Currencies image via epsos.de/flickr. Creative Commons 2.0 License.

The basic structure of capitalist monetary systems originated in Europe during the 15th and 16th centuries[1]. The most distinctive feature has been the gradual integration of privately organised banking networks (giros), for clearing and settling payments between producers and traders, with states’ issue of public currencies. Was this, as is widely accepted, a process of ‘evolutionary selection’ which has produced an increasingly effective system? Or, do we have a suboptimal outcome that owes its existence to the advantages that it confers on the major agents – the banks and states? If it’s the latter, can we do better?

Banks make profits by creating money from debt contracts with their borrowers who pay interest on the loans. It is essential to be clear that these are private debts (between two private agents: bank and borrower) which are transformed into public money (currency) by means of the links between the banks, the central bank, and in turn the link between these two to the state. Modern banks don’t merely lend money that has been deposited by savers; rather new money is produced by loans that create deposits for a borrower. Private debts – what has been borrowed – are spent as public currency. It is often said that banks create money ex nihilo – that is, out of nothing. But this way of looking at the process derives from seeing money as a material ‘thing’, which is based upon the old metallic currency conception of money. In modern capitalism, money it is not produced from ‘nothing’; rather it originates in the borrower’s promise to repay the private debt to the bank. In short, banks undertake two activities that are essential for the capitalist system: they operate the payments system and they create the credit-money by which it is financed.

In early modern Europe, private banks issued their own means of payment in the form of paper bills and notes which circulated within trading networks across Europe and the Near and Far East. The viability of these private payment networks was almost entirely dependent on the timely settlement of debts which, in turn, depended on the continuity of production and trade that made this possible. However, the vagaries of bad harvests and constant warfare, in addition to routine business failures and defaults, rendered the monetary networks unstable and fragile. Where states were able to establish a credible metallic standard and to impose and effectively collect taxes, denominated in their monetary measure of value (money of account), they were able to provide a stable public currency. In many regions, these two monetary systems remained quite separate and antagonistic – as in China and Islamic states.

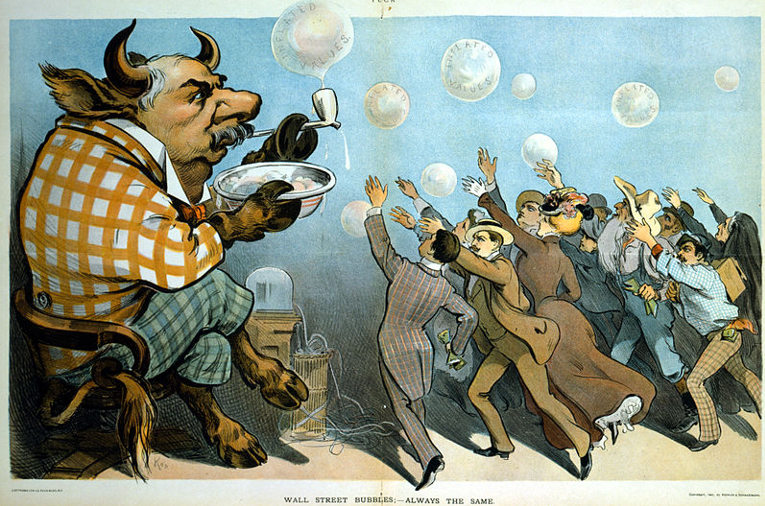

Private mercantile money enabled tax evasion (as it does today with Bitcoin and local exchange systems), and as a source of autonomous power it was resented by states. Despite the integration of private and public money in capitalism, the underlying antagonism has not been entirely eliminated. In the USA, for example, the conflict between democratic government and the ‘money powers’ persisted into the early twentieth century and surfaced again in the opposition between ‘Wall Street’ and ‘main Street’ in the wake of the Great Financial Crisis (GFC) of 2007-8[2]. But it is truly remarkable that this did not develop into a more radical and politically focused response.

In some European states, especially England, from the late 17th century onwards, private mercantile money and states forged a relationship in which each eventually came to depend on the other for long-term survival. In pursuit of domestic and geopolitical power, states borrowed from the merchants, and thereby escaped from the financial straitjacket imposed by the scarcity of precious metal currency, without having to debase the coinage and risk loss of legitimacy. Loans to states were organised by consortia of private bankers in return for which they were granted the lucrative monopoly to form ‘public’ (later ‘central’) banks. In this way, paper bills and notes used in the private banking payments system were ‘hybridised’ with states’ metal currency. Private bankers had access to the state’s backing of the currency which, in turn, greatly enhanced the acceptability of their own notes. (In very small print at the top of today’s banknotes, the Bank of England still anachronistically ‘promises to pay the bearer the sum of £5’. This is now five base metal £1 coins, not five gold sovereigns issued by a royal mint.) Backed by the state, Bank of England notes, for example, were soon most in demand, and by the early twentieth century they eventually supplanted the private issue of banknotes by the myriad independent ‘country’ banks. By the late nineteenth century, the Bank of England was no longer a mere intermediary between the state and the banks. Rather, it had become the ‘lender of last resort’ by providing money to save the banking system from a destructive chain reaction of defaults during financial crises. This is now augmented by a routine drip feed of loans to the banking system which has been augmented since the GFC in the guise of ‘quantitative easing’.

