By now, almost everyone has heard of one or more of the many local currency experiments that have sprung up in various places around the world in recent decades. Many of these have gotten a considerable amount of media attention and support from local government, but none of them has achieved the desired results of making their communities stronger, more prosperous and more resilient. Why is this?

First of all, community currency organizers typically begin with the wrong premise. Their objective has been to keep money circulating locally instead of leaking out. The presumption is that this will be sufficient to enhance the vitality of local economies and improve the prospects of local businesses in their struggle to compete with large corporations and merchandising chains. But this supposition misses the main point of what ails communities: the more fundamental problem is not that money leaves the community too quickly, but that not enough money is provided to the community to begin with.

Banks create money (liquidity) by making loans, through which process they monetize the promise of the borrower to repay. But experience has shown that banks can’t be relied on to provide an adequate supply of credit to small and medium sized enterprises (SMEs) that form the foundation of every economy. Instead, they prefer to lavish money on corporations and market speculators and to fund the ever-expanding debts of national governments that waste it on weapons, wars, and the enrichment of special interests. Nor is conventional money a friendly instrument for enabling local trade. Rather, centrally controlled currencies like the US dollar flow to centers of power, and when banks do lend to SMEs it is on onerous terms including high interest rates, burdensome repayment schedules, and demands for collateral.

Secondly, the design of most local currency models has been inadequate to the task, especially the basis on which the currency is issued and the way in which it is placed into circulation. These are the things that determine whether or not a currency will be sound, credible, effective, and scalable.

Up to now, virtually all community currencies have followed the ‘convertible local currency’ (CLC) model, including the Bristol Pound and Brixton Pound in the UK, Toronto Dollars and Salt Spring Island Dollars in Canada, and Berkshares in the US. Typically, these currencies are sold for, and can then be redeemed back into, conventional or official money. But even their proponents admit that these currencies have not been effective in achieving economic relocalization.

What really needs to be relocalized is the control of credit, which is the essence of every modern currency, not for the sake of isolating communities from the global economy but with the intent of reintegrating them on a sounder and more equitable and sustainable foundation. The fundamental need of communities is for additional means of exchange that supplement the available supply of money in circulation. Communities therefore need to find ways of providing their own home grown liquidity i.e their own means of payment to support their local economies and achieve some measure of self-determination.

The CLC model does not provide the community with additional liquidity. Rather, it substitutes a limited local currency in place of a relatively universal official one. Such currencies bear a strong resemblance to the gift cards that are sold by myriad retail companies like Marks and Spencer and Amazon. However, in these cases, redemption back into official currency is not allowed, so a gift card represents a pre-sale of merchandise or services by the issuing company; it’s a one way street.

While it has been well demonstrated that a perfectly sound community currency can be created on the basis of goods and services that local businesses have available for sale without the need for any additional backing, the general fixation on conventional forms of money has led many communities to issue local currencies by selling them for dollars or pounds and making the currency redeemable back into conventional money, on the grounds that this is necessary for the currencies to be acceptable to users.

But there is a different way to use conventional money to provide confidence in an alternative currency while at the same time providing the community with additional liquidity: supporters like nonprofits or peer-to-peer lenders can be asked to provide the community with conventional money for some minimum fixed period of time, either as loans or as purchases with a buy-back provision. These cash deposits could then be used to back the issuance of community currency when loans are made to businesses that have goods and services to sell. The cash could be invested in relatively liquid income-producing assets, while the community currency circulates throughout the local economy to enable a more optimal utilization of the available local supplies of merchandise and labor. In essence, this approach makes it possible to ‘have your cake and eat it too.’

In this model, the community currency is backed twice over, first by the goods and services that the recipient of the loans has to sell, and secondly, by the deposits of conventional money. This assures that defaults will be rare, and any that do occur can be written off against the income produced by the cash investments. Such a currency could provide a credible and effective means of exchange apart from the banking system.

The effectiveness of this model depends on applying particular conditions to cash redemption or community currency buy-back, including who can redeem it (for example, only sponsoring merchants or non-profit organizations); when it may be redeemed (only after some future date, say two or three years after its issuance); and at what discount from face value (e.g. five or ten percent).Restricting the redemption privilege and its timing should assure that community currency changes hands many times over before being redeemed back into cash.

