Finance & the crisis

It has been nearly two decades since a financial crisis unleashed an economic crisis known as the Great Recession. The post-mortem of the period running up to this event uncovered reckless investments, irresponsible lending, and banks given licence to create too much money. 30 years of deregulation had made financial services an even more unaccountable and opaque part of the UK economy, with a strong reputation for bad practice and high levels of public distrust.

In its immediate response to the crisis, the UK government’s rescue package for the finance sector took the form of quantitative easing, a fiscal policy asking central banks to create new money to lend to banks who, in turn, were supposed to increase their lending to businesses and individuals. But rather than benefiting the real economy, government bonds were largely used to buy financial assets, such as pension funds, and according to campaigners Positive Money, “boosted bond and stock markets nearly to their highest level in history.”

Alongside this monetary policy, the UK government introduced another controversial fiscal policy – austerity. Given the economic losses from the financial crisis, the Coalition government decided it was necessary for a deficit reduction programme of £30bn of cuts in spending on welfare payments, housing subsidies, and social services. These cuts in the public sector translated into the loss or poorer delivery of existing services and the sale of 75,000 public assets, such as playing fields, community centres, and swimming pools. Taking only the case of public libraries, numbers have fallen by 17% – 4,482 to 3,718 – since 2010. Despite the narrative of the Big Society, a recent report by IPPR estimates that local councils have sold off assets that are worth in the region of £15bn, with only just over 3% of these assets being transferred into community ownership.

The UK job market also became more insecure, as another legacy of the financial crisis was an increase in the controversial practice of zero-hour contracts in UK workplaces. These new levels of precarity represented a new opportunity for predatory lenders, such as the now defunct Wonga – a payday loans firm that was founded in 2006, shortly before the crisis. Exploiting high levels of personal and household debt, Wonga was charging annual percentage rates of up to 5,000%. Just a decade later, it fell into administration under pressure from politicians, the Financial Conduct Authority, and the cost of claims. Ultimately, it was a decade in which almost every financial institution failed taxpayers, customers, and investors.

The rise of ethical finance

The financial crisis and criticism of the government’s response inspired impassioned calls from civil society for reforms to our financial system – from limits on bonuses to fair tax policies – that highlighted the economic and social costs of reckless financial institutions. Alongside these lobbying efforts, it also inspired determined efforts to show that money could be transformative and a powerful tool for change. So, what if investors were driven by social, as well as financial, impact? If the cost of finance was fairer for businesses, would they invest in less profitable – but more socially beneficial – activities? And what if the expectation of returns was more patient and flexible than in mainstream finance?

During a period where financial services were slow to reform, and the UK government showed no sign of reversing its lack of investment in infrastructure, ethical finance had an opportunity to show that sustainable funds could outperform the average returns of traditional investments, fill a void in both public and private spending, and have a positive impact on an economy in decline. This created a new generation of activists who were not becoming minority shareholders in hedge funds to pressure management, but directly putting their money into ethical businesses that had transparent supply chains and paid decent wages.

Ethical investments also benefited from an increased demand from investors to be in control of their finances. Beyond the financial crisis, greater awareness of the climate crisis challenged the investment portfolios of financial institutions and funds, and encouraged both experienced and retail investors to invest in funds that were part of the transition from dirty to green fuels. The principle of transparency would attract more and more investors into ethical investments, as they became sceptical of the lack of scrutiny within traditional financial services and an increase in climate-related greenwashing incidents.

New policy frameworks and tax incentives were also instrumental in enabling ethical finance to take off and achieve scale quickly. These schemes include the Enterprise Investment Scheme which offered 30% off investments up to £1M, Social Investment Tax Relief offering tax relief of 30% for societies and charities with no more than £5M in gross assets and fewer than 20 employees, and the Feed-in Tariff scheme, which promoted the uptake of renewable and low-carbon electricity generation before closing in 2019.

