Common wealth, properly organized, provides a way to address the two greatest flaws in contemporary capitalism—its relentless destruction of nature and widening of inequality—while still keeping the benefits that markets provide. Common wealth—that is, wealth belonging to everyone equally—includes the gifts of nature, societal creations, and economic synergies. It is immense and in some cases imperiled, yet it remains invisible to markets because it is poorly organized and lacks clear property rights. Organizing common wealth so that markets respect its co-inheritors and co-beneficiaries requires the creation of common wealth trusts, legally accountable to future generations. These trusts would have authority to limit usage of threatened ecosystems, charge for the use of public resources, and pay per capita dividends. Designing and creating a suite of such trusts would counterbalance profit-seeking activity, slow the destruction of nature, and reduce inequality.

The Great Double Tragedy | What Belongs to Everyone Equally? | Property on the Outside, Commons on the Inside | Sharing Our Common Wealth | Creating the Future We Want | Endnotes

Mary Christina Wood, a professor of environmental law at the University of Oregon, has helped to launch a barrage of lawsuits throughout the world on behalf of young people and future generations. The suits argue that the legislative and executive branches of government have failed to fulfill their duties as trustees of the atmosphere and that, under common law, judges have the authority, and indeed the duty, to order them to do so. What she is hoping for is not just a reduction in carbon emissions, but a recognition by judges that citizens have an inalienable right to the common resources that support their survival.1

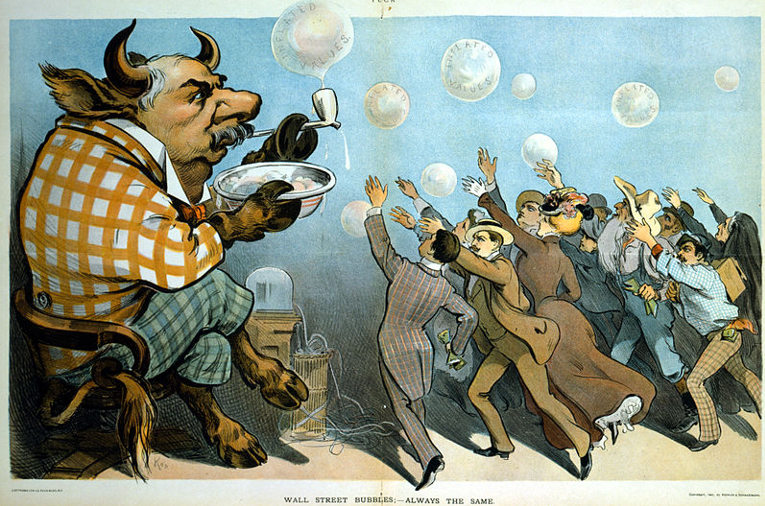

What drives Wood’s effort is a great tragedy of our time: capitalism is destroying nature, and it is concentrating wealth at accelerating rates, turning democracy into a thinly disguised façade for plutocracy. In the face of this tragedy, how can we assure that the well-being of both humanity and the planet is sustained? If there is to be a Great Transition, we must answer this question.

Most of us, I presume, want an economy that provides a good life for all on a healthy planet. Such an economy would operate within the boundaries of nature and provide more security and equality than our current winner-take-all system. Ideally, such an economy would help locally-owned businesses to thrive while curtailing the market and political power of large corporations. The question then becomes, what structural changes would make a modern market-based economy run this way?

Without structural changes, our current economic arrangements will continue to produce the results we see now. New economic thinking, shifts in consciousness, and grassroots initiatives can set the stage for the needed transition, but without structural change at the macro level, we will not be able to overcome the double tragedy of inequality and environmental destruction.

My proposition is that a system of common wealth, properly organized, is the broad structural innovation we need. In wealthy nations like the United States, organized common wealth can help fix the two greatest flaws in contemporary capitalism—its relentless destruction of nature and its equally relentless widening of inequality—while preserving the benefits that markets provide.2 In particular, organized common wealth can (1) slow the flow of energy and materials through the economy and (2) provide everyone a source of non-labor income. This combination will be essential for a transition to a more sustainable and equitable future.

What Belongs to Everyone Equally?

What is common wealth? And how might we, by properly organizing it, harness this wealth to fix our economic system?

We all know what private wealth is: stocks, bonds, real estate, and so on. The ups and downs of this wealth are reported every day in the news. By contrast, we barely notice our common wealth, which is a much richer trove. It includes the vast gifts of nature, including sources and sinks, along with socially created institutions without which large-scale enterprise could not flourish. Consider what would happen, for instance, if the Internet stopped functioning: all of the businesses that depend on it would suddenly have little value on their own. The same is true for our energy, transportation, and financial systems. It is common wealth that creates most of the value of private wealth.

