- As of November 17, the combined wealth of 647 U.S. billionaires increased by almost $960 billion since mid-March, the beginning of the pandemic lockdown—an increase of nearly $1 trillion in less than a year.

- Since March, there are 33 new billionaires in the U.S.

- Driving this exploding inequality are 12 companies whose profits are coming at the expense of workers and communities. These “Delinquent Dozen” companies are emblematic of the corporate greed that has grown rampant over the last 40 years.

- They include retailers like Walmart, Amazon, Target, and Dollar Tree and Dollar Store, gig economy companies like Instacart, and food producers like Tyson Foods.

- Also included is the investment giant BlackRock and private equity firms like Leonard Green Partners, Blackstone, Kohlberg, Kravis Roberts & Co, Cerberus Capital, BC Partners, and CVC Capital Partners.

- These private equity firms own several essential health care, grocery, and pet supply companies. Their business model of extreme cost cutting and debt loading to squeeze extra profits is fundamentally incompatible with protecting workers and communities during a pandemic.

- Ten billionaire owners of Delinquent Dozen companies have a combined worth of $433 billion. Since March 18, their combined personal wealth has ballooned by $127.5 billion, a 42 percent increase. These ten billionaires are Jeff Bezos (Amazon), Alice, Rob, and Jim Walton (Walmart), Apoorva Mehta (Instacart), John Tyson (Tyson Foods), Steve Schwarzman (Blackstone), Henry Kravis and George Roberts (KKR), and Steve Feinberg (Cerberus).

Billionaire Wealth Increasing During Pandemic

1. Walmart

Three owners of Walmart — Rob, Jim, and Alice Walton — have seen their combined personal wealth increase over $48 billion. In 2018, Walmart’s CEO Doug McMillion made 1,118 times the pay of Walmart’s median worker. Yet Walmart refuses to provide hazard pay to its workers.

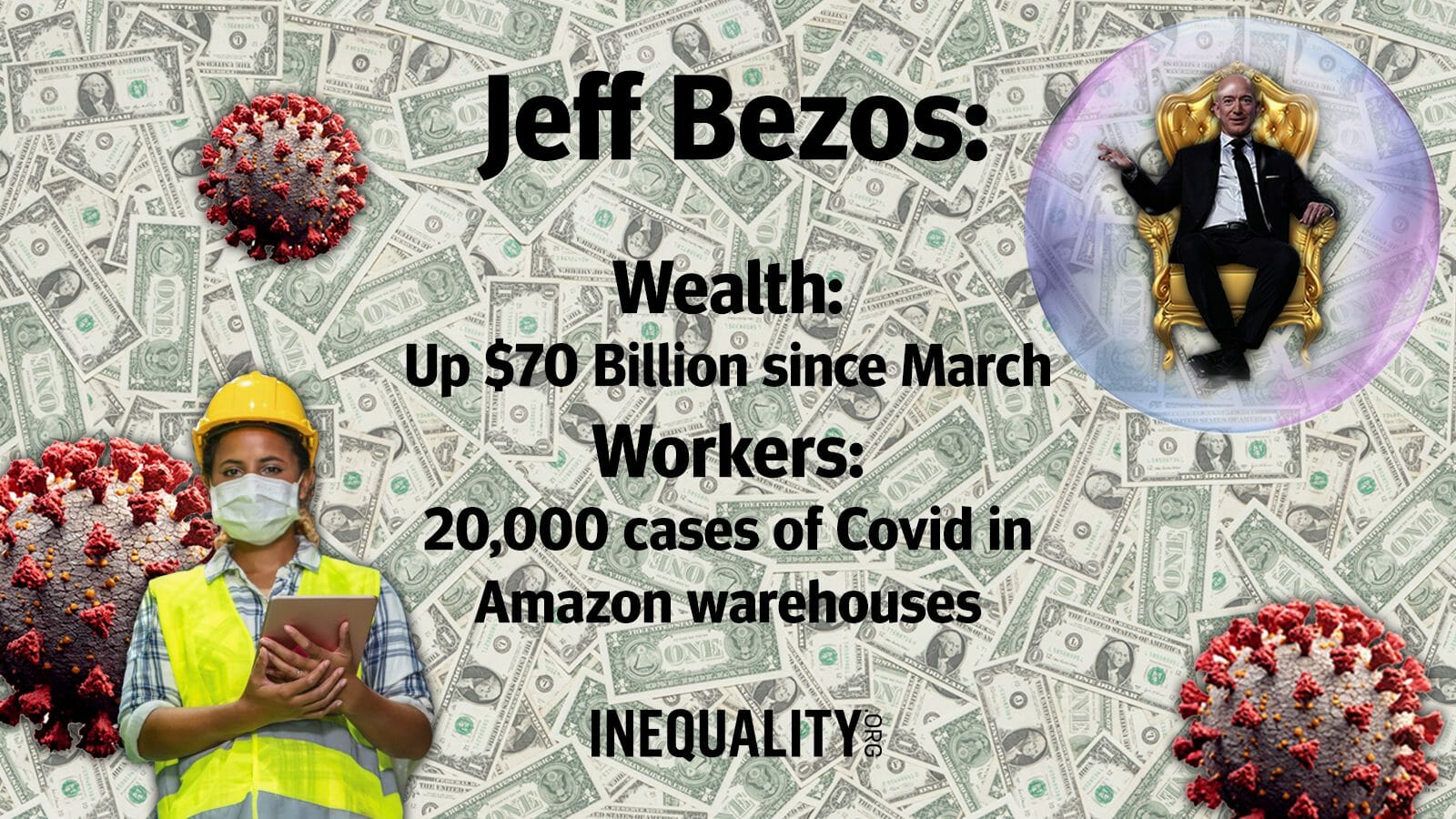

2. Amazon

The wealth of Amazon’s Jeff Bezos has increased by 62 percent since mid-March, totaling $188.3 billion as of November 17. Bezos is now the richest person on earth. Meanwhile an estimated 20,000 Amazon workers have been infected with COVID-19.

