In the religion of economics, the entrepreneur is a hero engaged in a narrative of destructive creation. Entrepreneurs are tragically noble figures on a treadmill of competition – but who is really making the sacrifices? Often it is the entrepreneur’s family or other “stakeholders” who are carrying the costs and risks. What motivates entrepreneurs and what are “animal spirits” anyway? As their organisations develop, the role of the entrepreneur changes and, at their most powerful, they seek to co-opt officials and politicians for their agendas. Management can be exercised through over centralised control freakery or via distributed decision-making systems. Many entrepreneurs and managers are psychopaths, and criminals are entrepreneurs too. In the modern world, control fraud i.e. looting your own company is not uncommon. The City of London as tax haven and secrecy jurisdiction is one of a number of places to hide out.

“Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.” John Maynard Keynes

In economics, particularly economics of the Austrian school, we not only have a story about the satisfaction of needs and wants, we also have a story with a hero. The hero is the entrepreneur.

The entrepreneur is celebrated because the entrepreneur takes risks. They advance some resources that they already own, their property, in anticipation of a successful venture in which they hope that they will make profit. However, the future is always uncertain. The best laid plans of mice and men often go awry so the entrepreneur can make a loss too.

One of the earliest theorists of this was Richard Cantillon, an Irish refugee in France, whose Essai sur la Nature du Commerce en General has been claimed by the Austrian school of economics as the first economic treatise (in other words before Adam Smith) and also the first example of Austrian economics. He is one of their heroes. (Thornton, 2010) (MisesWiki, 2013)

Cantillon wrote about how economic actors, lacking control over the market, had to operate in conditions of uncertainty in which losses as well as profits were possible.

The price of these products will depend partly on the weather, partly on demand; if corn is abundant relative to consumption it will be dirt cheap, if there is scarcity it will be dear. Who can foresee the number of births and deaths of the people in a State in the course of the year? Who can foresee the increase or reduction of expense that may come about in the families? And yet the price of the Farmer’s produce depends naturally upon these unforeseen circumstances, and consequently he conducts the enterprise of his farm at an uncertainty.

The unsuccessful entrepreneur will live poorly or go bankrupt, while the successful entrepreneur will obtain a profit or advantage and cause entry into the market, “and so it is that the undertakers of all kinds adjust themselves to risks in a State.” The entrepreneur brings prices and production into line with demand; in well-organized societies, government officials can even fix prices of basic items without too much complaint. ( quoted in Thornton, 2010)

It is through such stars that the world is “improved”, production is increased and jobs are created. Since the ultimate problem, as conceived by economists, is scarcity, the entrepreneurs preparedness to risk their wealth is an act to be celebrated by people who effectively become our saviours.

The narrative of the intrepid entrepreneur is closely tied with the romance of “innovation”. The entrepreneur is able to see the value of a new technical process or product and their visionary placement of their resources, their organisation of the productive process, and its transformative effects keeps society “moving forward”. This “dynamism” is self-evidently “a good thing”.

Other societies have existed that see things differently. They prioritise sustainability and resilience which are not at all the same thing as production increase and resource use efficiency. Indigenous people typically see themselves as having a responsibility to think of the consequences of major change for their descendants – sometimes for seven generations in the future. Their traditions are about preserving tried and tested approaches to living within the capacity limits of local ecological systems.

If a generation is 30 years then 7 generations are approximately 200 years. We are only now beginning to see whether the entrepreneurship and innovations of the industrial revolution can really be counted as “a good thing”. If we look at how damaging climate change already is, as well as at the rate of species loss, the situation is not looking very good.

It may be therefore that the plucky entrepreneur has a tragic destiny. Austrian economists wearing bow ties have been telling them that their creative destruction is wonderful for humanity when, all along, and without realising it, the profit seekers have been leading humanity into hell.

The tragic nobility of entrepreneurs on the treadmill of competition

At the time of writing, very few conventional entrepreneurs are likely to recognise this. They will be far too busy. An important part of the story that many entrepreneurs themselves like to believe is already tragic, but very noble. This is, that they can never rest in their ceaseless quest for improvement. The creative soul has a tragic but noble destiny because their successes bring imitators who erode the gains which come from being at the head of the field. So they are on a treadmill. Society benefits, however, in the form of increased efficiency and new toys that they did not know that they needed. As the entrepreneurs’ investment grows, it must be continually transformed or it will suffer at the hands of competitors, perhaps entering from other parts of the interrelated web of changes in the process of “creative destruction”. The entrepreneur that rests satisfied may find his assets are the ones whose value is destroyed by the next round of innovations introduced by pioneering new competitors. It is a neo- Darwinian world – destroy your competitors or they will destroy you. The successful entrepreneur is the long run survivor in this world.

