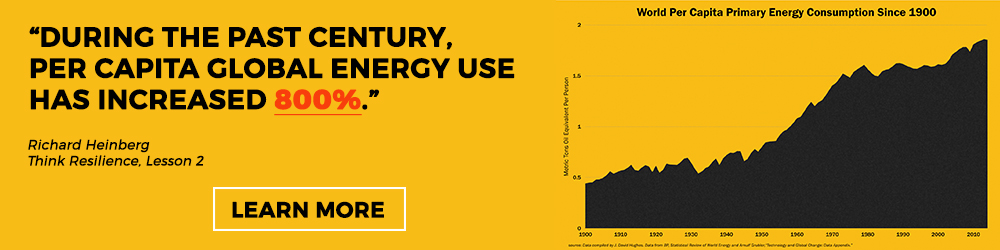

My wife Janet and I recently bought a used Nissan Leaf from a friend. We are now proud electric vehicle (EV) owners, and we love our plug-in, battery-powered car: some days we almost fight over who gets to drive it. If this essay were a consumer review, it would glow in the dark. The car is quiet, built solidly, cheap to operate, problem free, and nearly guilt free.

But a testimonial is not what I have in mind. I now have a personal stake in the EV transport revolution, which is key to the post-hydrocarbon energy transition, which in turn is key to collectively surviving climate change and oil depletion. A lot of hope is riding on the wheels of the world’s three million electric cars. So, how’s the EV revolution going? And even if it’s going well, is it really the best strategy? Those are the questions I want to address here. And, as one might expect, the evidence is open to widely varying interpretations.

The Boosters: EVs Are the Future!

Owner satisfaction for EVs is generally high. That’s partly because the overwhelming majority of buyers (so far) have been motivated by environmental concerns. And in this department electric cars deliver: even if the electricity to charge an EV’s battery comes from a typical combination of coal, natural gas, and hydro sources, the high efficiency of its electric motor means that its full lifecycle carbon emissions will likely be lower than those from a conventional gasoline-burning internal combustion engine. Add some rooftop solar panels, and seriously low-carbon personal transport is within reach.

Moreover, the appeal of EVs is gradually extending beyond the eco-hip. A recent AAA survey found that 20 percent of Americans want their next vehicle to be an electric car. Among millennials, the proportion is much higher.

For the past few years, automakers have seen the handwriting on the wall. Even if some governments (such as the Trump administration) eschew climate policy, existing international emissions reduction commitments mean that, over the long haul, there will be incentives for low-carbon transport options and disincentives for gas guzzlers. Many states and nations already offer significant subsidies to EV purchasers and some have passed legislation to ban sales of new internal combustion engines altogether (though in most cases these won’t go into effect for decades). Automakers are also aware that, while world oil production has been bolstered recently by a glut of U.S. fracked shale oil, the longer-term prospects for the global petroleum industry are dismal. Therefore some alternative to petroleum-powered transport is needed.

As a result of this analysis, automakers have begun retooling, and have many new EV models in the pipeline. The Chinese auto industry, which has been growing by leaps and bounds in recent years, is committed to producing more EVs as a way for the nation to curb the horrific pollution from its burgeoning traffic and coal power plants (the nation’s long-term energy plan also entails a transition to renewables and nuclear power). The Volvo car company, now owned by the Chinese car company Geely, announced last year that starting in 2019 it will phase out conventional gasoline and diesel engines altogether in favor of hybrids and EVs.

Traffic and smog in Beijing, China. Credit: Michael Davis-Burchat, c/o Flickr

Batteries, which represent about half the manufacturing cost of a typical EV, are getting cheaper and better. According to a recent Bloomberg New Energy Finance (BNEF) report, electric vehicles will be less expensive than comparable conventional cars in just five years. Meanwhile, battery range (which has been the bane of EVs since the dawn of the automobile age) is increasing rapidly. The range of my 2013 Nissan Leaf, which represents the first generation of mass produced modern EVs, is a mere 80 miles; as a result, I can’t practically use it for occasional long trips. But more expensive and newer electric cars do better in this department (the current Tesla Model S will travel up to 337 miles on a charge, while the 2018 Chevy Bolt hatchback can go a maximum 238 miles).

