Earth scientists have been making the case for years that the present level of human activity is not sustainable. We’re rapidly depleting resources, degrading ecosystems, altering the atmosphere, etc. What earth scientists are saying is generally not covered by the mainstream media, or is sugar coated, because the mainstream media is an outlet for the corporate perspective on the world.

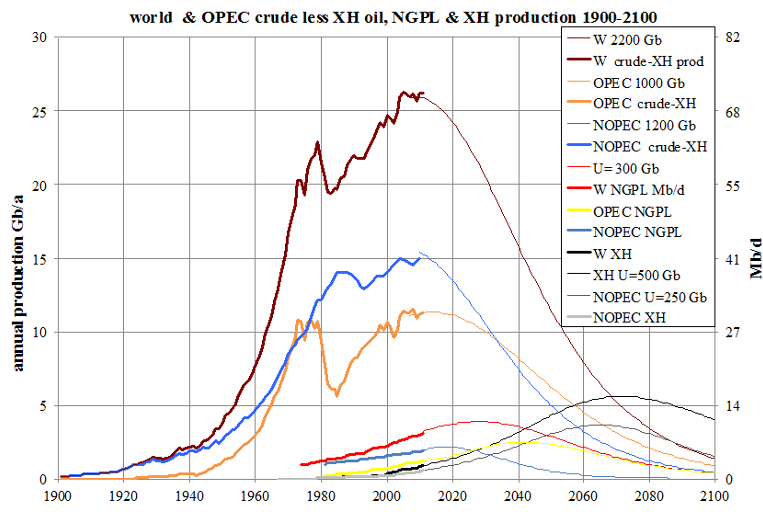

As an example, in 2017 global crude oil + condensate production (typically used to define oil-this does not include natural gas liquids, biofuels, or other hydrocarbon liquids) was about 30 billion barrels. Cumulative world oil production at the end of 2017 was approximately 1.36 trillion barrels (1,360 billion barrels). Since WWII, approximately 95% of the cumulative total global oil production has been produced (See Figure 1 by Jean Laherrere-the top brown line represents global oil production).

Figure 1

Jean Laherrere, an international petroleum geologist with over 50 years of experience, had estimated ultimate recoverable oil, excluding extra heavy oil, at approximately 2.2 trillion barrels back in 2013. It’s a good bet that the ultimate recovery of economically recoverable oil will be less than 3 trillion barrels. At the clip we’re burning oil, we could go through a significant percentage of the remaining economically recoverable oil in the next 20 years.

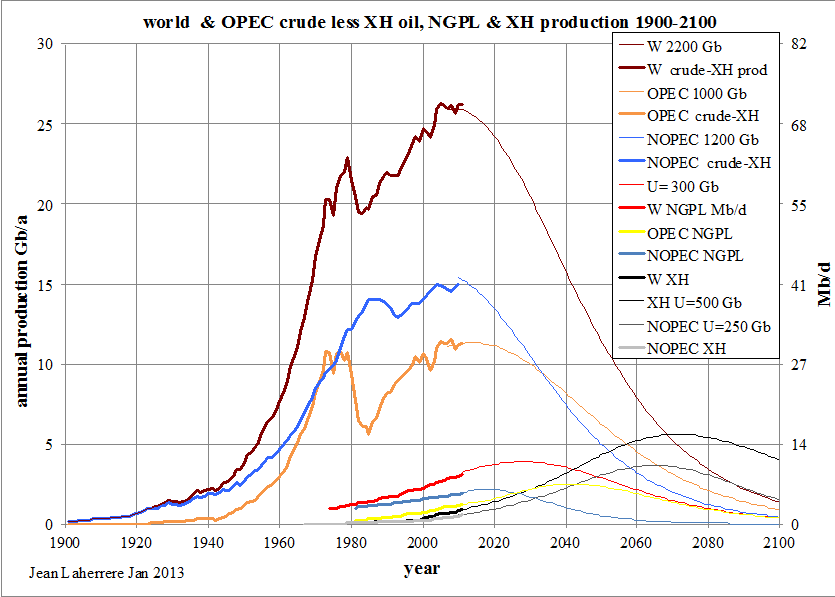

Ugo Bardi makes the case that the actual oil production curve will look more like Figure 2.