Common wealth, by right, belongs to everyone equally. However, markets currently do not acknowledge such wealth or recognize its value, much less its common ownership. Because of this enormous market failure, private businesses take, use, or pollute common wealth without limit, generally without paying its rightful owners for the privilege. By so doing, private businesses and their narrow group of owners capture much of the value added by common wealth, exacerbating inequality. If businesses had to pay for the use of common wealth, these things would not happen, or at least would happen much less. What are now unpriced externalities or straight-out thefts would become costs for businesses that could generate income for everyone.

Property on the Outside, Commons on the Inside

How should common wealth be organized to achieve these goals? Two needs are paramount: legal shells and fiduciary responsibility to future generations. The shells are necessary to enable managers of common wealth to bargain with profit-seeking enterprises in the marketplace. Fiduciary responsibility assures that the managers of common wealth act first and foremost on behalf of future generations—which, de facto, means nature.

Legal scholar Carole Rose has described the way common wealth ought to be organized as “property on the outside and commons on the inside.”3 Outwardly, the shells would be not-for-profit corporations with state charters, self-governance, perpetual life, and legal personhood. Inwardly, the managers of these not-for-profit corporations would be required to protect their assets for future generations and to share current income (if any) equally. We can call such entities common wealth trusts.4

Common wealth trusts would provide a counterweight to profit-maximizing enterprises within a market economy. The state’s job would not be to manage common wealth itself, but rather to maintain the proper balance between businesses and organized common wealth (See Figure 1).

The trust form of organization need not be applied to all forms of common wealth. However, at the very minimum, it should be applied to ecosystems that are approaching irreversible tipping points. By creating accountable, self-governing entities to hold and manage such common assets, we can create a market system that effectively and equitably represents both nature and all living persons.

Figure 1: A Balanced Market System

For some people, subjecting ecosystems to the market in any way is a sacrilege. A quote commonly attributed to Chief Seattle of the Suquamish tribe epitomizes this sentiment: “How can you buy or sell the sky, the warmth of the land?”5 Although I empathize deeply with this view, given current political and economic realities, the only likely alternative to a common wealth approach, as I see it, is the destruction and inequality we see today. Moreover, a common wealth trust would not entail “selling the sky,” but rather holding it in trust for future generations. The right to use the sky as a parking lot for gaseous wastes would be strictly limited and auctioned, and the revenue equally shared, but the sky itself would never be sold. It would be held in trust forever.

Guided by science, the trusts that steward critical ecosystems would set the aggregate level at which each ecosystem can be used and then let market forces determine who specifically uses them, and at what price. For ecosystems approaching their tipping points, the trusts would ratchet aggregate usage steadily downward, thus limiting human impact to scientifically determined levels. Prices would then be determined by the forces of demand and (now limited) supply. For sources of common wealth that are global, e.g., the air and the oceans, global negotiations would be important for harmonizing these limits.

Why do elected governments not act as trustees for common wealth, as many think they should? Our present form of elected government is simply not designed to balance the rights of future generations against those of the living. Since future generations do not vote or donate to candidates for public office, they have little to no clout in our electoral system. Historically, this was not a problem because when many of today’s democratic systems were established, nature was not imperiled as it is today. Now, however, the peril is great and cannot be ignored.

One way to work around this flaw in democracy is to give future generations representation in our economic system. Though difficult, this is easier to do—and once done, more durable—than representing them in our political system. We can assign property rights in critical ecosystems to trusts for which asset preservation, rather than winning elections or maximizing profit, is the paramount mission. The National Trust in England, which owns more than 600,000 acres of countryside, including one-fifth of the coastline, shows how such institutions could look. Community land trusts provide a similar example, albeit on a smaller scale.

What about workers and families? Many environmentalists believe that, in deference to nature, people in industrialized countries should learn to live with less. The trouble, though, is that because of corporate power, most of them are already doing so. A better strategy is to align the needs of nature with, rather than against, those of workers and families.

This is not a matter of “green jobs.” Green jobs will emerge when the costs of despoiling nature rise, but such jobs will absorb only a small percentage of our working population. Alone, they cannot address growing inequality. Further, the precariousness of employment and the stagnation of wages have produced widespread economic insecurity. In the United States, for instance, jobs that offer steady employment, decent wages, health insurance, paid vacations, and defined pensions are increasingly rare. Displacing them are on-demand jobs and freelance positions that do not offer guaranteed pay or benefits and thus shift multiple risks from companies to individuals.

