As eviction moratoriums around the United States come to an end, it is expected that landlords will begin evicting nonpaying tenants en masse. Eviction by itself is an unremarkable phenomenon in America. Some 900,000 per year have been occurring routinely in the last several years affecting about 2.3 million people annually.

The scale this time is different. No one knows exactly how things will play out in the United States (or elsewhere for that matter). But, barring new moratoriums on eviction one estimate suggests 23 million people will be subject to eviction by the end of September, more than 10 times the number for an entire year.

Where all those households would go is a puzzling question as the limited space in facilities for the homeless could never hold them. And, given the continuing coronavirus pandemic, those facilities that are observing proper social distancing have had to limit their capacity.

Perhaps the U.S. Congress will come to its senses and pass aid for renters just as it has done for businesses. I am doubtful about such prospects.

But, I am also interested in another important question: Who will replace evicted tenants? Here the problem of correlation looms large. Generally speaking, landlords don’t worry too much if Joe in apartment 238 and Sally in apartment 424 both lose their jobs. Their job losses are usually related to their specific circumstances, a company moving its operations or a firing due to poor performance. These losses are uncorrelated to the situations of other tenants. There will therefore be paying tenants to take the place of Joe and Sally should the landlord have to evict them.

But in the current situation, Joe and Sally are not the only two losing jobs. Their job loss is correlated with very large general job losses across the economy due to the pandemic and the crash in the economy. So, if landlords evict many current tenants for not paying their rent, who will show up to take the empty apartments and actually be able to pay?

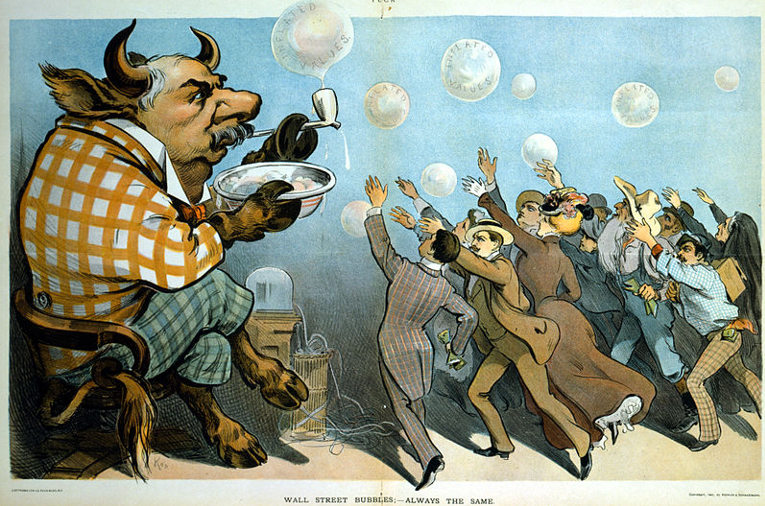

Correlation is an important concept in managing risk. And risk management around the world has included either explicitly or implicitly a reliance on the idea of uncorrelated events. This kind of thinking has left us wholly unprepared for what is happening now as practically every event social, political and economic is shaped by the pandemic and the economic catastrophe that has accompanied it. In March stocks, real estate, gold, silver, copper, soybeans, sugar and many other commodities all streaked downward as the world economy crashed. Only the highest quality bonds rose in price. Nearly everything became correlated. Wide diversification (except in high-quality bonds) didn’t matter.

We’d like to convince ourselves that such correlated catastrophes happen so rarely that we don’t need to worry about them. But the dramatic and deep effects such occurrences have suggest otherwise.

We may say it is “inefficient” to create enough excess capacity and diversity in our world system to help us endure such infrequent storms. But the main question is not whether they are infrequent, but whether, when they arrive, they can be ruinous—ruinous in ways that would make it difficult for our society to function at a high level afterwards. For lack of preparation this time around, we are now running a real-time experiment that will tell us whether preparation, perhaps expensive preparation, would have been worth it.