BNEF expects electric car sales to top 1.6 million in 2018, expanding to 11 million annually by 2025 and 30 million by 2030. By 2040, it anticipates that more than half of all light vehicles (sedans, pickup trucks, SUVs) sold will be EVs, and China will dominate the market.

For the time being, though, Norway—ironically, an oil-exporting nation—has the highest growth rates and highest market penetration of EVs in the world. This is due to the world’s most generous tax breaks and incentives (including free city tolls and parking), along with heavy taxes on diesel and gasoline engines.

All of the above serves to bolster what might be called the happy, easy EV transition story. In this story, EVs will grow rapidly in market share, helping to electrify society’s energy usage. At the same time, low-carbon energy sources (including solar and wind) will replace coal and natural gas for power generation. Oil demand will decline before geology and economics force a peak of production (according to BNEF, the penetration of EVs into the light-duty vehicle market will reduce oil demand by 7.3 million barrels per day by 2040, or roughly 8 percent of today’s demand). Even if the oil business eventually fails as a result of the depletion of non-renewable petroleum, it will do so at a point when we don’t really need the stuff anyway. In this story, the auto industry survives, we survive, and all is well.

The Critics: EVs Are Too Little, Too Late!

However, all observers are not convinced.

While EVs are catching on, some argue, they are doing so too slowly to make much of a difference anytime soon. That’s because it will take decades to change out the global fleet of light vehicles, each of which stays on the road for an average of 20 years. Even when over half of all light vehicles being sold are EVs, perhaps by 2040, the overwhelming majority of the world’s existing cars will still be petro-burners. Thus it will take time for the trend toward EVs to result in a corresponding decline in oil consumption, especially if the number of cars on the road—like global population—continues to rise. One gauge of this delay is the fact that Norway only began to see a fall in oil consumption in 2017, years after implementing the world’s most vigorous pro-EV policies.

Batteries are improving in terms of both cost and performance, but those improvements will have to accelerate in order for rosy EV projections to materialize. So far, car companies are banking on lithium-ion batteries—but even Tesla founder Elon Musk has said that the ultimate price/performance potential for this technology may soon be reached. Other battery technologies are being researched, but starting from scratch with a different set of elements will entail an R&D learning curve and a build-out of manufacturing capacity that could take another couple of decades.

With current battery technology, EVs are more expensive than comparable gasoline-powered cars. This persistent fact, in combination with rapid technology shifts and many governments’ and carmakers’ efforts to increase EV market penetration, has created some bizarre pricing realities. While EV owners like their vehicles, the resale value of electric cars is abysmal: many five-year-old Leafs, which cost $30,000 new, sell for less than $10,000. This is partly because buyers want the latest battery technology, and partly because they don’t want to purchase a car with batteries that are already somewhat degraded. Given the steep depreciation of new EVs, most would-be buyers end up leasing cars. But even leases are now being steeply discounted: BMW has recently been leasing its model i3 plug-in car, which sells for $50,000, for a mere $54 a month.

It’s no wonder, therefore, that carmakers have a tough time making a profit on EVs. Reportedly, Fiat loses $20,000 on each model 500e it sells. And according to credit agency Moody’s, overall returns on auto industry investments in EVs are likely to remain elusive until the 2020s.

So, while many automakers are beginning to bet their futures on EV technology, they are stuck with the fact that they must make a profit in the meantime to stay in business. While car companies in Europe and China are preparing to switch entirely to electrics and hybrids, Ford in the U.S. is discontinuing production of nearly all its sedans—including its Focus electric—and shifting toward an all-SUV and truck lineup, simply because these larger (and thus inherently less efficient) vehicles generate more profit. Of course, it’s possible that some of Ford’s SUVs and trucks will eventually be electric. But if EVs are generally less financially rewarding to manufacture and market than gasoline-burners, other carmakers may eventually be forced to make decisions as drastic (and some would say perverse) as Ford’s.

