Much of the media coverage of the American energy industry implies that America has become a vast and growing exporter of energy to the rest of the world and that this has created a sort of “energy dominance” for the country on the world stage.

Whether such reports qualify as so-called “fake news” depends very much on three things: 1) How one defines “fake news,” 2) whether writers of such reports qualify the words “imports” and “exports” with the word “net” and 3) which energy sources they are discussing.

In this case let’s define “fake news” as claims that official, publicly available statistics show plainly to be false. By that criterion anyone who claims that the United States is a net energy exporter would certainly be guilty of propagating “fake news.”

Energy statistics from the U.S. Energy Information Administration (EIA) show that in November 2017 (the most recent month for which figures are available) the United States had net imports 329.5 trillion BTUs of energy in all its forms.* That’s down from a peak of 2.74 quadrillion BTUs in August 2006, something that is certainly a turnabout from the previous trend. But all claims that the United States is a net energy exporter must be labeled as unequivocally false.

It turns out, however, that most people making misleading claims about America’s energy situation don’t actually say or write things which are technically false. What they do is use language which intentionally or unintentionally misleads the reader or listener.

For example, the claim that the United States is an exporter of crude oil is true. But that claim is entirely misleading. While the United States exports about 1.5 million barrels a day (mbpd) of crude oil, it also imports 7.5 mbpd. That puts the net imports of crude oil at about 6 mbpd. (All numbers are four-week averages as of February 23.) This reality is simply not conveyed by the unqualified statement that the United States is an oil exporter. Those making such a claim either haven’t done their research, are sloppy writers or intend to mislead.

This curious state of affairs in American crude oil imports and exports results from not having enough refining capacity for the kind of oil coming out of the country’s shale oil deposits, more properly called tight oil. That oil is too “light” for many American refineries. Therefore, much of it is shipped abroad to refineries with the capability to refine it. The United States tends to import heavier crudes that match its overall refinery capabilities.

The United States has more refinery capacity than it needs for its own consumption of petroleum products such as gasoline, diesel, jet fuel and heating oil. Some of that capacity has long been used to produce these products for export—for over 30 years, in fact.

The EIA reports 4.5 mbpd of these products shipped abroad as the four-week average as of February 23. But that overstates the case since the number includes an enigmatic category called “Other Oil” which consists primarily of natural gas plant liquids (products such as ethane, propane and butane) that are simply not part of the petroleum production stream. Subtracting those gives us about 3 mbpd which are curiously offset by imports of those same products of about 1 mbpd. That puts the net exports of petroleum products strictly speaking at about 2 mbpd—significant, but not enough to make the United States a net exporter of crude oil and petroleum products combined. The country remains a net importer of about 4 mbpd of those combined products .

When it comes to natural gas, it turns out the United States is just barely a net exporter. In 2017 the country exported 3.17 trillion cubic feet (tcf) of gas and imported 3.04 tcf. America is hardly a major force in the natural gas export market today. There are those who claim, however, that it will become one because of future growth in U.S. natural gas production. This includes the EIA.

The EIA’s record for long-term forecasts, however, is abysmal. (To see how abysmal, read here and here.) With regard to U.S. natural gas production, a private study based on actual natural gas well histories (rather than optimistic claims from the industry) suggests that production in 2050 will be only a fraction of what it is today. As the study points out, natural gas plays in shale basins are the only ones with growing production, and four of the six major shale gas plays are already in steep decline. It is difficult to see how such trends can lead to a major increase in U.S. natural gas production through 2050. (It is well to remember that oil and gas executives are on a constant hunt for capital with which to fund new drilling. Not surprisingly, it pays them to be optimistic when courting investors either in person or through the media.)

As for coal, the United States has long been self-sufficient in coal and currently exports about 3 percent of its production on a net basis according to EIA statistics.

There are connections between the U.S. and Canadian electricity grids. The Canadians send more electricity to the United States than the United States sends to Canada which, of course, makes the United States a net importer of Canadian electricity.

The United States does mine and process uranium for nuclear power stations. But almost 90 percent of the uranium purchased for American reactors must be imported.

The current picture of American energy production is decidedly not one of “dominance.” Instead, though rising production of oil and natural gas have reduced dependence on foreign energy supplies, the country remains dependent on imported oil, a situation that even the ever optimistic EIA does not expect to change through 2050.

For those who say they know the future of energy production in the United States, I recommend reading the linked critiques above of previous major long-term energy forecasts. Making energy policy based on long-term forecasts that have proven again and again to be wildly mistaken is not just unwise, but dangerous. An infrastructure built for overly optimistic projections of supply for particular fuels could end up worthless or at the very least create tense and destabilizing competition for fuel supplies that don’t grow as expected.

___________________________________

*It’s worth noting that nobody was touting American “energy dominance” when the net energy import number last hovered around this value in the early 1980s.

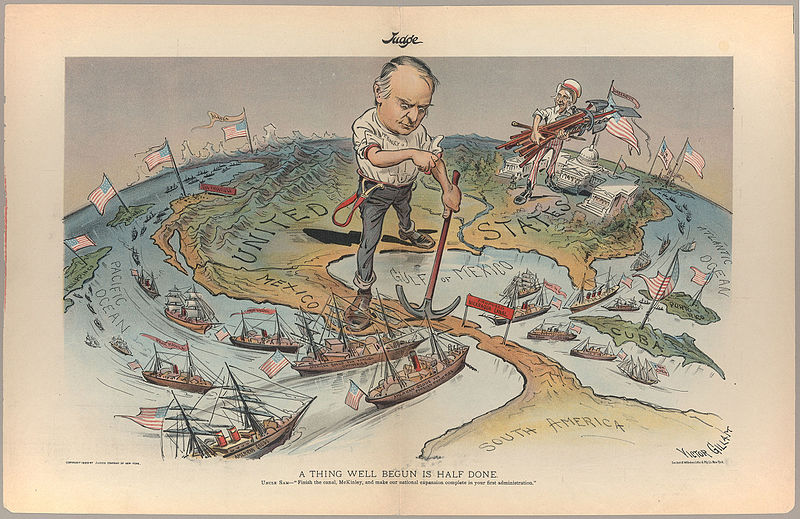

Image: “A Thing Well Begun Is Half Done.” A satirical political cartoon reflecting America’s imperial ambitions following quick and total victory in the Spanish American War of 1898. Victor Gillam (1899). Via Wikimedia Commons.