There is no doubt that bringing something new into existence, where the processes of doing so are complex and involve a lot of unknowns can be tough. This is particularly the case for young beginners when they are wrestling with the problem of business start-ups. The Buddhist idea of what causes suffering is where people want the world to be different from the way it is – and when people set out with an idea or a plan to bring forth a business and a product that has not existed before they can easily end up going round in circles. There will be times in the process when they will be under enormous pressure to give up – perhaps at the point that others begin to lose faith in their ability to realise their idea, and withdraw their previous commitment.

To successfully carry through the start-up, the entrepreneur may see themselves as needing an entire organisation, at least in embryo, but find this difficult to achieve. They will need the product or service AND the market AND the people to produce the product AND somewhere to produce it AND a functioning bookkeeping and management system AND an awareness of regulations AND a legal framework. All these elements will have to match together. Achieving each element of the complete package BEFORE being able to start seems like a formidable challenge requiring a considerable faith in oneself.

A common mistake in the early stages is to keep on thinking of more elaborate ideas and to try to achieve too much in the architectural mind-set just described. For very often, the best way of developing a company or small organisation is NOT to try to assemble all the elements together before starting.

If all elements of an organisation are to be evolved, then this must be through the smallest steps at first because small steps are achievable and bring a team together around practicalities, experiment and learning. To take a banal example, if you’re setting up a business selling pickles you would be advised not to try to go into serial production at first but to experiment on a very small scale with a single batch production made in a borrowed kitchen with friends and sold to friends too. Such small experiments become learning exercises, get people working together, synchronising their times and developing complementary roles. It enables an emergence process, where each step organically leads to a larger and more complex one that is closer to the complexity of a continually functioning organisation.

What is clear is that “entrepreneurs” are rarely doing things on their own. Their ability to achieve anything at all depends on their ability to bring a functioning team together, as well as to establish relationships of other sorts with suppliers, regulators, colleagues and customers. That’s why the idea of the heroic entrepreneur is a bit misleading if one takes it to mean that an individual is carrying the whole emotional and financial load of the process.

Entrepreneurs and their families – who is really making the sacrifices?

For a start, if, for example, a business has to be initially conducted from people’s houses, then a partner and children may also be carrying a part of the load and will also perhaps be soaking up the emotional frustrations of “the entrepreneur” (i.e. husband and father – perhaps wife and mother) as they hit obstacle after obstacle. One crucial aspect of the life of the entrepreneur may well be not being there mentally and emotionally for their children. Since this will have long run psychological effects, should we not also include these effects in our assessment of who is carrying the emotional load of “entrepreneurship”? These are not the only possible effects.

“Kyle” recognized fissures in his marriage before he launched an electronics manufacturing company. Afterward, those fissures widened into canyons. Kyle admits he neglected his wife, poring over business plans when she wanted to chat. For her part, his wife didn’t take him seriously; she openly doubted that the company would ever support them.

Again

One test of the entrepreneur’s motivation is how much of the family’s collective life he is willing to sacrifice with little payoff. Tony, a software and media entrepreneur, admits subjecting his wife to “eight years of damn-near abject poverty and suffering” while he struggled to produce and sell a TV show. Finally, “She couldn’t take it anymore,” he said. “Two kids in diapers and wondering where next month’s mortgage payment was coming from.” Tony’s wife delivered an ultimatum: the TV show or her. “I said, ’The TV show’”, he told me. “That was the day the love died.” The marriage died with it. (Hirshberg, 2010)

Although the entrepreneurial process is hard, and not just hard for the entrepreneur, it is not going

to be equally hard for everyone. For people who are well connected, who have resources and a track record, the process of drawing together the ingredients of a successful venture are bound to be easier. Start-ups by what might be called members of the “corporate aristocracy” will not have the same “heroic characteristics” as young unknowns just out of university. Although middle aged managers working through their mid-life crisis by striking out on their own again might like to imagine so. It is obviously going to be easier because with greater resources one can draw together the necessary package of elements to make for a functioning project. There will be easy access to the office facilities so that it will not be necessary to work in the bedroom. There will be easier access to the skilled people, the money, the advisers and the political connections.

Getting others to pay the costs – unrecognised stakeholders sharing risks

As often as not, many others are therefore sharing in the burdens and risks of the entrepreneur’s decisions. While Austrian economists celebrate heroic individuals, the truth is, that all business ventures are dependent on the participation of others, sometimes willingly involved and sometimes not. Many 18th and 19th century business ventures in “the colonies” required labour, and since voluntary labour was scarce slavery was resorted to. This was one way in which large amounts of capital were raised that was subsequently risked.

The development of limited liability and corporations as fictional persons, has also been all about reducing risks for individual entrepreneurs – which means, pari passu, imposing those risks on other people – creditors of various kinds and workers.