Another commitment with some ethical investments was to offer lower minimum investments to enable the participation of a wider section of the population. This encouraged those on lower salaries, more women, and other ‘everyday’ investors to use their money in a previously exclusive sector. But for the ethical finance movement to become a more significant player, there was a need for new ethical finance platforms that could make it easier for both investors and businesses.

Ethex: the founding of an ethical finance platform

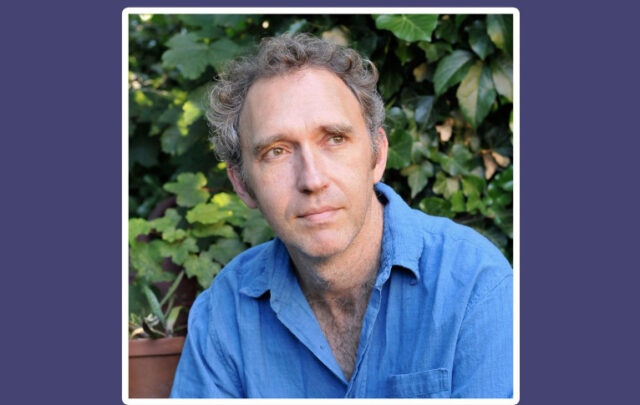

In 2012, social entrepreneur Jamie Hartzell founded Ethex, a direct impact investing online platform, with pioneering brands such as Cafédirect and Traidcraft among the first businesses featured. With previous experience of launching the successful Ethical Property Company, Hartzell found that ethical businesses lacked an online investment marketplace, making it difficult for the secondary trading of shares. As traditional finance services were so opaque, Ethex’s launch mission was focused on creating a market-place for ethical investments that made it both easy to understand and easy to do by and offering full transparency to investors.

Soon after Ethex’s launch, Lisa Ashford was graduating from a Diploma in Financial Strategy (DipFS) at Saïd Business School in Oxford. Inspired to find an impactful start-up, Ashford and Hartzell met for coffee on the Cowley Road and had a meeting of minds. Ashford started a consultancy position at Ethex in 2013, and soon after they saw the potential of Ethex not just to be a secondary market place but a platform to attract significant investment into social enterprises and communities across the UK who were delivering tangible environmental and social impact. Energised by this idea, after proving the concept, Ashford offered to take the helm which led to her becoming the CEO of the platform the following year. Hartzell and Ashford spent several years successfully working together as CEO and Chair and latterly Non-executive Director, before Hartzell moved on to other projects. The small founding team were passionate about not becoming another fintech platform with a low trust score, so they began by carefully curating campaigns, offering a rigorous process for due diligence, and working closely with each project on their business and marketing plans. Despite being focused on social and environmental impact, their approach ensured financial responsibility in terms of the offers it promoted to its investors. “These are investments after all,” says Ashford.

Since the early days of the platform, the ethical finance sector has shifted from an aversive ‘do no harm’ to a proactive ‘doing good’ approach where investors have more choice and opportunities to make positive investments in a range of sectors, from renewable energy and social care to housing to sustainable transport. It also highlighted another significant trend in investor preferences, with an increasing appetite to put money into local projects, rather than international Environmental, Social and Governance (ESG) initiatives.

Over the years, Ethex has offered a range of financial products, including the Innovative Finance (ISA) and is now a trusted direct impact investment platform with tens of thousands of ethical investors. “Many of those investing will only invest in one business,” Ashford explains, “and they may be supporters of a particular community initiative.” This supports the claim that there’s a powerful connection between investors seeing how their money is used and the pride in investing in a business that matters to the local community. It also explains the rise in ‘community shares’, which has now attracted more than 126,000 individuals to invest in their local community.

The community shares story

There has been a growing movement of ethical or intentional investors who are not just interested in buying shares, but co-owning local assets and services that are at-risk or could make their local economy more resilient. Unlike traditional investors, this new generation of investors are looking to place their savings into local businesses that offer membership, accountability, and broad community impact.

