The systems which underpin our lives are increasingly brittle and face growing array of intensifying pressures, we must prepare.

In China the circulation of people, goods and services has slowed and fragmented. An already weakening economy is now experiencing a major shock through the networks that sustain human welfare and societal functioning. Energy consumption is the most fundamental measure of economic activity and socio-economic complexity. Carbon Brief[i] has estimated that energy use was 25% below expectations in the two weeks following the end of the New Year holiday equivalent to the energy drop that occurred between 2012 and 2018 as Venezuela’s economy and society underwent its profound crisis[ii].

The longer the economy is undermined, the deeper the damage and the slower any recovery. Even if COVID-19 was to vanish this moment, the shock would ripple on as indebtedness, bankruptcy, lost purchasing power, and supply-chain choke points continued to drag on recovery.

The government will no-doubt do everything they can to support businesses and the banking system with credit and stimulus, adding yet more debt to an already overindebted system. That will constrain future economic growth, increase the likelihood of future financial crises, and make the country less resilient to the next shock, from whatever the source. It is also straining political legitimacy, adding further uncertainty.

China’s centrality to global systems integration is being vividly demonstrated as viral, supply-chain, demand, information and financial system contagion transmit through global society. The emergence of new infection epicentres and containment measures open additional sources of contagion processes. The emergence of multiple intensifying and interacting cascading processes generates fundamental uncertainty, with attendant growing tail risks. Economic models are largely blind to the structure of very large cascading shocks and will tend to underestimate impacts.

This shock is propagating through a global economy that prior to the virus had declining resilience and adaptive capacity. Weakening economic growth, ever-growing indebtedness, increased tensions within and between countries, and the growing potential for shocks from climate and environmental change, and resource constraints and disruptions, mean we were already in uncertain and dangerous territory. The warning in January 2020 by Kristalina Georgieva, the head of the International Monetary Fund, that the global economy risks the return of the Great Depression, surprised few[iii]. It’s no longer the preserve of peripheral Cassandras to warn of escalating systemic risk.

The extent of the damage this will do to the economy and society is unclear. Beyond the impact on health and healthcare systems, it exposes the web of synchronized social and economic conditions that constitute the operational conditions of our day-to-day lives. That we take them for granted is a measure of our habituation to systemic stability. The more that this is disrupted by the direct and indirect impacts of the pandemic, the greater the potential for further disruption. This is true at scales from the local to global. The inherent uncertainty reflects our ignorance of the complexity of our dependencies, and our behavioural and cultural adaptation to those conditions.

Slower global growth and an increase in the likelihood of a financial crisis can be expected. If process contagion begins to accelerate significantly, there are limits on how much governments and central banks can do to respond. Injecting stimulus can address a demand shock, but it would have limited supply-side effectiveness. Assuming a deeper shock (equivalent to the 2% GDP contraction during the Global Financial Crisis) followed by stabilization, society and economies will be left less resilient as it faces the increasingly turbulent years ahead.

At the furthest extreme there is runaway process contagion. In such a case supply-chain contagion (broadly defined, including impacting critical infrastructure services, for example) would begin to severely undermine global socio-economic integration and coherence. As it disintegrated and the forward-looking outlook became more uncertain, the failing financial system (credit, bank solvency, monetary stability and visibility, counter-party risk) would disrupt further supply-chains inducing a re-enforcing (positive feedback) supply-chain financial-system cross-contagion[iv]. No central bank can maintain a credit-monetary system if it’s core collateral, the expectation of economic production is opaque and collapsing in real-time. Beyond a tipping point, this could accelerate rapidly. It would effectively shut-down the flow of goods and services. Were this to happen, it would be a global catastrophe of unprecedented scale and duration.

This latter outcome is very unlikely.

There are two elements that can be seen in the overview above. The first is related to the structure of civilisation, societal vulnerability, and the potential for contagion, and in extremis, collapse. The second is that society for broader reasons is losing resilience to shocks, while stressors, environmental and socio-economic, are growing in range and intensity. This means societal systems may have entered a period of sustained global destabilization, coupled to an increasing likelihood of catastrophic systems failure. It is to these elements that we now briefly turn our attention to.

