One of the reasons I gave up on journalism 30 years ago, or maybe journalism gave up on me, was because of what I came to think of as ‘chicken likken’ journalism. Journalists were very good at describing what was going on, but not as interested as they should have been on why that was happening—even on a programme like Channel 4 News, which had set out to be better at doing this.

The current UK energy crisis has brought all of this to mind. The sky is falling in, but the level of analysis as to why and what might be done about it has been woeful. (There are one or two exceptions, which I’ll come to later).

This is the first of two posts on this subject.

Spiking price caps

If you’ve been under a rock for the past six months, however: the UK energy “price cap”, set by the regulator Ofgem as a measure of consumer protection (it’s worth reminding ourselves of this), is due to rise from around £1,277 in March this year to £3,549 in October, and potentially circa £4,000, or more, in the first half of 2023. The result of this is likely to be a spike in both “fuel poverty” and, well, poverty, in the UK.

We’re well past the stage where some household efficiencies might make a difference, as Moneysaving Expert’s Martin Lewis pointed out in an interview. And so far, the government’s response has been minimal. It’s almost as if a market-based system that stops behaving like a market in an economics textbook is just too baffling for them. The responses by the Opposition parties have tried to deal with the pain, but not in a way that deals with the underlying problem.

So let’s go back to a few first principles for a moment.

Incoherent and inconsistent

Dieter Helm summarised the state of the UK energy market in a paper in April:

Consumers are paying too much, the system lacks resilience, the supply market has witnessed 28 bankruptcies and one nationalisation, and the 2035 target for decarbonising electricity looks ever more unlikely to be achieved.

It is a mess both for fundamental reasons – there is no coherent and consistent energy policy – and for immediate reasons, connected to the morass of ever more complex interventions. To use the familiar expression, we are in a hole of mostly our own making, and we keep digging at an ever more frantic pace.

The limits of markets

I’m not sure about some of his remedies, but as he also notes, the objectives of energy policy aren’t that complicated:

Energy policy is not rocket science. It is about achieving core objectives – security of supply and decarbonisation – and achieving them at the lowest cost. Neither will be met by purely private markets, since the former is a public good and carbon is an externality not properly integrated in competitive markets. Furthermore, energy is a primary good for citizens: not to have energy deprives people and businesses from access to the wider economy and to society. It is a core USO: a Universal Service Obligation. That is why energy cannot be treated like any other commodity.

In terms of achieving these objectives—energy security plus decarbonisation, in a cost-effective way—the political focus on the price cap is a bit of a distraction. (Though obviously it’s not a distraction for consumers.)

‘Consumer harm’

So it’s worth reminding ourselves what the price cap is. The principle of price capping is completely linked to the need to regulate businesses in monopolistic markets where they may otherwise be tempted to be unscrupulous. The price cap mechanism comes from a view of market regulation and competition policy that views the only source of failure in such markets as being a matter of “consumer detriment” or “consumer harm”.

In other words, it is straight out of Robert Bork and the “Chicago School”. I don’t have enough space for this point here, but Bork’s reinterpretation of American competition law under Ronald Reagan in the 1980s was an important step in reducing the political limits placed on corporations.

Handmaiden to privatisation

The price cap is of a similar vintage—it was developed by the UK Treasury, mostly by the economist Stephen Littlechild—as a handmaiden to the whole Conservative privatisation programme, which largely involved selling natural monopolies into the private sector.*

The reason that the price cap came into the energy sector is also relevant to this discussion. When she was Prime Minister, Theresa May became concerned that consumers who didn’t switch suppliers or negotiate fixed-price arrangements were being disadvantaged—or perhaps more exactly, exploited, by their suppliers. So the reason we have a price cap at all is as a constraint on the tendency of utility retailers to be rapacious.

Retail prices

But, as Karen Turner reminded us at The Conversation, the price cap had nothing to say on energy producers or energy wholesalers.

(T)his protection is only in terms of ensuring people pay a “fair” retail market price (even if relative to an unfair or unaffordable wider energy market), with bills falling when suppliers’ costs do. But there are two crucial points. First, the price cap doesn’t apply further upstream, where energy is actually produced and where most of the price rise comes from. Second, it was never designed to keep gas and electricity affordable or to offer any specific protection for those in danger of slipping into fuel poverty.

It’s also worth noting that the cap isn’t actually a cap—it’s a ceiling on the bill of an average household. There’s also no protection in the system for businesses, many of whom currently face ruin if energy prices aren’t constrained.

Ideology at work

I’m labouring this point slightly to make it clear that the ‘price cap’ is not a neutral mechanism. It was constructed from a particular ideological perspective to justify a particular set of political and economic arrangements.

Either way, when the Opposition parties propose solutions to the current crisis that take the price-cap as a given (as both Labour and the Liberal Democrats have done), they are accepting a whole set of political arrangements that are not politically or economically neutral.

Littlechild later became the Director General of the Ofgem forerunner OFFER, which tells you something about the revolving door that the privatisation programme created for policy-makers and politicians between the public and the private sector. (This also creates misaligned incentives in policy discussions about the whole privatised utility sector).

Strategic significance

Anyway, the other important point here is that a sector that has strategic significance and is central to a core government objective (Net Zero) is not best managed through a mechanism that is designed to manage for “consumer detriment”.

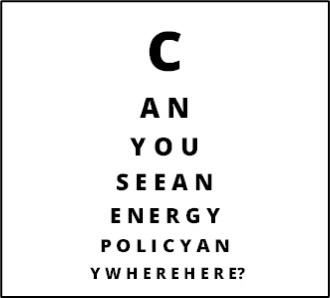

One of the implications of this was pointed out entertainingly in a couple of illustrations to Dieter Helm’s article. Here’s the first one:

Source: Dieter Helm

The second one is a hard-to-read list of all of the schemes and mechanisms that the government has used to influence the market:

‘Managing’ the energy market. Source: Dieter Helm

A serious point sits behind this, however, as Helm notes:

No energy policy with this degree of complexity could work if no one understands it all and if no one can name the policies, let alone the details. It is worse than this. Complexity is a lobbyist’s utopia. Engaged in each consultation, clear about the single aims of its vested interest, able to engage in each and every consultation, able to brief MPs, the media and the ministers, and sow doubt where interests are threatened, it is no wonder that the energy sector is now close to resembling that of agriculture, captured by the core interests.

The final point here is about incentives. There’s a gap here between efficiency and resilience—or even just between efficiency and effectiveness.

Increasing their returns

Market-led companies, even in well-regulated markets, seek to increase their returns by whatever means they can, mostly but not always lawfully. Lawful methods, in a price-capped system, include skimping on investment. Yes, there’s an assumption in the price cap that it incentivises investment because at least in theory it’s a way to reduce your costs, but that’s not actually what happens in financialised systems.

The demands of security and long-term benefits require different forms of management. This is the distinction that Jane Jacobs makes in her book Systems of Survival between Guardians and Traders. (I have written about this before.)

Clearly in the middle to long term we need to move towards a system that rebalances the whole energy system towards security—both the security of users and the security of the planet. But in the short term, we’re staring at an economic and humanitarian catastrophe, and to fix this in the few months we have we have to work with the system we have.

That’s the subject of the second half of this post.

———————

* It may not be coincidence that Littlechild has written recently on the price cap for the Telegraph. He’s not a fan, but not for the reasons you might imagine. He has also contributed articles to the hawkishly pro-market Institute of Economic Affairs, mostly on the theme of how to make privatised markets “competitive”.

Teaser photo credit: Pylons, by Mat Fascione. CC BY-SA 2.0