The rise of ‘community shares’ – alternatively known as ‘withdrawable shares’ – has led to a market now worth more than £210M according to Co-operatives UK’s latest report. As a form of equity, it provides patient capital for businesses and democratic ownership for investors, and allows unlisted businesses to raise finance from the public without being routed through a statutory regulated – and costly – process.

In 2015, the arrival of an independent foundation supporting community business – Power to Change – increased the visibility of the co-operative and community benefit societies to groups taking on assets or providing services. According to Ashford, “Power to Change’s presence reassured investors that community shares were a credible financial product,” and accelerated the growth of the community shares market in parallel to the growth of community renewable energy projects supported by the Feed In Tariff, and later, the introduction of the Community Shares Standard Mark, which ensures that community share offers are clear, honest, and transparent.

Other support came in the form of equity match funding initiatives like the Booster Fund, which provides groups with pre-grant and development grant support to develop their investment readiness. For Ethex to be more successful, “we need more of these capacity support programmes,” says Ashford, “that can support businesses to become investment ready. This can be complicated for groups that have limited business and financial experience.”

Ethex: a decade of impact

Over the last decade, over 200 projects have raised more than £120M via Ethex through 25,000+ investments. In the absence of sufficient public or private funding, these projects represent initiatives that are taking climate action, building stronger communities, and are creating a fairer society all across the UK.

Renewable energy

Representing the greatest number of projects and finance raised through Ethex’s platform in the last ten years, 90 renewable projects have raised more than £80M, saving 919,000 tonnes of CO2 and producing 143 MW of clean energy, which can power the equivalent of 50,910 homes.

Low Carbon Hub, Oxfordshire

Over 2000 investors have raised £9.6M via Ethex to support green energy projects in Oxfordshire. There are 47 clean energy projects ongoing, including in local energy generation and storage, and supporting the transition to electric transport.

Affordable homes for all

Representing a growing sector for ethical investment over the last ten years, and with more than half in areas of deprivation, 20 affordable homes projects have raised more than £8M from 2,536 investors to fund the development of 173 homes.

Bridport Cohousing, Dorset

This innovative cohousing community of 53 affordable eco homes raised £363,825 through withdrawable shares, helping them to complete the construction of a Common House and two guest bedrooms, and to repay earlier supporters who loaned money to purchase the land. 123 people invested via Ethex, and the investment was match funded with £30,000 from the People’s Postcode Lottery.

Leeds Action to Create Homes (LATCH)

LATCH was founded in 1989 by a group of students. Initially set up as a co-operative to provide housing for its members, it shifted its model to provide housing for those in need, while also inspiring the creation of other housing organisations over the years, such as Canopy which provides self-help housing for people experiencing homelessness.

Today, LATCH is a member-led Community Benefit Society whose mission is to bring long-term empty properties back into use, refurbishing derelict and run-down houses in the Chapeltown, Harehills, and Burley areas of Leeds. In the last three decades it has acquired 110 houses, typically taking on four to six new properties each year, all of which have long waiting lists in a metropolitan area where 7,000 individuals have priority homeless status.

Most of the renovation work on the properties is carried out by LATCH staff and trainees with support from private contractors. This refurbishment process provides work experience opportunities for eight to ten trainees, many of whom come from challenging backgrounds, and supports them to develop construction, decorating, and employability skills. As an ethical landlord, LATCH’s 22 members of staff provide property maintenance, as well as providing other forms of support to tenants who have complex needs, such as a history of mental ill-health, or having left an abusive relationship. Each tenant has a dedicated support worker who helps the tenant address the issues that led to their homelessness and supports them to move from LATCH housing to independent living after two to three years.

LATCH’s funding model

When there are no progressive policy programmes within government, such as the Coalition’s Empty Homes programme which previously provided up to 85% of capital between 2012-2016, LATCH will typically receive grants that equate to 30% of redevelopment costs, with the remaining 70% raised through repayable finance.