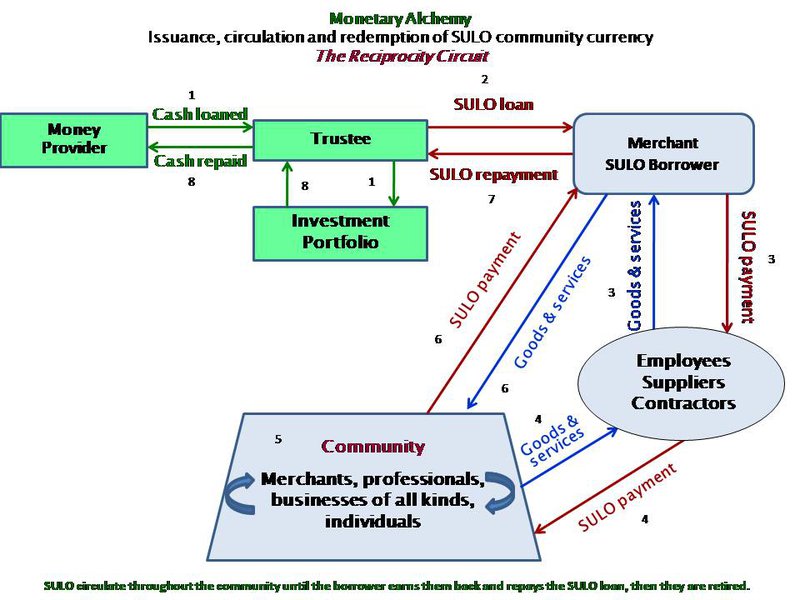

When conventional money is accepted in the form of interest-free loans from supporters, it can be transmuted into an effective community currency in the following way: crowd-funders or other community supporters might provide dollars or Euros to a non-profit trustee organization that then makes loans to qualified businesses in the form of a community currency called Sustainability Loans or SULOs. Each SULO note or credit would be 100% backed by investing those currencies in relatively liquid assets like bank deposits, government notes or bonds, or real assets that will hold their value despite bank failures, deposit confiscation, or the debasement of official currencies by monetary authorities.

Some financial advisors favor holding wealth in the form of precious metals like gold or silver, but those are sterile investments that do not benefit anyone in the economy. A better and more secure option would be to invest in income-producing real estate, which has the added benefit of making housing available to people in the community at reasonable rental cost.

SULO currency could then be used by the borrower businesses to pay their employees and suppliers who, in turn, can use them to make purchases from shops or other local providers of desired goods and services. SULO currency would change hands many times prior to repayment of the loans, circulating throughout the local economy in parallel with conventional money for the duration of the loan, which might be two or three years or even longer.

As the borrowers earn back the SULO, they would repay their SULO loans at maturity. The trustee organization would then extinguish that amount of SULO and return to the original lenders the money they provided as backing. Whatever income is derived from the official currency investments could be used to cover the costs incurred by the trustee in administering the program, while any residual income might be paid out as dividends to the people who provided the capital. Digital community currencies might be better than printed notes, issued as account balances that are accessed by means of debit cards or transferred between users via mobile phone applications.

The key to success of this program is to make the SULO loans only to established businesses that have desired goods and services already available and waiting for buyers (not to finance business start-ups or capital projects). They could include food, clothing, housing rents, building supplies, energy, or any other necessities and essential services. In each case, SULO provides the means of payment required to connect available local supplies with unmet needs. In short:

- Supporters provide a trustee with deposits of euros, dollars, pounds, or other official currency which the trustee invests in secure financial or real assets, just as is commonly done in retirement funds.

- Using those assets as backing, the trustee then issues a community currency called SULO as interest-free short-term loans to qualified domestic producers and sellers of essential consumer goods and services.

- This enables the reemployment of idle workers and the sale of excess business capacity (like available inventories of goods or underutilized services), while at the same time satisfying basic needs without price inflation.

- SULO loans are then repaid to the trustee and the corresponding amount of SULO is extinguished.

- The assets that backed the retired SULO are liquidated and cash deposits are returned to the original lenders at maturity.

- The process becomes continuous as new deposits enable new SULO loans to be made.

The prosperity, resilience and self-determination of a community is greatly dependent on its having an adequate supply of payment media to connect available supplies with basic needs, so the usual scarcity of conventional money needs to be overcome. That can best be achieved by monetizing the value of locally available goods and services in the form of community currencies that are spent into circulation by trusted producers, or by organizing local businesses into mutual credit clearing exchanges. But considering the common mistrust of innovative approaches to money and finance, the ideas I’ve presented here offer a way to support alternative currencies with conventional money while adding new liquidity to the community. This cash backing, like training wheels on a bicycle, can build enough confidence to get things moving, then quickly be dispensed with.