(Conversation Recorded on August 17, 2022.)

On this episode, we meet with legendary financial icon Kiril Sokoloff to take a bird’s eye view of the global energy/financial situation.

Why is the financial community so complacent about peak oil and the relationship between increasing energy scale and growth? Can we make predictions about the future by looking back at history?

Kiril shares his professional experiences with scenario planning, disruption, and investing as well as his passion for history and the practice of Buddhism to influence and inform decision making and life.

About Kiril Sokoloff

Kiril is an investor, a researcher, and long-time writer of the highly respected weekly publication “13D – What I Learned this Week”. For 50 years he has predicted major inflection points in energy and commodity prices correctly including 1980, 2002, and 2008 and recently stated sanctions on Russia will result in economic suicide for Europe.

Kiril is active in philanthropy in areas of healthcare, education, and the scaling of human consciousness.

Show Notes & Links to Learn More

00:45 – Kiril’s info + works , XIIID

03:17 – Kiril’s book “Is Inflation Ending? Are You Ready?”

03:36 – “Hubbert’s Peak”

03:44 – Peak Oil

04:45 – Oil prices in 2007-2008

05:00 – The Oil Drum

05:40 – The shale revolution

06:17 – George Soros and writing on Reflexivity

06:34 – Our culture is energy blind

06:44 – Commodities and the importance of gas and oil

07:17 – Deflation in the 2000s

08:06 – OPEC+ power

08:15 – The Green Energy revolution (Renewable energy)

09:20 – Global oil production decline rate if no there were no new drilling

09:26 – Tech productivity is deflationary and energy depletion is inflationary

09:37 – Kiril and 13D research on disruption

09:43 – Durations for building landlines and mobile phone systems by country

10:10 – As the world digitized, industry would be disrupted, which is deflationary

10:46 – All inflations since 1973 were oil-induced

11:05 – The cycle of wealth distribution is inflationary

12:04 – Number of vehicles in the world and 95% of them use petroleum

12:11 – Petroleum demand for transportation

12:15 – Number of electric vehicles worldwide

12:25 – Percent of automobiles sold which will be electric by 2030

12:34 – What goes into electric car batteries

12:46 – The copper needed in electric car batteries is a bottleneck

13:18 – The crisis in Europe is economic suicide

13:37 – Sanctions on Russia

13:40 – Russia oil exports

13:48 – Germany and natural gas from Russia

13:56 – German labor costs

14:04 – Germany’s low cost natural gas replaced with market-cost LNG

14:11 – German breweries to close

14:26 – Italy’s massive drought

14:34 – France nuclear reactors and drought impacts

14:40 – Rhine River low water levels affecting transport

15:20 – Russian stance – WWII, Invasion by Napoleon

15:46 – Forward price for electricity in Germany is 10x higher than 10 years ago

16:23 – Europe has no other option than to obtain Russian energy

16:35 – Europe’s relationship with Russia

16:44 – The fight between China and the U.S. for global supremacy

16:45 – China largest exporter of green energy

17:09 – Emmanuel Macron cohabitation with the Left and the Right

17:22 – The fall of Boris Johnson

17:54 – The Russian invasion into Ukraine and energy awareness

18:24 – Limits to materials growth

18:46 – Causes of WWI and resulting destruction

19:09 – German and Russian mobilization readiness in WWI

19:28 – Nancy Pelosi visit to Taiwan

19:32 – Republican representatives visit to Taiwan

19:42 – Japan’s access to oil cutoff in 1941

19:58 – John Mearsheimer “The Tragedy of Great Power Politics”

20:12 – The G7

20:30 – Growth in global energy use

20:54 – Vaclav Smil “How the World Really Works”

21:00 – Ammonia is responsible for 4-5 Billion people on Earth [“Population Growth and Nitrogen”]

21:12 – Impacts due to curtailment of fertilizer and natural gas

21:35 – Joe Tainter Works + Info

21:44 – Complexity

21:53 – Availability of natural gas and oil in the world

22:05 – Scottish farmers not using fertilizer due to high cost

22:35 – Natural gas market from bearish to bullish

22:44 – Natural gas should sell on btu basis like oil

23:26 – Financial claims on biophysical reality

23:36 – We create more money rather than tighten our belts

24:03 – Democracy, subsidies, and demand

24:54 – The energy equivalent to one barrel of oil

25:35 – Scenario Planning

26:24 – Covid vaccination rates and Covid variants

26:35 – Long Covid

26:42 – Decline in productivity due to Covid and airline shortages

27:11 – Economic stagnation

27:24 – Democracy vs Authoritarianism

27:37 – Darwinian thesis of economic growth

28:37 – Americans use 4x more energy than world average

28:49 – Loss aversion

29:17 – 1978 Shah of Iran overthrown

29:33 – Gasoline station lines in the 1970s

30:27 – Cochlear implant

31:00 – 2002 500-year flood in Eastern Europe

31:21 – Global climate extremes

31:44 – Financial overshoot

32:08 – Climate impact to water cooled nuclear power plants in China

32:37 – Florida building and hurricanes

33:03 – Potential for San Francisco Bay to flood

33:12 – Half of U.S. vegetables produced in CA

33:21 – Energy descent and Finland

34:30 – Barry Lynn and supply chain management

34:42 – Localization

34:51 – Outsourcing and downsizing

37:13 – “The Lessons of History” by Will Durant and Ariel Durant

38:11 – 1970s “Supply-siders”