There is no marque more emblematic of EV potentials and problems than Tesla. Driven by a compelling vision and a passion for quality, Elon Musk has managed to do what most industry observers thought impossible—start a large-scale car company from scratch. Naturally, this effort has required massive investment. Tesla now has a market valuation of $46 billion—compared to $54 billion for GM and $45 billion for Ford. Yet Tesla so far has made cars that are affordable only to an upscale niche market, (it sold only 50,000 cars last year); meanwhile, its entry-level Model 3, intended for the masses, is largely stalled. Although Musk promised a $35,000 price point for the car, so far only versions heavily weighted with expensive options—and thus selling for $50,000 or more—have been delivered. That’s presumably because Tesla hasn’t yet figured out how to make a no-frills Model 3 profitably. If the company doesn’t sort that problem out soon, investors may head for the exits.

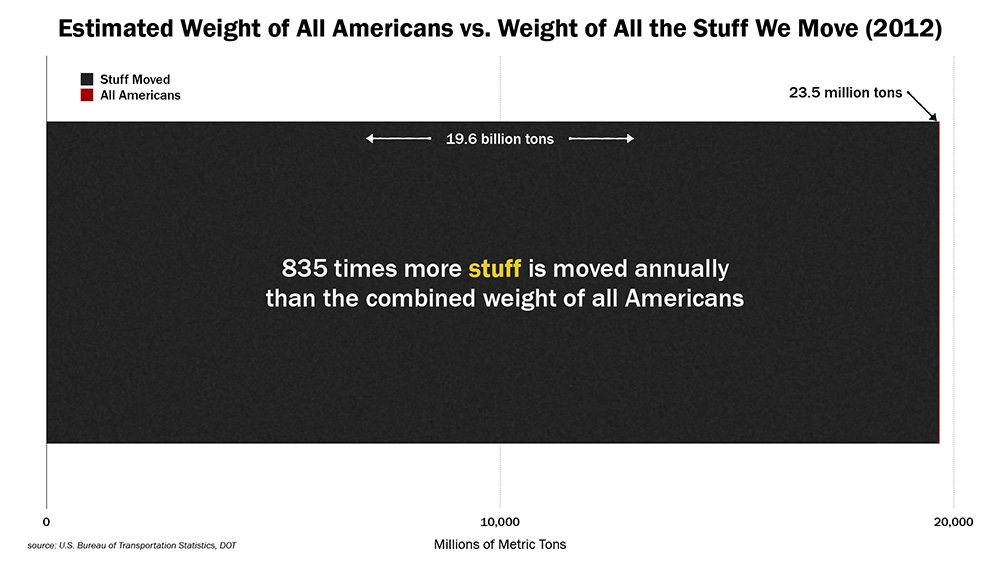

While EVs are a first step in electrifying transport, further steps need to be considered. We transport goods, including food (the weight of which exceeds the weight of people moved in cars by 800 times) with trucks, ships, trains, and airplanes, and these transport modes (with the partial exception of rail) will be a challenge to electrify: batteries would be extraordinarily and often prohibitively heavy.

Even assuming the transition to electric cars goes quickly and smoothly, the transport revolution will fail if we cannot find low-carbon solutions for shipping, freight hauling, and aviation.

Finally there is the question of supplies of ores and metals, especially lithium for batteries. Many analysts expect demand for lithium to double or triple by 2030, even with more recycling. Just since 2015, the cost of lithium has more than doubled, which has led to increased EV production costs. There’s little risk of the world’s lithium resources being exhausted any time soon; however, as with all mineral resources, we are harvesting the low-hanging fruit (i.e., the most concentrated ores) first. The real danger is that the rate of extraction for lithium won’t keep up with soaring demand. Argonne National Laboratory reports that, “Known lithium reserves could meet world demand to 2050.” But that’s only a little over three decades from now. By 2050 the auto industry will have nearly finished building its first full fleet of EVs—assuming the easy transition scenario. Presumably batteries for the following generation of cars, if there is one, will rely on other, more abundant chemical elements.

Wild Card: The Economy

As we’ve seen, a great deal hinges on the questions of investment and profitability—the success of carmakers, the build-out of charging stations, and the growth of the electric power industry so it can charge the world’s massive future EV fleet (while also switching to low-carbon energy sources). Indeed, the health of the world’s banking and financial sector may be even more important to the success of EVs than the development of better batteries. So, while the subject might seem tangential, it’s fair to consider whether financial markets are headed for many years of smooth sailing, or toward a “correction,” perhaps on the scale of 2008 or worse.