Nor should we forget that risks are also carried by communities and ecological systems. As already argued, the whole idea of “externality” is utterly ideological because it appears that externality is somehow exceptional, a special case. Yet ALL economic decisions involve taking materials and energy out of the environment where people and other species live. All economic activity ultimately involves wastes going back into the environment. NO economic activity takes place without these “externalities”. No entrepreneurs have ever, or can ever, produce and sell anything without “externalities”. Thus, a very large part of the long run unknown costs of economic activity are actually not born by the entrepreneur at all but by the environment, by communities and by future generations. The destruction in the “creative destruction” is therefore not just of “capital”, or of jobs… the destruction is of ecological systems, species, and the stability of the Earth’s climate.

Over the centuries, entrepreneurs have also spent a lot of time thinking how they can shunt losses arising from uncertainty, including about the environment, onto the state and therefore onto today’s taxpayers and onto future taxpayers. No doubt, this doesn’t quite match the economist’s ideology but it is what happens. The successful entrepreneur needs to be “well connected”. By intensive lobbying of politicians and officials, as well as parachuting their people into government offices to write draft legislation, it has been possible, for example, for the carbon aristocracy to offload the risks of developing “unconventional fuels” like shale gas in the UK government’s energy strategy. You get lots of “enterprise” if there are no risks when taking investment decisions because the state/taxpayer are backing them. We’ve also seen that state backing for “too big to fail” financial institutions has led to a reckless “entrepreneurialism”, partly because banks expect to be rescued when they come unstuck.

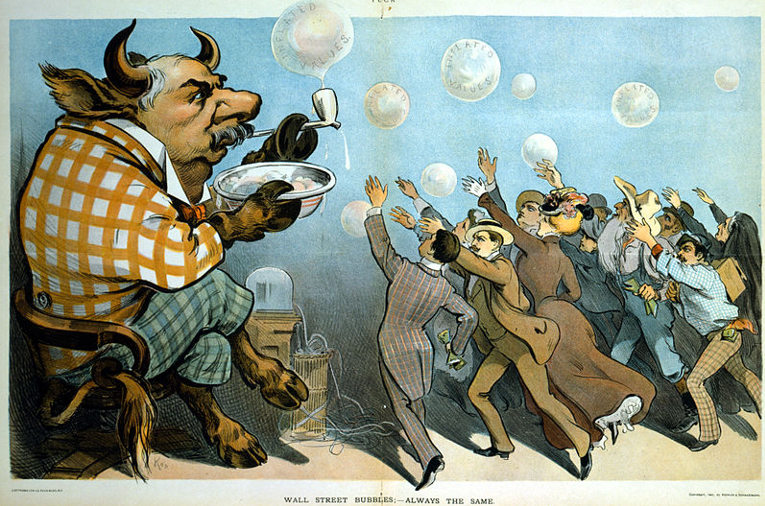

The repeated experience, through economic history, of market bubbles which are characterised by collective euphoria, tells us something very powerful about “entrepreneurship”. It enables us to “get real” about the people who play leading roles in the economy. Although it is true that entrepreneurs are making decisions which involve committing resources in the face of an unknown future, the main method most managers use to guess the future is to try find out what everyone else thinks – it is to “go with the herd”.

At least then, if everyone gets it wrong, one cannot be singled out as any more blameworthy than anyone else. In a newspaper like the Financial Times, journalists – typically called “market strategists” – collect opinions from people in companies about what the market trends are. That way, they get a bit of fame while their peers get a sense of what others in the market are thinking.

To sum up thus far, “entrepreneurship” is a category covering a multitude of circumstances, a multitude of actors and a multitude of behaviours. Some of these may certainly approximate the challenging obstacle race that justifies the romance. But a closer look reveals a range of often unrecognised stakeholders sharing the risks, many of whom are unwilling participants; that by no means all entrepreneurial actors have it difficult and those who are well connected and well-resourced may get the state to hold their hands. In addition, it is by no means self-evident that a restless increase in production is in the long term interests of a sustainable and resilient society. Nevertheless, there are plenty of people out there who are desperate to prove themselves, to prove that they can “perform”, to “achieve” – who are not asking themselves from whence this inner drive comes.

Motivations – what drives entrepreneurs? What are “animal spirits” anyway?

Childhood neglect perhaps? Only being noticed when they were “a credit for the family?” Having to “earn” love?

Before going further, let us have a look at the psychological roots that drive people to want to be entrepreneurs. While economists would say that the motivation of the entrepreneurs is the profit, more particularly the rate of return on the capital that they risk, there is clearly usually more going on than this. The famous phrase used by John Maynard Keynes to describe the preparedness of entrepreneurs to venture into the unknown and to try to shape the economic future was “animal spirits”. This description does not really tell us anything in depth, but it does not convey a feeling of the rational calculation of future profit probabilities. The phrase evokes something more emotional and perhaps driven.