Dependency and Systemic Vulnerability

We have become ever-more part of a singular civilizational organism that has grown in scale, complexity, interdependence, and speed. As it has evolved, it has optimized towards growth, efficiency and self-stabilization. People, organisations, businesses, and countries can design and influence it in parts, but the whole is the emergent outcome of many interactions evolving over time. There’s nobody in control. It is these structural and dynamical properties that define societal stability, resilience, vulnerability, the propensity to contagion processes, global systemic destabilization, and collapse dynamics.

Our ability to sustain our basic needs anywhere, now depends upon system integration everywhere. That means no infrastructure, society or country can be fully resilient as the conditions that maintain function are dispersed beyond visibility or control.

To get a sense of why complexity can amplify a societal shock, consider sophisticated surgery that requires the skills of five distinct specialists working in concert. If just one surgeon is incapacitated, the whole operation must be stopped, they can’t just do 80% of the procedure. This vulnerability to the weakest link (sometimes called Liebig’s Law of the Minimum) becomes more acute as businesses, critical infrastructures and public bodies depend upon increasing numbers of specialized roles and inputs that are essential for the output of the whole. As those outputs, be they goods or services, may be necessary inputs into other businesses and services, failure can cascade, even shutting organisations where everybody is available.

Because society depends upon multiple interacting networks, within cities and across the globe, there are many routes to cascading disruption. This is an example of non-linearity- a relatively small number of directly impacted people or functions can still cause the failure of a whole system. The speed of our societal processes, from Just-in-Time logistics to financial transactions means that shocks can rapidly cascade.

We can think of society as an ecosystem, with keystone species providing the structural anchors through which society functions. Such keystones include critical infrastructure (the grid, telecommunications, water and sanitation etc.); the financial system; societal cohesion; supply-chains, and environmental inputs (food, oil, water etc.). These are also interdependent with each other, if you remove any one of them, the others will topple. This allows us to see other paths toward systemic failure.

A severe solar storm, natural disaster, or a major physical-cyber-attack on the grid provides one avenue to large-scale critical infrastructure failure. The President’s National Infrastructure Advisory Council 2018 report[v] examined the United States preparedness for a prolonged wide-area catastrophic power outage. Again, it would undermine societal integration and lifeline operations. Depending upon the centrality of the impacted region/ networks to global systems integration, it could drive global process contagion and systemic failure. Growing international tensions are therefore adding to this risk. A massive cyber-attack or war between parties with high global centrality becomes everybody’s problem- even the toe is in trouble if the heart goes to war with the liver.

The global financial system is also an increasing source of catastrophic risk, it’s the operating system for the flow of goods and services. It is massively overindebted (there are far more claims on future economic growth than can ever be delivered) and it is losing resilience as monetary policy becomes less effective, and polarization within countries and discord between them intensifies. Indeed, this is what is increasing general vulnerability to supply-chain contagion from a pandemic or other catastrophic shock. It now faces the convergence of growing climate change and environment related impacts, multi-dimensional threats to food security, potential critical resource constraints, and the feedback of those stressors on socio-political stability and conflict. A global financial system collapse would be similar to a catastrophic pandemic collapse, just an inversion of the initiating shock- a financial-system supply-chain cross-contagion.

Pandemic risk is also growing. It may not be COVID-19 but someday, somewhere, a virus with high infectivity and virulence will emerge with potentially catastrophic consequences for our species. Urbanization, a large-scale animal food industry, intensive transportation networks, advances in widely accessible biotechnology, our increasing incursion into animal habitats, the expanding impacts of climate and environmental change, and the growing likelihood of socio-political instability are increasing the likelihood of such an emergence.