How could we, then, construct a society that is not subject to this kind of ruin? Decentralization would be at the heart of such a society. In finance we have very large banks and investment funds which now dominate the world financial system. Even a small number of failures could lead to a collapse of the entire banking system, one which is concentrated and tightly networked in ways that lead to cascades across the entire globe when failures occur. Many smaller banks not so tightly networked would be “inefficient” but far more resilient in the face of a major shock.

In manufacturing we have concentrated much of the world’s production in China. When something major goes wrong—a pandemic comes to mind—supply lines quickly deteriorate and production and commerce around the world are deeply affected. Making things closer to where they are used is an idea that is starting to be taken seriously. In fact, we may be on a bumpy road to deglobalization of manufacturing supply chains as the fragility of those chains is now creating enormous headaches and costs for companies.

Likewise in agriculture, a few large exporters provide the balance of practically every major agricultural product to the rest of the world. (Click on any product listed on the linked page to see this.) We have concentrated production of major grains and other agricultural products in ways that make our food supply vulnerable to disruption. A poor wheat harvest in the Russian Federation and one other large exporter could mean major disruptions in the wheat market.

Yet, the idea of becoming largely self-sufficient in food for a country or a region is not even being seriously considered because it would be “inefficient.”

I could give many more examples. The idea is that a robust worldwide system would contain much more diversity in finance, manufacturing and agriculture in each country or region than it now does. Political and economic systems would be designed to insure this rather than discourage it.

We cannot do a genuine comparison of a system built along these lines and our current one by replaying recent events to see which system fares best. But logic would dictate that a much more regionally and locally diverse system would have fared much better with far fewer disruptions. Using a concept introduced earlier, these regional and local systems would be far more uncorrelated than the current system.

The logic of modern finance capitalism, however, seeks to concentrate wealth in the hands of the few. This can only be done by concentrating finance, industry and agriculture in ways that are amenable to control by financial interests. As such, this logic runs counter to what constitutes a robust system. Finance capitalism thus creates the conditions for its own demise as the systems it builds become more and more fragile and correlated in their operation because they increasingly march exclusively to the drumbeat of financial actors (and fewer and fewer of those over time).

I believe that there is yet great turmoil ahead. We are unlikely to return to the system of finance capitalism which is crumbling before our eyes. The new systems that will be put into place will not be an accident. Governments and people in their daily lives (by their actions and purchases) are making decisions about those new systems consciously or not. If we want more robust systems, we cannot just hope for them. To whatever extent we can, we must participate in the remaking of the world that is now proceeding apace around us.

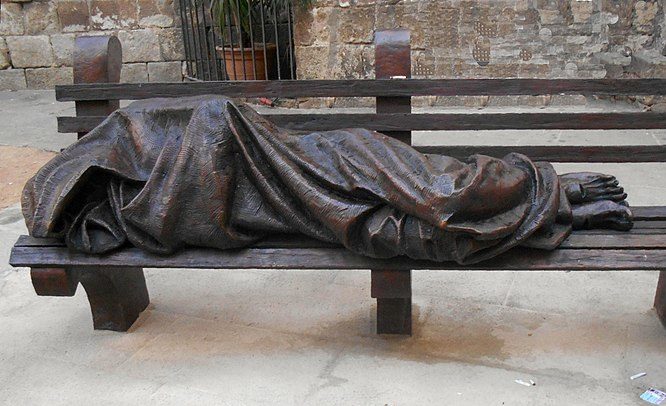

Photo: “Homeless Jesus, also known as Jesus the Homeless, is a bronze sculpture by Canadian sculptor Timothy Schmalz depicting Jesus as a homeless person, sleeping on a park bench. The original sculpture was installed at Regis College, University of Toronto, in early 2013. Other casts have since been installed and blessed in many places across the world.” (Wikipedia)

This statue is in Barcelona via Wikimedia Commons https://commons.wikimedia.org/wiki/File:Jesus_Homeless_BCN_1b.jpg