Over a lifetime in an entrepreneurial role, people’s motivations are likely to change too. Indeed, some entrepreneurs may lose interest in their entrepreneurial role once the company that they have helped to found is well established. After a point, it will become possible to move on without any loss of income because they have accumulated enough capital. Thomas Picketty points how the fortune of Bill Gates, the founder of Microsoft, has continued to grow just as rapidly since he stopped working for that company. A very rich person can plough back virtually all their income into further investment so their wealth will grow with no effort at all. (If there is any connection between effort, ability and wealth it disappears altogether at this point. A point that is even more evident in the case of people who inherit their wealth and put in no work to earn it at all.) (Piketty, 2014, p. 440)

As I have attempted to convey already, the superficial idea that you might get having read too much economics is that new entrepreneurs are responding to market opportunities to make money and, in particular, to maximise the rate of return on capital. However, this kind of thinking about motivations doesn’t get us very far. Certainly, if one looks at the literature that tries to motivate people to set up their own businesses, the potential rate of return is not the only or even the main motivation mentioned. Being one’s own boss and having the scope to realise one’s creative impulses are also there. No doubt, many people have experience of how institutions and companies run and want to show how it could be done differently and, as they see it, better. Then there are those who “want to prove themselves”.

Companies are set up by human beings and human beings are more complex and varied than one will learn from economic texts. The rate of return on capital is only the way of keeping score in a choice of “life game” in which the deeper motivations need to be uncovered. It is possible to conceive of many different motivations to be an entrepreneur, but there is clearly a difference between those whose motivations are extrinsic and those who are intrinsic.

The intrinsically motivated entrepreneur is interested in what they are trying to sell or produce for its own sake. They are the producers of a particular product because that product interests them, or they believe in it and they are only secondarily interested in it as a way of making money. Some of these kind of entrepreneurs may work together with peers to innovate forms of social and environmental enterprise and/or strive to develop a co-operative or a community business. In many cases, money making is merely a means to another end.

An extrinsically motivated entrepreneur is not really interested in the product or service that they sell as such. They are interested in it chiefly because it makes money and it allows them to profile themselves in a status role, in short, as a vehicle for attention seeking and social cache. The entrepreneurship is about proving to other people something about themselves. This kind of entrepreneur has what the therapist Erich Fromm called a “marketing personality”.

For some entrepreneurs the exercise is about “being” and involves factors such as work satisfaction; the exercise of creativity; the engagement with something that interests them; the development of working relationships; contribution to a local community and protection of the environment.

For others it is about “having”, that is, purchasing power; celebrity status; the ability to prove to those that doubted them in the past that “they can make it” and that they can be really grown up.

This distinction makes sense of a phenomenon noticed by John Kay, which he explains in his book, Obliquity. The companies that tend to do best in terms of financial performance are often the ones in which the managers are not striving for best possible financial returns, but have other motivations – which business partners and customers perhaps sense and respond to positively – sensing a greater concern for quality and trustworthiness, sensing shared values. (Kay, 2010)

The “legacy problem”

Evidently, a person can make a transition from one kind of entrepreneurship to another, and they do.

Organisations can also change. They can start from an idealistic vision and lose that as they grow larger and find it difficult to manage the complexity of relationships in the organisation in a non-hierarchical way, finally resorting to conventional command and control top-down management systems. This changes the entire spirit of the venture and culture of the organisation. As it degenerates away from its ideals, it starts to follow much more conventional extrinsic goals.

Another pressure to change identity and purposes lies in the difficulty that small organisations often have of expanding because they lack finance. Perhaps the team that started up the company finally resorts to a “venture capitalist”, which leads to a powerful player coming into a business with a different value system. This person has no loyalty to original colleagues or original ideals, but plenty of concern about his money stake and a desire to prove that he is smart when it comes to business. His money stake turns out to be the purchase of the right to push around an “old guard” who are not regarded as equal partners because, as the newcomer sees it, they lack the savoir faire in cut and thrust, the ruthlessness of the market, possessed by the man with the money. He turns into the new boss… very much like the old boss that the initiators of a company were running away from when they set up their new company in the first place.

Yet another process is where the originator of an organisation is ready to move on, either because of tiredness, age, or for some other reason. A successful organisation is likely to be eyed-up by money junkies as a desirable acquisition and, as the founder moves on, the time to move in arrives.

The name for these kinds of transitional crises is the “legacy problem”. It is not just communism that degenerated and disappointed expectations. Many idealistic business ventures do as well. Nothing lasts. (Kelly, 2012, p. 157)

One interesting and little known fact is that there are more people employed by co-operatives in the world than there are employed in large corporations. We can ponder why the successes of co-operative are so little recognised. Perhaps it is because they make less fuss about themselves and their managers. Partly this is because, in co-operatives, people are likely to share management decisions, or at least the managers are unlikely to stand out. Perhaps also it is because there are people and co-ops who do not want to grow their organisation larger and face the legacy problem. Co-operative managers are more likely to be in the background.