The Age of Destabilization

The recovery from the COVID-19 shock will be slow. In addition, there is potential for further pandemic waves. It may also contribute to the generation of new stresses and shocks later in the year. For example, the disruptions to agricultural production in China and elsewhere (due to COVID-19), Australia[vi] (drought influenced by climate change), East Africa (locust plague influenced by climate change) is more likely to be further compounded by other climate impacts as yet unrealised[vii]. A rise in the cost of staples on global food markets is more likely to drive social unrest and even state failure in poorer countries[viii], generating new stresses through global systems. This would increase stress even in rich countries, with more of the population struggling to get by, and feeling the effects of a slowing global economy in addition to the economic impacts of COVID-19. It could be expected to squeeze discretionary income, putting further pressure on economies and the financial system, and increase social tensions. This is but one speculative path, there are innumerable potential interactions and a myriad of potential tail risks.

Whatever path the global economy takes in the next year, it will bequeath an even more fragile economic and financial system that is already facing mounting risks from climate change related impacts[ix]. There are increasing risks to global food production with many drivers in addition to climate change[x]. The multi-dimensional impacts of declining biodiversity to socio-economic stability are accelerating[xi]. The security impacts of climate change are growing[xii], while societal polarization and loss of trust continues[xiii]. Though receiving little attention and much misunderstood, there are major reasons to be concerned about the ability to sustain affordable oil production[xiv].

Food, oil, water, a functioning financial system, a stable environment for societal infrastructures (relative to the conditions in which they evolved), and large-scale societal cooperation are individually critical for the stability of global systems integration. We are seeing intensifying stresses on all fronts. Further, stresses in each will tend to further increase pressures on the others.

These stressors are intensifying their interactions through increasingly vulnerable civilizational networks. Society, locked into systems of dependency adaptive to system stability with correspondingly low resilience, is vulnerable to Liebig’s Law. In such an environment, economic growth is persistently undermined, there is increased socio-economic stress, while the intensity and frequency of shocks increases. This creates the conditions for rapid and diverse local and globalised contagion, compounding, simultaneous crises, and the generation of new stresses and shocks. General systemic instability, volatility and uncertainty accelerates, and future expectations become more pessimistic.

The impacts are likely to become more non-linear, with associated tipping points. Losing a thousand euros means different things depending on whether it’s your first, or last. Even more so if your rent is late and eviction beckons, a family member is sick and needs medicine, and those who once might have supported you, be it friends or state, are themselves overwhelmed. Similar scenarios could be drawn for any scale of societal systems.

As the need to build resilience into existing systems becomes more apparent, our capacity to invest -in inventories, flood defenses, and critical infrastructure redundancy is more difficult, as incomes fall, affordable financing becomes scarce or non-existent, and the ability to produce and access constituent inputs becomes uncertain. Further, in an increasingly stressed and volatile environment, the necessity of maintaining existing systems and expectations is more likely to take precedence over investments in future resilience.

For example, our food systems are very vulnerable, but making them more resilient at scale would raise food prices. Yet if food prices are already high due to production/ distribution constraints, and/or if incomes are falling and governments’ intervention capacity is already strained, adding further to food prices risks potentially intensifying present crisis (food prices having highly non-linear societal impacts), to marginally ameliorate a future crisis. In such contexts, people tend to become even more present focused. This is a feature of civilizational lock-in, we become trapped within increasingly dangerous systems of complex dependency as our adaptive capacity becomes further undermined.

Prolonged low and declining growth, rising socio-economic stress and volatility, growing asymmetric downside uncertainty, declining resilience and adaptive capacity and intensifying stressors create the conditions for catastrophic financial system failure.

This means we may have a declining window of opportunity, both in terms of time, and capacity to deploy resources, to prepare ourselves to avoid the very worst of consequences.

Preparing for What?

Societies’ capacities to deal with stress, shocks, and catastrophes are primarily shaped by their historical experiences. This includes the type, likelihood, and impacts that might be anticipated; the resilience of society and infrastructures; the scale and role of contingency and preparedness within the wider government and society; and the range of scenarios that have been planned for and exercised.