3. Instacart

CEO and founder Apoorva Mehta became an instant billionaire in June 2020. Yet Instacart has over-hired 300,000 new workers and failed to provide sufficient protections.

4. Tyson Foods

John H. Tyson, the billionaire owner of Tyson Foods, has seen his personal wealth increase over $600 million since the beginning of the pandemic. Meanwhile an estimated 11,000 Tyson workers have been infected with COVID-19.

5. Target

Target CEO Brian Cornell is paid 821 times the median worker at Target. The company has enjoyed a protected status as its competition was shut down during the pandemic as “nonessential.”The company enacted an already promised $2 increase in its starting wage, but also cut the pay of its Target-owned Shipt delivery workers.

6. Dollar General and Dollar Tree (BlackRock Investment)

Dollar Tree CEO Gary Philbin is paid 690 times his median paid worker.Dollar General CEO Todd Vasos is paid 824 times his median paid worker.The companies have profited tremendously during the pandemic, but understaffed stores and skimpy security pose some of the many risks to workers — including an increase in assaults when Dollar Store workers were attacked for asking customers to wear masks. The investment fund giant BlackRock has a large ownership stake in both companies.

7. Leonard Green Partners (Prospect Health)

Leonard Green Partners owns Prospect Medical Holdings, a major owner of hospitals. A number of investigations of Prospect Medical have found poor infection control and maintenance at their facilities. Workers at Prospect have been pressing for better infection protections, hazard pay, and safer working conditions. Over the last several years, Leonard Green has also saddled Prospect Medical with debt while paying dividends to shareholders.

8. Blackstone (TeamHealth)

Private equity giant Blackstone owns TeamHealth, a company that demoted a whistleblower doctor who went public about the company’s lack of COVID-19 safety precautions and aggressive cost-cutting. Blackstone founder and CEO Steve Schwartzman has seen his personal wealth increase $4.1 billion since the beginning of the pandemic.

9. Kohlberg, Kravis Roberts & Co. (Envision Health)

Henry R. Kravis and George R. Roberts, the two billionaire owners of the private equity giant Kohlberg, Kravis, Roberts & Co. (KKR), have seen their wealth increase almost $3 billion since the beginning of the pandemic.

KKR owns Envision HealthCare. In April 2020, Envision announced it was withholding some pay for doctors, between $4 million to $5 million per practice for a group of about 16 to 30 doctors. During the same month, the President of Emergency Medicine reported a growing number of Envision doctors under quarantine.

10. Cerberus Capital (Albertsons, Safeway, and Steward Health)

Cerberus Capital owns a number of companies with frontline essential workers, including Albertsons and Safeway supermarkets and Steward Health Care.Steve Feinberg, the billionaire cofounder of the private equity firm, has seen his personal wealth increase $276 million since the beginning of the pandemic.

In June 2020, a group of Steward Health doctors purchased a controlling stake in Steward from Cerberus. Prior to that, the private equity giant drew fire for shutting down intensive care units in rural Massachusetts and failing to provide sufficient PPE equipment.

Meanwhile, Safeway markets had initial hazard pay that ended in June. Since then, COVID-19 infections have increased 161 percent in Safeway stores.

11. BC Partners (PetSmart)

The UK-based BC Partners owns the pet supply company PetSmart, which benefited from its designation as an essential business. But that didn’t stop PetSmart from furloughing and then permanently terminating workers across the U.S., causing them to lose health insurance and incomes.

12. CVC Capital Partners (Petco)

CVC Capital Partners owns the pet supply company PetCo, another essential business. CVC Partners just announced it is looking to take PetCo public with a valuation of $6 billion, even with worker reports of serious health and safety issues.

Recommendations

Corporations and their billionaire owners and investors have the responsibility — and more than enough resources — to protect their employees during this extraordinary time. They must commit the resources necessary to put essential workers’ and their communities’ health and safety first.

Corporations employing essential workers must:

- Immediately implement hazard pay of at least an extra $5 per hour.

- Provide substantial paid sick leave benefits for workers to stay home when ill, quarantine when exposed, and care for sick loved ones, as well as paid bereavement leave for those who have had family members die from COVID-19.

- Provide, regularly replace, and upgrade high quality personal protective equipment (PPE) at no cost to all their essential workers.

- Establish workplace health councils to enable workers to participate actively in monitoring workplace conditions.

To protect essential workers, policy makers must:

- Establish a Presidential Commission on Essential Workers with on-the-ground, diverse worker representation.

- Pass an Essential Workers Bill of Rights developed in collaboration with workers’ organizations at the local, state, and federal levels.

- Legislate the creation of workplace health councils so workers can monitor and participate in the enforcement of compliance with health and safety regulations and guidance.

To rein in pandemic profiteering, policy makers must:

- Levy an Emergency Pandemic Wealth Tax on billionaires to raise $450 billion and fund protections for essential workers.

- Establish a Pandemic Profiteering Oversight Committee that goes beyond oversight of stimulus funds.

- Impose conditions on corporations receiving federal pandemic financial support, including the requirement to retain workers, preserve worker rights, and institute policies and procedures to protect workers from exposure to the virus.

- Pass the Stop Wall Street Looting Act (SWSLA) to eliminate the “carried interest” loophole that enables private equity and hedge fund billionaires to pay lower tax rates.