The idea can be expressed the other way round. In capitalist corporations where extrinsic motivations are uppermost, it is more important to the managers that everyone knows that they are there. This might be regarded as narcissism but also their way of justifying their large remuneration. Thus, rather than their fabulously productive role accounting for their income, it might be the other way round. Their fabulously large income accounts for their very visible role and also meets a “look at me” need to be recognised as a very smart operator in a fast changing environment.

The changing role of entrepreneurs as their organisations develop

If a start-up is successful – and one in three fail in the first 3 years in the UK – then the entrepreneur who has been there from the beginning will progressively move into a different role. As an organisation grows in size it will also grow in complexity. Entrepreneurship becomes a different kind of process, namely, how to manage and steer in conditions of growing size and increasing complexity.

As explained above, the development of organisations in a competitive environment is a struggle to grow larger in order to survive. A transition from flexible pioneers with the freedom of action that comes from having few ties, to highly networked and highly integrated bureaucracies with many stakeholders and many different elements to co-ordinate through necessary changes.

Economists like to argue that markets are the best way to manage complex systems. The different nodes in a network of productive interrelationships (suppliers and customers) can best be organised by independent actors who organise specialist production and services, a fragment of a larger whole, and then buy and sell with the rest of the whole network. Prices are used as the signal that co-ordinates the information needed for successful insertion in the wider whole. That is how it is supposed to work. Yet the modern world is characterised by vast multinational economic empires that co-ordinate a huge amount of productive activity “in house”. While economists denounce economic planning by the state, a huge amount of highly complex economic activity is effectively planned “in house” by corporations.

The reasons for this are not hard to find. “In house”, a company has more control over potentially destabilising variables – like untrustworthy and unreliable suppliers of crucial components and materials if they have to be purchased. Through the market the so called “transaction costs” are higher – investigating the reliability of retailers and suppliers, drawing up contracts etc. Every business operates in a larger environment which is a source of potential instabilities and unpleasant surprises.

One way of trying to master the risks and uncertainties arising in this unknown environment is to swallow it up, take it in and make it part of the company.

Co-opting governments

For very large companies, the final end of this process is to co-opt government too, as we can see

when large companies move from being on the consultation lists of officials, to a position where these companies parachute their staff into government ministries and are consequently allowed to draft regulations and legislation. This enables “entrepreneurs” to rope in taxpayers to underwrite their activities and pick up their risks, at the same time as undermining the rights of citizens to resist the environmental and community costs of “enterprise”. (A recent example has been the policy to promote the development of shale gas in the UK).

It was Mussolini who described fascism as the unity of the state with corporations.

Entrepreneurship at this level is something else again from that described earlier in the case of small pioneering start-ups. At this level, it is quite impossible for business leaders to have a knowledge of all that is going on in their companies. In fact, they can at most have a tiny amount of knowledge. The “allocation of resources” inside large corporations consists of decisions distributed to many people across many parts of the organisation.

Control freakery

Whether the personality of the “entrepreneur” will allow this to happen is another matter. The history

of some organisations, some businesses, and some states, is dominated by sociopathic control freaks whose personalities drive them to take all the detailed decisions and to be seen to take all the detailed decisions so that they can also take all the credit. Such people are narcissistic – self-absorbed, arrogant and domineering. Their behaviour reveals outbursts of petulance and rage if they are not deferred to and it is clear that what they crave is to be able to exercise control over people that are supposed to admire and worship them. It is often said that psychopaths are very charming and charismatic and thus, appear, at first sight to be ideal leaders – but the charisma and the charm is merely one of a repertoire of control tools.

What kind of childhood and upbringing predisposes a person to develop into this type of personality is outside the scope of an economic anti-textbook, but a realistic theorisation of “entrepreneurship” is incomplete without a description of the type – for entrepreneurship, management, politics and military service are typical favoured launching pads for the rise of such creatures.

If it is not clear enough already, perhaps I should spell it out in simple words. Economics gives us an abstract description in which entrepreneurs seek to maximise the rate of return. In fact, business is made by people and people have all sorts of different kinds of personalities and motivations. If this complex picture cannot be synthesized into a single clever mathematical model, then tough for the model builders. It is easy enough to see what is going on and write the story in words.

Reality also includes people who are flexible enough to be able to delegate without feeling desperately emotionally insecure and/or getting into a rage. There are people who are able to share management functions and control with others without having what my mother would have called the “screaming hab dabs”. There are lots of people who are not dependent for their self-esteem on other people admiring and adoring them, or having them as an audience. There are people too who are quite content to work in the background, and not seek the limelight in any way. Not everyone wants to live in a soap opera like Dallas. There are people who have intrinsic motivations and who are able to live a life that, while not always blissfully happy, are nevertheless able to be authentic, true to themselves.