Governments, societies, and expert communities are often slow to recognize a changing paradigm, especially when it comes into conflict with established expectations, worldviews, sunk costs, analytic traditions, and institutional lock-in.

Our experience of and habituation to broad societal stability, the relative invisibility of the structural and dynamical foundations of societal operations, dysfunctional economic risk models, and our siloed approach to individual stressors means society may be seriously underestimating global and catastrophic risk. We need to consider our transforming risk environment from an integrated perspective: the interactions of a growing range and intensity of stressors, environmental and socio-economic, through increasingly brittle societal systems[xv].

There are two broad, and concurrent societal risks that have been outlined. The first is systemic failure, which could range from localised and recoverable, to global and irreversible. Because keystone systems are interdependent and can fail collectively, different hazards or combination of them have the same outcome – a shutdown in the flow of goods and services. It is therefore suggested there should be a Hazard Independent Impact Preparedness approach. There is an urgent need for catastrophe planning, exercise and simulation capacity, and deployment.

The second is that we have already entered a period of growing destabilization. There may be no good times just around the corner. This will profoundly challenge societal expectations, government and state capacities. Ideally, we can address some of the challenges of today, while building preparedness for further destabilization and potential future catastrophes. For example, A Whole of Society Preparedness approach brings citizens into the heart of preparedness. The example of Nordic and Baltic countries should give some confidence that this may be a path worth taking. Done wisely, it could even contribute to overcoming some of the polarization affecting societies.

Conclusion

We do not know what the future will bring. Risk is a measure of impact and likelihood. The impacts outlined above could be devastating. We’ve also suggested that the likelihood of destabilization and catastrophic systemic failure is growing. We are manifestly ill-prepared to deal with such consequences. We can hope and work towards kinder futures, but we must also prepare for things going seriously wrong.

Our species rarely anticipates and prepares for novel risks, nor should we expect this to happen now. We need to be able to move forward with preparedness efforts without relying upon wide society buy-in. Facing such challenges head on is an act of optimism. It will require the combined efforts of astute governments, citizens, social organisations, the private sector, and philanthropy. There is nothing else as important, or as urgent.

1 March 2020.

[i] https://www.carbonbrief.org/analysis-coronavirus-has-temporarily-reduced-chinas-co2-emissions-by-a-quarter

[ii] https://www.bp.com/en/global/corporate/energy-economics/energy-charting-tool-desktop.html

[iii] IMF boss says global economy risks return of Great Depression. https://www.theguardian.com/business/2020/jan/17/head-of-imf-says-global-economy-risks-return-of-great-depression.

[iv] Korowicz, D. Trade Off: Financial System Supply-Chain Cross Contagion- a study in global systemic collapse. 2012 Feasta, The Foundation for the Economics of Sustainability. https://www.korowiczhumansystems.com/publications

[v] NIAC Surviving a Catastrophic Power Outage: How to Strengthen the Capabilities of the Nation https://www.cisa.gov/sites/default/files/publications/NIAC%20Catastrophic%20Power%20Outage%20Study_FINAL.pdf

[vi] https://www.reuters.com/article/australia-wheat/update-1-australia-says-2019-20-wheat-harvest-drops-to-lowest-in-12-years-idUSL4N2AI1RS,

[vii] Zscheischler, J., Westra, S., van den Hurk, B.J.J.M. et al. Future climate risk from compound events. Nature Clim Change 8, 469–477 (2018). https://doi.org/10.1038/s41558-018-0156-3

[viii] Marc F. Bellemare, Rising Food Prices, Food Price Volatility, and Social Unrest, American Journal of Agricultural Economics, Volume 97, Issue 1, January 2015, Pages 1–21, https://doi.org/10.1093/ajae/aau038

[ix] Bolton, P. Despres, M. Pereira De Silva, L. Samama, F. Svartzman, R. The Green Swan: Central Banking and Financial Stability in the Age of Climate Change. Banque de France. January 2020. https://www.bis.org/publ/othp31.pdf