Thus private capitalist banks are able to ‘advance’ money into existence on the basis of the support they receive both routinely and in crises from the central bank and, in turn, from the state. Looking at the system from the other side of the links, we may say that the state ‘spends’ money into existence when its treasury, using its central bank account, pays for the goods and services that it buys from the private sector)[3]. These payments are deposited in the private banks, increasing their reserves held at the central bank which are available to maintain the economy’s payments system. Despite the recurrent crises, persistent malpractice, and predatory levels of remuneration coupled with incompetence, it could, with some effort, be argued that capitalist banks do discharge basic functions – the payments system is never seriously disrupted and some level of credit money continues to be created. However, as even this minimally acceptable performance now depends entirely on the support of the state and its central bank, it could be argued that the private banking system should be placed under public control on the grounds of both efficiency and equity.

Currently, there is a lively debate in some academic economic circles about the ultimate point of origin of money creation – that is, a debate about ‘whose money is it’? Does money start its circuit from state expenditure or from advances by the banking system, including the central bank? Is the treasury account at the central bank merely a ‘useful fiction’ that reinforces the belief that governments need ‘our’ money in taxes? Does the state first need our taxes in order to spend or do we need to acquire the state’s money in order to pay them? In the absence of sufficient tax revenue states sell bonds to finance spending; but whose money does it borrow? Is it that which has been created in the private banking system or its own money that it has spent into existence[4]? Aside from the arcane technical details of the balance sheets and transfers between treasuries, central banks and the banking system, these questions are fundamentally about who has the power to create and control money. Arguably, this is the most important source of power in modern democracies, but it is largely outside democratic control.

These arrangements–the pivotal ‘public-private partnership’ in capitalism–bring both benefits and costs. On the one hand, the transformation of private debts into public currency, especially after the abandonment of the gold standard, has enabled the vast expansion of finance upon which modern capitalism is based. It is a major source of ‘infrastructural power’ – that is, the means of collectively getting things done. On the other hand, a range of deleterious consequences follow from the private control of this collective capacity. The production of money is operated as a profitable franchise underwritten by the public sector. Banks make their money by selling debt and consequently there is a constant tendency for its volume to increase to the point at which destabilising defaults occur. Collective infrastructural social power and systemic fragility both increase simultaneously – a genuine contradiction for which, as such, there is no final resolution within the existing system.

In the short term at least, as operators of the payments system and the immediate source of credit-money, private producers and controllers of money are ‘too big’ to be allowed to fail in the crises that their activities bring about. Furthermore, this monopoly power in the control of the production of credit money is exercised ‘despotically’ by the power to impose rates of interest and to rig markets to extract more value – as in the recent manipulation of the Libor rate and foreign exchange markets. In a further expression of the ‘too big to fail’ dilemma, regulators are increasingly reluctant to impose further large fines for these transgressions for fear of weakening the banks’ capital and ability to withstand crises.

The complexity of this hybridisation of public and private functions means that the question of who is responsible for the aims and conduct of monetary policy remains obfuscated and continuously contested. For example, the government is engaged in a futile attempt to exhort banks to lend to small and medium enterprises, but cannot command them to do so. Given the self-inflicted damage of the GFC, banks prefer to repair their balance sheets. The impasse is entirely a result of the structure of the existing system. The ambiguous and vacillating status and role of central banks as expressed in their dual roles as agents of governments and guardians of the private banking system is a constant source of tension. For example, the fad for ‘independent’ central banks in the late twentieth century was intended to persuade foreign exchange markets that freedom from manipulation by profligate governments would enable them to control inflation. However, the façade of independent neutrality has become increasingly difficult to maintain since the crisis[5].

What is to be done? This brief introduction to the question is not concerned with the widely discussed details of the proposed reforms to the existing system – increasing capital adequacy ratios; separation of the lending and payments settlement from speculation/investment banking and so on. Leaving aside the political struggle that it would involve, the focus here is on the fundamental issue of whether basic public-private linkage and the franchising of the state’s monetary sovereignty could be abolished. Moreover, this question is not merely about money, but entails two unresolved doubts about the possibility of a feasible democratic socialism. First, by what democratic means might a public agency reach an agreement on the principles and management of the supply of money – how much and to what ends? A necessary precondition for the formulation of any answer is an adequate theoretical understanding of money. In this way, the money question is soon shown to be the question. Second, the ‘socialist calculation’ debate of the 1920s and 1930s will have to be revisited. Opponents of socialism contended that as we can never have sufficient knowledge effectively to plan an economy, the adaptive reflexivity of decentralised (or ‘market’) mechanisms, including demand and supply for money, is the only viable alternative.

This article is part of the OurKingdom series, Just Money, examining some of the themes in Ann Pettifor’s new ebook Just Money: How Society Can Break the Despotic Power of Finance, published by Commonwealth. It is available on Kindle and direct from the Prime Economics website. You can donate to OurKingdom’s work here.