In these circumstances, it is possible to conceive of organisations that are not necessarily going to be those where an “entrepreneur” tries to oversee as many decisions as possible. Indeed, as I have already explained, there are more employees of co-operatives in the world than there are of corporations. If we don’t hear of this very much it is probably because the co-operatives get on with what they do and don’t make a fuss to get noticed in the same way that the corporations and their very important managers do.

Distributed management – the viable systems model of Stafford Beer

So, there are organisations in which it is possible to conceive of different kinds of management arrangements. Organisations where the managers are prepared to acknowledge when they do not know, and when someone else knows better, because that other person has more experience and more day to day contact with the issues in question. Another way of putting this is that a well-managed organisation is one that has the right balance of autonomy in its specialist parts with arrangements to make the specialist parts cohere together in a larger whole.

This idea was elaborated by the management theorist, Stafford Beer, in his so called “Viable Systems Model”. His co-ordination approach is a tool for management of complex arrangements. It is based on two overarching principles: maximised self-determination for the participants in the specialist activities of a larger structure balanced against arrangements to ensure overall coherence between these specialist activities. (Walker J. , 2006)

Coherence arrangements between the specialist activities are ensured by the provision of 4 types of co-coordinative functions to ensure that the specialist departments “remain in each other’s loop”, are accountable to each other and work together effectively for the same greater purpose.

These 4 types of co-coordinative function are:

1. Harmonisation

2. Mutual enhancement

3. Strategic external orientation

4. Maintenance of joint purpose

Maximised self-determination of specialist departments is balanced in the interests of co-ordinated coherence in a negotiated and periodically updated structure. There is also agreement regarding what information is required to keep track of the overall structure in meeting its goals.

The basic principle is that the people taking management decisions about specialist tasks should be the people involved in the specialist tasks and therefore knowledgeable about them. They agree with the larger organisation what specialist objectives their part of the organisation will seek to achieve and how they will be monitored on these achievements. To avoid interfering micro-management, they are then entitled to be left to do the job as they see fit as long as results are adequate in relation to what has been agreed.

Coordinative service functions are only activated in the interests of the common purpose, with specialist departments compelled to be involved in pre-agreed circumstances.

These circumstances are where:

1. Departments are at odds with each other and their activities need harmonisation (conflict resolution and stabilisation)

2. By mutual agreement, joint action between specialist functions will achieve more than working separately (arrangements to realise synergies)

3. External orientation intelligence reveals emerging opportunities and threats (strategic orientation to an evolving external environment)

4. There appear to be differences in agreed purposes and values (work to ensure that the organisation maintains a common culture, identity and values)

The viable systems model was meant by Beer to describe not only business organisations but any system that had staying power, including, for example, the human body. For any viable system to be able to persist, it must always exist nested inside a larger viable system. Thus, a company exists in an economic sector which, in turn, is part of an economy which is part of the human-ecological system. In the “other direction” the specialist parts of a company, say, are themselves nested sub-systems e.g. the sales department; the production department; the purchasing department.

When organised in this way, the structure is not one in which the entrepreneur is taking the crucial decisions as a heroic individual. The structure is aimed to distribute decision-making to the appropriate places in an organisation, namely to the people who are doing the work and who are best informed about locally specialised decisions. Further, while coordinative decisions can and are taken for specialist departments to ensure that they are properly integrated into the larger whole, these coordinative functions are not “the boss” but services which negotiate with the specialist work departments, in the interests of the whole organisation.

Properly conceived of, this is a structure that does away with “the entrepreneur” because the decision- making is taken by everyone in an organisation according to their place in it. This is why it has been described as an ideal organisational framework for workers’ co-operatives and for federations of co- operatives. (Where the federation is the next level of recursion in the system). See Jon Walker: The Viable Systems Model. A guide for co-operatives and federations (Walker J. , 2006)

Management by psychopaths and their loyal followers – university of chicago trained

Not only can the entrepreneur be thought of as disappearing in this structure, so too can any form

of top down command and control management. But this is profoundly threatening to any structure

of the authoritarian type. In the early 1970s, Stafford Beer was invited to go to Chile to help design a management system for the Chilean economy using the VSM as a participative model. It came to an end when a murdering psychopath called General Pinochet organised a coup against the elected government, supported by a team of economists trained at the University of Chicago.