In the future, even steady jobs are likely to pay less (in real terms) than they do today. In unionized industries like autos and airlines, two-tier contracts are now the norm, with younger workers paid substantially less than older ones for doing the same work. Nor is the picture brighter elsewhere in the economy. In the US Labor Department’s latest list of occupations with the greatest projected job growth, only one out of six pays more than $60,000 a year.6

There are numerous reasons for this decline in job security and pay, but the biggest are globalization and automation, neither of which is going away. The implication is clear, if not yet widely recognized: assuring a decent living for all and reducing inequality will require some form of non-labor income. Organized common wealth can come to the rescue here as well.

In the US, for example, organized common wealth could, over time, generate enough income to pay dividends of up to $5,000 per person per year. Initially, a sizable portion of the funds would come from selling a declining number of permits to park carbon dioxide in our shared air. Later, additional dividends could be generated by charging corporations that use our country’s financial infrastructure, patent and copyright systems, and electromagnetic airwaves.7

The idea of paying dividends from income generated by common wealth is not new. In his 1796 essay Agrarian Justice, Thomas Paine distinguished between two kinds of property: “natural property, or that which comes to us from the Creator—such as the earth, air, water…[and] artificial or acquired property, the invention of men.” The second kind of property, he argued, must necessarily be distributed unequally, but the first kind belongs to everyone equally. It is the “legitimate birthright” of every man and woman, “not charity but a right.”8 Paine went on to propose a practical way to implement that right: create a “National Fund” to pay every man and woman a lump sum (roughly $17,000 in today’s money) at age twenty-one and a stipend of about $1,000 a month after age fifty-five. Revenue would come from what Paine called “ground rent” paid by landowners.

A version of Paine’s idea was implemented in Alaska to distribute income from the state’s oil wealth. Called the Alaska Permanent Fund, it was created in the 1970s and has been supported by all governors since, regardless of party affiliation. Every year since 1980, it has paid equal dividends to all Alaskans, both children and adults, ranging from $1,000 to over $3,000 per person per year. The beauty of Alaska’s model—and the reason for its popularity—is that it is not based on taxes. Instead, it is based on equal sharing of income derived from the state’s oil wealth, wealth that belongs to everyone. Such a model could be applied nationally by expanding the notion of common wealth beyond oil.

In her book Owning Our Future, Marjorie Kelly describes a number of institutions that, if widely replicated, could constitute the core of a new economy: worker-owned businesses, corporations with social missions, community loan funds, “wind guilds,” and cooperatives of all sorts. She emphasizes that ownership is the primary factor that drives economic outcomes.9 Not only could common wealth trusts contribute to such an ownership revolution, but the non-labor income they provide would enable citizens to take the risks involved in developing other new forms of human enterprise. This is a crucial step on the road to a Great Transition.

Designing and creating common wealth trusts, when and where possible, will involve research, discussion, and experimentation. What assets should be held by common wealth trusts? How should the trusts be governed? How should their valves—that is, the mechanisms that reduce overuse of nature—operate, and how should revenue be collected? There are no perfect answers to these questions, but there are many good ones worth testing.

A transition to an economy in harmony with nature and human needs will take a great deal of time and effort. During this multi-decade endeavor, I would not place too much faith in public policies that can fluctuate with the vagaries of politics. However, I would place it in solidly built common wealth trusts, supported by a society of co-owners and bound as much as humanly possible to generations to come.

1. For more on this effort, see Wood’s book Nature’s Trust: Environmental Law for a New Ecological Age (New York: Cambridge University Press, 2013).

2. This Viewpoint primarily focuses on the United States, but the common wealth approach is applicable to other countries as well, with appropriate modifications.

3. Carol M. Rose, “The Several Futures of Property: Of Cyberspace and Folks Tales, Emission Trades and Ecosystems,” Minnesota Law Review 83 (1998): 144.

4. Peter Barnes, Capitalism 3.0: A Guide to Reclaiming the Commons (San Francisco: Berrett-Koehler, 2006).

5. James Martin, “How Can You Buy or Sell the Earth?: Chief Sealth’s (Seattle’s) Reply to Franklin Pearce,” Management and Accounting Web, http://maaw.info/ChiefSealthsReply.htm.

6. C. Brett Lockard and Michael Wolf, Occupational Employment Projections to 2020 (Washington, DC: US Labor Department Bureau of Labor Statistics, 2012), Table 3, http://www.bls.gov/opub/mlr/2012/01/art5full.pdf.

7. Peter Barnes, With Liberty and Dividends For All: How to Save Our Middle-Class When Jobs Don’t Pay Enough (San Francisco: Berrett-Koehler, 2014).

8. Thomas Paine, Agrarian Justice (London, 1797), iii, https://pdf.yt/d/2sZb8-NWPHhiTGSP.

9. Marjorie Kelly, Owning Our Future: The Emerging Ownership Revolution (San Francisco: Berrett Koehler, 2012), 111.