I don’t propose to make a specific or detailed economic forecast; that’s the job of financial analyst—who usually get it wrong in any case. Everyone agrees that—following the global financial crisis of 2008 and subsequent years of massive deficit spending, quantitative easing, and zero interest rate policy (ZIRP)—we’re now enjoying one of the longest uninterrupted recoveries since World War II (tepid and unequal though it may be). However, the political and economic situation in Italy has many observers worried. George Soros is warning of a major financial crisis stemming from the “existential” euro dilemma; other economic observers are concerned about rising interest rates and new U.S. tariffs on products from China, Europe, Mexico, and Canada. Still another issue is the enormous current debt bubble based on subprime auto loans. Again, I have no idea whether we do in fact face an imminent economic Armageddon. But no boom lasts forever, and a cyclical downturn of the economy is inevitable. To plan as though no such thing could occur seems at least as foolish as to pretend to know the exact timing and magnitude of a coming crash.

Recent experience suggests that the auto industry may be highly vulnerable to even a brief bout of economic contraction. In 2008 the U.S. economy nearly lost General Motors and Chrysler. Instead, these giant companies downsized and consolidated, and were partly bailed out by taxpayers (the loans were later mostly repaid). But, in the process, the Mercury, Oldsmobile, Pontiac, Hummer, and Plymouth brands disappeared. Chrysler was absorbed by the Italian automaker Fiat. Imagine the possible consequences of a similar downturn today, a decade later. Would Tesla survive? Would Fiat-Chrysler continue making an EV model on which the company loses $20,000 with each unit sold?

Perhaps Chinese carmakers would be more resilient than American ones in the face of a global recession, because the Chinese government more actively manages the country’s powerhouse economy and could easily bail out a seriously ailing auto industry. However, some argue that China’s economy is actually quite fragile and corrupt. Even though the Chinese government is in the habit of propping up unprofitable enterprises, in a cascading financial meltdown it might be unable to continue doing so.

In short, while the happy EV transition story assumes no recurrence of global financial turmoil, the real world may not be so kind.

In addition to crippling the EV transition, another financial crash might also wipe out the mostly unprofitable U.S. fracking industry, thus reducing world oil output. This might increase demand for EVs, but it would also likely impact the overall economy, leaving us approximately in the dreary place that peak oil analysts warned about a decade ago. Except that we might find the culprit to be not just geological limits; rather, both the oil industry and our car-centric way of life—whether petro-powered or electric—might turn out to be just as vulnerable to fluctuations in the world of finance.

Beyond EVs: We Can Do Better than Cars

Modern industrial society is in the early stages of two historically pivotal shifts—from internal combustion engines to battery-powered electric motors, and from fossil fuel-sourced electrical power to low-carbon sources. If these shifts are successful, then we may have a shot at addressing a panoply of converging ecological crises including not just climate change, but also species extinctions, toxic pollution, and resource depletion. If these shifts fail, then the whole scaffolding of modern industrial society could come unglued. Either way, the auto industry can’t continue in its current configuration. If it cannot transform itself, it will eventually disappear.

This brings us to the mostly unspoken tragedy at the heart of our transport dilemma. That is the fact that hundreds of millions of people worldwide have no alternative to the automobile. For decades, sustainable transport experts have pointed out that cars are inherently inefficient (so much metal, glass, and plastic needed to transport what is usually a single occupant); that highways destroy landscapes and neighborhoods; and that people are happier in communities that are walkable and bikable, and that have robust public transit systems.

Pedestrians and cyclist crossing street in Copenhagen, Denmark. Credit: A. Aleksandravicius, c/o Shutterstock.com

Some countries and cities have followed these experts’ recommendations. But for most of America, the car is still king. There is often no other practical means of getting to work, to the store, or to school.

For suburban Americans, the EV is an imperfect, hopefully temporary workaround to this conundrum. If those of us who live in car-centric regions want to contribute to the energy transition, the first thing we should do is to work to reduce our community’s prioritization of automobile transportation in planning and investment, and push for public transit and people-centered neighborhoods (with attendant shifts in land use, building codes, and zoning). As an afterthought, there’s a good argument to be made for electric cars, and for making the EV transition now rather than waiting for the perfect car to arrive. If my experience with the Nissan Leaf is any indication, there’s little reason, from a driver’s point of view, not to do so.