Shenzhen Stock Exchange (2010) byLeon Petrosyan. Via Wikimedia Commons.

Defenders of the free market faith tell us that price conveys a great deal of information, enough that you can base an entire economic system on it without any central planning or coordination whatsoever. Whether extreme devotion to this principle is wise may not be so important to determine this week as whether free market prices are actually available in many markets. Recent events surrounding the precipitous decline of the Chinese stock market are illustrative of this problem, but I’ll come back to this a little later.

Years of suppressing the cost of credit through central-bank imposed near zero interest rates has led to the mispricing of anything that depends on credit. The list is long and includes real estate because mortgages are central to its purchase; oil because cheap bank loans and low bond rates financed otherwise uneconomic deposits of tight oil from deep shale deposits in the United States; natural gas in the United States for similar reasons; stocks and bonds because large investors often borrow to buy them; and cheap Chinese consumer goods made more and more available by cheap finance to build the factories that produce them.

The effect is not uniform, that is, cheap credit tends to make some things go up by stimulating demand for them such as real estate, stocks and bonds–while making some things go down such as the price of oil and natural gas because U.S. drillers got cheap financing which encouraged overproduction.

Which brings us to the curious historical irony of a nominally communist regime in China using public credit and regulatory maneuvers to reverse the trend of a crashing domestic stock market. The Shanghai Composite had been down 25 percent in just one month creating fear that the turbocharged Chinese stock market–which had risen 68 percent in one year and almost 150 percent in two–might be crashing.

The Chinese like many other governments across the globe are addicted to rising stock and bond prices in part because they believe the so-called"wealth effect"–that is, the desire by consumers to spend more because of perceived increases in wealth–has been a central factor in the post-2008 recovery. But perhaps more important, a market crash might not only reduce consumer spending a little, but also lead to a cascade of financial defaults and failures within the highly leverage global finance system. The result could be an economic depression, one that was supposed to have been vanquished by the extraordinary government and central bank interventions post-2008.

Ideally, a market is supposed to be a place where buyers and sellers come together to discover prices with minimal interference from government. And, discovering a fair price for something you own generally requires that you offer it for sale or that something very nearly identical already have a known price. The Chinese government simply halted trading for about half of all stocks on the country’s two leading exchanges so that it became impossible to get a price on many stocks. A few days later the government forbade large investors–those holding 5 percent or more of a stock–from selling for the next six months. It’s hard to know what someone will offer you for a stock, if you are not allowed to sell it.

This moment was inevitable. When prices are manipulated, eventually people catch on and the smart ones either buy if the price is too low or sell if it is too high.

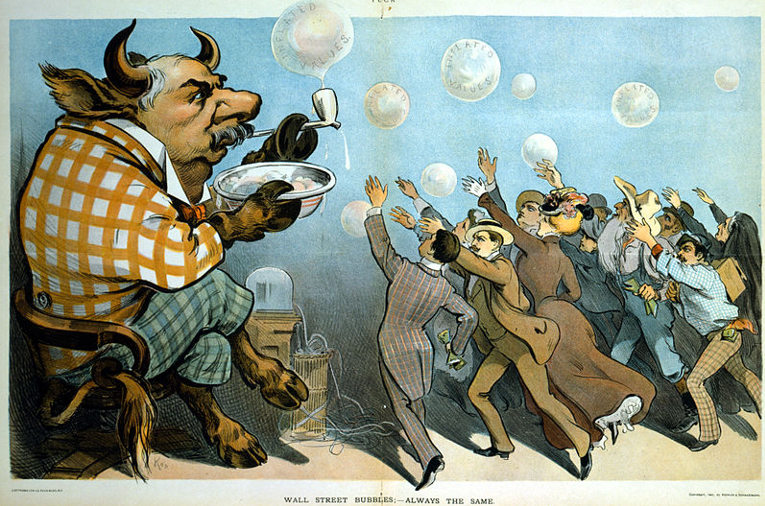

I am reminded of economist Herbert Stein’s pithy truism: "If something cannot go on forever, it will stop." The faith that stock and bond bull markets can go on forever precisely because central banks will make them do so took a big hit last week. After years of extraordinary government intervention directly and indirectly in the financial system, renewed bubbles in real estate, stocks and bonds worldwide started to look genuinely vulnerable last week.

The assumption that these bubbles can continue indefinitely or that they aren’t bubbles at all finds its basis in the notion that these extraordinary interventions are now ordinary and will not be withdrawn.

There may be some truth in this. Worried about excessive speculation, China tried tightening flows to financial markets back in May. The government wanted to let some air out of the stock market bubble, but not pop it. The measures definitely let some air out, but too much, it appears, for the comfort of Chinese officials. Keep in mind that despite the recent drop, the Shanghai Composite is still up 90 percent in the last year.

Governments do not intervene in markets without reason. The reason given for the extraordinary intervention since the 2008 market crash is that a depression would have ensued without that extraordinary intervention which turned out to be on a scale never before seen. This claim is almost certainly correct. The question now is: Why almost seven years after the crash does such extraordinary intervention continue? Why are central-bank controlled interest rates still at or near zero percent? Is there something fundamentally wrong with the economy such that raising interest rates and withdrawing other interventions (as in a normal business cycle) are ill-advised?

I have an answer that entails a lengthy exposition that must wait for another time, but which I’ve discussed in part here and here. For now, I will say this: As the global regime of perpetual economic growth has stopped working as robustly as we want it to, the reaction has been two-fold. First, we’ve convinced ourselves that it is just a matter of time before things return to "normal." Second, we’ve loaded up on debt to bring forward that consumption that would otherwise be delayed in a slow- or no-growth environment.

The second step presupposed the first. But, as "normal" has failed to return, all we’ve been left with are some extra trinkets and the debt used to purchase them. The debt service subtracts from consumption, the economy sputters, business investment stalls in response, and cheap credit then flows away from productive investment and into speculation.

That’s where we find ourselves today. If the Chinese stock market stabilizes here, there will be no shortage of commentators telling us that the recent rapid decline was just the pause that refreshes.

No one knows whether the vast credit bubble which now encircles the globe is about the pop. Perhaps it has many months or even years to run. The mispricing of stocks, bonds and real estate can get worse–much worse–before it gets better. That means that right now every investor is engaged in a high-stakes game of chicken–and most of them don’t even know it.