[x][x] Mbow, C., C. Rosenzweig, L.G. Barioni, T.G. Benton, M. Herrero, M. Krishnapillai, E. Liwenga, P. Pradhan, M.G. Rivera-Ferre, T. Sapkota, F.N. Tubiello, Y. Xu, 2019: Food Security. In: Climate Change and Land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems [P.R. Shukla, J. Skea, E. Calvo Buendia, V. Masson-Delmotte, H.-O. Pörtner, D.C. Roberts, P. Zhai, R. Slade, S. Connors, R. van Diemen, M. Ferrat, E. Haughey, S. Luz, S. Neogi, M. Pathak, J. Petzold, J. Portugal Pereira, P. Vyas, E. Huntley, K. Kissick, M. Belkacemi, J. Malley, (eds.)]. In press.

[xi] IPBES Global Assessment on Biodiversity and Ecosystem Services May.2019 https://ipbes.net/global-assessment

[xii] “The World Climate and Security Report 2020.” Product of the Expert Group of the International Military Council on Climate and Security. Authors: Steve Brock (CCS), Bastien Alex (IRIS), Oliver-Leighton Barrett (CCS), Francesco Femia (CCS), Shiloh Fetzek (CCS), Sherri Goodman (CCS), Deborah Loomis (CCS), Tom Middendorp (Clingendael), Michel Rademaker (HCSS), Louise van Schaik (Clingendael), Julia Tasse (IRIS), Caitlin Werrell (CCS). Edited by Francesco Femia & Caitlin Werrell. Published by the Center for Climate and Security, and the institute of the Council on Strategic Risks. Feb 2020. https://climateandsecurity.files.wordpress.com/2020/02/a-security-threat-assessment-of-global-climate-change_nsmip_2020_2.pdf

[xiii] Public Trust in Government 1958-2019. Pew Research 2019. https://www.people-press.org/2019/04/11/public-trust-in-government-1958-2019/

[xiv] Michaux, S. Oil from a Critical Raw Materials Perspective. Geological Survey of Finland. 2019. http://tupa.gtk.fi/raportti/arkisto/70_2019.pdf

[xv] Korowicz, D., Calantzopoulos, M. Beyond Resilience: Global Systemic Risk, Systemic Failure, and Societal Responsiveness. 2018. Geneva Global Initiative. https://389781d4-2000-4800-8ff2-c13e64a6aa0c.filesusr.com/ugd/94fdd9_d0ee5f5e0c264527ba423ad920a8bd5c.pdf?index=true

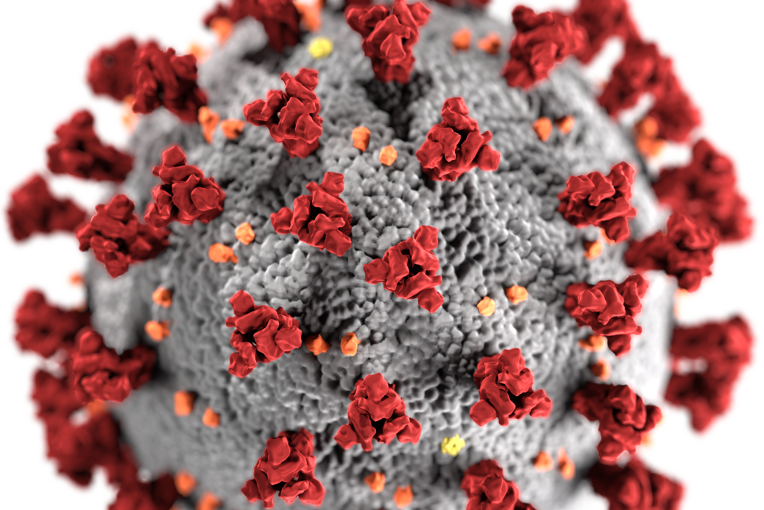

Teaser photo: The morphology of a corona virus. Illustration created by the Center for Disease Control.