38:34 – Signs of wealth distribution – PBOC (People’s Bank of China) and 25% wage increases, Xi JinPing, Occupy Wall Street, Brexit, President Donald J Trump

39:42 – Arnold Toynbee book “A Study of History”

40:53 – History of invasions into Russia and WWII Russian death toll

41:10 – Negative interest rates and negative yield

41:51 – The Federal Reserve

42:43 – Financial repression after WWII

43:13 – 2021 US debt to GDP

43:26 – The supply-side solution

44:20 – 1989 Japanese bubble burst

44:36 – Chinese “property bubble”

45:00 – Yield curve control – nationalizing the bond market

45:17 – Late 1990s and short JGBs

45:43 – Shinzo Abe and deflationary monetary policy

45:57 – Japan and population peak

46:55 – Japan’s yield differential between JGB and 10 year treasury is large

47:33 – US is 85% energy independent but Japan, Europe and UK import a large % of their energy

48:02 – Fiat currencies

48:17 – US Treasury dependency on capital gains taxes

48:27 – US trade deficit last 50 years

48:33 – Charles de Gaulle and “exorbitant privilege”

48:43 – Current US debt to foreign countries

48:50 – Freezing of Russian foreign exchange reserves

49:52 – EU crisis

50:10 – Stocks are a measure of the flow of money in and out of them

50:49 – Ray Kurzweil’s book “The Singularity is Near: When Humans Transcend Biology”

51:17 – Identity politics

51:34 – Blaise Pascal

51:48 – Canals in Venice clear after Covid

52:12 – The dangers of AI

52:27 – The complexity of technology’s rapid advance

53:09 – Arnold Toynbee, Joseph Tainter, Vaclav Smil

54:14 – Zbigniew Brzezinski

54:35 – Agreement made between Vladimir Putin and Xi Jinping before the Olympics

54:52 – World land mass once controlled by Europe

55:07 – Opium addiction in China

55:15 – The Congo

55:40 – BRICS and the countries wanting to join

55:56 – Shanghai Cooperation Organisation

56:17 – Henry Kissinger and a new world order

56:19 – Treaty of Westphalia and the European world order

56:36 – Dollar based hegemony

56:54 – Afghanistan’s frozen foreign reserves and China

57:55 – Xi Jinping visit to Saudi Arabia

58:42 – Tar sands

59:02 – US benefits from WWI and WWII

1:01:51 – Crack-Up Boom and Ludwig von Mises

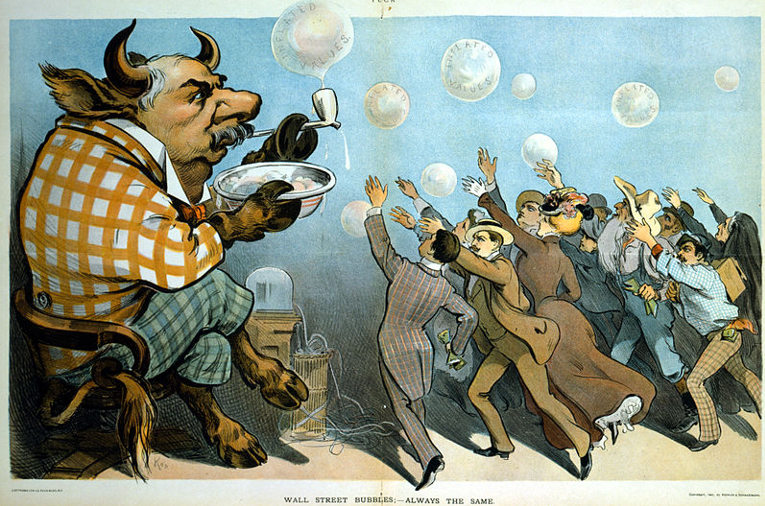

1:02:48 – Bear Market, Bull Market, Meme stocks

1:03:15 – Inflation is really 15%, shrinkflation

1:05:08 – Empathic understanding

1:05:32 – Japanese invasion of Nanking

1:05:55 – Pope’s visit to Canada to apologize to indigineous people

1:06:15 – Siddhārtha quote

1:06:58 – His Holiness the 14th Dalai Lama

1:07:14 – The basic tenets of Buddhism

1:07:36 – Pandemic in the U.S.

1:07:51 – Coca Cola and WWII

1:09:08 – Debt from climate-induced hurricanes

1:09:53 – Mahatma Gandhi

1:10:08 – Capitalism and fairness

1:10:51 – The Age of Aquarius and becoming a more enlightened species

1:14:22 – “A Clockwork Orange” book by Anthony Burgess

1:15:04 – Education about Auschwitz

1:16:43 – Who we are, how we got here, how things fit together

1:17:07 – George Orwell

Teaser photo credit: By EDF Energy, Attribution, https://commons.wikimedia.org/w/index.php?curid=94779379