome,” Foreign Policy.

3. From a social standpoint, Japan handled its economic transition away from high growth rates well: throughout the 1990s, the Japanese unemployment rate was about three percent, only half the U.S. rate at the time. The Japanese also maintained universal health care, and had low wealth inequality, low rates of infant mortality, crime and incarceration, as well as the highest life expectancy. Steven Hill, “

Reconsidering Japan and Reconsidering Paul Krugman,”

Truth-out.org, posted December 12, 2010.

4. Devine, “The Japan Syndrome,” Foreign Policy.

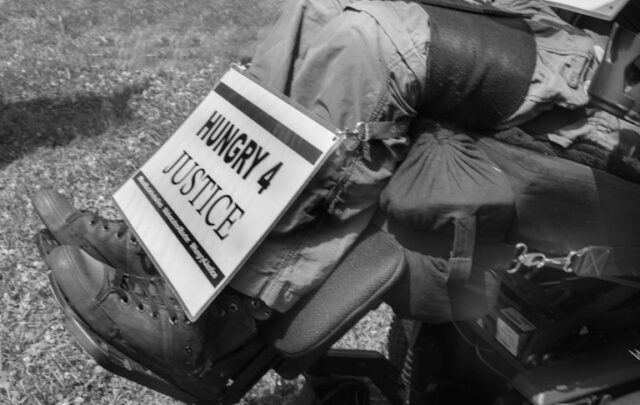

Like this article?

Keep the information flowing: Donate to Post Carbon Institute

Stay connected: Receive our monthly e-newsletter

Reposting: See our reposting policy