As a Community Benefit Society, LATCH has run two share offers on Ethex, raising £1.125M from 315 investors, with each successful campaign inviting prospective shareholders to invest from a £500 minimum, with the first campaign in 2021 offering a 4% forecast return, and the second in 2023 a 5% forecast return.

Support

As a small charity with limited experience in raising repayable finance, working with Ethex provided the necessary support on due diligence, assessing the robustness of the business plan, and developing a strong marketing strategy to attract investors. As well as a local campaign for Leeds and West Yorkshire, this included an article in The Guardian, which elevated the campaign to the national level and drew in more support, including some high-lev-el supporters investing £50,000.

“Without the second share offer we would have had to restructure, pause development, and make staff members redundant,” explains LATCH CEO James Hartley. Following the successful campaigns, LATCH now has 400 members, which include the core members, namely tenants and staff; and supporters, which include directors, investors, and trainees.

Where next for LATCH?

With such high levels of housing need, LATCH is in more demand than ever. Off the back of these successful raises, their development plans are in place for the next two years, while looking after their existing property portfolio. They also hope to benefit from Leeds Council’s new policy of offering a Right to Buy grant, and have plans to increase tenant engagement and participation in the membership.

Signalise

Signalise is a multi-stakeholder co-operative which provides an innovative online system for booking British Sign Language (BSL) interpreters in order to enable Deaf people to more easily navigate every-day services, from meetings to medical appointments. In 2021, through Ethex’s platform, Signalise raised over £300,000 from 203 investors, which helped them to develop the online booking system, fund staffing and training costs, and ensure that qualified, trustworthy BSL interpreters get paid fairly for their services. The offer was also match funded with an investment of £30,000 from the Peoples’ Postcode Lottery.

Solar for Schools

“Energy Education funded by the sun” Solar for Schools CBS is a community benefit society set up in 2016 to help schools and communities to decarbonise, while also educating pupils on sustainable energy, making the energy transition a tangible reality for school children. The CBS funds solar panels on school roofs, and contracts out all development, operations and education delivery to Solar Options for Schools Ltd (SFS) which provides management software and services to a growing number of community energy groups, councils, and trusts.

Funding solar panels on schools represents an increase in clean energy production – which saves an average of two tonnes of carbon every year per £10,000 invested – but also an education impact that is much higher. Empowering students with knowledge on energy and how to decarbonise means they can very effectively persuade parents and their community to take positive action, from small changes at home, to persuading the companies their parents work at to do more to ensure the next generation has a future to look forward to. “Solar powered pester power at its best”, as SFS founder and CBS Director Robert Scrimpff puts it.

The CBS’s democratic ownership model means that it is owned by the schools, not private energy companies, funds, or individuals seeking to mainly extract profits from renewable installations on public infrastructure. As members, each of the more than 130 schools so far can vote in board elections, nominate directors, influence priorities, and determine how any surplus funds in the CBS are used. They are effectively joining a club that provides solar energy and education, rather than handing over the rights to their roof to a solar investor.

So far, the CBS has generated 21,333MWh of solar electricity from its own installations on schools, which is enough to charge over 350,000 electric vehicles, and to mitigate a total of 4,117 metric tonnes of CO₂, equivalent to 10.5 million miles driven by an average fossil-fuel-powered vehicle. More impressively, over 150,000 students see solar power in action and receive energy related lessons and workshops, as well as access to the SFS energy mobile app, which is now being used by teachers to provide homework to students.

Why bonds?

Since launching, the CBS has raised more than £6M from nearly 1,000 bond holders, who range from parents and grandparents supporting their local school to savvy investors who want their savings to deliver more than income and like the idea of helping the next generation have a better future by financing renewable energy projects on schools. The CBS has offered bonds mainly via Ethex through ten campaigns, issuing Innovative Finance ISA eligible bonds – which allow the bond holder to invest up to £20,000 every year and then reinvest any proceeds, with all resulting profits being tax free. They are currently offering a five-year fixed interest return of 5.5%.