Figure 2

Bardi is the author of a Club of Rome produced report titled “Extracted” that reiterated the earlier conclusions of the Club of Rome in their “Limits to Growth” report of 1972. Bardi concludes that the problem of depletion is real and that it is progressively getting worse.

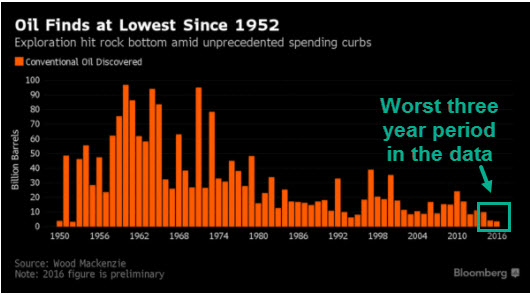

In recent years, the rate of global oil discovery has been running less than 1/5th the rate of global oil consumption (Figure 3). It appears that the 2017 discovery rate will end up around 1/10th of the consumption rate. The most favorable geologic areas for oil have now been extensively explored so there isn’t that much oil left to find.

Figure 3

About 95% of transportation fuel is oil distillates. It’s common to hear that electric vehicles are going to take over the motor vehicle market sometime soon and eliminate much of the demand for oil in the not-too-distant future.

In spite of those claims, which have been made for some years now, global oil consumption has risen at a rate of nearly 1 million barrels/day (mb/d) per year on average from 2000 to 2017. The U.S. Department of Energy/Energy Information Administration (US DOE/EIA or EIA) is predicting that global petroleum consumption (this includes all hydrocarbon liquids) will increase ~1.6 mb/d in 2018. In the U.S., petroleum consumption for 2017 will be approximately 20.2 mb/d or ~7.3-7.4 billion barrels/year, the most since 2007.

The argument for the takeover of the motor vehicle market by electric vehicles ignores the fact that the energy per unit mass of presently used lithium ion batteries in electric vehicles is less than 1/50th that of gasoline or diesel fuel. Possibly there will be some improvement in lithium ion batteries in the future but not by a factor remotely close to 50. The much higher energy per unit mass for gasoline and diesel fuel provides a significant advantage for gasoline and diesel over lithium ion batteries, particularly in terms of hauling, towing and long-distance driving.

To compensate for the low energy per unit mass of lithium ion batteries in motor vehicles, exotic light weigh, and expensive, materials are used in the vehicles. For that reason, electric vehicles are expensive to make.

At present, auto companies subsidize the cost of electric vehicles through the sale of gasoline and diesel fueled vehicles. If they sell electric vehicles in large quantities, the subsidy would have to be removed so auto companies could make money on those sales. The federal government also presently provides a $7,500 tax credit to electric vehicle purchases although there has been talk of eliminating the tax credit by the current administration.

Americans were quite happy when the price of oil went down significantly in late 2014. There were several reasons for the decline in the price of oil. One was the rapid development of fracking in U.S. A second reason was the large increase of oil production in Iraq, from 2.398 mb/d in 2010 to 4.050 mb/d in 2015 according to EIA data.

U.S. oil production from fracking (light tight oil) increased by 3.933 mb/d from 2010 to 2015 (EIA). Global crude + condensate production increased 5.618 mb/d from 2010 to 2015 so the increase from U.S. light tight oil and Iraq, 5.585 mb/d, represented almost all of the global production increase.

The increase for U.S. light tight oil production was achieved through intensive development of several key oil plays most importantly the Bakken Shale (North Dakota/Montana), Eagle Ford Shale (Texas), Permian Basin (Texas/New Mexico), Niobrara Shale (Colorado/Wyoming) and Anadarko Basin (Oklahoma/Texas).

The top 3 producing regions for fracked oil are Permian Basin, Eagle Ford and Bakken. They are significantly more productive than Niobrara and Anadarko. The Permian Basin is now the hot play with production rapidly increasing.

When the price of oil went down in late 2014, the rate of drilling decreased which provides an argument for the production declines in Bakken and Eagle Ford after their peaks in late 2014/early 2015. The price decline was indeed a factor but in the Bakken region of North Dakota, there were 2,817 more producing well, as of Dec. 2017, then there were in Dec. 2014. Oil companies didn’t stop drilling and completing wells.