One of the writings of Stafford Beer is titled Designing Freedom (Beer, 1973) but freedom for those they regard as their social inferiors is the last thing that psychopaths are able to contemplate. What’s more, there are plenty of people who have grown up, adapted to living with and surviving under control freaks. These people are frightened of freedom because they want someone to tell them what to do, and what to believe. The secret of surviving as such a person is to be able to manage your emotional responses in such a way as not to offend your “betters”, to give them the loyalty and admiration that they demand, and to use the power that they give you to manage your emotions. Naturally, to be in an inferior position to your betters is humiliating and demeaning and one has feelings that arise from this situation that are not very nice. But loyal bullies can always channel their feelings into kicking around people who they feel to be their social inferiors. The loyal bully notices these people because they are troublemakers and/or layabouts. They show disrespect to the better class of people, as well as the institutions that promise stability and efficiency, and so need to be kept under surveillance. If necessary, the trouble makers can be given a good thumping, or even killed, if the circumstances are that extreme. Loyalty to the machine gives meaning, simple explanations and things for loyal bullies to do in troubled times. When conditions are chaotic, the simplest explanation is that social pests and nuisances are not doing what they are told and law and order must be restored. What the Nazis did when they came to power in Germany was to introduce a policy of “Gleichschaltung” – a German word that conveys uniformity, bringing into line and total conformity. It is an engineering view of society and life as if everyone were components in a machine and should do exactly and only what they are told. Any person, society or nation external to the “engineered harmony” is automatically a source of disorder to the machine and, since this world view matches quite well with the viewpoint of the military, they are seen as enemies to be subordinated and brought into conformity.

As already pointed out, Mussolini defined fascism as the combination of the corporations and the state. In order to crush dissent on behalf of the state-corporate alliance, fascism works with people of this type. No doubt, the personality type was also enrolled under the bureaucratic dictatorships of the soviet type too. However, when such societies collapsed the opportunities for sociopathic entrepreneurs and loyal bullies blossomed.

Criminals are entrepreneurs too

According to a senior fellow at the Washington based Center for International Policy, in the 1990s “Russia suffered the greatest theft of resources that has ever occurred from any country in a short period of time, $150 billion to $200 billion in a decade. This is the low end of the figure which goes as high as $350 billion” (Raymond Baker, quoted in Loretta Napoleoni Rogue Economics). At the same time, the collapse of the East European economies was extremely good for entrepreneurs in the sex trades.

A strong correlation exists between the supply of Slavic prostitutes and female unemployment; to an extent, they show identical geographical patterns. (Napoleoni, 2008, p. 13)

… the new sex trade was only the tip of the iceberg. Globalisation allowed the exploitation of slave labour at an industrial level, reaching an intensity never seen before, not even during the transatlantic slave trade. From the cocoa plantations of West Africa to the orchards of California, from the booming illegal fishing industry to counterfeit producing factories, as I found again and again during my research, slaves have become an integral part of global capitalism. (Napoleoni, 2008, p. 1)

Once we recognise that many entrepreneurs are psychopaths, we must also acknowledge that criminals can be very entrepreneurial too. Of course, not all entrepreneurs are criminals – just a large proportion.

Central to the economics as a belief system is the idea that looking after oneself, the pursuit of self- interest, leads through the magic of the market process, to a greater good. The idea has always been garbage, as we have seen, but even its proponents will admit that it assumes that everyone is playing by a set of rules. At least the state can impose a set of rules, even if the entrepreneurs don’t like them.

But why should we believe that this happens when there is so much evidence that many entrepreneurs go to a lot of trouble to evade regulation and to hide what they are doing? If economics is supposed to explain the features of the world as it is, rather than how we would like it to be, then economists need to explain what the captains of industry and finance are hiding when over 80% of international loans are routed through secrecy jurisdictions, more than half of world trade passes (on paper) through these same jurisdictions, virtually every major European company and the majority of American companies use secrecy jurisdictions for a variety of unspecified purposes. Also, when at least $21 trillion of unreported private wealth was owned in tax havens by private individuals in 2010 – equivalent to the size of the United States and Japanese economies combined. (Henry, Christensen, & Mathiason, 2012)

Control fraud – pursuing self-interest by looting your company

A crucial assumption in much economics is that there is an alignment between the interests of the companies and their managers. In recent years, however, there has been a recognition that if people see “their rational interest” in making as much money as possible, then it might be in the interest of the entrepreneurs to loot their companies – to run them for maximum gain for the managers until they run into bankruptcy.

William K Black is an economist who has studied this in depth, particularly as it applies in the US finance sector. After his experience as investigator and prosecutor of crimes committed in the US Savings and Loans scandal of the late 1980s, Black developed the concept of “control fraud”.

According to Black:

Individual “control frauds” cause greater losses than all other forms of property crime combined. They are financial super-predators. Control frauds are crimes led by the head of state or CEO that use the nation or company as a fraud vehicle. Waves of “control fraud” can cause economic collapses, damage and discredit key institutions vital to good political governance, and erode trust. The defining element of fraud is deceit – the criminal creates and then betrays trust. Fraud, therefore, is the strongest acid to eat away at trust. Endemic control fraud causes institutions and trust to become friable – to crumble – and produce economic stagnation. (Black, 2005)

What is taking place here is that the senior managers run companies (or other organisations) in their own interests and against the interests of all the other stakeholders – not just shareholder and creditors, but also employees and communities.