But why has the CBS decided to use bonds instead of shares? “Unlike shares, a bond is based on a five-year term, so investors can plan their finances better and are IF ISA eligible for tax free income. Shares are not ISA eligible. Solar is also a relatively safe investment and thus well-suited to bonds or debt. This is particularly true when the solar is installed on a school, as schools in the UK always pay their bills and are unlikely to go out of business. Given the long-term nature of these investments, we are considering offering legacy shares in the future that would enable funders to pass on their investment to their family without paying inheritance tax,” says Scrimpff.

Where next?

Solar for School’s ambition is to install solar on 100,000 schools a year around the world, with new partnerships planned for schools in South Africa, India, and Ireland. To achieve this scale means attracting more capital. “We need to get to the point where we can attract pension funds,” Schrimpff says. “But pension funds do not write cheques for less than £25-40M.” So SFS and the CBS are working with Ethex in a push to attract even more investors to the platform, aiming to grow Solar for schools supporter base from nearly 1,000 investors to 10,000 investors for UK pro-jects this year.

Kindling Farm

In 2021 and 2023, Kindling Farm launched two successful community share offers via Ethex to purchase and develop a community-owned organic farm in Greater Manchester. For a minimum of £200, investors became part-owners of the farm, and enabled Kindling to purchase and transform 77 acres of established farmland into a pioneering, large-scale farm which uses agroforestry methods to produce sustainably-grown fruit and vegetables while promoting the soil health and biodiversity of the diversely-planted fields. Kindling Farm also offers educational visits for local groups and schools, and a unique year-long training programme (FarmStart) to train a new generation of ecological growers.

The Project PT

The Project PT, based in Oxford, is currently looking to raise £350,000 to open three new female-owned gyms in venues around Oxfordshire. Alongside the fitness activities, including group sessions and personal training, The Project PT has an active social impact programme, working with young people and vulnerable communities who might not ordinarily join a gym, as well as offering work experience, training, and employment opportunities. Funds raised via Ethex will allow The Project PT to expand their services, as well as creating a blueprint for the development of other such inclusive spaces within the wider fitness industry. Investment begins at £500 for a six-year bond at 7% interest – visit ethex.org.uk to find out more (offer ends June 2024).

The next five years for Ethex

After ten years of leading the direct ethical investment sector, the team at Ethex are excited about the next challenge. The most obvious area for growth, and given that money is the main growth limitation, is focusing on onboarding more investors to the platform to encourage them to start building a positive impact portfolio. “We need to break into the mainstream to further build out awareness for Ethex. When people find us, their first comment is – this is amazing, how have I never heard of you before,” says Ashford. Making these steps towards the mainstream will help them to reach their milestone for the next five years: raising and deploying £200M for impactful projects and organisations.

Across the economy, as more councils declare bankruptcy, such as Birmingham City’s Council’s recent announcement in early 2024, and the anticipated ‘fire sale’ of more public assets, local investors have an opportunity and responsibility to help communities to become more resilient. Given the survival rates of community-owned businesses – which the Plunkett Foundation estimates to be above 90% – community shares have a clear role in increasing the size of the market and retaining local wealth.

As climate change becomes an even more immediate threat, net zero targets provide an opportunity for more partnerships between government and communities. With recent research showing that 90% of investment in clean energy is from private – extractive – finance, the future of the climate is currently relying on asset managers whose incentive is to make profits for their clients. This short-term, extractivist model is increasingly dominating essential infrastructure and planetary resources, beyond simply stocks and bonds.

Ethex’s recently launched 10 years of Impact report demonstrates that the direct impact investing model works and has the potential to provide the vital funding needed by hundreds more impactful organisations that are taking action against climate change, social inequality and the break-down of communities. For Ethex, it’s a rallying call for investors to join their community and enable them to scale their collective impact.

As intimidating as the challenge is, Ashford says “we need to keep taking a bigger share of the financial marketplace one percent at a time.”