It’s easy to assume that the Bakken Shale has truly huge quantities of oil based upon the extensive area of the play (see Figure 4) and the production results within the sweet spot.

Figure 4

The problem is that about 90% of Bakken oil production in North Dakota comes from 4 counties out of the 16 in the Bakken region of North Dakota. Those 4 counties are where the sweet spot is located. Drilling outside of the sweet spot results in significantly lower oil production. From my experience, a high percentage of the wells in the sweet spot have initial production values over 1,000 b/d whereas outside of the sweet spot, initial production values are often less than 100 b/d.

For the period 2008-2017, total Bakken Shale oil production in North Dakota was 2.32 billion barrels. Art Berman, a petroleum geologist with decades of experience in the U.S. oil and gas industry, has estimated the economically recoverable amount of oil from Bakken, including Montana, to be approximately 5 billion barrels. The amount of oil produced from the North Dakota Bakken play over the last 10 years is approaching half of 5 billion barrels.

Figure 5

For the period 2008-2017, total Eagle Ford Shale oil production was 1.94 billion barrels (See Figure 6). Art Berman has estimated the economically recoverable amount of oil from Eagle Ford to be approximately 5 billion barrels. The amount of oil produced in the last 10 years is nearly 40% of 5 billion barrels.

Figure 6

Production from fracked wells generally declines by 70-90% by the end of the 3rd year of production. That means to maintain or increase production, new wells must be drilled at a rapid pace to overcome the declines from older wells.

The Barnett Shale region (mostly gas) illustrates what happens with intensive development in a shale play. Barnett was an early intensively fracked shale region in Texas. Figure 7 Is a graph of Barnett Shale gas production versus time.

Figure 7

In 2008, there were 194 rigs drilling in the Barnett Shale. In 2016, there were periods with no drilling rigs because the region had been drilled to the point of saturation. Since 2012, natural gas production from the Barnett Shale has declined by over 40% and will likely continue to decline. The sweet spots of Bakken and Eagle Ford have now been fairly extensively drilled which creates a problem for future production like the problem in the Barnett Shale.

Here is what Wikipedia says about the Barnett Shale region:

As of 2007, some experts suggested that the Barnett Shale might have the largest producible reserves of any onshore natural gas field in the United States.[1] The field is thought to have 2.5×1012 cu ft (71 km3) of recoverable natural gas, and 30×1012 cu ft (850 km3) of natural gas in place.[1]

The point here is that the Barnett Shale is not an insignificant source of natural gas for the U.S. With intense development of shale oil and natural gas plays, it typically takes less than 10 years from initial production to the time of peak production.

Art Berman has expressed the opinion that it’s unlikely that there will be shale plays that aren’t presently producing oil and/or gas in the U.S. that will produce significant quantities of oil and gas in the future.

In the initial boom of fracked shale oil production, there was a lot of hype about the quantity of oil available through fracking. The mainstream media made it sound like the quantity was so huge that it would ensure that the U.S. would be awash in oil for many, many decades to come.

The media appear to be basing their pronouncements on projections from the EIA. Petroleum geologist David Hughes has produced multiple reports highlighting the flawed assumptions of the EIA, the most recent of which is here: http://www.postcarbon.org/publications/shale-reality-check/

Hughes states that EIA projections are extremely optimistic. That is a polite way of saying they are delusional. It appears that the EIA is assuming that well productivity outside of the sweet spots will parallel well productivity within the sweet spots. Based upon results thus far, that will not remotely be the case.

Why does the EIA assume that light tight oil production will remain high for decades to come? It appears to me that their objective is to provide comforting projections that will make the American public feel good, to feel that their high consumption lifestyles can continue for as long as the EIA can see into the future.

The EIA has a history of providing unrealistic projections, which I highlighted in this paper from 2012: https://www.resilience.org/stories/2012-02-17/how-reliable-are-us-department-energy-oil-production-forecasts/

Unfortunately, the U.S. media never questions the projections of the EIA.

What oil companies are doing in the shale plays is extracting the oil that exists as rapidly as humanly possible. The objective of oil executives is to make their millions or billions of dollars before they’re pushing up daisies. There isn’t a lot of thought about the long-term consequences.