The problem is not just to be found in the United States, obviously. Similar examples of looting by elite entrepreneurs were revealed across the globe by the financial crisis of 2007-2008, including in banks in the UK, Ireland, France, Germany and Iceland.

In order to loot your company in the finance sector, you get it to grow rapidly to maximise short term profits and thus, your own bonuses and executive pay – but in so doing you run it over a cliff edge. This is because rapid growth means lending with no heed for proper standards of prudence and without regard for risk. As much as possible, you grow the company by borrowing money from others to fund your lending (i.e. you don’t risk your own money). You don’t set aside reserves for inevitable losses because the accounting for that would reduce short term earnings. You pass the risk parcel to other suckers where possible. This happened just before the 2007 crisis when big financial institutions were selling financial assets with AAA ratings that they were privately describing as “toxic waste”. (Black, 2005)

You then get your friends in high places to bail you out and block prosecution. As in the game, Monopoly, you get your “Get out of Jail Free” card. Control fraud of this type is often covered up with the support of corrupt friends in government.

After the Savings and Loan Crisis in the late 80s and early 90s, a thousand people were convicted of financial fraud by prosecutors like Black. By contrast, after the crisis of 2007/2008 the elite criminals in the US financial sector have largely walked away with their fortunes and very few have been prosecuted.

This is true of the UK too where, despite warnings, the regulators i.e. the Financial Services Authority, allowed reckless lending at two banks, namely, Halifax and Bank of Scotland (HBOS) and the Royal Bank of Scotland (RBS), and then failed to properly investigate. (Fraser, 2011) (Murray, 2011)

The city of London and its network of tax havens sells itself as a place that sees and hears no evil. The “light regulatory touch” in the City of London has not been accidental. It is part of a political- economic strategy. In his book Treasure Islands, financial journalist Nicholas Shaxon explains how, at the end of the British Empire, the City of London had to re-invent itself as a financial centre. In the late 1950s, the euro-dollar market enabled London to offer the evasion of Federal Reserve Regulation on dollars held in London instead of in the USA. This strategy of making London into a place to evade financial regulation was then extended geographically through a network of tax havens and secrecy jurisdictions in Britain’s dwindling network of colonies and “dependencies”, for example, in places like the Channel Islands, the Isle of Man and, above all, the Cayman Islands. The process took place with the help and connivance of the gentlemen at the Bank of England and the City of London. (Shaxon, 2011)

As Nicholas Shaxon documents, the function of these islands is to launder the profits of international crime syndicates; arrange finance associated with gun running and the arms trade; park money looted from countries by their oligarchies; evade financial regulation; provide havens for the shadow banking sector and to facilitate tax evasion. Since the evasion has been on a substantial scale, that is one of the little stated reasons for a crisis of government finances in many countries, the problem of fiscal deficits, financial instability and the austerity attacks on ordinary people. The chief purpose of these places is to create places where the global business elite can operate as “unknown unknowns”.

Writing about the predominance of British “overseas territories” (OTs) and “crown dependencies” (CDs) in the financial secrecy index (FSI), the Tax Justice Network comments:

If the Global Scale Weights of just the OTs and CDs were added together (24% of global total), and then combined either with their average secrecy score of 70 or their lowest common denominator score of 80 (Bermuda), the United Kingdom with its satellite secrecy jurisdictions would be ranked first in the FSI by a large margin with a FSI score of 2162 or 3170, respectively (compared to 1765 for Switzerland). Note that this list excludes many British Commonwealth Realms where the Queen remains their head of state. (TaxJusticeNetwork, 2013)

In simple terms, the City of London and its network has retained its global financial presence by becoming the chief haven for crooks and tax cheats.

Elite fraud causes intensifying economic, political and moral crises but, for some difficult to explain reason, it does not a figure much, if at all in neoclassical economics. According to William K. Black:

Economic theory about fraud is underdeveloped, core neoclassical theories imply that major frauds are trivial, economists are not taught about fraud and fraud mechanisms, and neoclassical economists minimize the incidence and importance of fraud for reasons of self-interest, class and ideology.

Neoclassical economics” understanding of fraud is so weak that its policy prescriptions, if adopted wholly, produce strongly criminogenic environments that cause waves of control fraud. Neoclassical policies simultaneously make control fraud easier and more lucrative, dramatically reduce the risk of detection and prosecution by maximizing “systems capacity” problems, and encourage crime by making it easier for fraudsters to “neutralize” the social and psychological constraints against deceit and fraud. Thus, the paradox: neoclassical economic triumphs produce tragedy… (Black W. K., 2010)