Based upon results from Barnett, Bakken, and Eagle Ford, economically recoverable oil and gas is far more limited than the EIA is portraying. The Permian Basin is now experiencing extremely intensive development which will lead to the peaking of production in the not-too-distant future. Fracking will be a relatively short-term phenomenon in the U.S. As Art Berman says, “fracking is a retirement party for petroleum geologists”.

The current administration is doing everything possible to open all federal areas closed to oil development in the U.S. The reality is that most federal areas closed to oil development do not have the geology necessary to produce large quantities of oil.

One of the more favorable areas geologically that was opened during the Obama administration is the National Petroleum Reserve-Alaska (NPRA). Here is an excerpt from an article in 2011 about the NPRA (NPRA is west of the Prudhoe Bay region):

Reporting from Washington — President Obama will open Alaska’s national petroleum reserve to new drilling, as part of a broad plan aimed at blunting criticism that he is not doing enough to address rising energy prices.

The plan, unveiled in Obama’s weekly radio address Saturday, also would fast-track environmental assessment of petroleum exploration in some portions of the Atlantic and extend the leases of oil companies whose work in the Gulf of Mexico and the Arctic Ocean was interrupted by the drilling moratorium after last year’s BP oil spill.

Here is what is stated on Wikipedia concerning the NPRA:

An assessment by the United States Geological Survey (USGS) in 2010 estimated that the amount of oil yet to be discovered in the NPRA is only one-tenth of what was believed to be there in the previous assessment, completed in 2002.[3] The 2010 USGS estimate says the NPRA contains approximately “896 million barrels of conventional, undiscovered oil”.[3] The reason for the decrease is because of new exploratory drilling, which showed that many areas that were believed to hold oil actually hold natural gas.

As of October 2012, a total of 1,374,583 acres (556,274 ha) have been leased; 872,125 acres (352,936 ha) in the Northeast region, and 502,458 acres (203,338 ha) in the Northwest region.[13]

Little new oil has been produced from the NPRA thus far. Even if the USGS says there are 896 million barrels (mb) of oil, that doesn’t mean it’s economically extractable. Alaska is now producing about 25% of what it was producing at its peak in the late 1980s (~0.5 mb/d vs 2.1 mb/d) in spite of many new fields brought on-line and new areas opened for oil development.

With the passage of the recent federal tax bill, the Arctic National Wildlife Refuge (ANWR) has been opened for oil development (ANWR is east of the Prudhoe Bay region). It is probably the last significant area in the U.S. that is geologically favorable for oil left in the U.S.

I heard a comment on the radio recently that ANWR contains 19 Gb (billion barrels) of oil. A common tactic of proponents of oil drilling is to greatly exaggerate how much oil is in a region to make it appear too appealing to pass up. In reality, the best that could be hoped for is maybe 3-4 Gb of economically extractable oil. There is a good possibility that there is considerably less than 3-4 Gb of economically recoverable oil in ANWR.

Americans appear to believe that they are entitled to cheap and abundant oil and that the cheap and abundant oil will last forever. Cheap and abundant oil will go on until it can’t go on. Even the largest oil fields ultimately decline. As an example, the largest oil complex in the western world is the Cantarell Complex in Mexico (Estimated Ultimate Recovery, EUR,~20 Gb). In 2004 Cantarell was producing 2.1 mb/d. It Is presently producing approximately 0.25 mb/d (~12% of maximum production) as it rapidly declines.

The Prudhoe Bay oil field (Alaska) is the largest field ever discovered in the U.S. (EUR ~12 Gb). In 1988 it was producing 1.6 mb/d. In 2017, Prudhoe Bay, along with its satellite fields, produced ~0.28 mb/d (17.5% of maximum production) as it continues to decline. The large fields in the North Sea such as Brent, Piper, Forties, Statfjord, Oseberg, Gullfaks and many more show the same tendency to decline. The largest fields in the Middle East like Ghawar (EUR ~120 Gb) and Burgan (EUR ~70 Gb) are showing signs of strain from decades of intensive pumping.

Are there not moral issues when it comes to using finite natural resources? If there are, we should consider the morality of how we are rapidly consuming our finite oil resources. Future generations may look at our rampant use of oil much differently than we do.